MONDAY86

liked

Last week, the markets were dominated by escalating trade tensions, with tariffs on steel and aluminum imports sparking fears of a global trade war. The European Union retaliated with counter-tariffs on $28 billion worth of U.S. goods, further spooking investors. Meanwhile, concerns over valuations and earnings continued to weigh on the tech sector, with $Adobe (ADBE.US)$ and $Intel (INTC.US)$ making headlines f...

+13

2072

359

23

MONDAY86

reacted to

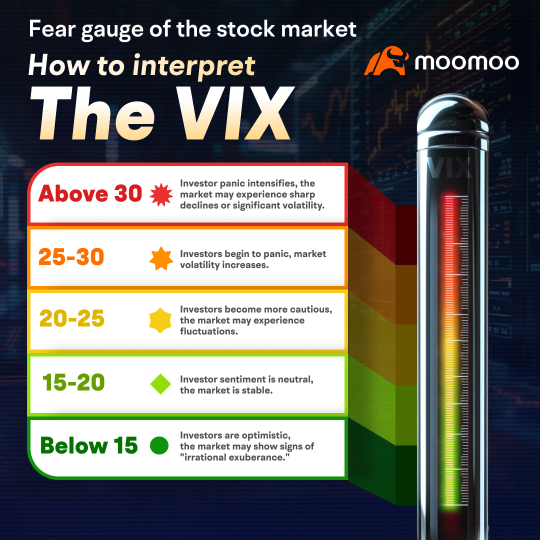

On Monday, March 10, 2025, the U.S. stock market saw a sharp decline, with the Nasdaq Index falling over 4%. This followed President Trump's announcement of higher tariffs on imports, which exceeded market expectations.

The policy is expected to raise production costs, fuel inflation, and tighten financial conditions. Goldman Sachs has cut its 2025 U.S. GDP growth forecast from 2.4% to 1.7%.

Fears of trade friction and its impact on the economy ha...

The policy is expected to raise production costs, fuel inflation, and tighten financial conditions. Goldman Sachs has cut its 2025 U.S. GDP growth forecast from 2.4% to 1.7%.

Fears of trade friction and its impact on the economy ha...

244

108

161

I was filled with anticipation for investing, thinking that as long as I chose a "good-looking" stock, I could easily make money. I chose a technology company that was very popular in the market at the time and eagerly invested my first funds without hesitation. Watching the stock price rise steadily, I was filled with confidence, as if I had already mastered the secret to investing.

However, the good times didn't last long. A few months later, the stock price suddenly plummeted, as the company released an Earnings Report that fell short of expectations. In that moment, I felt completely shattered. My investment had nearly turned negative, giving me a profound understanding of the market's unpredictability and my lack of investment experience.

But this setback also taught me a valuable lesson. I began to study Fundamental Analysis of the stock market in depth, learning how to evaluate company performance, industry outlook, and overall market trends. Gradually, I became more rational, no longer solely relying on market hype, but starting to make more prudent and informed investment decisions.

To this day, the pain of that investment mistake still lingers, but it was also an important step in my growth as a more mature investor. This experience made me realize that investing in stocks is not a one-time achievement, but a process of long-term accumulation and continuous learning.

However, the good times didn't last long. A few months later, the stock price suddenly plummeted, as the company released an Earnings Report that fell short of expectations. In that moment, I felt completely shattered. My investment had nearly turned negative, giving me a profound understanding of the market's unpredictability and my lack of investment experience.

But this setback also taught me a valuable lesson. I began to study Fundamental Analysis of the stock market in depth, learning how to evaluate company performance, industry outlook, and overall market trends. Gradually, I became more rational, no longer solely relying on market hype, but starting to make more prudent and informed investment decisions.

To this day, the pain of that investment mistake still lingers, but it was also an important step in my growth as a more mature investor. This experience made me realize that investing in stocks is not a one-time achievement, but a process of long-term accumulation and continuous learning.

Translated

5

1

MONDAY86

commented on

Greetings, mooers!

