Invest With Cici

Pinned

The Chinese market has attracted increased attention in global markets, accompanied by rising volatility as more capital seeks to capitalize on potential opportunities largely driven by government measures. This environment led to a sharp rebound at the end of September, just before the National Holiday.

A specific example of this volatility: after two days of significant declines, the Chinese stock market rebounded...

A specific example of this volatility: after two days of significant declines, the Chinese stock market rebounded...

353

133

201

Invest With Cici

liked

As 2024 draws to a close, have you participated in the bustling Bursa Malaysian IPO on moomoo this year? Almost 90% IPO surged on debut, rally up to 189%. Here are 7 facts worth your attention!

1. 55 stocks were listed on Bursa Malaysia this year (11 on Main Market, 40 on ACE Market and 4 on Leap Market), setting a record since 2006.

2. This achievement represents a significant 72% increase compared to the 32 companies that had their IPO in 2023...

1. 55 stocks were listed on Bursa Malaysia this year (11 on Main Market, 40 on ACE Market and 4 on Leap Market), setting a record since 2006.

2. This achievement represents a significant 72% increase compared to the 32 companies that had their IPO in 2023...

47

24

28

Invest With Cici

liked

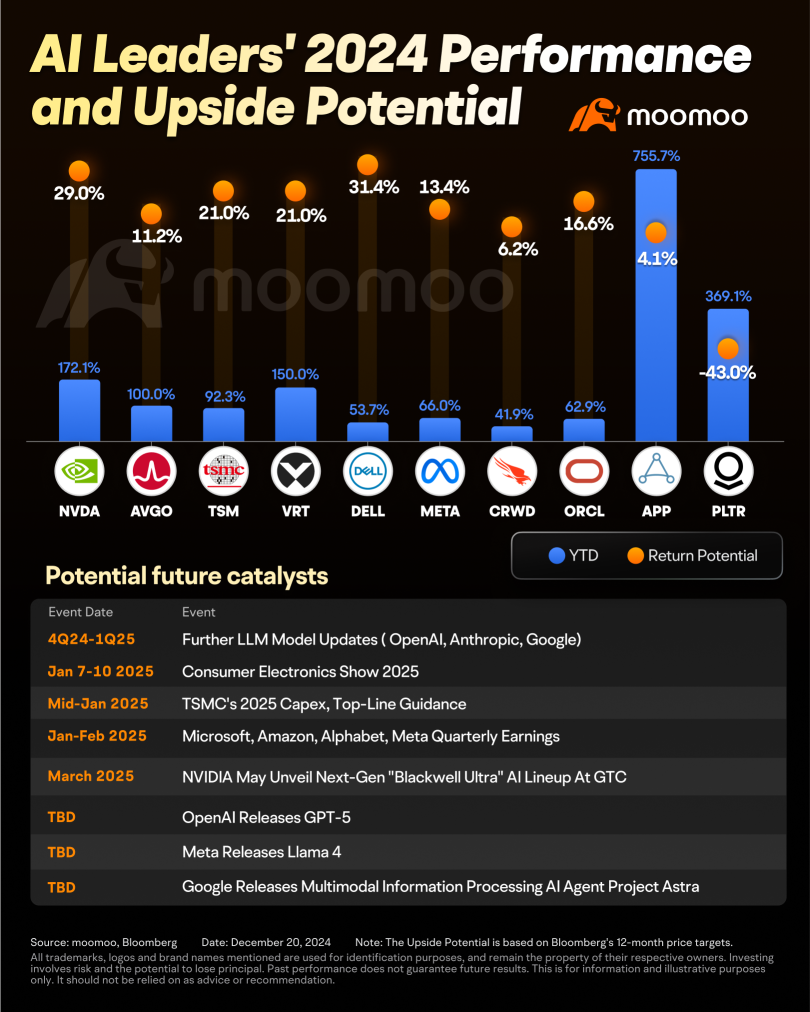

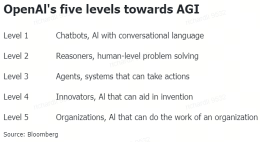

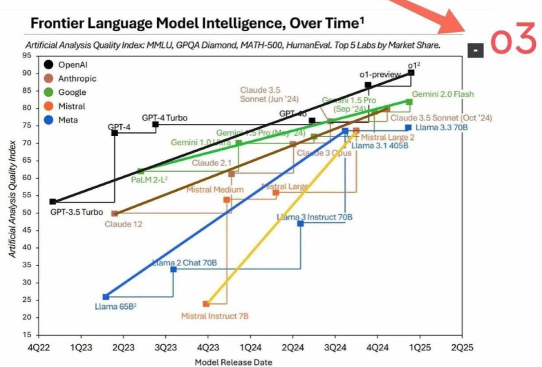

The AI theme is undoubtedly one of the most important global trading trends in 2024. Driven by the AI boom and chip demand, NVIDIA briefly became the world's largest listed company.

