Niuniu88

voted

Hello mooers~

Welcome back to "What's new in moomoo"!

Spoiler: you can have the chance to win reward points in the end. Don't miss it!

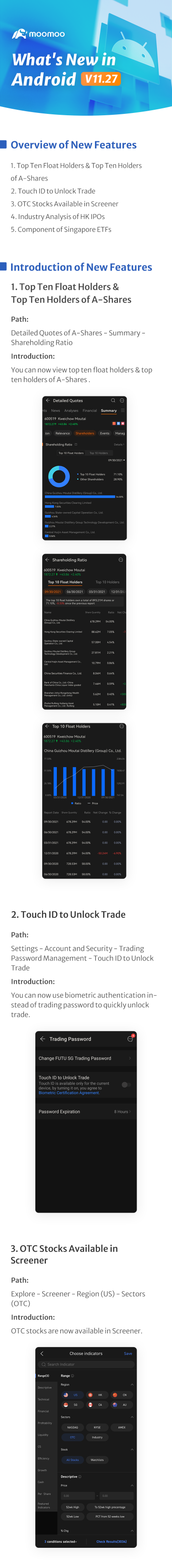

This time we have brought you the new features from Android v11.27, including face ID (or touch ID) to unlock trade, OTC indicator added in screener, industry analysis viewable in HK IPOs, and even more. Why don't you scroll down to have a quick look? More new features await!

![]() Let's vote! And here comes the question:

Let's vote! And here comes the question:

In a relatively long run (within 3-5 years), which industry of stocks do you most bullish and will HODL?![]()

Leave your comment before Nov. 29th 24:00 ET and win 66 points! (at least 30 words to qualify)

Welcome back to "What's new in moomoo"!

Spoiler: you can have the chance to win reward points in the end. Don't miss it!

This time we have brought you the new features from Android v11.27, including face ID (or touch ID) to unlock trade, OTC indicator added in screener, industry analysis viewable in HK IPOs, and even more. Why don't you scroll down to have a quick look? More new features await!

In a relatively long run (within 3-5 years), which industry of stocks do you most bullish and will HODL?

Leave your comment before Nov. 29th 24:00 ET and win 66 points! (at least 30 words to qualify)

290

18

1

Niuniu88

commented on

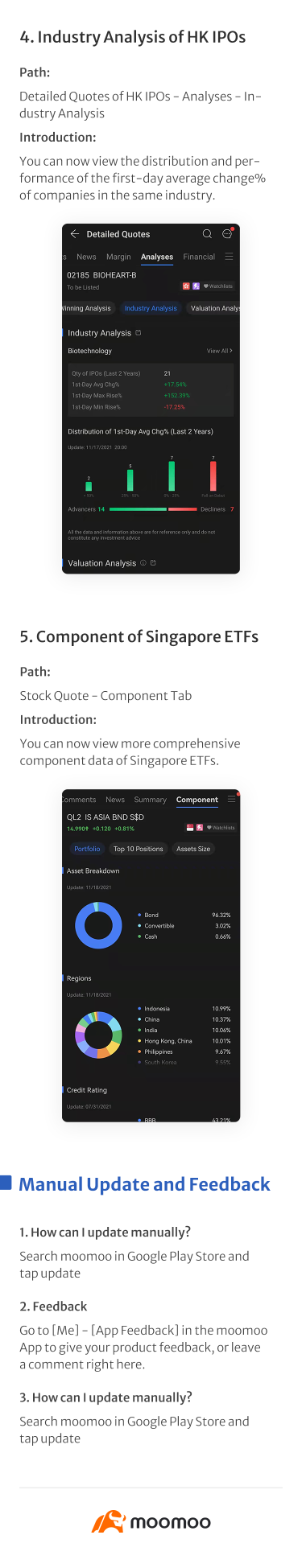

Recently, UK inflation jumps to the highest in a decade. US inflation hit 31 years high in October as CPI jumped 6.2%.

Some people flirted :"Proof inflation doesn't only impact prices. You can see the nefarious art of shrinkflation. "![]()

![]()

![]()

Do you know how much $100 in 1950 was equivalent to today's purchasing power?

