Moomoo AU

liked

$Tesla (TSLA.US)$ $Bitcoin (BTC.CC)$ $Trump Media & Technology (DJT.US)$ $MicroStrategy (MSTR.US)$

My YTD Return![]()

Reason: I have held my Tesla C purchased before the USA election on 11/5 until now.

Do you all think it's better to earn more by holding a good stock for the long term, or by day trading?

I do not know how to perform T, I do not have this ability.![]()

My YTD Return

Reason: I have held my Tesla C purchased before the USA election on 11/5 until now.

Do you all think it's better to earn more by holding a good stock for the long term, or by day trading?

I do not know how to perform T, I do not have this ability.

Translated

14

2

Moomoo AU

liked

$Tesla (TSLA.US)$

![]() Do you all have Hold Positions? I only have less than half a position.

Do you all have Hold Positions? I only have less than half a position.![]()

![]()

So what's your cost?

So what's your cost?

Translated

8

Moomoo AU

liked

soxl recovering….

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$

however, it needs to be above 31.50 to be sure….

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$

however, it needs to be above 31.50 to be sure….

10

7

Moomoo AU

liked

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$

Hi, Dear followers; thank you so much for your support every day :)

In the past few days, I hope some of you, the SOXL gang, have had a good time seeing our beloved SOXL recovering !!

I apologise for not being able to post much lately due to my work on weekends.

$iShares Semiconductor ETF (SOXX.US)$

This is the original chart of SOXL: SOXX, and thanks to the $Broadcom (AVGO.US)$ , which we can probably call ...

Hi, Dear followers; thank you so much for your support every day :)

In the past few days, I hope some of you, the SOXL gang, have had a good time seeing our beloved SOXL recovering !!

I apologise for not being able to post much lately due to my work on weekends.

$iShares Semiconductor ETF (SOXX.US)$

This is the original chart of SOXL: SOXX, and thanks to the $Broadcom (AVGO.US)$ , which we can probably call ...

9

1

Moomoo AU

liked

After reading moomoo's 25-year outlook white paper, it's very good and professional. As the new year approaches, I will also write a 25 forecast. It's not professional, just for entertainment.

I would like to declare in advance that because this is guesswork, the reasons I provide will be relatively one-sided. This does not constitute any investment advice, nor does it assume any responsibility. I welcome friends with different ideas to offer valuable opinions. Let's get to the point:

1. ETF

This year's popularity is very high, with a record high of 1.4 trillion. Next year, continue with music and dance, ETF is a trend, especially in a bullish market, who doesn't like leverage?

