Happy New Year to all MOOMOO users.![]()

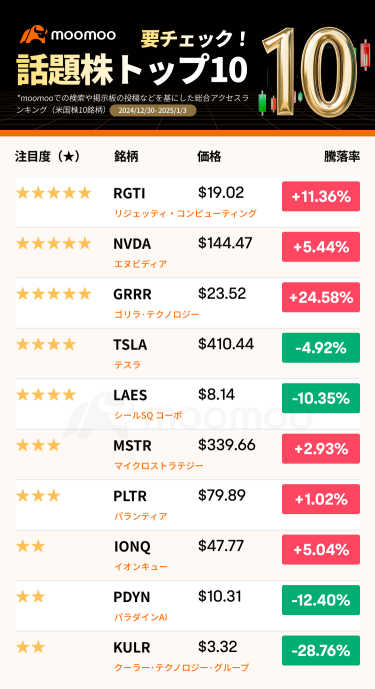

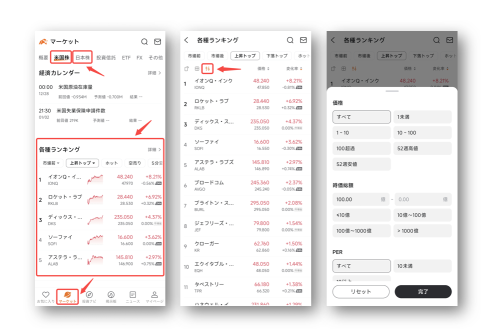

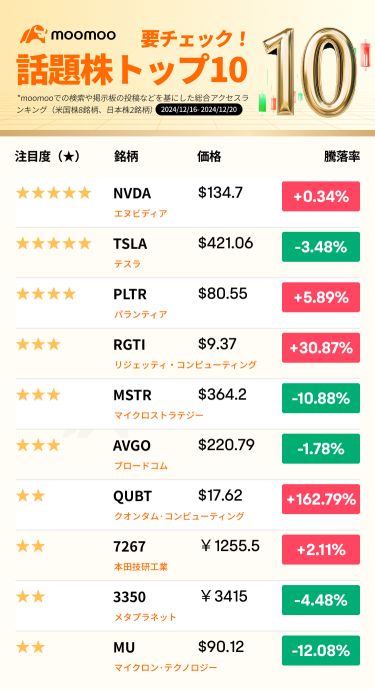

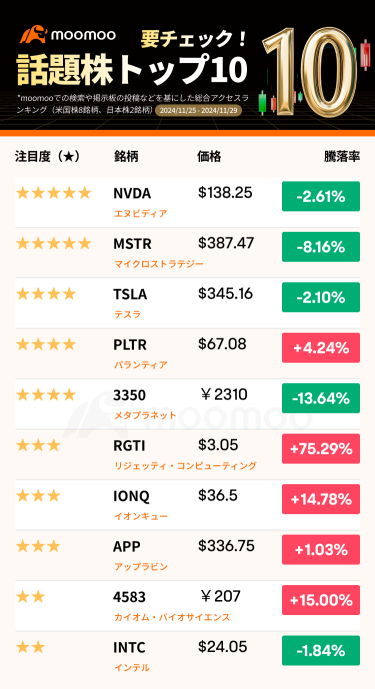

【Must-Check! Top 10 Popular Stocks】Welcome to!

Introducing the top 10 stocks that were hot topics within the app last week, all at once.By providing this information, we hope you can gain new perspectives or find opportunities to enhance your investment skills.

Furthermore, discussing topics in the comments section allows you to exchange them for stock cashback vouchers.Opportunity to earn pointsPlease actively participate as there is also a chance to earn points.

Now, let's begin,Top 10 trending stocksLet's check it out!![]()

1. $Rigetti Computing (RGTI.US)$ (Attention level ⭐⭐⭐⭐⭐)

Rigetti is related to Google's latest quantum chip 'Willow'.Advancement in quantum technologyやStock prices of related stocks are rising.Amidst the market's attention,Quantum-related stocks, which are expected to benefit greatly from future growth,are attracting investors' interest.

