MissyPolkaDolly

liked

Updated on October 29

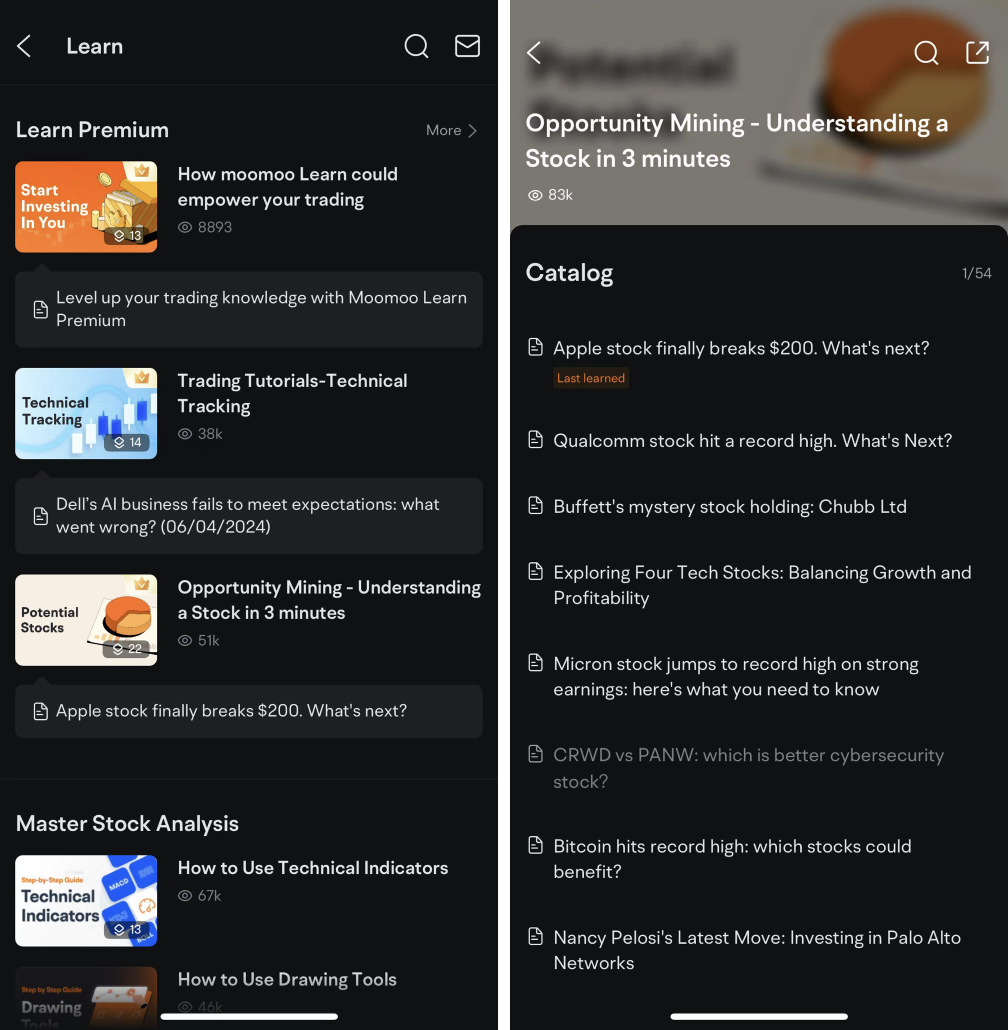

This week, the Q3 earnings season is in full swing. During this critical period, investors can evaluate a company's operational performance through its earnings reports, which may lead to fluctuations in stock prices.

How can investors interpret earnings reports and find potential trading opportunities in volatile market conditions?

![]() Four-Step method to interpret earnings reports

Four-Step method to interpret earnings reports

Earni...

This week, the Q3 earnings season is in full swing. During this critical period, investors can evaluate a company's operational performance through its earnings reports, which may lead to fluctuations in stock prices.

How can investors interpret earnings reports and find potential trading opportunities in volatile market conditions?

Earni...