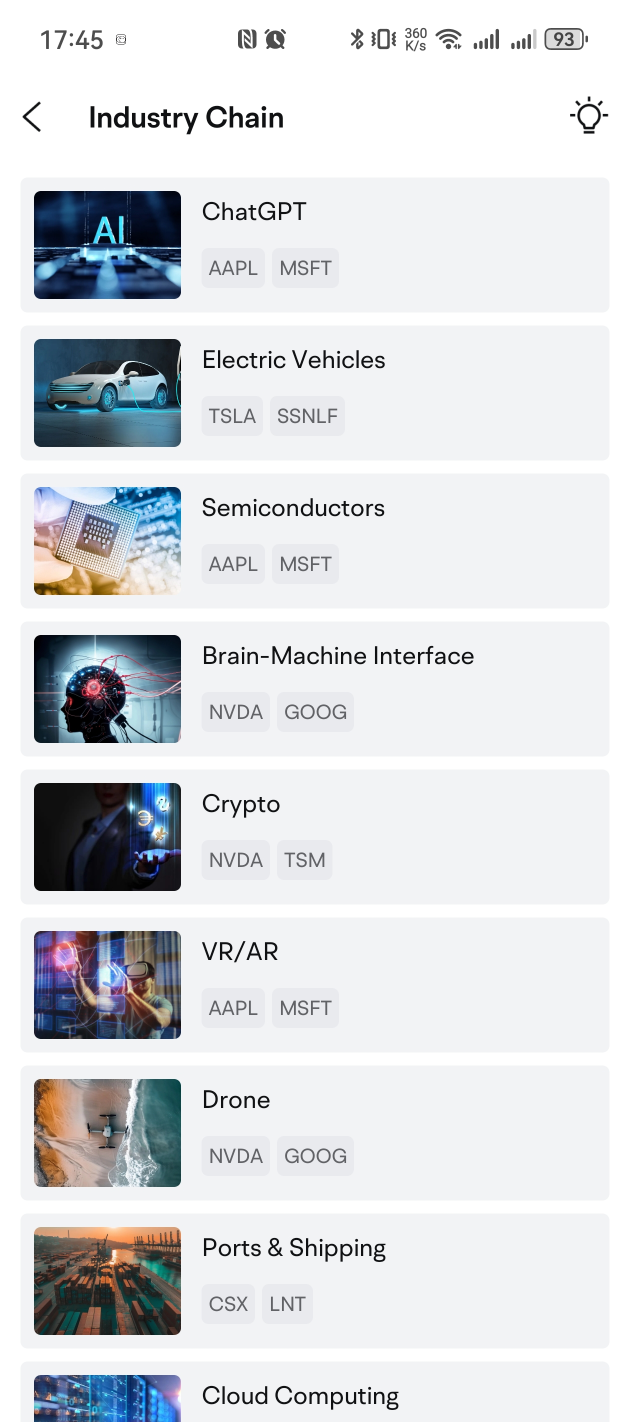

2.AI Wave

The party has just begun, still a long way from the bubble, let's keep playing in these years.

The main reason is that the big shots have invested a lot of real money and silver. Before they have eaten enough and drunk enough, the retail investors want to leave? The Seven Sisters don't mention any bubbles. Let's see who dares to burst it first. So in 25 years, AI will continue to be the advanced toy for the seven sisters and their buddies.

Although Ying's circle of friends has not been going well recently, Google has developed new quantum patterns, and Microsoft is also becoming stronger. The Seven Sisters will each show off their talents at intervals to attract investment.

In 2025, I am more bullish on Google and Microsoft. These two industry giants cannot always be at the bottom. The other elite beauties are too high, so I don't want to pursue them. When negative news such as Google's Chrome divestment lawsuit and the mess left by Microsoft's former CEO emerge, it is the time for me to get on board in my opinion.

3. The Federal Reserve cuts interest rates

Hey hey, how much of a rate cut counts as a cut...

I would like to declare in advance that because this is guesswork, the reasons I provide will be relatively one-sided. This does not constitute any investment advice, nor does it assume any responsibility. I welcome friends with different ideas to offer valuable opinions. Let's get to the point:

1. ETF

This year's popularity is very high, with a record high of 1.4 trillion. Next year, continue with music and dance, ETF is a trend, especially in a bullish market, who doesn't like leverage?

2.AI Wave

The party has just begun, still a long way from the bubble, let's keep playing in these years.

The main reason is that the big shots have invested a lot of real money and silver. Before they have eaten enough and drunk enough, the retail investors want to leave? The Seven Sisters don't mention any bubbles. Let's see who dares to burst it first. So in 25 years, AI will continue to be the advanced toy for the seven sisters and their buddies.

Although Ying's circle of friends has not been going well recently, Google has developed new quantum patterns, and Microsoft is also becoming stronger. The Seven Sisters will each show off their talents at intervals to attract investment.

In 2025, I am more bullish on Google and Microsoft. These two industry giants cannot always be at the bottom. The other elite beauties are too high, so I don't want to pursue them. When negative news such as Google's Chrome divestment lawsuit and the mess left by Microsoft's former CEO emerge, it is the time for me to get on board in my opinion.

3. The Federal Reserve cuts interest rates

Hey hey, how much of a rate cut counts as a cut...

Translated

3

1

Moomoo AU

liked

Preface

As 2024 comes to an end, this year has been filled with major events and key turning points. With the Nasdaq Composite Index breaking through a new high of 0.02 million points, the US stock market concludes the year with a bull market trend. Major investment institutions have also begun to make predictions and layouts for the 2025 market. Based on the 2025 Investment Outlook White Paper released by Moomoo, combined with personal thoughts and suggestions, this article analyzes the US stock market, aiming to provide a new perspective for everyone.

The article will discuss the following two sectors:

1. 2025 US economic outlook and risk analysis

2. Focus on industry analysis and corresponding stock analysis

Reference whitepaper link:2025 Moomoo Investment Outlook Whitepaper

1. 2025 US Economic Outlook and Risk Analysis:

I will elaborate on three key points, my personal opinions are for reference only

1 Currently still in a loose monetary policy easing cycle by the Federal Reserve, the overall economic situation is improving.

