On 2023-2-7, JBL had a all time high. Year-To-Date JBL has gained 22.35%, which far outperformed the S&P 500 and Nasdaq-100 as represented by the $Vanguard S&P 500 ETF (VOO.US)$ and $Invesco QQQ Trust (QQQ.US)$ETFs.

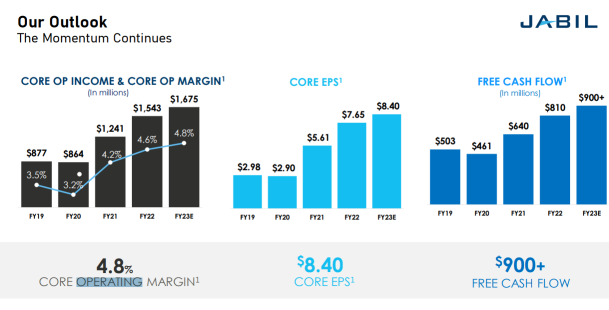

However, the operating margin of Jabil is not high, usually about 5%, which is not impressed to many technology investors.

Bussiness

Jabil Inc. is a global technology manufacturing solutions provider that offers design, production...

However, the operating margin of Jabil is not high, usually about 5%, which is not impressed to many technology investors.

Bussiness

Jabil Inc. is a global technology manufacturing solutions provider that offers design, production...

+1

1

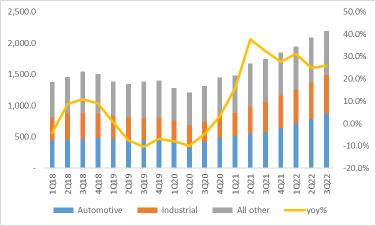

ON Semiconductor is set to release its Q4 2022 earnings on Monday(2023-2-6 ). According to bloomberg , 22Q4 revenue is 2.081 billion and GAAP EPS is 1.145 .

The company is a leading provider of advanced semiconductor solutions for a range of industries and applications, including automotive, industrial, consumer, and communications.

In recent years, ON Semiconductor has benefited from the growing demand for semiconductor...

The company is a leading provider of advanced semiconductor solutions for a range of industries and applications, including automotive, industrial, consumer, and communications.

In recent years, ON Semiconductor has benefited from the growing demand for semiconductor...

1

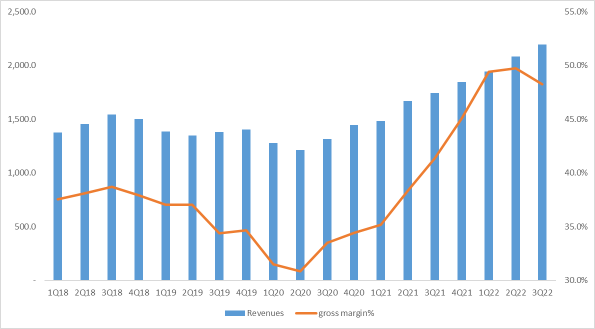

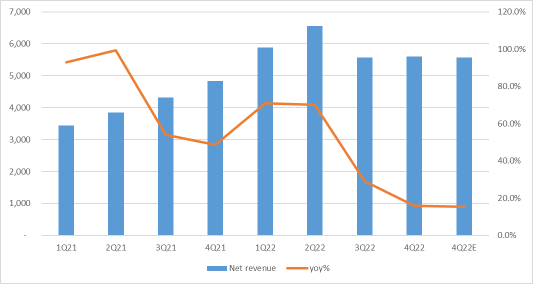

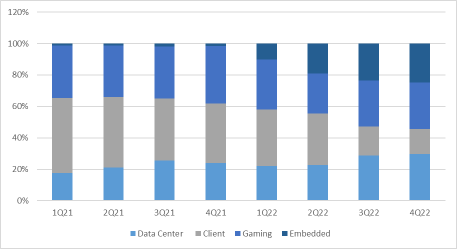

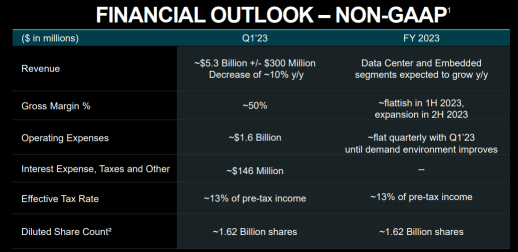

AMD 2022 Q4 results: GAAP, revenue of $5.6 billion slightly supermarket expectations, up 16% year-on-year, 0.6% month-on-month, gross margin of 43% , down 7 percentage points year-on-year; For 2022, revenue was $23.6 billion, up 44% year-on-year, gross margin was 45% , down 3 percentage points year-on-year, and net profit was $1.32 billion, down 58% year-on-year.

1.Data centers grow strongly to the first business, smoothing PC bus...

1.Data centers grow strongly to the first business, smoothing PC bus...

+1

3

3

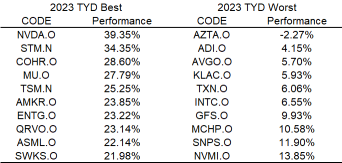

As of January 28, $iShares Semiconductor ETF (SOXX.US)$ was up 16.99% for the 2023 year and $NVIDIA (NVDA.US)$ rebounded nearly 40% to regain its $500 billion market value, surpassing $Taiwan Semiconductor (TSM.US)$.

The $STMicroelectronics (STM.US)$ was the second biggest STMicroelectronics, with net revenue of $4.424 bn on the back of strong demand from the automotive and industrial sectors, it beat the consensus forecast of...

The $STMicroelectronics (STM.US)$ was the second biggest STMicroelectronics, with net revenue of $4.424 bn on the back of strong demand from the automotive and industrial sectors, it beat the consensus forecast of...

3

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)