Mylef Extreme

liked

KUALA LUMPUR: DHL Express, the world's leading international express services provider, has announce an average 6.9 per cent price increase for its services from Jan 1, 2025.

In a statement today, DHL Express said prices are adjusted on an annual basis by DHL Express, taking into consideration inflation and currency dynamics as well as administrative costs related to regulatory and security measures.

National and international authorities re...

In a statement today, DHL Express said prices are adjusted on an annual basis by DHL Express, taking into consideration inflation and currency dynamics as well as administrative costs related to regulatory and security measures.

National and international authorities re...

1

Mylef Extreme

voted

OB HOLDINGS BERHAD (OBHB 0327)

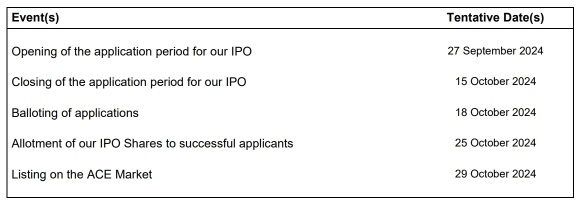

Timetable of IPO

Figure 1: IPO timetable of OB Holdings Berhad

-Will be listed on the ACE Board

Full Video of OB Holdings Berhad (Chinese version) - YouTube

Info of IPO

Enlarged no. of shares upon listing: 391.627 million

IPO price: RM0.24

Market capitalization: RM93.99 million

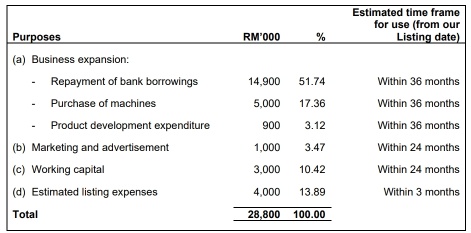

Estimated funds to raise from Public Issue: RM 28.8million

PE ratio = 17.08x (based on FY2024)

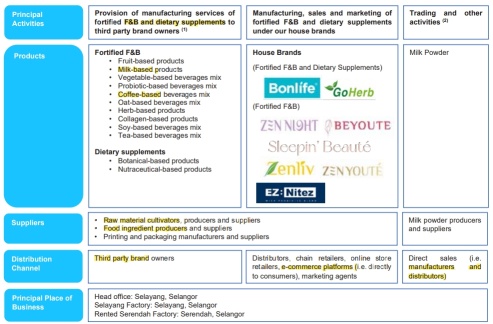

Busin...

Timetable of IPO

Figure 1: IPO timetable of OB Holdings Berhad

-Will be listed on the ACE Board

Full Video of OB Holdings Berhad (Chinese version) - YouTube

Info of IPO

Enlarged no. of shares upon listing: 391.627 million

IPO price: RM0.24

Market capitalization: RM93.99 million

Estimated funds to raise from Public Issue: RM 28.8million

PE ratio = 17.08x (based on FY2024)

Busin...

+6

8

1

Mylef Extreme

reacted to

This year has benefited from a full recovery in the country's GDP, and some gains have been made in the financial sector. Next, we need to consider what areas, maybe industries, will lower interest rates?

Translated

51

Mylef Extreme

liked

Foreign capital has fled again! Last week, there was a net outflow of more than 0.4 billion.

On Monday of last week, the country celebrated Hari Raya Haji. With only 4 trading days left, after two consecutive weeks of inflows, foreign capital had a net sell of 0.4 billion and 41.1 million ringgit last week.

According to the latest capital trend report from MIDF Research, foreign capital had a net sell of Malaysian stocks in all 4 trading days last week; among them, Friday recorded the highest net sell of 0.1 billion and 75.8 million ringgit.

Looking at last week, the sectors that were sold off the most severely include financial services (-0.5 billion and 29.9 million ringgit), healthcare (-56.2 million ringgit), and plantation (-36.4 million ringgit).

While foreign capital was selling Malaysian stocks in large quantities, local institutions and retail investors took the opportunity to absorb them, and both local institutions and retail investors were net buyers last week.

Local institutions only sold 27.9 million ringgit of Malaysian stocks on Thursday last week, and were net buyers for the remaining trading days, with the strongest buying power on Friday, with a total net purchase of 0.1 billion and 77.5 million ringgit of Malaysian stocks.

Retail investors followed the footsteps of local institutions and had a net purchase of 0.1 billion and 67.1 million ringgit of Malaysian stocks last week.

In terms of participation, the average daily trading volume (ADTV) of the domestic market increased by 36.1% last week, while local institutions and retail investors had a quiet trading activity, with a decrease of 18.1% and 11.1%, respectively.

Foreign capital net sold stocks last week.

$PBBANK (1295.MY)$

$CIMB (1023.MY)$

$MAYBANK (1155.MY)$

$MYEG (0138.MY)$

$YTLPOWR (6742.MY)$

$RHBBANK (1066.MY)$

���������...

On Monday of last week, the country celebrated Hari Raya Haji. With only 4 trading days left, after two consecutive weeks of inflows, foreign capital had a net sell of 0.4 billion and 41.1 million ringgit last week.

According to the latest capital trend report from MIDF Research, foreign capital had a net sell of Malaysian stocks in all 4 trading days last week; among them, Friday recorded the highest net sell of 0.1 billion and 75.8 million ringgit.

Looking at last week, the sectors that were sold off the most severely include financial services (-0.5 billion and 29.9 million ringgit), healthcare (-56.2 million ringgit), and plantation (-36.4 million ringgit).

While foreign capital was selling Malaysian stocks in large quantities, local institutions and retail investors took the opportunity to absorb them, and both local institutions and retail investors were net buyers last week.

Local institutions only sold 27.9 million ringgit of Malaysian stocks on Thursday last week, and were net buyers for the remaining trading days, with the strongest buying power on Friday, with a total net purchase of 0.1 billion and 77.5 million ringgit of Malaysian stocks.

Retail investors followed the footsteps of local institutions and had a net purchase of 0.1 billion and 67.1 million ringgit of Malaysian stocks last week.

In terms of participation, the average daily trading volume (ADTV) of the domestic market increased by 36.1% last week, while local institutions and retail investors had a quiet trading activity, with a decrease of 18.1% and 11.1%, respectively.

Foreign capital net sold stocks last week.

$PBBANK (1295.MY)$

$CIMB (1023.MY)$

$MAYBANK (1155.MY)$

$MYEG (0138.MY)$

$YTLPOWR (6742.MY)$

$RHBBANK (1066.MY)$

���������...

Translated

36

1

5

..

..![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)