Moomoo 攻略

reacted to

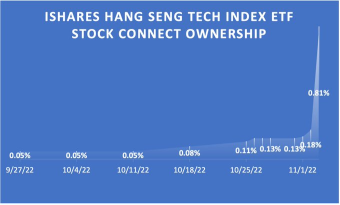

Now, we just had a big pop in mainland China investor ownership in the long-ignored iShares HSTI ETF. While 0.81% isn't big, it's a 4-fold pop in just one day. Watching this closely.

$ALIBABA GROUP HOLDING LTD (BABAF.US)$ $Alibaba (BABA.US)$ $BABA-W (09988.HK)$ $Tencent (TCEHY.US)$ $TENCENT (00700.HK)$ $JD.com (JD.US)$ $JD-SW (09618.HK)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $Hang Seng TECH Index (800700.HK)$ $China Concept Stocks (LIST2517.US)$

$ALIBABA GROUP HOLDING LTD (BABAF.US)$ $Alibaba (BABA.US)$ $BABA-W (09988.HK)$ $Tencent (TCEHY.US)$ $TENCENT (00700.HK)$ $JD.com (JD.US)$ $JD-SW (09618.HK)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $Hang Seng TECH Index (800700.HK)$ $China Concept Stocks (LIST2517.US)$

8

1

TSM's Q1 2021 earnings call is currently live! Let's listen to the management's interpretation and outlook on the earnings together!

Translated

3

2

5

On March 24th, $XIAOMI-W (01810.HK)$ announced its performance report for the fourth quarter of 2020. In the fourth quarter of 2020, Xiaomi Group's total revenue reached RMB 70.5 billion, a year-on-year growth of 24.8%; adjusted net income reached RMB 3.2 billion, a year-on-year growth of 36.7%. Xiaomi Group's total revenue for the full year of 2020 was RMB 245.87 billion, with a market estimate of RMB 247.76 billion; the adjusted net income for the full year was RMB 13.01 billion.![]()

![]()

![]() In the fourth quarter of 2020, Xiaomi's smartphones performed very well, with a shipment volume of 0.146 billion units, a year-on-year growth of 17.5%, and revenue reaching RMB 152.2 billion, a year-on-year growth of 24.6%. In 2019, Xiaomi's smart phone revenue growth rate was only 7.3%.

In the fourth quarter of 2020, Xiaomi's smartphones performed very well, with a shipment volume of 0.146 billion units, a year-on-year growth of 17.5%, and revenue reaching RMB 152.2 billion, a year-on-year growth of 24.6%. In 2019, Xiaomi's smart phone revenue growth rate was only 7.3%.![]() In 2020, Huawei's global market shipments declined significantly, while Xiaomi and Apple both achieved positive growth. Especially in Europe, Xiaomi captured a considerable market share and reached the top spot in Central and Eastern Europe for the first time.

In 2020, Huawei's global market shipments declined significantly, while Xiaomi and Apple both achieved positive growth. Especially in Europe, Xiaomi captured a considerable market share and reached the top spot in Central and Eastern Europe for the first time.

Translated

3

2

$SNDL Inc (SNDL.US)$ The 2020 Q4 and full-year earnings call is currently live! Let's listen to the management's interpretation and outlook on the earnings together!![]()

Translated

On March 11, $JD.com (JD.US)$ The financial performance for the fourth quarter and the full year of 2020 was released. Let's take a look at jd.com's financial performance first.

In the fourth quarter of 2020, JD Group's net income was 224.3 billion RMB, a year-on-year increase of 31.4%.

The full-year net income for 2020 was 745.8 billion RMB, with net service income accounting for over 14% for the first time. As of December 31, 2020, jd.com's active purchasing users over the past 12 months reached 0.4719 billion, with a net increase of nearly 0.11 billion active users for the whole year.

In addition to the high-quality growth of core indicators such as income and users, the financial report also disclosed jd.com's inventory turnover days. (Note: Inventory turnover speed is one of the most critical indicators in the retail industry).

With a total net income of over 700 billion for the whole year, where does jd.com rank in the current e-commerce landscape?![]() What is jd.com's inventory turnover days? What does it represent?

What is jd.com's inventory turnover days? What does it represent?![]() Tonight at 7 p.m., join Mr. Li Chengdong to interpret the financial report $JD.com (JD.US)$ interpretations.

Tonight at 7 p.m., join Mr. Li Chengdong to interpret the financial report $JD.com (JD.US)$ interpretations.![]()

![]()

![]()

In the fourth quarter of 2020, JD Group's net income was 224.3 billion RMB, a year-on-year increase of 31.4%.

The full-year net income for 2020 was 745.8 billion RMB, with net service income accounting for over 14% for the first time. As of December 31, 2020, jd.com's active purchasing users over the past 12 months reached 0.4719 billion, with a net increase of nearly 0.11 billion active users for the whole year.

In addition to the high-quality growth of core indicators such as income and users, the financial report also disclosed jd.com's inventory turnover days. (Note: Inventory turnover speed is one of the most critical indicators in the retail industry).