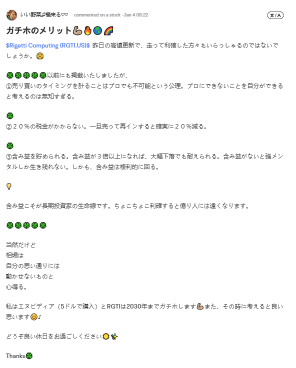

💡ユーザーの見解

@いい野菜♫福来る♡♡

2. $NVIDIA (NVDA.US)$(Attention⭐⭐⭐⭐⭐)

NVID...

【Must-Check! Top 10 Popular Stocks】Welcome to!

Introducing the top 10 stocks that were hot topics within the app last week, all at once.By providing this information, we hope you can gain new perspectives or find opportunities to enhance your investment skills.

Furthermore, discussing topics in the comments section allows you to exchange them for stock cashback vouchers.Opportunity to earn pointsPlease actively participate as there is also a chance to earn points.

Now, let's begin,Top 10 trending stocksLet's check it out!

1. $Rigetti Computing (RGTI.US)$ (Attention level ⭐⭐⭐⭐⭐)

Rigetti is related to Google's latest quantum chip 'Willow'.Advancement in quantum technologyやStock prices of related stocks are rising.Amidst the market's attention,Quantum-related stocks, which are expected to benefit greatly from future growth,are attracting investors' interest.

💡ユーザーの見解

@いい野菜♫福来る♡♡

2. $NVIDIA (NVDA.US)$(Attention⭐⭐⭐⭐⭐)

NVID...

Translated

+6

40

21

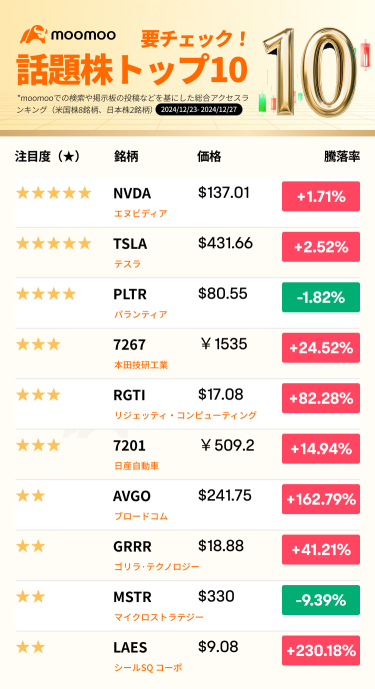

【Must-Check! Top 10 Popular Stocks】Welcome to!![]()

Introducing the top 10 stocks that were hot topics within the app last week, all at once.By providing this information, we hope you can gain new perspectives or find opportunities to enhance your investment skills.

Now, let's begin,Top 10 trending stocksLet's check it out!![]()

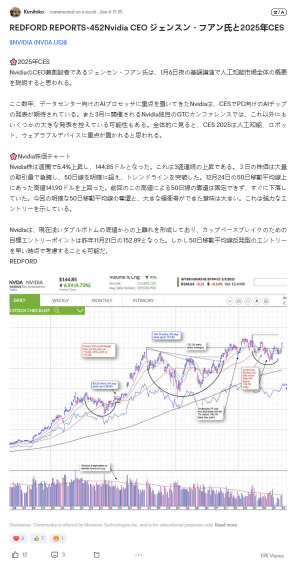

1. $NVIDIA (NVDA.US)$ (Attention level ⭐⭐⭐⭐⭐)

