meowathome

voted

Without looking at charts, you won't think that China's three other main indices are right behind their US counterparts.

Remember that China's markets underwent a major correction in October. We already had the Trump bump this month.

On a side note: Is the Dow Jones Industrial Average still relevant in this day and age?

$BABA-W (09988.HK)$ $TENCENT (00700.HK)$ $XIAOMI-W (01810.HK)$ $MEITUAN-W (03690.HK)$ $JD-SW (09618.HK)$ $BIDU-SW (09888.HK)$ $LI AUTO-W (02015.HK)$ $Hang Seng TECH Index (800700.HK)$ $Hang Seng Index (800000.HK)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $iShares MSCI Hong Kong ETF (EWH.US)$ $Kraneshares Tr Bosera Msci China A Sh Etf (KBA.US)$ $iShares MSCI China ETF (MCHI.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

Remember that China's markets underwent a major correction in October. We already had the Trump bump this month.

On a side note: Is the Dow Jones Industrial Average still relevant in this day and age?

$BABA-W (09988.HK)$ $TENCENT (00700.HK)$ $XIAOMI-W (01810.HK)$ $MEITUAN-W (03690.HK)$ $JD-SW (09618.HK)$ $BIDU-SW (09888.HK)$ $LI AUTO-W (02015.HK)$ $Hang Seng TECH Index (800700.HK)$ $Hang Seng Index (800000.HK)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $iShares MSCI Hong Kong ETF (EWH.US)$ $Kraneshares Tr Bosera Msci China A Sh Etf (KBA.US)$ $iShares MSCI China ETF (MCHI.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

meowathome

liked

$Canaan (CAN.US)$ If you are smart you know that with the coming BTC super cycle CAN will be an overvalued company.

In the gold rush those who sold shovels and picks got richer than those who looked for gold.

Watch out with $CAN they have improved quite a bit the last few years and it is obvious that they must mine BTC and because of that price fluctuation the financial statements got a little dirty. But as soon as BTC starts phase 2 of the Bull Run a lot of "Dump mone...

In the gold rush those who sold shovels and picks got richer than those who looked for gold.

Watch out with $CAN they have improved quite a bit the last few years and it is obvious that they must mine BTC and because of that price fluctuation the financial statements got a little dirty. But as soon as BTC starts phase 2 of the Bull Run a lot of "Dump mone...

11

1

meowathome

voted

Columns Is Intel in Trouble?

$Intel (INTC.US)$

Big Red Week for Intel

Intel experienced a sharp selloff last week after reporting billions in losses from its foundry business. Apparently, investors didn't like the headlines.

Head-and-Shoulders Pattern?

The selling corresponds with the price breaking down below the neck line of a head-and-shoulders pattern as well as a long-term Fib level. There was high volume associated with the selling. This adds validity to the bearishness. Bearish candlestick pattern...

Big Red Week for Intel

Intel experienced a sharp selloff last week after reporting billions in losses from its foundry business. Apparently, investors didn't like the headlines.

Head-and-Shoulders Pattern?

The selling corresponds with the price breaking down below the neck line of a head-and-shoulders pattern as well as a long-term Fib level. There was high volume associated with the selling. This adds validity to the bearishness. Bearish candlestick pattern...

+3

12

21

7

meowathome

voted

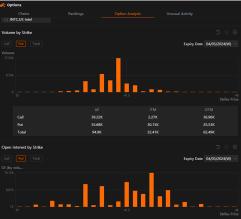

Intel's slump to the lowest since December is fueling the biggest volume since February in put options that give the holder the right to sell the stock at $41 by the end of this week.

Almost 18,000 of the $41 put options expiring on Friday changed hands just less than halfway through the trading day, making them the most-active options tied to Intel's stock according to data compiled by moomoo. That's almost seven times the la...

Almost 18,000 of the $41 put options expiring on Friday changed hands just less than halfway through the trading day, making them the most-active options tied to Intel's stock according to data compiled by moomoo. That's almost seven times the la...

22

4

5

meowathome

voted

Hi, mooers! Check out moomoo's fresh earnings calendar to start your week! ![]()

This week, various companies including $Tesla (TSLA.US)$, $Netflix (NFLX.US)$ and $Intel (INTC.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!![]()

Rewards

![]() An equal share of 1,000 points: For mooers who correctly guess the winner who makes the biggest gains in intraday trading on the day of earni...

An equal share of 1,000 points: For mooers who correctly guess the winner who makes the biggest gains in intraday trading on the day of earni...

This week, various companies including $Tesla (TSLA.US)$, $Netflix (NFLX.US)$ and $Intel (INTC.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

Rewards

31

20

7

meowathome

reacted to

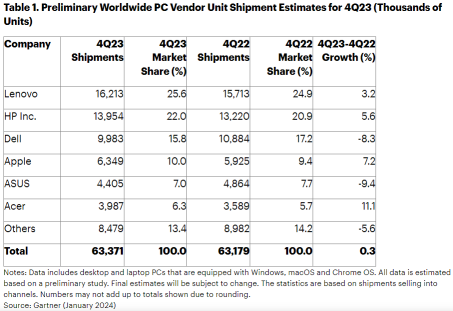

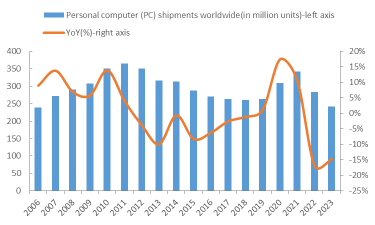

The PC industry, which experienced its lowest sales in 17 years in 2023, is now showing signs of a potential recovery. Preliminary results from $Gartner (IT.US)$ indicate that the PC shipments have recorded a growth in the fourth quarter of 2023, marking the first time in eight consecutive quarters.

During the quarter, the industry managed to ship a total of 63.3 million units, marking a modest 0.3% increase from the corresponding...

During the quarter, the industry managed to ship a total of 63.3 million units, marking a modest 0.3% increase from the corresponding...

21

16

meowathome

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)