MONEYCOMETOME

voted

1

MONEYCOMETOME

voted

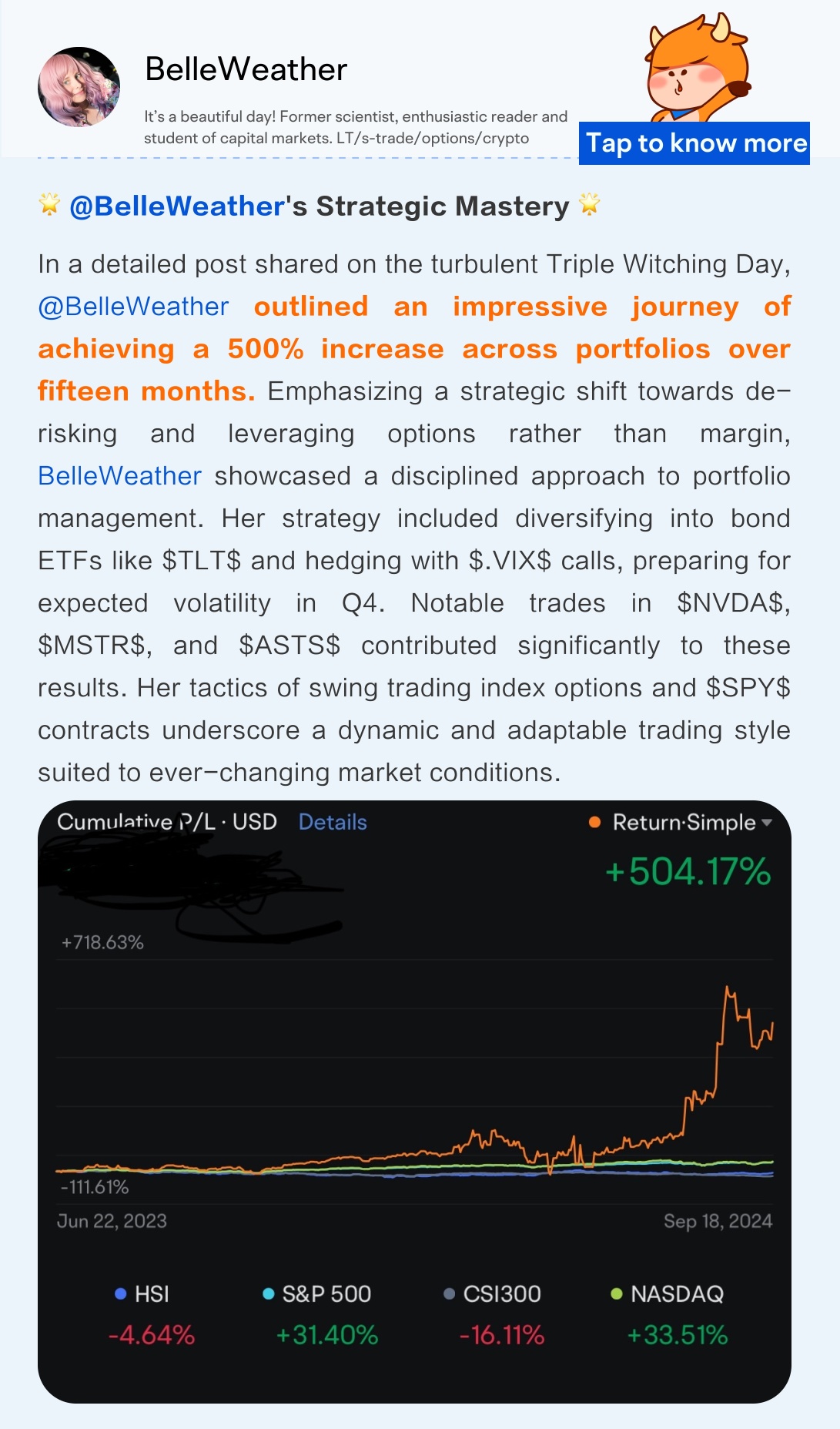

As September 2024 comes to a close, we take a moment to reflect on a tumultuous month marked by significant market volatility and pivotal economic events that shaped trading strategies and decision-making within our dynamic community. From Nvidia's somber guidance that triggered a downturn to the eagerly awaited Federal Reserve rate cuts and the positive surge in Chinese stocks following policy stimuli, mooers ...

+6

97

46

MONEYCOMETOME

voted

$NATGATE (0270.MY)$ time to give up on this share?

2

MONEYCOMETOME

liked

Last week's review👉🏻Market review + positions (23/09-27/09 2024)

Market behavior this week:

$NASDAQ 100 Index (.NDX.US)$ Tuesday and Thursday distribution, Friday absorption;

$S&P 500 Index (.SPX.US)$ Monday absorption, Tuesday distribution, Friday absorption;

$Russell 2000 Index (.RUT.US)$ Thursday distribution, Friday absorption.

spx > rut < ndx.

NDX and SPX both experienced a small dip this week, basically recovered on Friday; RUT had a second small retreat, testing the 20, 30 MA; all three indices closed above the 10 MA on Friday; overall, it's a swinging market, a bit boring, the market's profit effect is not yet optimal, it's also a good time for the market to help screen stocks, where you can see which names quickly attract buyers after a dip, and which ones are left unnoticed.

Weekly charts:

NDX and SPX tested the previous neckline, while RUT completed a 10-week weekly chart test, all in low volume weeks.

Breadth Record:

Continuing to stay green.

Weekly Notes:

The RS strength of APLD in internal system trades slightly downgraded.

Market sentiment:

The overheated sentiment of AAII has cooled slightly, and the counter-sentiment behavior on Thursday and Friday has slightly helped the index to rise. However, the main increase was driven by Labor Day on Friday...

Market behavior this week:

$NASDAQ 100 Index (.NDX.US)$ Tuesday and Thursday distribution, Friday absorption;

$S&P 500 Index (.SPX.US)$ Monday absorption, Tuesday distribution, Friday absorption;

$Russell 2000 Index (.RUT.US)$ Thursday distribution, Friday absorption.

spx > rut < ndx.

NDX and SPX both experienced a small dip this week, basically recovered on Friday; RUT had a second small retreat, testing the 20, 30 MA; all three indices closed above the 10 MA on Friday; overall, it's a swinging market, a bit boring, the market's profit effect is not yet optimal, it's also a good time for the market to help screen stocks, where you can see which names quickly attract buyers after a dip, and which ones are left unnoticed.

Weekly charts:

NDX and SPX tested the previous neckline, while RUT completed a 10-week weekly chart test, all in low volume weeks.

Breadth Record:

Continuing to stay green.

Weekly Notes:

The RS strength of APLD in internal system trades slightly downgraded.

Market sentiment:

The overheated sentiment of AAII has cooled slightly, and the counter-sentiment behavior on Thursday and Friday has slightly helped the index to rise. However, the main increase was driven by Labor Day on Friday...

Translated

+25

23

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)