The latest platform specialized in data centers and compute-intensive tasks.The 'GB200 NVL4' is equipped with two Grace CPUs and four Blackwell GPUs, featuring a balanced design between performance and energy efficiency. The company is planning to announce the next generation GB300 AI server platform at the 'GTC Conference' scheduled for March 2025, as reported on December 23.The 'GB200 NVL4' is equipped with two Grace CPUs and four Blackwell GPUs, featuring a balanced design between performance and energy efficiency. The company is planning to announce the next generation GB300 AI server platform at the 'GTC Conference' scheduled for March 2025, as reported on December 23.The 'GB200 NVL4' is equipped with two Grace CPUs and four Blackwell GPUs, featuring a balanced design between performance and energy efficiency. The company is planning to announce the next generation GB300 AI server platform at the 'GTC Conference' scheduled for March 2025, as reported on December 23.The 'GB200 NVL4' is equipped with two Grace CPUs and four Blackwell GPUs, featuring a balanced design between performance and energy efficiency. The company is planning to announce the next generation GB300 AI server platform at the 'GTC Conference' scheduled for March 2025, as reported on December 23.The 'GB200 NVL4' is equipped with two Grace CPUs and four Blackwell GPUs, featuring a balanced design between performance and energy efficiency. The company is planning to announce the next generation GB300 AI server platform at the 'GTC Conference' scheduled for March 2025, as reported on December 23.The 'GB200 NVL4' is equipped with two Grace CPUs and four Blackwell GPUs, featuring a balanced design between performance and energy efficiency. The company is planning to announce the next generation GB300 AI server platform at the 'GTC Conference' scheduled for March 2025, as reported on December 23.

💡User's opinion

@いい野菜♫福来る♡♡:

nvidia (NVDA.US) Even with profits related to Quantum Computing, the performance is expected to skyrocket next year with tremendous results. 🚀🌋🌋🚀 Supporting and assisting Quantum...

Introducing the top 10 stocks that were hot topics within the app last week, all at once.By providing this information, we hope you can gain new perspectives or find opportunities to enhance your investment skills.

Now, let's begin,Top 10 trending stocksLet's check it out!

1. $NVIDIA (NVDA.US)$ (Attention level ⭐⭐⭐⭐⭐)

The latest platform specialized in data centers and compute-intensive tasks.The 'GB200 NVL4' is equipped with two Grace CPUs and four Blackwell GPUs, featuring a balanced design between performance and energy efficiency. The company is planning to announce the next generation GB300 AI server platform at the 'GTC Conference' scheduled for March 2025, as reported on December 23.The 'GB200 NVL4' is equipped with two Grace CPUs and four Blackwell GPUs, featuring a balanced design between performance and energy efficiency. The company is planning to announce the next generation GB300 AI server platform at the 'GTC Conference' scheduled for March 2025, as reported on December 23.The 'GB200 NVL4' is equipped with two Grace CPUs and four Blackwell GPUs, featuring a balanced design between performance and energy efficiency. The company is planning to announce the next generation GB300 AI server platform at the 'GTC Conference' scheduled for March 2025, as reported on December 23.The 'GB200 NVL4' is equipped with two Grace CPUs and four Blackwell GPUs, featuring a balanced design between performance and energy efficiency. The company is planning to announce the next generation GB300 AI server platform at the 'GTC Conference' scheduled for March 2025, as reported on December 23.The 'GB200 NVL4' is equipped with two Grace CPUs and four Blackwell GPUs, featuring a balanced design between performance and energy efficiency. The company is planning to announce the next generation GB300 AI server platform at the 'GTC Conference' scheduled for March 2025, as reported on December 23.The 'GB200 NVL4' is equipped with two Grace CPUs and four Blackwell GPUs, featuring a balanced design between performance and energy efficiency. The company is planning to announce the next generation GB300 AI server platform at the 'GTC Conference' scheduled for March 2025, as reported on December 23.

💡User's opinion

@いい野菜♫福来る♡♡:

nvidia (NVDA.US) Even with profits related to Quantum Computing, the performance is expected to skyrocket next year with tremendous results. 🚀🌋🌋🚀 Supporting and assisting Quantum...

