Thks ,from what i know China has just pump in another 1 trillion yuan into the economy.🤨

mikerai

liked

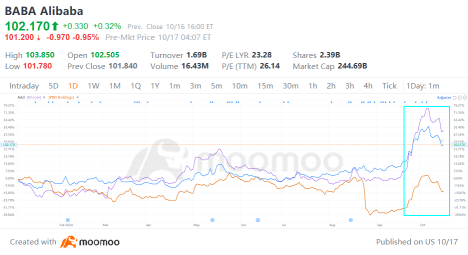

Following a series of stimulus measures introduced by the Chinese government at the end of September, Chinese e-commerce stocks saw a rapid surge and subsequent pullback.

From September 24 to October 7, shares of China's top three e-commerce giants each surged over 30%, with $JD.com (JD.US)$ climbing nearly 60% and $PDD Holdings (PDD.US)$ almost 50%. However, since trading resumed after China's National Day holiday, thes...

From September 24 to October 7, shares of China's top three e-commerce giants each surged over 30%, with $JD.com (JD.US)$ climbing nearly 60% and $PDD Holdings (PDD.US)$ almost 50%. However, since trading resumed after China's National Day holiday, thes...

+2

35

5

mikerai

liked

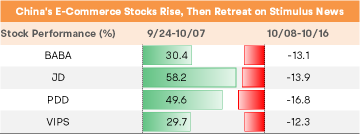

Hey there, mooers! Welcome back to "What's new in moomoo"!

Dive into our advanced Options Screener with over 30 new filters, get exclusive insights from top analysts and Morningstar reports, and uncover potential investment gems with our new pattern-based stock selection tool. Elevate your trading to new heights with these latest features on moomoo!

Disclaimer: This presentation is for information and educati...

Dive into our advanced Options Screener with over 30 new filters, get exclusive insights from top analysts and Morningstar reports, and uncover potential investment gems with our new pattern-based stock selection tool. Elevate your trading to new heights with these latest features on moomoo!

Disclaimer: This presentation is for information and educati...

Expand

Expand 54

10

mikerai

voted

I always remind myself to review my trades and strategies each quarter. ![]()

It helps me to be disciplined, to check my positions and make adjustments timely.![]()

Securities Position: Looking good with gradual profits![]()

Asset Distribution:

For me my Golden Ratio (Stocks/Funds) was previously 20/80. Seems like I’ve moved towards 50/50 with my bullishness on $NVIDIA (NVDA.US)$ .![]()

Currency Exposure:

40/60 is sufficient for my golden ratio for trading in US market.![]()

YTD Return:

56% So ...

It helps me to be disciplined, to check my positions and make adjustments timely.

Securities Position: Looking good with gradual profits

Asset Distribution:

For me my Golden Ratio (Stocks/Funds) was previously 20/80. Seems like I’ve moved towards 50/50 with my bullishness on $NVIDIA (NVDA.US)$ .

Currency Exposure:

40/60 is sufficient for my golden ratio for trading in US market.

YTD Return:

56% So ...

+3

38

13

mikerai

liked

Weekends are usually great window of time for me to look for setups in the stocks I wanna trade and invest in. I usually like to look for:

1. descending triangles break outs, OR

2. support/resistance flipping into strength

Using this opportunity to share some of my findings with everyone;

Stocks: $TSLA $NVDA $CART $PYPL $ASTS $SOFI $CRM

$Tesla (TSLA.US)$ , $NVIDIA (NVDA.US)$ , $Maplebear (CART.US)$ , $PayPal (PYPL.US)$ , $AST SpaceMobile (ASTS.US)$ , $SoFi Technologies (SOFI.US)$ , �������...

1. descending triangles break outs, OR

2. support/resistance flipping into strength

Using this opportunity to share some of my findings with everyone;

Stocks: $TSLA $NVDA $CART $PYPL $ASTS $SOFI $CRM

$Tesla (TSLA.US)$ , $NVIDIA (NVDA.US)$ , $Maplebear (CART.US)$ , $PayPal (PYPL.US)$ , $AST SpaceMobile (ASTS.US)$ , $SoFi Technologies (SOFI.US)$ , �������...

+4

40

13

mikerai

reacted to

As a part of my daily work as an equity sales, I have the chance to look at thousands of investors portfolio from various walks of life, ranging from 3 figures to 8 figures.![]()

![]()

The shocking fact is that majority of them is still losing money despite some having “Years of experience in the market”.![]()

![]()

Below are some of the things that made me understand much deeper about trading/investing through my work and I hope can provide some valuable insight...

The shocking fact is that majority of them is still losing money despite some having “Years of experience in the market”.

Below are some of the things that made me understand much deeper about trading/investing through my work and I hope can provide some valuable insight...

+8

207

33

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Foreign investors are expecting more to stimulus to directly address consumer confidence. But Beijing is taking an indirect but prudent approach that attempts to address the root cause, which I feel is healthier. Foreign investors are working against Beijing. I tend to believe that Beijing hv sufficient resolve and tools to hold on, but I think it takes time, and Trump 2.0 will add to the complexity for many countries and investors.