+7

530

212

142

MissyPolkaDolly

commented on and voted

Happy Friday, Mooers! ![]()

![]()

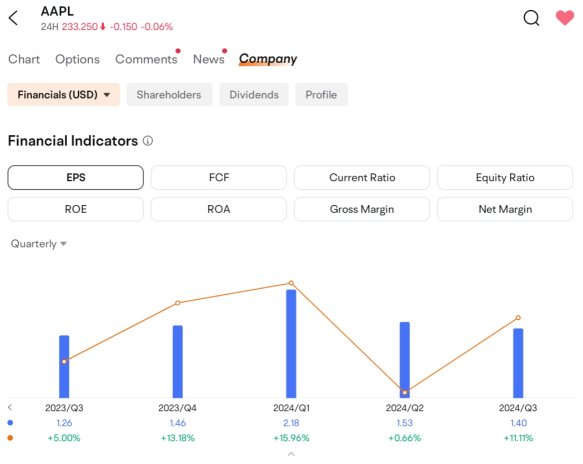

It's once again time for the annual major event—the new iPhone launch from Apple. This year's iPhone might introduce "Apple Intelligence," which has been highly anticipated by many analysts. In fact, Citi analysts have listed Apple as their "Top AI Pick" for 2025.

So, what do you think, Mooers?![]()

![]()

Join the discussion below to win points rewards!

🎯Predicting time!

Come and participate in predicting $Apple (AAPL.US)$'...

It's once again time for the annual major event—the new iPhone launch from Apple. This year's iPhone might introduce "Apple Intelligence," which has been highly anticipated by many analysts. In fact, Citi analysts have listed Apple as their "Top AI Pick" for 2025.

So, what do you think, Mooers?

Join the discussion below to win points rewards!

🎯Predicting time!

Come and participate in predicting $Apple (AAPL.US)$'...