Translated

+3

66

3

4

Hello everyone!![]()

As the new year approaches, why not look back at the events that shook the market in 2024? This time, we will focus on what attracted special attention on moomoo.Top 6 Events of 2024we have carefully selecteddelivers hints that will help with your investment strategy in the new yearI hope that 2025 will be an even more fruitful year. Let's take a look back at the market trends in 2024 together,as a reference when planning your investment for the next year.Please make use of it.![]()

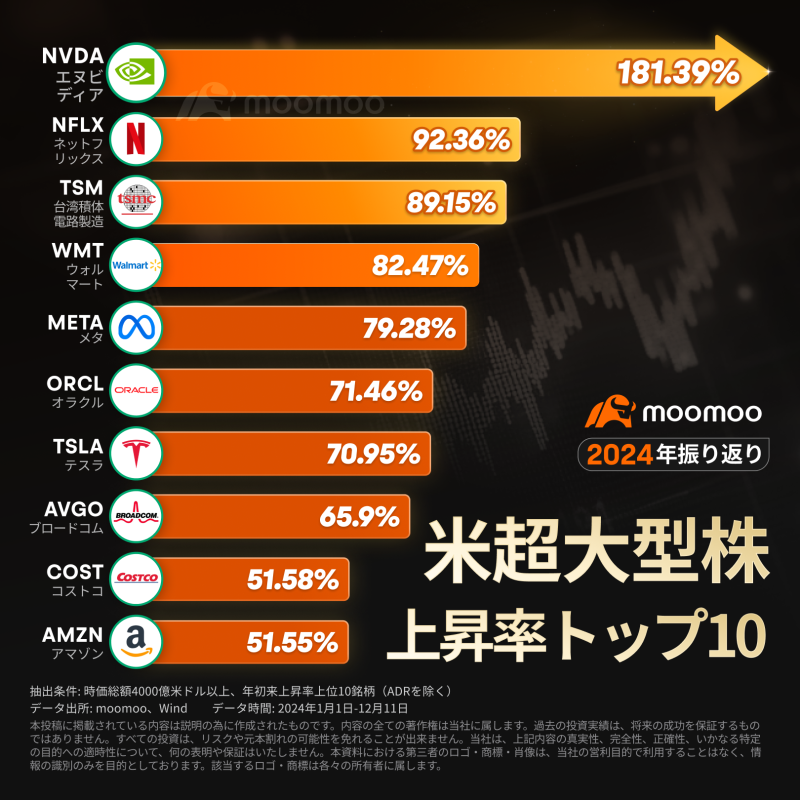

1. nvidia, The strongest AI champion leads the US stock boom.

In 2024, in the midst of the AI revolution sweeping the world, the center of attention was ETF. $NVIDIA (NVDA.US)$ Against the backdrop of its overwhelming presence in AI and Semiconductors, ETF's stock price soared by about 180% this year.announcing a surprising growth of 180% in stock price.In the Earnings Reports of May, a Stock Splits was announced, resulting in a 9% increase in stock price the following business day. In June, its Market Cap surpassed Microsoft and Apple, temporarily securing the position of world No.1. Then, in November, both stock price and Market Cap peaked, reaching a Market Cap of 3.74 trillion dollars.the Market Cap reached $3.74 trillion.At present,

Black...

As the new year approaches, why not look back at the events that shook the market in 2024? This time, we will focus on what attracted special attention on moomoo.Top 6 Events of 2024we have carefully selecteddelivers hints that will help with your investment strategy in the new yearI hope that 2025 will be an even more fruitful year. Let's take a look back at the market trends in 2024 together,as a reference when planning your investment for the next year.Please make use of it.

1. nvidia, The strongest AI champion leads the US stock boom.

In 2024, in the midst of the AI revolution sweeping the world, the center of attention was ETF. $NVIDIA (NVDA.US)$ Against the backdrop of its overwhelming presence in AI and Semiconductors, ETF's stock price soared by about 180% this year.announcing a surprising growth of 180% in stock price.In the Earnings Reports of May, a Stock Splits was announced, resulting in a 9% increase in stock price the following business day. In June, its Market Cap surpassed Microsoft and Apple, temporarily securing the position of world No.1. Then, in November, both stock price and Market Cap peaked, reaching a Market Cap of 3.74 trillion dollars.the Market Cap reached $3.74 trillion.At present,

Black...

