MoneyMoneyCome

reacted to

$Intel (INTC.US)$ poor pat carry the black wok that Intel misleaded by shitty previous leaderships. not much he can do with covid and late game move into ai and phone chips when previous leadership on their high horses

![]()

6

4

MoneyMoneyCome

commented on

$Intel (INTC.US)$ Curious who will be the new ceo

3

MoneyMoneyCome

liked

RecentlyGold has continued to rise, reaching new highs,once again sparking everyone's attention to gold! I remember the last time everyone was so enthusiastic about gold was in September. At that time $XAU/USD (XAUUSD.CFD)$ near the 2600level, and then continued rising, breaking through2600American dollar.

The questions asked then and now are almost the same:![]()

Those who haven't gotten on the bus are asking if they can get on??

Those already on the bus are asking whether to reduce positions???

A month has passed, and the answers remain unchanged!

Suggestions for those who haven't gotten on boardBuild positions in batches, or directly set up a dollar-cost averaging plan for a strategic layoutTo prevent oneself from not daring to buy when the price rises and wanting to sell when it drops. You may also say, if I am bullish on gold for the long term, why not just make a single purchase and wait for the price to rise? In fact, I don't think there's any problem with doing this operationally. The key is whether you can hold on when gold falls. Some students chase after the rise but lack confidence, especially for high-priced varieties like gold, which are very scary. It's probably unsustainable to drop by 5 points, but for me, if gold can drop by 5 points, it's really a great opportunity to increase my holdings. Last time gold only corrected by one point, I think it's too little, so I didn't add to my position.

So everyone should lay out their gold investments according to their own risk tolerance, otherwise you will find that even assets with high winning rates like gold can still lead to losses!

In order to deepen everyone's understanding of gold and enhance confidence in gold. Next, we will start from the basics...

The questions asked then and now are almost the same:

Those who haven't gotten on the bus are asking if they can get on??

Those already on the bus are asking whether to reduce positions???

A month has passed, and the answers remain unchanged!

Suggestions for those who haven't gotten on boardBuild positions in batches, or directly set up a dollar-cost averaging plan for a strategic layoutTo prevent oneself from not daring to buy when the price rises and wanting to sell when it drops. You may also say, if I am bullish on gold for the long term, why not just make a single purchase and wait for the price to rise? In fact, I don't think there's any problem with doing this operationally. The key is whether you can hold on when gold falls. Some students chase after the rise but lack confidence, especially for high-priced varieties like gold, which are very scary. It's probably unsustainable to drop by 5 points, but for me, if gold can drop by 5 points, it's really a great opportunity to increase my holdings. Last time gold only corrected by one point, I think it's too little, so I didn't add to my position.

So everyone should lay out their gold investments according to their own risk tolerance, otherwise you will find that even assets with high winning rates like gold can still lead to losses!

In order to deepen everyone's understanding of gold and enhance confidence in gold. Next, we will start from the basics...

Translated

+2

59

6

10

MoneyMoneyCome

commented on and voted

Every company's financials tell a unique story, revealing important information about its revenue, assets, liabilities, and cash flow.

By analyzing this data, investors can gain valuable insights into a company's performance and make informed decisions about where to put th...

+2

1599

1831

152

MoneyMoneyCome

voted

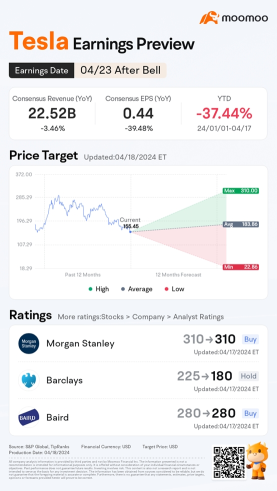

Tesla is releasing its Q1 2024 earnings after the market closes on April 23.

Since its Q4 earnings release, shares of $Tesla (TSLA.US)$ have seen a decrease of 29%.![]() Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now!

Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

Since its Q4 earnings release, shares of $Tesla (TSLA.US)$ have seen a decrease of 29%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

144

371

34

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)