Money 3

liked

$AMC Entertainment (AMC.US)$

Broke $28 support/trend line its held for 7 months. Could be a very bearish signal. then again, this stock does what it wants when it wants. Charts can only be so helpful, so keep an eye on the price action. If it starts to breakdown under $24.90. We could see $17-$12 areas as a gap fill down. Watching 24.90 closely for a bounce or a breakdown

F $Ford Motor (F.US)$

52 week highs on Friday with significant volume,but bulls should be weary at these levels in my opinion. If you look back to 1998 about 23 years ago Ford hit an all time high of $22.84 which I think could be a key resistance spot. short interest is nonexistent . So anything around $22-$23 could be a potential short term profit taking area. I’ll be watching for potential puts idea off that 22.84 all time high. We’ll see if we breakthrough that area or it acts as a resistance

AAPL $Apple (AAPL.US)$

An absolute Beast. Showing me

that this is where investors fellel comfortable putting capital when the markets go red. That price action showed me how strong AAPL was even with the few reports on slower iPhone growth and adoption. Now the RSI is getting a bit hot up here in the 80s… It’s looking overbought in the short term. I am not a buyer here but any 5-10% pull back could be a good opportunity to go long, very long

COIN

$Coinbase (COIN.US)$

Lots of bears lots of bulls on this name. Valuation aside this runs on the BTC and Crypto charts. If we see BTC break $50 and start to approach all time highs again in the $60.000s this is a name that could be poised to push that $300 spot. I am not sold yet that crypto, BTC or ETH or any coin in the digital asset space will be the savior for long term inflation or interest rate spikes. If we that the fed timelines are increasing for rate hikes this week and BTC moves higher off that news I would be very bullish long term on BTC ETH $Ethereum (ETH.CC)$ and COIN $Bitcoin (BTC.CC)$

Broke $28 support/trend line its held for 7 months. Could be a very bearish signal. then again, this stock does what it wants when it wants. Charts can only be so helpful, so keep an eye on the price action. If it starts to breakdown under $24.90. We could see $17-$12 areas as a gap fill down. Watching 24.90 closely for a bounce or a breakdown

F $Ford Motor (F.US)$

52 week highs on Friday with significant volume,but bulls should be weary at these levels in my opinion. If you look back to 1998 about 23 years ago Ford hit an all time high of $22.84 which I think could be a key resistance spot. short interest is nonexistent . So anything around $22-$23 could be a potential short term profit taking area. I’ll be watching for potential puts idea off that 22.84 all time high. We’ll see if we breakthrough that area or it acts as a resistance

AAPL $Apple (AAPL.US)$

An absolute Beast. Showing me

that this is where investors fellel comfortable putting capital when the markets go red. That price action showed me how strong AAPL was even with the few reports on slower iPhone growth and adoption. Now the RSI is getting a bit hot up here in the 80s… It’s looking overbought in the short term. I am not a buyer here but any 5-10% pull back could be a good opportunity to go long, very long

COIN

$Coinbase (COIN.US)$

Lots of bears lots of bulls on this name. Valuation aside this runs on the BTC and Crypto charts. If we see BTC break $50 and start to approach all time highs again in the $60.000s this is a name that could be poised to push that $300 spot. I am not sold yet that crypto, BTC or ETH or any coin in the digital asset space will be the savior for long term inflation or interest rate spikes. If we that the fed timelines are increasing for rate hikes this week and BTC moves higher off that news I would be very bullish long term on BTC ETH $Ethereum (ETH.CC)$ and COIN $Bitcoin (BTC.CC)$

22

7

1

Money 3

liked

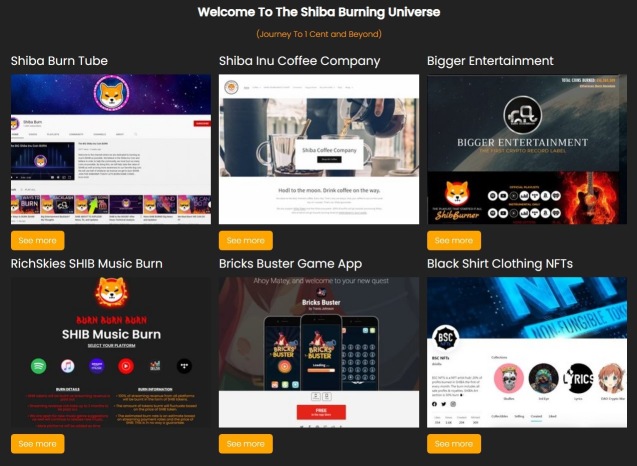

Spread the Word SHIB Army! Here’s the Ways YOU Can BURN $Shiba Inu !!! Google for more info about these BURN Methods and Do YOUR Part to Help ALL of SHIB Army reach $0.01!! 🚀🚀📈📈🤑🤑