Translated

+8

39

10

【Must-Check! Top 10 Popular Stocks】Welcome to!![]()

Introducing the top 10 stocks that were hot topics within the app last week, all at once.By providing this information, we hope you can gain new perspectives or find opportunities to enhance your investment skills.

Furthermore, discussing topics in the comments section allows you to exchange them for stock cashback vouchers.Opportunity to earn pointsPlease actively participate as there is also a chance to earn points.

Now, let's begin,Top 10 trending stocksLet's check it out!![]()

1. $NVIDIA (NVDA.US)$ (Attention level ⭐⭐⭐⭐⭐)

At CES 2025 scheduled to be held on January 6, 2025, the next-generation GPU 'GeForce RTX 50 series' will be announced. This series adopts the 'Blackwell' architecture, and the flagship product RTX 5080 is equipped with 16GB of GDDR7 memory. The RTX 5080 is expected to be released in mid-January, followed by the RTX 5090 with 32GB of GDDR7 memory to be introduced to the market from late January to mid-February. These new GPUs are designed for 4K gaming...

Introducing the top 10 stocks that were hot topics within the app last week, all at once.By providing this information, we hope you can gain new perspectives or find opportunities to enhance your investment skills.

Furthermore, discussing topics in the comments section allows you to exchange them for stock cashback vouchers.Opportunity to earn pointsPlease actively participate as there is also a chance to earn points.

Now, let's begin,Top 10 trending stocksLet's check it out!

1. $NVIDIA (NVDA.US)$ (Attention level ⭐⭐⭐⭐⭐)

At CES 2025 scheduled to be held on January 6, 2025, the next-generation GPU 'GeForce RTX 50 series' will be announced. This series adopts the 'Blackwell' architecture, and the flagship product RTX 5080 is equipped with 16GB of GDDR7 memory. The RTX 5080 is expected to be released in mid-January, followed by the RTX 5090 with 32GB of GDDR7 memory to be introduced to the market from late January to mid-February. These new GPUs are designed for 4K gaming...

Translated

+3

31

2

12

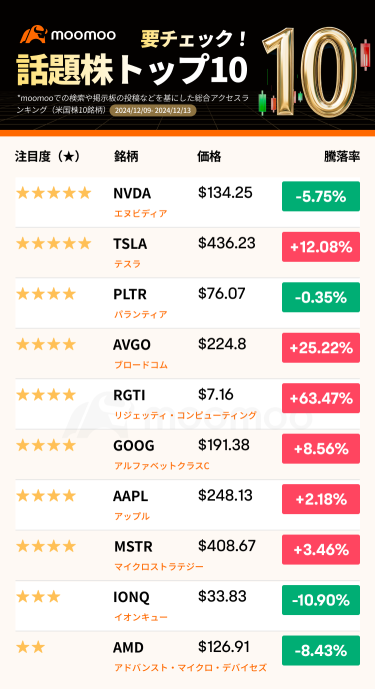

【Must-Check! Top 10 Popular Stocks】Welcome to!![]()

Introducing the top 10 stocks that were hot topics within the app last week, all at once.By providing this information, we hope you can gain new perspectives or find opportunities to enhance your investment skills.

Now, let's begin,Top 10 trending stocksLet's check it out!![]()

1. $NVIDIA (NVDA.US)$ (Attention level ⭐⭐⭐⭐⭐)

On the 9th, the China State Administration for Market Regulation announced that it had started an investigation into the US semiconductor giant NVIDIA for suspected violations of antitrust laws.

💡ユーザーの見解

@らら_5870:

I think it will go up eventually.

Among the Magnificent 7, it is expected to grow the most in terms of performance.

