Neil_03

liked

15

6

Neil_03

reacted to

8

Neil_03

liked

Translated

4

2

Neil_03

liked

$RHBBANK (1066.MY)$ TMD has been falling all along.

Translated

5

3

Neil_03

voted

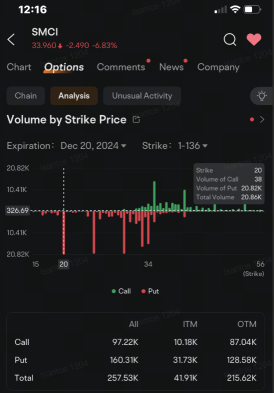

$Super Micro Computer (SMCI.US)$ is seeing increasing demand for put options that could protect the holders against continued slump in the stock price.

Shares of the maker of high-powered servers tumbled more than 7% Monday morning, after the announcement late Friday that SMCI will be removed from the $NASDAQ 100 Index (.NDX.US)$ before the market opens on Dec. 23. Deletions from the index typically result from money outflows because...

Shares of the maker of high-powered servers tumbled more than 7% Monday morning, after the announcement late Friday that SMCI will be removed from the $NASDAQ 100 Index (.NDX.US)$ before the market opens on Dec. 23. Deletions from the index typically result from money outflows because...

32

1

10

Neil_03

liked

$Super Micro Computer (SMCI.US)$ Just by looking at this, it is clear that they are pushing up the price to sell, deceiving retail investors to take over.

Translated

4

3

Neil_03

liked

$Tesla (TSLA.US)$ The beginning of this week was very smooth because tsla brought me a 10% profit in just two days, which was really lucky. However, my mood was affected on Wednesday when I made a reverse put trade. Although it was a profitable put, it affected me on Thursday.![]()

![]()

![]()

The logic here is that I put Options on TSLA because after trying to break through 430 four times unsuccessfully, there should be a significant adjustment, so I set a target of 410-420. Thursday really reached 420 as I expected, but I was too tired and fell asleep, missing the opportunity to liquidate. This left me unprepared for the whole Thursday and led me to blindly wait for it to drop (which was a wrong decision). During the waiting period, I did nothing and missed the great intraday trading volatility on Thursday, which needs to be reflected upon.![]()

![]()

![]()

On Friday, I was originally determined to close the position and switch to call once it dropped a bit, but I still hoped it would break even. As everyone can see, I missed the best opportunity again, which will not happen today. Therefore, I had to exit with even greater losses. Fortunately, I did learn from yesterday's lesson. I made myself forget about this put trade, and when the right time came for tsla, I boldly entered with a call, turning today's loss into profit. This was really good. At least not taking the same path as yesterday is a kind of progress.![]()

![]()

![]()

Finally, currently I have not...

The logic here is that I put Options on TSLA because after trying to break through 430 four times unsuccessfully, there should be a significant adjustment, so I set a target of 410-420. Thursday really reached 420 as I expected, but I was too tired and fell asleep, missing the opportunity to liquidate. This left me unprepared for the whole Thursday and led me to blindly wait for it to drop (which was a wrong decision). During the waiting period, I did nothing and missed the great intraday trading volatility on Thursday, which needs to be reflected upon.

On Friday, I was originally determined to close the position and switch to call once it dropped a bit, but I still hoped it would break even. As everyone can see, I missed the best opportunity again, which will not happen today. Therefore, I had to exit with even greater losses. Fortunately, I did learn from yesterday's lesson. I made myself forget about this put trade, and when the right time came for tsla, I boldly entered with a call, turning today's loss into profit. This was really good. At least not taking the same path as yesterday is a kind of progress.

Finally, currently I have not...

Translated

+3

loading...

78

69

8

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)