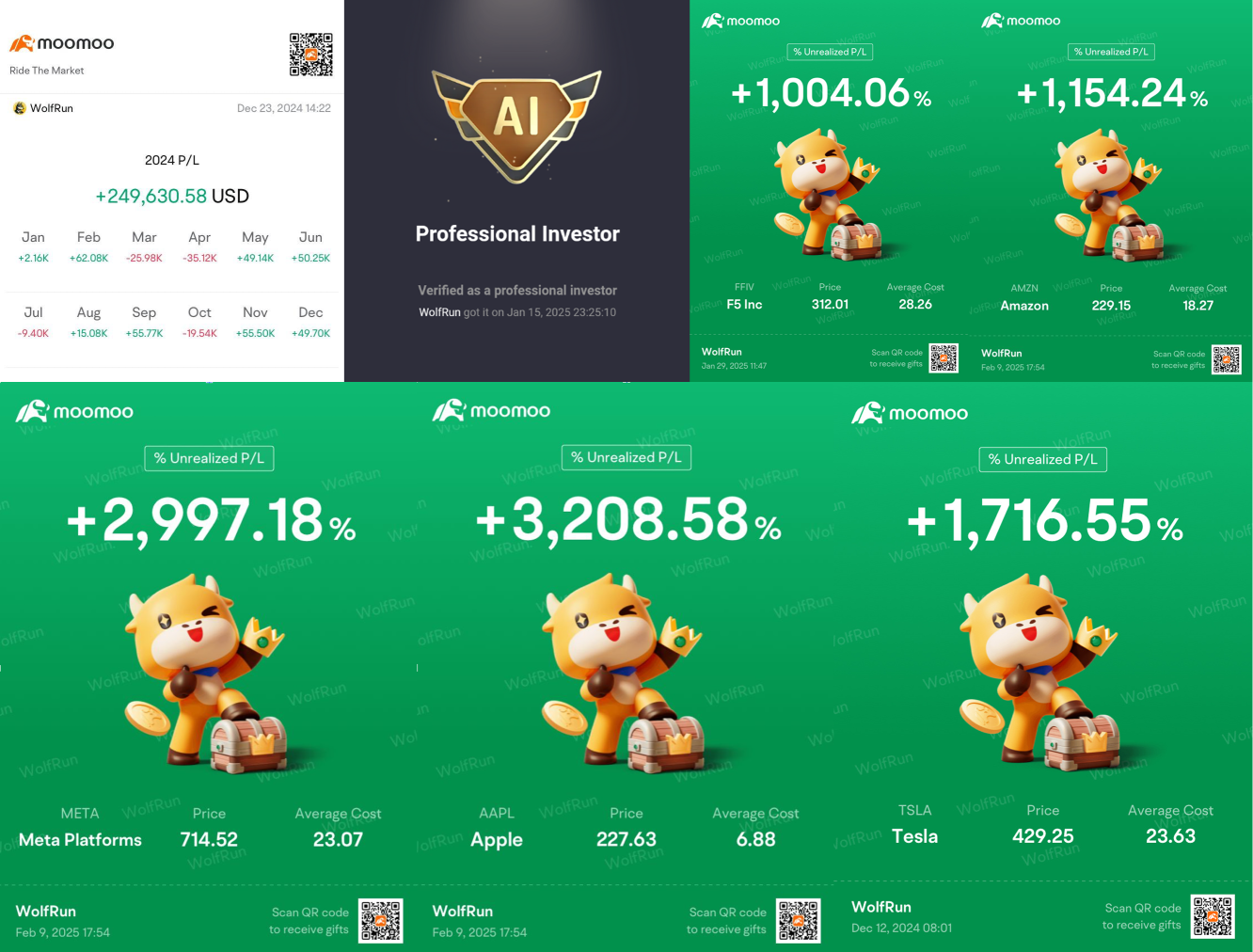

In this special edition, we're excited to bring you the motivating story of @WolfRun, who achieved a remarkable milestone by growing five stocks in his portfolio by tenfold. Don't miss our interactive giveaway at the end of this post!

*Disclaimer: All views expressed in the Mooers' Stories are the independent opinions of WolfRun, which do not reflect the opinions, views, or positions of Moomoo F...

In this special edition, we're excited to bring you the motivating story of @WolfRun, who achieved a remarkable milestone by growing five stocks in his portfolio by tenfold. Don't miss our interactive giveaway at the end of this post!

*Disclaimer: All views expressed in the Mooers' Stories are the independent opinions of WolfRun, which do not reflect the opinions, views, or positions of Moomoo F...

+1

925

344

247

MONDAY86

reacted to

As a pillar of Malaysia’s financial system, MAYBANK delivered a **"steady yet progressive"** performance in 2024. While its core businesses demonstrated strong risk-resilience, the costs associated with digital transformation and regional expansion strategies became increasingly evident. We present a balanced framework for investors by analyzing both operational highlights and underlying risks.

I. Traditional...

I. Traditional...

627

225

60

MONDAY86

reacted to

$NVIDIA (NVDA.US)$

NVIDIA Q4 FY2025 earnings conference call is scheduled for February 26 at 5:00 PM EDT /February 27 at 6:00 AM SGT /February 27 at 9:00 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from NVIDIA's Q4 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation is for information ...