The issue is when it will rise, but you know.

2. $Tesla (TSLA.US)$(Attention⭐⭐⭐⭐⭐)

On the 11th, Tesla announced that it had set a new record for EV passenger sales in China in the first week of December with 20,000 vehicles1900 and the highest in the fourth quarter (September-December). The stock price of Tesla also hit an all-time high in the U.S. stock market on the same day for the first time in about 3 years.

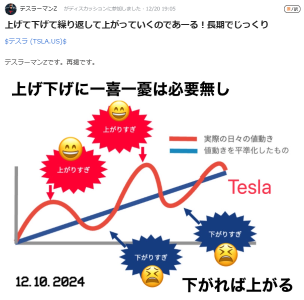

💡ユーザーの見解...

Introducing the top 10 stocks that were hot topics within the app last week, all at once.By providing this information, we hope you can gain new perspectives or find opportunities to enhance your investment skills.

Now, let's begin,Top 10 trending stocksLet's check it out!

1. $NVIDIA (NVDA.US)$ (Attention level ⭐⭐⭐⭐⭐)

On the 9th, the China State Administration for Market Regulation announced that it had started an investigation into the US semiconductor giant NVIDIA for suspected violations of antitrust laws.

💡ユーザーの見解

@らら_5870:

I think it will go up eventually.

Among the Magnificent 7, it is expected to grow the most in terms of performance.

The issue is when it will rise, but you know.

2. $Tesla (TSLA.US)$(Attention⭐⭐⭐⭐⭐)

On the 11th, Tesla announced that it had set a new record for EV passenger sales in China in the first week of December with 20,000 vehicles1900 and the highest in the fourth quarter (September-December). The stock price of Tesla also hit an all-time high in the U.S. stock market on the same day for the first time in about 3 years.

💡ユーザーの見解...

Translated

+5

13

2

Hello everyone!

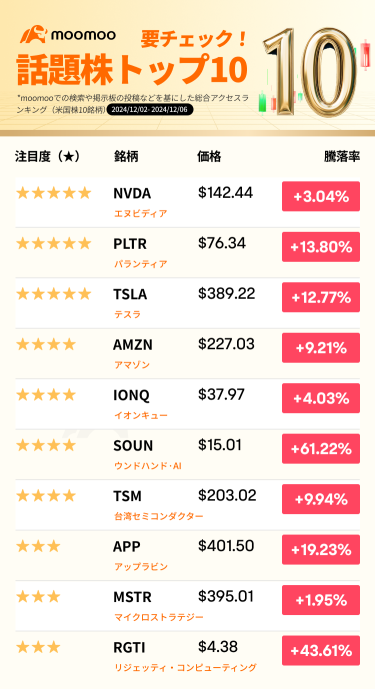

[Must Check! Top 10 Trending Stocks]Welcome!![]()

Introducing at once the top 10 stocks that became a hot topic within the app last weekThrough this information, we hope you can gain new perspectives and find opportunities to enhance your investment skills.

Furthermore, by discussing topics in the comments section, you can exchange for stock cashback vouchers.Chance to earn points.We also have options available. Please feel free to actively participate.

Well then,Let's check out the top 10 trending stocks!Let's check out the top 10 trending stocks!![]()

1. $NVIDIA (NVDA.US)$ (Attention⭐⭐⭐⭐⭐)

On December 5th, NVIDIA (NVDA) opened its first research and development center in Vietnam, demonstrating a strong belief in the promising future of artificial intelligence in the country. According to reports, Nvidia's next-generation AI GPU architecture 'Rubin' may be officially announced as early as six months ahead of expectations, in the second half of 2025.

💡User's Perspective

Dear Tarou,Only holding strong stocks with good earnings and positive guidance...

[Must Check! Top 10 Trending Stocks]Welcome!

Introducing at once the top 10 stocks that became a hot topic within the app last weekThrough this information, we hope you can gain new perspectives and find opportunities to enhance your investment skills.