$100 in 1950, equivalent to $8.7 today.![]()

In 70 years, $100 lost 91.3% of its real value.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$

Some people flirted :"Proof inflation doesn't only impact prices. You can see the nefarious art of shrinkflation. "

Do you know how much $100 in 1950 was equivalent to today's purchasing power?

$100 in 1950, equivalent to $8.7 today.

In 70 years, $100 lost 91.3% of its real value.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$

11

6

20

Niuniu88

liked

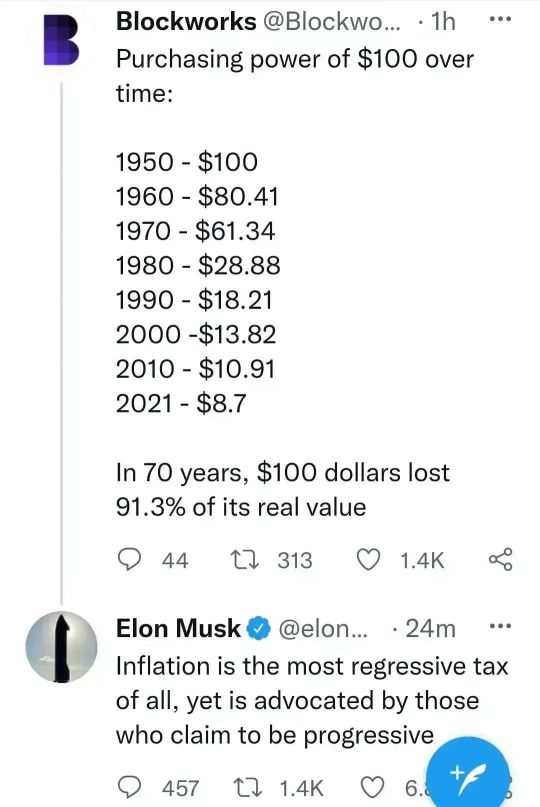

It was a wild Q3, so did mooer @mooboosay. The market is volatile as always. It bears risk and opportunity at the same time. ![]() How was your trading in Q3? Any lesson learned or ideas occurred? Time to look back to your Q3 trading performance! Before you start, let's take a look at how mooers reviewed their Q3 trades.

How was your trading in Q3? Any lesson learned or ideas occurred? Time to look back to your Q3 trading performance! Before you start, let's take a look at how mooers reviewed their Q3 trades.![]()

![]()

![]() No.1 What did you trade?

No.1 What did you trade?

"My positions in Chinese stocks have all taken a hit; my safer positions...have been doing decently, my riskier plays...have gone to dust as of now..." @mooboo

![]()

![]() No. 2 How did you feel?

No. 2 How did you feel?

"Glad I exited flat. The lesson probably is cheap can still be cheaper, low can still go lower, still need to develop more patience since it's showing no signs of recovery as yet." said by @GratefulPanda

"I am extremely happy with my progress" @John Allen2

"Worst mistakes made in the world of meme stock" @GJLGJL

![]()

![]() No. 3 What have you learned?

No. 3 What have you learned?

A lesson learned in Q3: "the right and the wrong"![]()

"I should do more research and not only based on the news"

"I should be more patient. I got jogged out."

As @NANA123shared her experience: "See it - analyze it - plan it - trade it", and we believe one more thing should be added, that it, to REVIEW it.

"This Q3 was no different and the market was unable to beat the September Curse."![]()

@HopeAlwaysreview what he has done right in Q3 trading. He believes that with dollar-cost averaging, he "was able to buy more of the stocks with the same capital. Most importantly, it aligns well with my investment goal of building up a high-quality stock portfolio that can withstand the test of time and any market upheavals."

Review the market, review portfolio, review trading mindset![]()

Although you must have heard about trading psychology, you need to constantly remind yourself what your trading goal is and what you should do. @Syueebelieves a conservative practice will grand her/him a solid trading result to meet the goal. Syuee is a believer in lifetime learning, which is the spirit for all walks of life.

![]()

![]() No. 4 What would you do next?

No. 4 What would you do next?

"Keep learning how to see the chart and P/E ratio" @102960292

"Let's hope that things will look brighter as we move into Q4!" @mooboo

As such, a basic trading review idea is formed.![]()

![]() Review might be a bit boring, but it will definitely help with your future trading.