$Bitcoin (BTC.CC)$ $Ethereum (ETH.CC)$ $Dogecoin (DOGE.CC)$ $Bitcoin Cash (BCH.CC)$ $Bitcoin SV (BSV.CC)$ $Bitcoin Gold (BTG.CC)$ $Tether (USDT.CC)$ $Litecoin (LTC.CC)$ $Binance Coin (BNB.CC)$ $Cardano (ADA.CC)$ $BAT (BAT.CC)$ $Stellar (XLM.CC)$ $XRP (XRP.CC)$ $Cosmos (ATOM.CC)$ $Decentraland (MANA.CC)$ $Dash (DASH.CC)$ $ZEC (ZEC.CC)$ $Polygon (MATIC.CC)$ $

$Bitcoin (BTC.CC)$ $Ethereum (ETH.CC)$ $Dogecoin (DOGE.CC)$ $Bitcoin Cash (BCH.CC)$ $Bitcoin SV (BSV.CC)$ $Bitcoin Gold (BTG.CC)$ $Tether (USDT.CC)$ $Litecoin (LTC.CC)$ $Binance Coin (BNB.CC)$ $Cardano (ADA.CC)$ $BAT (BAT.CC)$ $Stellar (XLM.CC)$ $XRP (XRP.CC)$ $Cosmos (ATOM.CC)$ $Decentraland (MANA.CC)$ $Dash (DASH.CC)$ $ZEC (ZEC.CC)$ $Polygon (MATIC.CC)$ $

19

2

Money 3

liked and commented on

Stocks seen wavering amid investors' risk-off mood

Stocks look set to start the week under pressure with investors looking to U.S. inflation data amid the Federal Reserve's hawkish tilt, and the impact of omicron as risk aversion grips financial markets.

Asian futures pointed to benchmarks opening lower. Australia fluctuated at the open, while U.S. futures edged up. U.S. stocks extended a weekly slide Friday after a mixed U.S. jobs report fanned volatility.

Shock to crypto daredevils joins list of scary omens in markets

A hawkish turn from the Federal Reserve and the omicron variant have erased more than 10% off the market value of cryptocurrencies. The cryptocurrency lost as much as 21% since Friday's stock-market close and swung wildly throughout the weekend. The decline brought it down to around $42,290 at one point, well below its record high of near $69,000 just a few weeks ago.

Big drops in an asset like Bitcoin have the potential to lower confidence among the larger population of bettors, a concept described as negative wealth effect.

High-flying tech stocks are bordering on correction territory

The stock-market drubbing is hitting the once-favored technology giants hard.

The so-called NYSE FANG+ Index tracking the tech industry's giants brushed up against a correction on Friday -- with a drop of 9.99% from its closing peak on Nov. 4. That leaves it just shy of the 10% tumble that would mark a full-fledged correction in the eyes of traders.

Hedge funds suffer big losses on biotech rout

Biotech stocks have fallen to earth with a thud in 2021 after soaring last year amid excitement over the development of Covid-19 vaccines, dealing big losses to some hedge funds. The sector is being buffeted by concerns Congress will move to put a lid on drug pricing and a surfeit of early-stage biotech shares as the IPO market booms.

The SPDR S&P Biotech ETF, an equal-weighted index of biotech stocks, has fallen about 22% so far this year through Friday, and is down 37% from its Feb. 8 peak. The ETF has tumbled nearly 9% since Thanksgiving. Biotech is the worst-performing of all 11 S&P 500 sectors this year, a time when the broader index has notched a total gain of nearly 21%.

Charlie Munger says he wishes cryptocurrencies had 'never been invented'

Billionaire investor Charlie Munger still isn't a fan of cryptocurrency.

"I wish they'd never been invented," Munger said at the Sohn conference in Sydney on Friday, according to The Australian Financial Review. "Of course," he said. "I don't welcome a currency that's so useful to kidnappers and extortionists and so forth, nor do I like just shuffling out of your extra billions of billions of dollars to somebody who just invented a new financial product out of thin air."

Buy now pay later boom shows no signs of slowing this holiday season

7% of shoppers said they will be using buy now, pay later as a payment method for holiday purchases this year, according to a CNBC/Momentive Small Business Survey. The credit card alternative has exploded in popularity as online shopping has boomed during the pandemic and more retailers and payment providers have adopted it.

The use of BNPL globally during Cyber Week — from Nov. 23 to Monday — jumped 29% year over year, according to Salesforce data.