Furthermore, by discussing topics in the comments section, you can exchange for stock cashback vouchers.Chance to earn points.We also have options available. Please feel free to actively participate.

Well then,Let's check out the top 10 trending stocks!Let's check out the top 10 trending stocks!

1. $NVIDIA (NVDA.US)$ (Attention⭐⭐⭐⭐⭐)

On December 5th, NVIDIA (NVDA) opened its first research and development center in Vietnam, demonstrating a strong belief in the promising future of artificial intelligence in the country. According to reports, Nvidia's next-generation AI GPU architecture 'Rubin' may be officially announced as early as six months ahead of expectations, in the second half of 2025.

💡User's Perspective

Dear Tarou,Only holding strong stocks with good earnings and positive guidance...

Translated

+7

31

10

6

Hello everyone!

New column[Must Check! Top 10 Trending Stocks]Welcome!![]()

[Must Check! Top 10 Trending Stocks]However,Introducing at once the top 10 stocks that became a hot topic within the app last week. Looking back at each stock's performance and trends,Stock Price PerformanceTrends, materials that moved stock pricesmaterials that influenced stock pricesand popular user posts (stock analysis, opinions, profit and loss sharing, etc.) shared by our users.

Through this information, I hope you can gain new perspectives and find opportunities to improve your investment skills. Additionally, by discussing topics in the comments section, there is also a chance to earn points.Chance to earn points.Please actively participate!

Well then,Let's check out the top 10 trending stocks!Let's check out the top 10 trending stocks!![]()

1. $NVIDIA (NVDA.US)$ (Attention⭐⭐⭐⭐⭐)

Anticipating the release of the next-generation GPU 'Blackwell', over 20 analysts predict an increase in sales. JP Morgan raised the stock price target from $155 to $170, emphasizing the competitive advantage of NVIDIA's business.

💡User's Perspective

@いい野菜♫福来る♡♡

���������...

New column[Must Check! Top 10 Trending Stocks]Welcome!

[Must Check! Top 10 Trending Stocks]However,Introducing at once the top 10 stocks that became a hot topic within the app last week. Looking back at each stock's performance and trends,Stock Price PerformanceTrends, materials that moved stock pricesmaterials that influenced stock pricesand popular user posts (stock analysis, opinions, profit and loss sharing, etc.) shared by our users.

Through this information, I hope you can gain new perspectives and find opportunities to improve your investment skills. Additionally, by discussing topics in the comments section, there is also a chance to earn points.Chance to earn points.Please actively participate!

Well then,Let's check out the top 10 trending stocks!Let's check out the top 10 trending stocks!

1. $NVIDIA (NVDA.US)$ (Attention⭐⭐⭐⭐⭐)

Anticipating the release of the next-generation GPU 'Blackwell', over 20 analysts predict an increase in sales. JP Morgan raised the stock price target from $155 to $170, emphasizing the competitive advantage of NVIDIA's business.

💡User's Perspective

@いい野菜♫福来る♡♡

���������...

Translated

+5

47

4

15

Mooナビゲーター

voted

moomoo investors, there is no shortage of hot investment topics to discuss this week! We will deliver a weekly digest full of must-see information!

■Most liked post🎖️

Selected based on the number of views, likes, and comments.

![]() Number one @KimihikoSan:「Marie's perspective.」

Number one @KimihikoSan:「Marie's perspective.」

The 'red wave' caused by Trump's overwhelming victory surprised the market, detailed analysis of sector-specific reactions. It has become an insightful article incorporating implications for future investment strategies and stock selection.

![]() TOP2 @sato kojiSan:「Regarding recent earnings and future investment policies.」

TOP2 @sato kojiSan:「Regarding recent earnings and future investment policies.」

💡 ...Great job!! An overwhelming profit, along with analysis of the market post-presidential election, adjustments to the portfolio considering AI, cryptocurrency, and geopolitical risks, and the proposal of a flexible investment strategy.