82

139

18

MissyPolkaDolly

liked

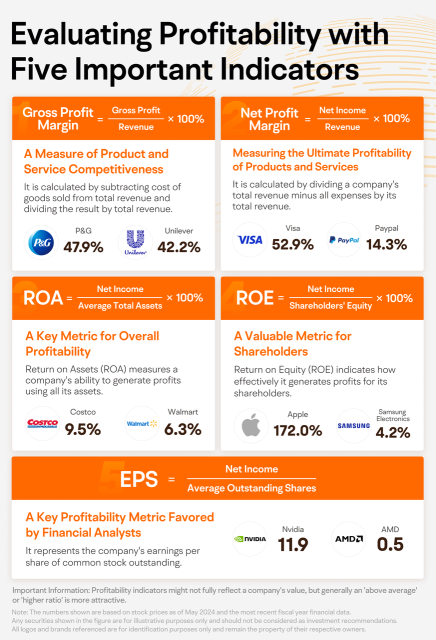

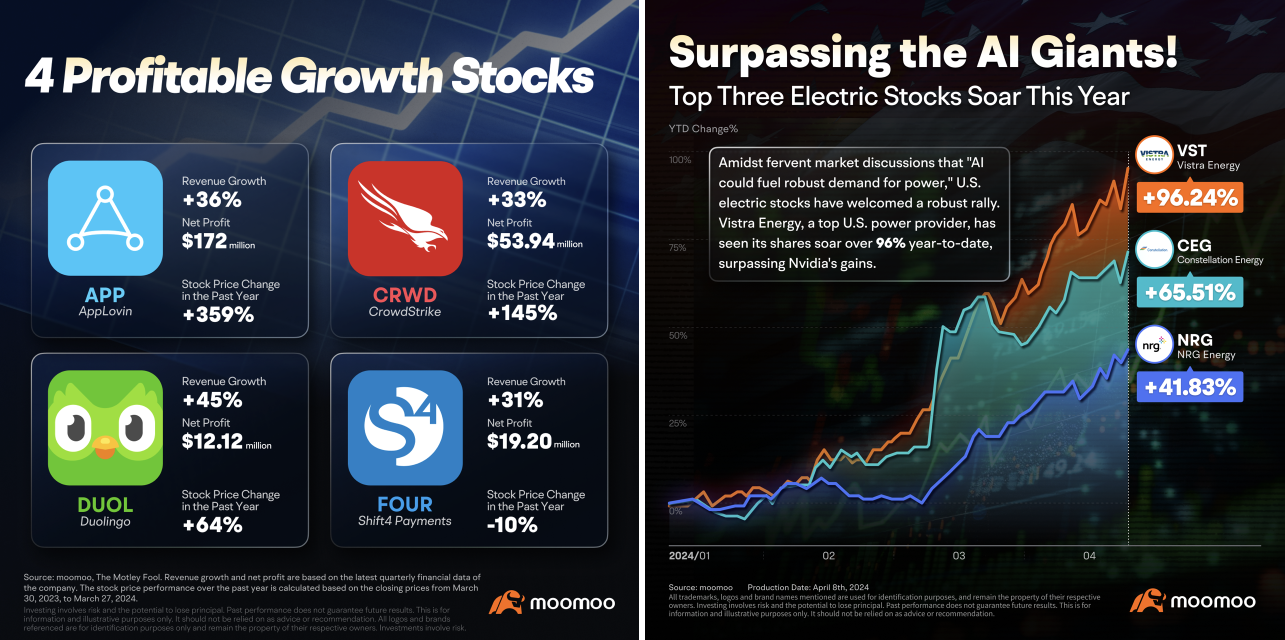

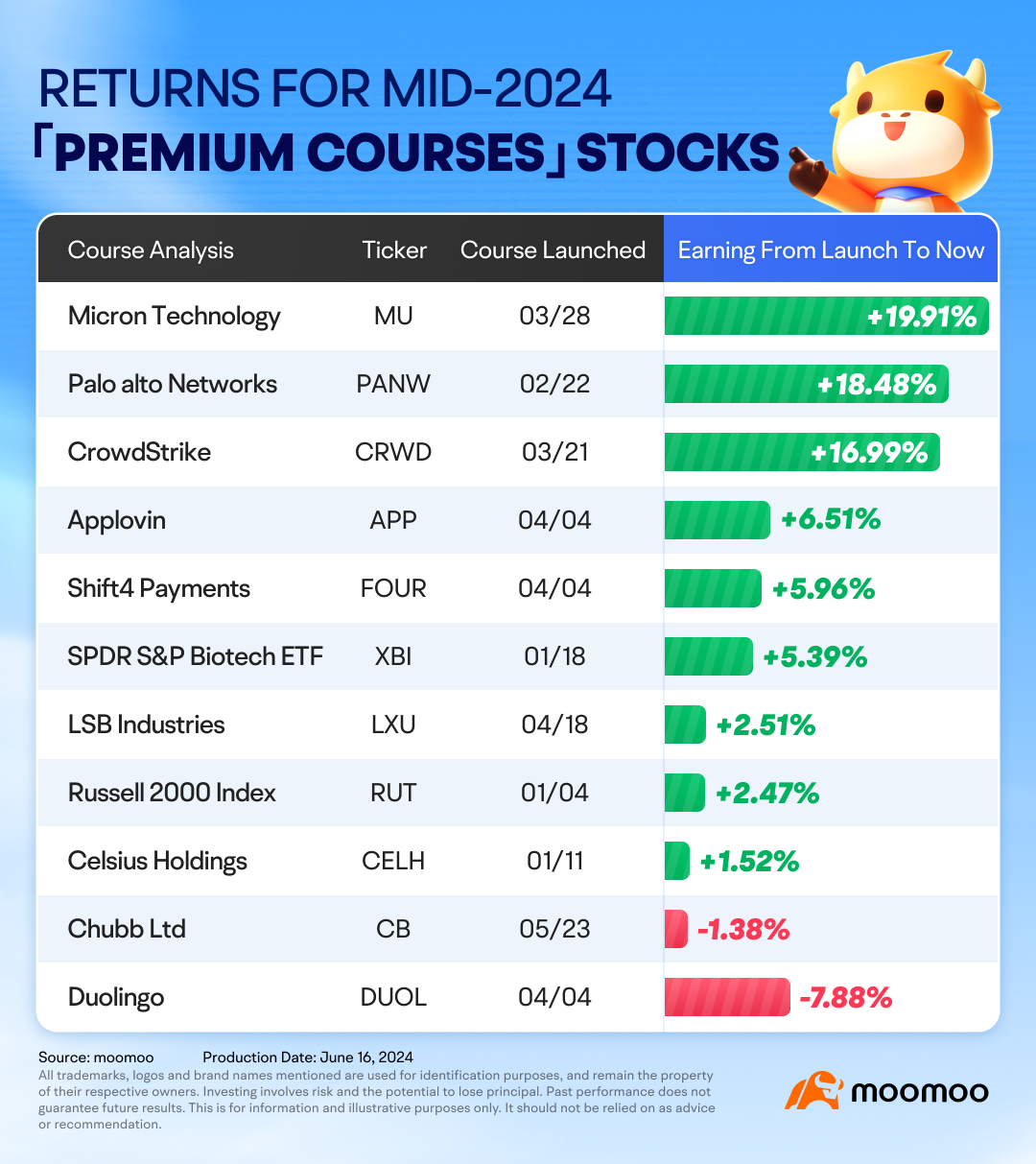

The U.S. stock market has hit new highs again! Congrats!👏 If you started investing in the US market at the beginning of the year and haven't made any major mistakes, you've probably seen some gains! 🎉

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have repeatedly reached new highs over...