With a total net income of over 700 billion for the whole year, where does jd.com rank in the current e-commerce landscape?

Translated

5

1

Reporter: “If investors decide to invest in individual stocks, how should they get more information about the company?”

Buffett: “Investors first need to figure out if they know enough to deserve high returns. Investors should read the company's financial statements as much as I did, including annual and quarterly reports. However, after carefully reading these public documents, they are still not sure if they understand the company's business, and they'd better not invest or buy index funds.”

Financial reports provide information that allows price investors to see companies that are undervalued by the market and make investment decisions. Their confidence in investing comes from analyzing financial reports, and then obtaining objective data, data-based logical analysis, and understanding of various business models. Why is studying financial reports the first step in value investing? What is the effect of financial reports? What valuable information can we find in financial reports? This article will answer your questions.![]()

![]()

![]()

1. Discovering “Doubtful Points” in Financial Reports

Some companies falsified transactions before listing in order to successfully complete their IPOs and raise as much capital as possible. Listed companies, on the other hand, aim to reduce their holdings at the highest possible price. The higher the stock price, the previous group of investors, executives, or original shareholders can only cash out the transaction as high as possible. If you pay attention to information such as cash flow and liabilities in financial data, you can see questions. Click to read previous articles![]()

![]()

II. Discover the core competitiveness of enterprises and provide reference for investment

Emerging markets are the cradle of future leading companies, and market demand is positive...

Buffett: “Investors first need to figure out if they know enough to deserve high returns. Investors should read the company's financial statements as much as I did, including annual and quarterly reports. However, after carefully reading these public documents, they are still not sure if they understand the company's business, and they'd better not invest or buy index funds.”

Financial reports provide information that allows price investors to see companies that are undervalued by the market and make investment decisions. Their confidence in investing comes from analyzing financial reports, and then obtaining objective data, data-based logical analysis, and understanding of various business models. Why is studying financial reports the first step in value investing? What is the effect of financial reports? What valuable information can we find in financial reports? This article will answer your questions.

1. Discovering “Doubtful Points” in Financial Reports

Some companies falsified transactions before listing in order to successfully complete their IPOs and raise as much capital as possible. Listed companies, on the other hand, aim to reduce their holdings at the highest possible price. The higher the stock price, the previous group of investors, executives, or original shareholders can only cash out the transaction as high as possible. If you pay attention to information such as cash flow and liabilities in financial data, you can see questions. Click to read previous articles

II. Discover the core competitiveness of enterprises and provide reference for investment

Emerging markets are the cradle of future leading companies, and market demand is positive...

Translated

![[Financial Report 101] How should investors respond when the market fluctuates drastically?](https://sgsnsimg.moomoo.com/1614859595244-77777006-android-org.gif/thumb)

![[Financial Report 101] How should investors respond when the market fluctuates drastically?](https://sgsnsimg.moomoo.com/1614859595254-77777006-android-org.png/thumb)

5

2

14

The Ideals autos 2020 Q4 and full year earnings call is currently live! Let's listen together to the management's interpretation and outlook on the performance!![]()

Translated

Friends in Lion City, hello, moomoo is here!![]()

Translated

2

Moomoo 攻略

reacted to and commented on

Hey Singapore mooers, It's great to have you here!

As we got lots of new mooers joined moomoo since its launch in SG recently, this topic could be a good place to get all SG mooers together.

If there is anything I can help you with, please follow me and send me a shout, I am all ears.

Now it's your time to show.

[How to Enter]

Before March 19 12:00 am,

1. Tap the Post button in the topic page, tell us a little bit about your story and investment wishes, each of you will win 200 task points;

2. If you are one of the first 1500 to sign up with moomoo in SGP and have received the FUTU bull doll gift, share the garage kit photo in your post (be original), and you’ll get another 88 points.

Note: Points reward for Singapore users only.

[About task points]

Task points will be delivered every Friday till the giveaway ends. You will be able to exchange points for FUTU bull doll and other brand gifts very soon.

Currently, you can exchange it for coupons in the points club (Me->Task Center->Club)....

As we got lots of new mooers joined moomoo since its launch in SG recently, this topic could be a good place to get all SG mooers together.

If there is anything I can help you with, please follow me and send me a shout, I am all ears.

Now it's your time to show.

[How to Enter]

Before March 19 12:00 am,

1. Tap the Post button in the topic page, tell us a little bit about your story and investment wishes, each of you will win 200 task points;

2. If you are one of the first 1500 to sign up with moomoo in SGP and have received the FUTU bull doll gift, share the garage kit photo in your post (be original), and you’ll get another 88 points.

Note: Points reward for Singapore users only.

[About task points]

Task points will be delivered every Friday till the giveaway ends. You will be able to exchange points for FUTU bull doll and other brand gifts very soon.

Currently, you can exchange it for coupons in the points club (Me->Task Center->Club)....

![[Reward] Say huat ah with moomoo Singapore](https://sgsnsimg.moomoo.com/1614081625744-101000100-android-org.png/thumb)

89

145

8

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)