NVIDIA Q4 FY2025 earnings conference call is scheduled for February 26 at 5:00 PM EDT /February 27 at 6:00 AM SGT /February 27 at 9:00 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from NVIDIA's Q4 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation is for information ...

NVIDIA Q4 FY2025 earnings conference call

Feb 27 06:00

1108

573

55

MONDAY86

reacted to

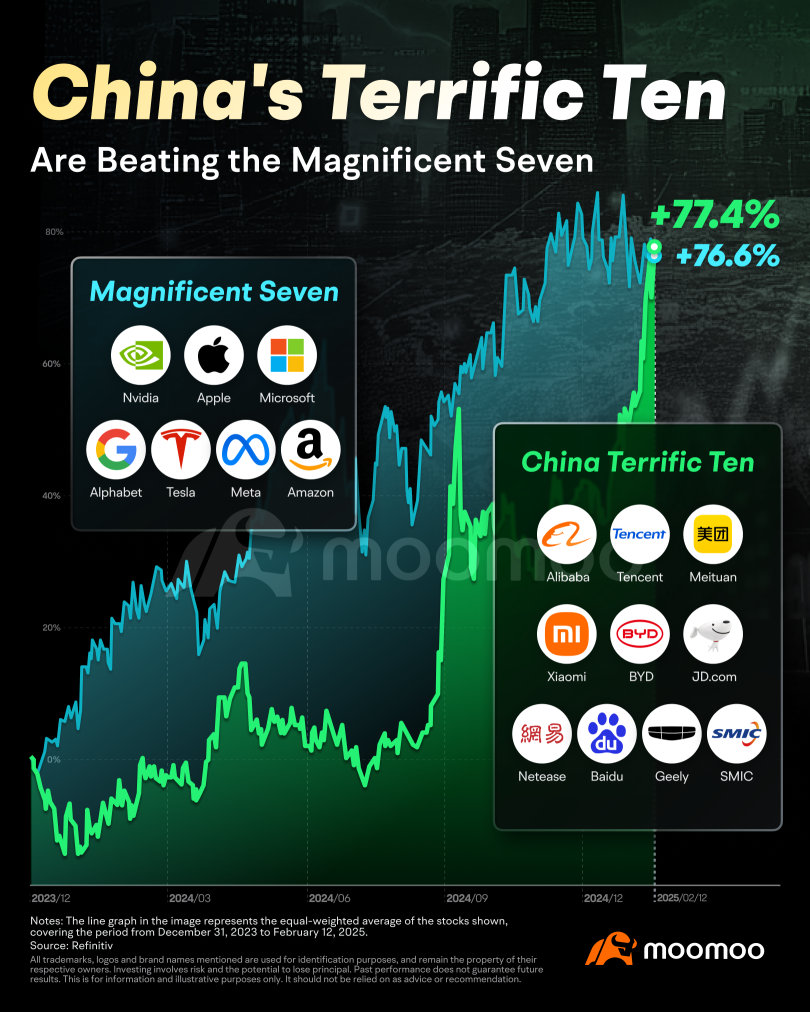

The $Hang Seng TECH Index (800700.HK)$ soared to its highest level since February 2022 last Friday. Despite ongoing volatility in U.S. tech stocks, the index has surged by 23.08% since the start of the year. Leading the charge are the 'Terrific Ten,' a group of major Chinese tech firms including $Tencent (TCEHY.US)$, $Alibaba (BABA.US)$, and $SMIC (00981.HK)$, which have outpaced the Magnificent 7 in gains since early 2024.

F...

F...