Specifically, tech giants have accelerated AI capital expenditure, with hardware sector companies such as NVIDIA, Broadcom, TSMC, TSM, and VRT performing impressively as direct beneficiaries. Extended concept companies in energy and nuclear power like VST, CEG, and NRG have also...

Specifically, tech giants have accelerated AI capital expenditure, with hardware sector companies such as NVIDIA, Broadcom, TSMC, TSM, and VRT performing impressively as direct beneficiaries. Extended concept companies in energy and nuclear power like VST, CEG, and NRG have also...

+2

78

4

61

Invest With Cici

liked

The Federal Reserve's interest rate meeting is about to take place on December 18th, Eastern Time. The current market consensus for this meeting is a 25 basis points rate cut, with a 95% probability. The market has already priced this in. The key is whether the changes in the interest rate path in next year's dot plot meet expectations. Stubborn core inflation and low unemployment rate are expected to significantly reduce the number of rate cuts by the Federal Reserve. I boldly speculate that there will only be one rate cut next year, and the 10-Year T-Note yield will surpass 4.5% again. Moreover, with the new administration taking office, there will be a substantial increase in federal debt, and high interest rates will pose a dilemma for the continuous government spending by the USA.

Conclusion: The current overvaluation of the US stock market running up to the upper limit of 6100 points forward-looking to FY25 is absolutely unsustainable, and a 5-10% index-level pullback is bound to occur. (After the Christmas market, positions from January to February need to be significantly increased for protection.) The index has risen by 27% this year. I can only wish good luck to those who are looking to chase the uptrend at this point.

Individual stocks:

AMD: Falling below $129, starting to approach the 25-year forward valuation lower limit of $118-124. I will start to establish positions and sell Put options at the end of March.

NVIDIA: Retracing to the strong support zone of $121-$128, friends without positions can start to build small positions. The super strong support zone of $112-$118 can be significantly increased to do the FY25 valuation mean reversion. If the index retraces as expected, this level is highly likely to be visible, so don't rush.

Tesla: This wave has already soared, I took profit halfway at $320 and sold, currently around $440 😭 I will buy Put options after January 5th...

Conclusion: The current overvaluation of the US stock market running up to the upper limit of 6100 points forward-looking to FY25 is absolutely unsustainable, and a 5-10% index-level pullback is bound to occur. (After the Christmas market, positions from January to February need to be significantly increased for protection.) The index has risen by 27% this year. I can only wish good luck to those who are looking to chase the uptrend at this point.

Individual stocks:

AMD: Falling below $129, starting to approach the 25-year forward valuation lower limit of $118-124. I will start to establish positions and sell Put options at the end of March.

NVIDIA: Retracing to the strong support zone of $121-$128, friends without positions can start to build small positions. The super strong support zone of $112-$118 can be significantly increased to do the FY25 valuation mean reversion. If the index retraces as expected, this level is highly likely to be visible, so don't rush.

Tesla: This wave has already soared, I took profit halfway at $320 and sold, currently around $440 😭 I will buy Put options after January 5th...

Translated

+2

23

10

7

Invest With Cici

voted

Have you ever been troubled by this problem? In fact, the two are not in conflict. From an asset allocation perspective, trading in high-growth companies while holding high-dividend stocks can effectively manage risk.

For instance, if you’re bullish on data center development and invested in $YTLPOWR (6742.MY)$ this year...