The policy impact and inflation rebound in the era of 'Donald Trump 2.0.'

Expansion: Yesterday, Donald Trump just rang the bell at the NYSE, declaring that the stock market is everything. Although the response was mediocre, I believe that the US stocks will continue to shine brightly next year. Under Donald Trump's series of tax cuts and favorable regulations, the fundamentals are certainly solid. It is worth noting that, influenced by the tariff policy, I believe that inflation may see a slight rebound next year, and interest rate cuts may slow down...

As 2024 comes to an end, this year has been filled with major events and key turning points. With the Nasdaq Composite Index breaking through a new high of 0.02 million points, the US stock market concludes the year with a bull market trend. Major investment institutions have also begun to make predictions and layouts for the 2025 market. Based on the 2025 Investment Outlook White Paper released by Moomoo, combined with personal thoughts and suggestions, this article analyzes the US stock market, aiming to provide a new perspective for everyone.

The article will discuss the following two sectors:

1. 2025 US economic outlook and risk analysis

2. Focus on industry analysis and corresponding stock analysis

Reference whitepaper link:2025 Moomoo Investment Outlook Whitepaper

1. 2025 US Economic Outlook and Risk Analysis:

I will elaborate on three key points, my personal opinions are for reference only

1 Currently still in a loose monetary policy easing cycle by the Federal Reserve, the overall economic situation is improving.

The policy impact and inflation rebound in the era of 'Donald Trump 2.0.'

Expansion: Yesterday, Donald Trump just rang the bell at the NYSE, declaring that the stock market is everything. Although the response was mediocre, I believe that the US stocks will continue to shine brightly next year. Under Donald Trump's series of tax cuts and favorable regulations, the fundamentals are certainly solid. It is worth noting that, influenced by the tariff policy, I believe that inflation may see a slight rebound next year, and interest rate cuts may slow down...

Translated

8

1

7

Moomoo AU

liked

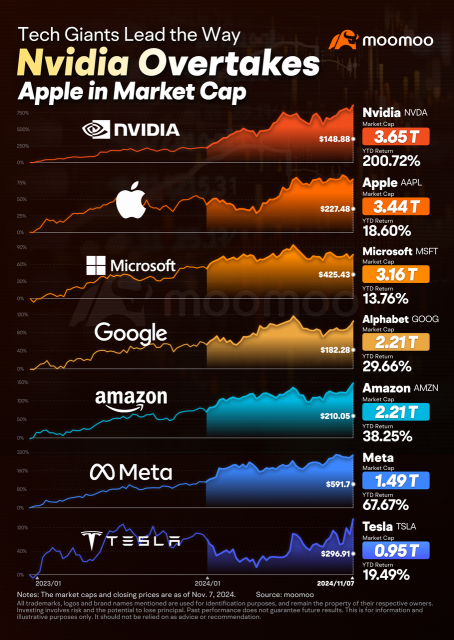

As we close the chapter on 2024, let's revisit the critical incidents that not only shook the markets but also inspired vibrant dialogues among us. This year was rich with tech innovation, economic twists, and strategic shifts. Join us as we explore the highlights and the key players who shaped the financial landscape.

Ready to start our recap? Let’s Go!!! ᯓ🏃♀️➡️🏃♂️➡️

Top 1. Nvidia takes the crown in AI surge

The AI revolution has d...

+10

72

52

12

Moomoo AU

liked

2024 is finally coming to an end and its been a great 2nd year bull! The jounery is full of ups and downs! Recaping some of the key moments to remind myself and lessons learnt.

1. 1st half was generally good with $S&P 500 Index (.SPX.US)$ up also 15% by end June. Did some shorts in Jan and Feb and got short squeezed and had to cut loses. Was thinking market might pull back and try to position my trades.![]() KEY LESSON here - Never try to predict what the market might do i...

KEY LESSON here - Never try to predict what the market might do i...

1. 1st half was generally good with $S&P 500 Index (.SPX.US)$ up also 15% by end June. Did some shorts in Jan and Feb and got short squeezed and had to cut loses. Was thinking market might pull back and try to position my trades.

+5

36

1

1

Moomoo AU

liked

I joined moomoo in October this year and tried options, feeling that the success rate is quite high.

Translated

17

3

2

Moomoo AU

liked

Google continues to skyrocket. Increase leverage with call options, easily earning 170% in a week.

Translated

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)