125

12

191

MONDAY86

reacted to

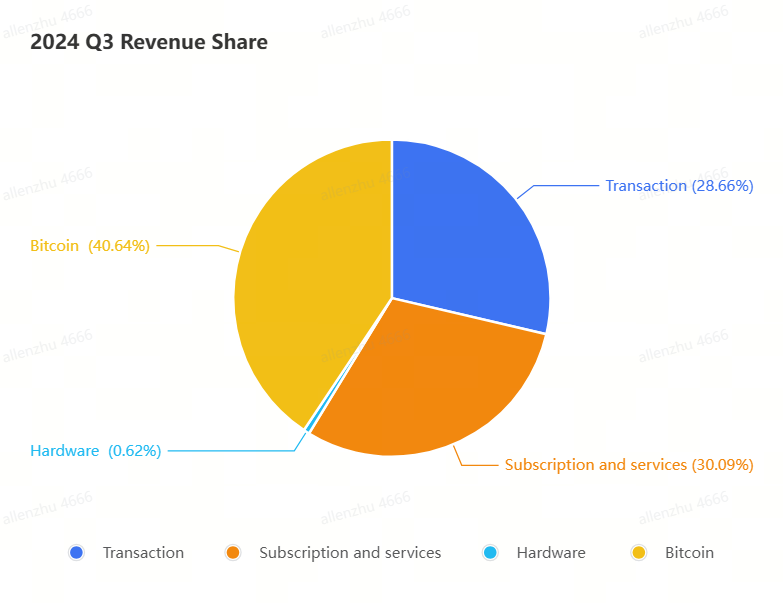

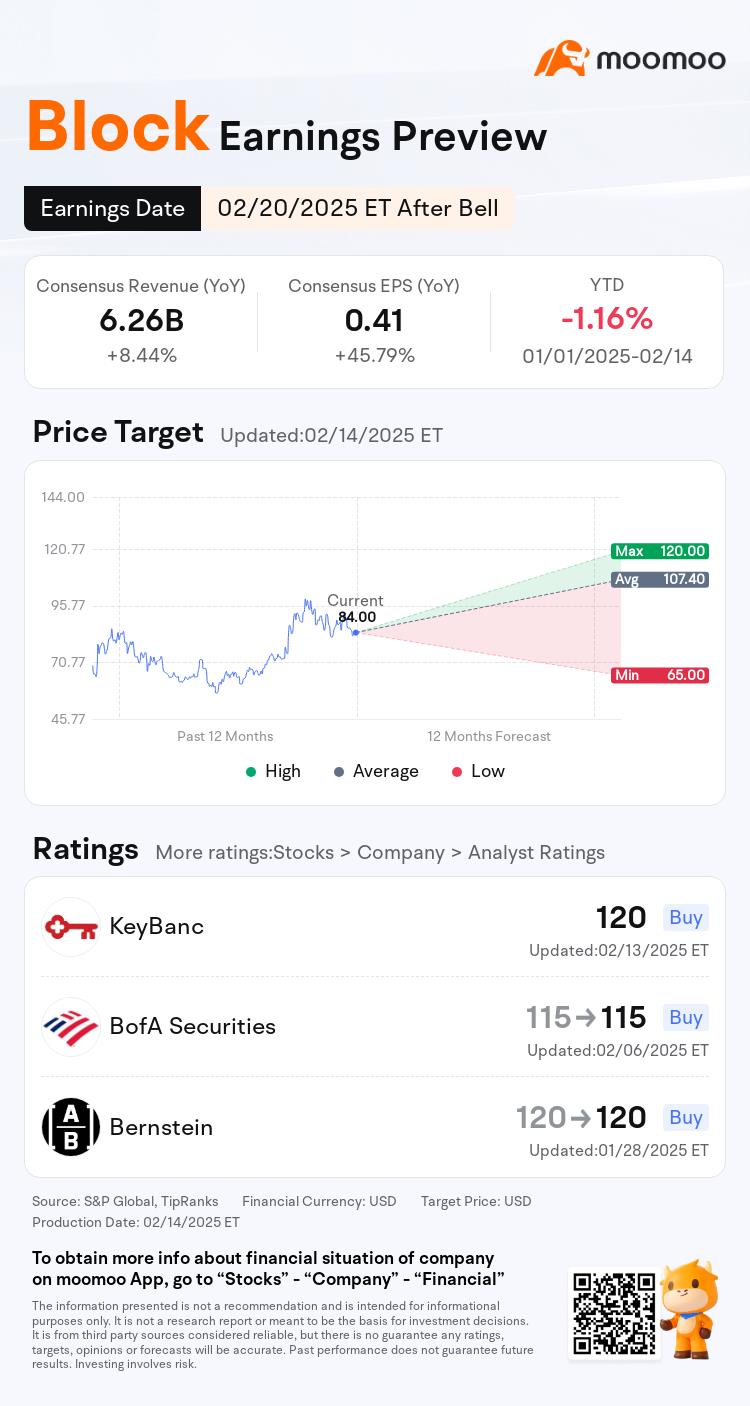

$Block (XYZ.US)$ is a company that integrates payment, financial, and blockchain technologies to provide a one-stop financial services solution for businesses and individuals.

Block's merchant services, which are the company's traditional core business, primarily offer payment processing, business management tools, and financial services to merchants through the Square platform.

The company's ...

Block's merchant services, which are the company's traditional core business, primarily offer payment processing, business management tools, and financial services to merchants through the Square platform.

The company's ...

77

11

24

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)