![]() TOP 3 @WatchlistSan:「This week is about bitcoin, bitcoin-related stocks,」

TOP 3 @WatchlistSan:「This week is about bitcoin, bitcoin-related stocks,」

💡 Against the background of Bitcoin's sharp rise, it is recommended to seize the investment opportunities at the beginning of the bubble and advocate a strategy of holding and buying. It is an excellent analysis full of enthusiasm wishing for the success of Japanese investors.

■ Best Post Recommended by Operation👍

![]() @PinhaneSan:After a comprehensive analysis of NVIDIA, the following trends are becoming apparent.🧐🤔��������...

@PinhaneSan:After a comprehensive analysis of NVIDIA, the following trends are becoming apparent.🧐🤔��������...

■Most liked post🎖️

Selected based on the number of views, likes, and comments.

The 'red wave' caused by Trump's overwhelming victory surprised the market, detailed analysis of sector-specific reactions. It has become an insightful article incorporating implications for future investment strategies and stock selection.

💡 ...Great job!! An overwhelming profit, along with analysis of the market post-presidential election, adjustments to the portfolio considering AI, cryptocurrency, and geopolitical risks, and the proposal of a flexible investment strategy.

💡 Against the background of Bitcoin's sharp rise, it is recommended to seize the investment opportunities at the beginning of the bubble and advocate a strategy of holding and buying. It is an excellent analysis full of enthusiasm wishing for the success of Japanese investors.

■ Best Post Recommended by Operation👍

Translated

![[Investor Highlights] Reflecting on last week's popular posts and best users 🔍!](https://sgsnsimg.moomoo.com/sns_client_feed/181000007/20241118/1731917993091-123d782b23.png/thumb?area=105&is_public=true)

59

3

Hello, all moomoo users!![]()

Not at all in moomooNEW WEEKLY COLUMNWe are planning to start! In this column, every week“Last Week's Top 10 Notable Stocks”Pick it up,The latest events related to each stock and investment ideas from usersI'll take it up. While following market trends, we will support you in further deepening your investment knowledge.![]()

Now, I would like everyone to choose the name of this column so that more people can enjoy it. From the following candidatesNames you think are most attractivePlease vote for![]()

If “this is it!” If you have any other ideas you think of, please let us know in the comments section. Let's make this column more engaging with everyone's votes and ideas. Now, let's participate in choosing names and start a new weekly column together!

We look forward to your vote.![]()

Not at all in moomooNEW WEEKLY COLUMNWe are planning to start! In this column, every week“Last Week's Top 10 Notable Stocks”Pick it up,The latest events related to each stock and investment ideas from usersI'll take it up. While following market trends, we will support you in further deepening your investment knowledge.

Now, I would like everyone to choose the name of this column so that more people can enjoy it. From the following candidatesNames you think are most attractivePlease vote for

If “this is it!” If you have any other ideas you think of, please let us know in the comments section. Let's make this column more engaging with everyone's votes and ideas. Now, let's participate in choosing names and start a new weekly column together!

We look forward to your vote.

Translated

4

Mooナビゲーター

liked and voted

Berkshire Hathaway, based in Omaha, USA, is experiencing impressive growth. According to the 2023/Q1 financial results announcement, sales increased 20.5% from the same period last year to 85.3 billion dollars, and profit increased 7%. Additionally, Berkshire's share price increased by around 10% in the first half of 2023.

Buffett's investment strategy has been praised by investors around the world who want to replicate his success.

Let's take a look at Mr. Buffett's words and actions in the first half of 2023 in chronological order!

question:

What do you think about Buffett's investment strategy?

What aspects of Buffett are you referring to? Are you also getting inspiration from other investors?

Buffett's investment strategy has been praised by investors around the world who want to replicate his success.

Let's take a look at Mr. Buffett's words and actions in the first half of 2023 in chronological order!

question:

What do you think about Buffett's investment strategy?

What aspects of Buffett are you referring to? Are you also getting inspiration from other investors?

Translated

Expand

Expand 55

6

13

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)