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have repeatedly reached new highs over...

+5

437

226

34

MissyPolkaDolly

voted

Hello Mooers! ![]()

So, what value do you think the August 2023 CPI will have?![]()

* The U.S. CPI data are scheduled to be released on the following date & time.![]()

![]() Date

Date

September 13, 2023 Wednesday

![]() Time

Time

8:30 AM Eastern Time

8:30 PM Singapore Time

8:30 PM Hong Kong Time

10:30 PM Australian Eastern Time

![]()

![]()

![]()

$Futu Holdings Ltd (FUTU.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $Meta Platforms (META.US)$ $Amazon (AMZN.US)$ $AMC Entertainment (AMC.US)$ $NVIDIA (NVDA.US)$ $NIO Inc (NIO.US)$ $GameStop (GME.US)$ $GameStop (GME.US)$ $BlackBerry (BB.US)$ $VinFast Auto (VFS.US)$ $Netflix (NFLX.US)$ ��������...

So, what value do you think the August 2023 CPI will have?

* The U.S. CPI data are scheduled to be released on the following date & time.

September 13, 2023 Wednesday

8:30 AM Eastern Time

8:30 PM Singapore Time

8:30 PM Hong Kong Time

10:30 PM Australian Eastern Time

$Futu Holdings Ltd (FUTU.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $Meta Platforms (META.US)$ $Amazon (AMZN.US)$ $AMC Entertainment (AMC.US)$ $NVIDIA (NVDA.US)$ $NIO Inc (NIO.US)$ $GameStop (GME.US)$ $GameStop (GME.US)$ $BlackBerry (BB.US)$ $VinFast Auto (VFS.US)$ $Netflix (NFLX.US)$ ��������...

9

5

MissyPolkaDolly

reacted to and voted

Rewards

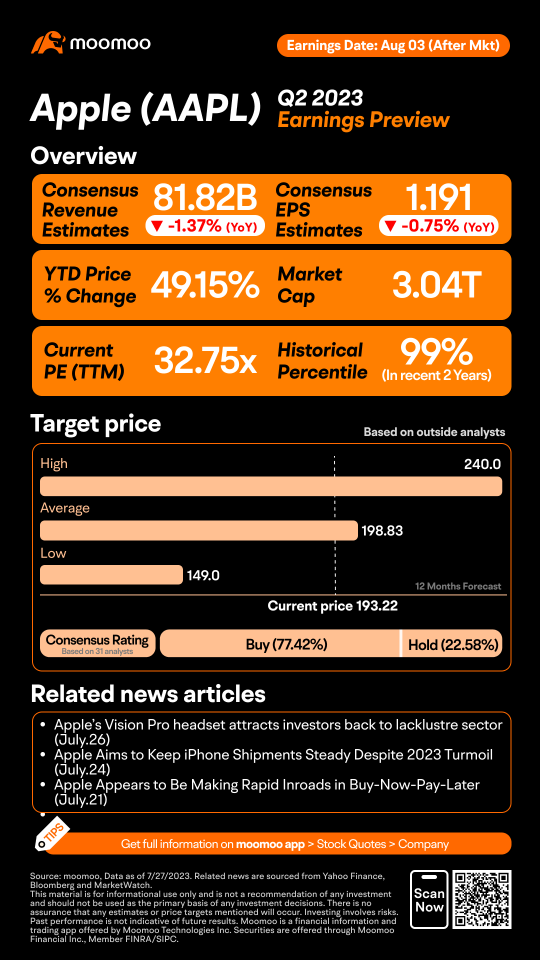

● An equal share of 1,000 points: For mooers who correctly guess AAPL's closing price range on August 4 ET by 2:30 PM, August 4 ET. (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

● Exclusive 300 points: For the writer of the top post on analyzing Apple's earnings preview as an inspiration reward.