50

12

24

Invest With Cici

liked

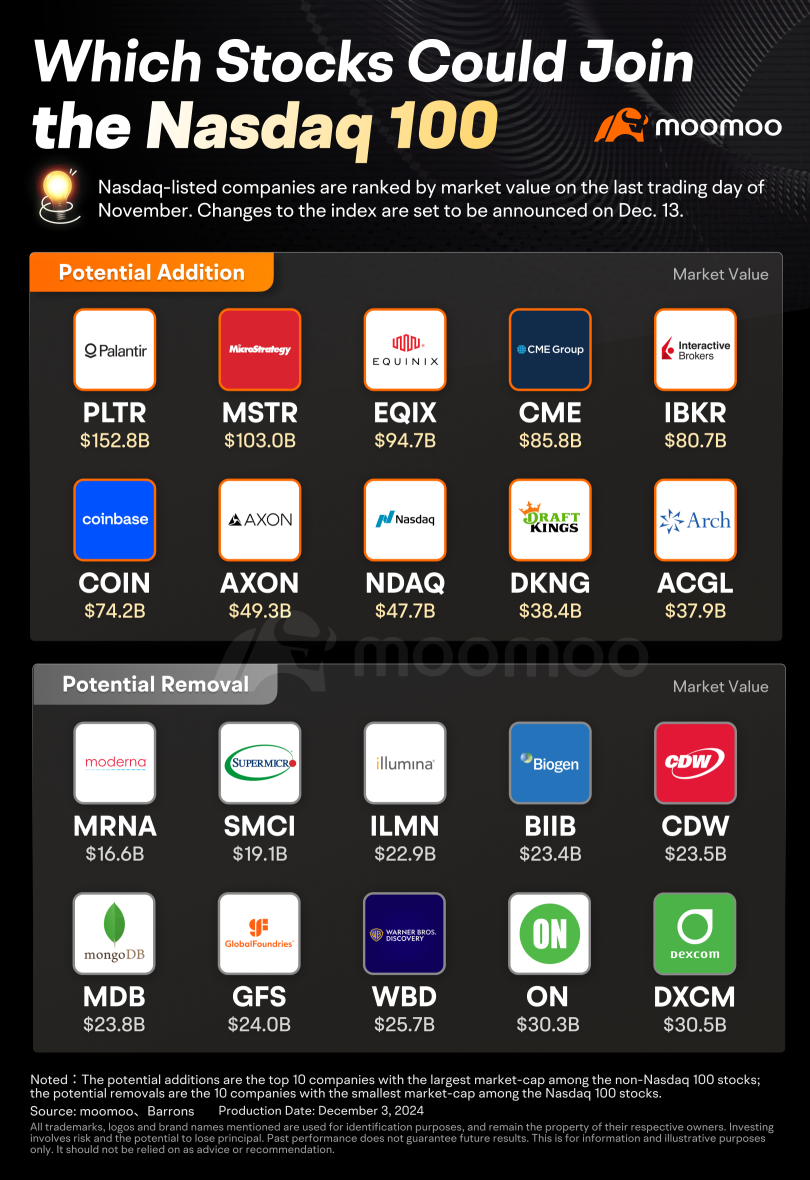

The annual adjustment of the $NASDAQ 100 Index (.NDX.US)$ components will be announced next Friday (December 13). According to the market capitalization ranking, in addition to the strong performers $Palantir (PLTR.US)$ and $MicroStrategy (MSTR.US)$, $Equinix Inc (EQIX.US)$, and $Coinbase (COIN.US)$ are also expected to become new members.

On the other hand, six companies, headed by $Moderna (MRNA.US)$, $Super Micro Computer (SMCI.US)$, ��������...

On the other hand, six companies, headed by $Moderna (MRNA.US)$, $Super Micro Computer (SMCI.US)$, ��������...

46

7

58

Invest With Cici

liked

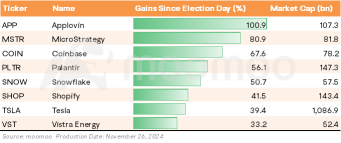

Three weeks after the election, investors are zeroing in on the Trump administration’s policy trajectory. The Trump 2.0 cabinet is nearly set, with nominees for key economic roles like Treasury and Commerce Secretary mostly decided.

In this environment, U.S. equities have been volatile. The 'Trump trade' initially surged, pulled back on concerns about reflation, and then began to rebound. Since election day, the $S&P 500 Index (.SPX.US)$ has risen...

In this environment, U.S. equities have been volatile. The 'Trump trade' initially surged, pulled back on concerns about reflation, and then began to rebound. Since election day, the $S&P 500 Index (.SPX.US)$ has risen...

+1

96

12

86

Invest With Cici

liked

Global markets

Overnight, the US markets continued risk-on mode. All 3 indices edged higher, whereby DJ (+0.28%), S&P (+0.57%) closed at record high and Nasdaq (+0.62%).

Trump said he would impose 25% tariffs on all imports from Canada and Mexico, additional 10% tariffs on Chinese imports.

VIX is the implied volatility of 1month S&P500. It continued downtrend and settled at 14.10 (-0.50), showing improvement in risk sentiment.

U.S. 10-Year Treasury Yiel...

Overnight, the US markets continued risk-on mode. All 3 indices edged higher, whereby DJ (+0.28%), S&P (+0.57%) closed at record high and Nasdaq (+0.62%).

Trump said he would impose 25% tariffs on all imports from Canada and Mexico, additional 10% tariffs on Chinese imports.

VIX is the implied volatility of 1month S&P500. It continued downtrend and settled at 14.10 (-0.50), showing improvement in risk sentiment.

U.S. 10-Year Treasury Yiel...

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Invest With Cici OP steady Pom pipi :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) a victim of Chinese stocks?

a victim of Chinese stocks?