Elon Musk being allowed to "make the rules" in space, ESA chief warns

Josef Aschbacher, the new director-general of ESA, said that Europe's readiness to help the rapid expansion of Musk's Starlink satellite internet service risked hindering the region's own companies from realising the potential of commercial space.

He said Musk's Starlink was already so big that it was difficult for regulators or rivals to catch up. "You have one person owning half of the active satellites in the world. That's quite amazing. De facto, he is making the rules, the rest of the world including Europe.

Apple's iPhone successor comes into focus

$Apple (AAPL.US)$ is raising the stakes with what analysts say are plans for a headset or smart glasses that will offer access to a layer of information, objects and data spread across our view of the real world like so much digital pixie dust—a so-called augmented reality, or AR. While the company hasn't disclosed its plans, analysts and other industry insiders expect Apple's first AR device could be announced by the end of 2022.

Source: Bloomberg, WSJ, CNBC, Financial Times

Stocks look set to start the week under pressure with investors looking to U.S. inflation data amid the Federal Reserve's hawkish tilt, and the impact of omicron as risk aversion grips financial markets.

Asian futures pointed to benchmarks opening lower. Australia fluctuated at the open, while U.S. futures edged up. U.S. stocks extended a weekly slide Friday after a mixed U.S. jobs report fanned volatility.

Shock to crypto daredevils joins list of scary omens in markets

A hawkish turn from the Federal Reserve and the omicron variant have erased more than 10% off the market value of cryptocurrencies. The cryptocurrency lost as much as 21% since Friday's stock-market close and swung wildly throughout the weekend. The decline brought it down to around $42,290 at one point, well below its record high of near $69,000 just a few weeks ago.

Big drops in an asset like Bitcoin have the potential to lower confidence among the larger population of bettors, a concept described as negative wealth effect.

High-flying tech stocks are bordering on correction territory

The stock-market drubbing is hitting the once-favored technology giants hard.

The so-called NYSE FANG+ Index tracking the tech industry's giants brushed up against a correction on Friday -- with a drop of 9.99% from its closing peak on Nov. 4. That leaves it just shy of the 10% tumble that would mark a full-fledged correction in the eyes of traders.

Hedge funds suffer big losses on biotech rout

Biotech stocks have fallen to earth with a thud in 2021 after soaring last year amid excitement over the development of Covid-19 vaccines, dealing big losses to some hedge funds. The sector is being buffeted by concerns Congress will move to put a lid on drug pricing and a surfeit of early-stage biotech shares as the IPO market booms.

The SPDR S&P Biotech ETF, an equal-weighted index of biotech stocks, has fallen about 22% so far this year through Friday, and is down 37% from its Feb. 8 peak. The ETF has tumbled nearly 9% since Thanksgiving. Biotech is the worst-performing of all 11 S&P 500 sectors this year, a time when the broader index has notched a total gain of nearly 21%.

Charlie Munger says he wishes cryptocurrencies had 'never been invented'

Billionaire investor Charlie Munger still isn't a fan of cryptocurrency.

"I wish they'd never been invented," Munger said at the Sohn conference in Sydney on Friday, according to The Australian Financial Review. "Of course," he said. "I don't welcome a currency that's so useful to kidnappers and extortionists and so forth, nor do I like just shuffling out of your extra billions of billions of dollars to somebody who just invented a new financial product out of thin air."

Buy now pay later boom shows no signs of slowing this holiday season

7% of shoppers said they will be using buy now, pay later as a payment method for holiday purchases this year, according to a CNBC/Momentive Small Business Survey. The credit card alternative has exploded in popularity as online shopping has boomed during the pandemic and more retailers and payment providers have adopted it.

The use of BNPL globally during Cyber Week — from Nov. 23 to Monday — jumped 29% year over year, according to Salesforce data.

Elon Musk being allowed to "make the rules" in space, ESA chief warns

Josef Aschbacher, the new director-general of ESA, said that Europe's readiness to help the rapid expansion of Musk's Starlink satellite internet service risked hindering the region's own companies from realising the potential of commercial space.

He said Musk's Starlink was already so big that it was difficult for regulators or rivals to catch up. "You have one person owning half of the active satellites in the world. That's quite amazing. De facto, he is making the rules, the rest of the world including Europe.

Apple's iPhone successor comes into focus

$Apple (AAPL.US)$ is raising the stakes with what analysts say are plans for a headset or smart glasses that will offer access to a layer of information, objects and data spread across our view of the real world like so much digital pixie dust—a so-called augmented reality, or AR. While the company hasn't disclosed its plans, analysts and other industry insiders expect Apple's first AR device could be announced by the end of 2022.

Source: Bloomberg, WSJ, CNBC, Financial Times

77

11

25

Money 3

liked

$Bitcoin (BTC.CC)$ from 66k to 56k, buy if you are interested

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)