*The selection is based on post quality, originality, and user engagement.

Note: 1. Rewa...

● An equal share of 1,000 points: For mooers who correctly guess AAPL's closing price range on August 4 ET by 2:30 PM, August 4 ET. (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

● Exclusive 300 points: For the writer of the top post on analyzing Apple's earnings preview as an inspiration reward.

*The selection is based on post quality, originality, and user engagement.

Note: 1. Rewa...

91

105

11

MissyPolkaDolly

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

![]() Happy new year, mooers!

Happy new year, mooers! ![]()

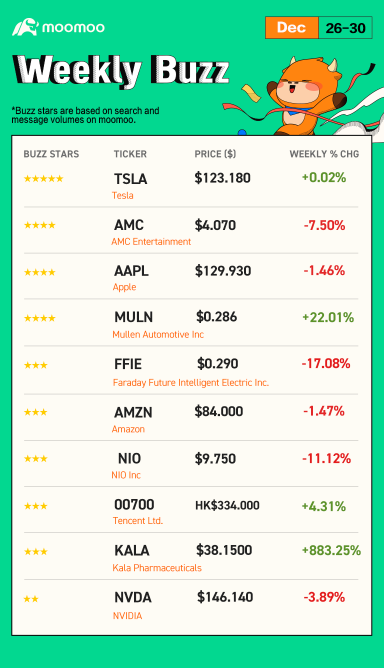

Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week (Nano caps are excluded).

Make Your Choices

Buzzing Stocks List & Mooers Comments

The US market closed the holiday-shortened week on the low. The market closed positively only...

At the end of this post, there is a chance for you to win points!

Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week (Nano caps are excluded).

Make Your Choices

Buzzing Stocks List & Mooers Comments

The US market closed the holiday-shortened week on the low. The market closed positively only...

42

39

10

MissyPolkaDolly

voted

Dear mooers,

There are only a few days before the New Year's bell rings. New year, new hope!

For most investors, 2022 is a roller coaster ride. As we approach the end of 2022, all three major US stock indexes are on track to break their 3-year winning streaks and have their worst year since 2008. Let's look at the performance of the —an indicator of US stock performance this year:

* S&P 500 index focuses on the larg...

There are only a few days before the New Year's bell rings. New year, new hope!

For most investors, 2022 is a roller coaster ride. As we approach the end of 2022, all three major US stock indexes are on track to break their 3-year winning streaks and have their worst year since 2008. Let's look at the performance of the —an indicator of US stock performance this year:

* S&P 500 index focuses on the larg...

120

483

23

MissyPolkaDolly

liked

Netflix shares fall 20% on slowing subscriber growth

$Netflix (NFLX.US)$ missed its subscriber target for the latest quarter and forecast a much-smaller number of subscriber additions for the current quarter than it did a year ago, sending its shares down 19% in after-hours trading.

The company on Thursday said it signed up 8.3 million subscribers in the latest quarter, bringing its paid global subscriber base to 221.8 millio...

$Netflix (NFLX.US)$ missed its subscriber target for the latest quarter and forecast a much-smaller number of subscriber additions for the current quarter than it did a year ago, sending its shares down 19% in after-hours trading.

The company on Thursday said it signed up 8.3 million subscribers in the latest quarter, bringing its paid global subscriber base to 221.8 millio...

25

4

19

MissyPolkaDolly

voted

Welcome back Mooers. ![]()

In today discussion, we will talk about trading the news.![]()

Many of us would have heard news about Mr. Trump own social media TMTG, which came with a mission, that is to give a voice to all. The price of $Trump-Related Stocks(N/A) (LIST2592.US)$ stocks such as $Digital World Acquisition Corp (DWAC.US)$ and $Phunware (PHUN.US)$ “went to the moon” when the news came out. At one point, $Phunware (PHUN.US)$ made a heroic rise of 1099.35%!

Beside the O...

In today discussion, we will talk about trading the news.

Many of us would have heard news about Mr. Trump own social media TMTG, which came with a mission, that is to give a voice to all. The price of $Trump-Related Stocks(N/A) (LIST2592.US)$ stocks such as $Digital World Acquisition Corp (DWAC.US)$ and $Phunware (PHUN.US)$ “went to the moon” when the news came out. At one point, $Phunware (PHUN.US)$ made a heroic rise of 1099.35%!

Beside the O...

16

11

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)