Review might be a bit boring, but it will definitely help with your future trading. ![]() Many the above mooers to present to us excellent ideas!!

Many the above mooers to present to us excellent ideas!!

Finally, there are only a few days left before our topic activity ends. Join the discussion now to win up to 8,888 points at "Review Q3 Trading Performance". (Click to Join!) Let's excel starting from here!

"My positions in Chinese stocks have all taken a hit; my safer positions...have been doing decently, my riskier plays...have gone to dust as of now..." @mooboo

"Glad I exited flat. The lesson probably is cheap can still be cheaper, low can still go lower, still need to develop more patience since it's showing no signs of recovery as yet." said by @GratefulPanda

"I am extremely happy with my progress" @John Allen2

"Worst mistakes made in the world of meme stock" @GJLGJL

A lesson learned in Q3: "the right and the wrong"

"I should do more research and not only based on the news"

"I should be more patient. I got jogged out."

As @NANA123shared her experience: "See it - analyze it - plan it - trade it", and we believe one more thing should be added, that it, to REVIEW it.

"This Q3 was no different and the market was unable to beat the September Curse."

@HopeAlwaysreview what he has done right in Q3 trading. He believes that with dollar-cost averaging, he "was able to buy more of the stocks with the same capital. Most importantly, it aligns well with my investment goal of building up a high-quality stock portfolio that can withstand the test of time and any market upheavals."

Review the market, review portfolio, review trading mindset

Although you must have heard about trading psychology, you need to constantly remind yourself what your trading goal is and what you should do. @Syueebelieves a conservative practice will grand her/him a solid trading result to meet the goal. Syuee is a believer in lifetime learning, which is the spirit for all walks of life.

"Keep learning how to see the chart and P/E ratio" @102960292

"Let's hope that things will look brighter as we move into Q4!" @mooboo

As such, a basic trading review idea is formed.

Finally, there are only a few days left before our topic activity ends. Join the discussion now to win up to 8,888 points at "Review Q3 Trading Performance". (Click to Join!) Let's excel starting from here!

29

8

10

Niuniu88

liked

The Week Ahead In Biotech : Avadel FDA Decision, Conference Presentations And IPOs Take Center Stage

Biotech stocks retreated in the week ending Oct. 8, extending losses for the third straight week. Some of the selling in the space was due to money moving out of defensive stocks and into risky bets amid the broader market strength.

Vaccine stocks continued to experience selling pressure in the week. Data readouts and presentations at conferences also moved stocks in either direction.

Xenon Pharmaceuticals Inc. (NASDAQ:XENE) was among the biggest gainers after it reported positive topline results from the Phase 2b study of XEN1101 in adult patients with focal epilepsy. On the other hand, Prelude Therapeutics Incorporated (NASDAQ:PRLD) lost about one-half of its market-cap following its presentations at the AACR-NCI-EORTC conference.

Meanwhile, Allogene Therapeutics, Inc. (NASDAQ:ALLO) lost over 100% after the Food and Drug Administration imposed a clinical hold on its CAR T-cell therapy studies following reporting of a chromosomal abnormality in a treated patient.

ChemoCentryx, Inc. (NASDAQ:CCXI) shares benefitted from a positive FDA decision for its avacopan as a treatment for ANCA-associated vasculitis.

Three healthcare companies debuted on Wall Street, raising a combined $452 million.

$ChemoCentryx (CCXI.US)$ $Allogene Therapeutics (ALLO.US)$ $Xenon Pharmaceuticals (XENE.US)$

Vaccine stocks continued to experience selling pressure in the week. Data readouts and presentations at conferences also moved stocks in either direction.

Xenon Pharmaceuticals Inc. (NASDAQ:XENE) was among the biggest gainers after it reported positive topline results from the Phase 2b study of XEN1101 in adult patients with focal epilepsy. On the other hand, Prelude Therapeutics Incorporated (NASDAQ:PRLD) lost about one-half of its market-cap following its presentations at the AACR-NCI-EORTC conference.

Meanwhile, Allogene Therapeutics, Inc. (NASDAQ:ALLO) lost over 100% after the Food and Drug Administration imposed a clinical hold on its CAR T-cell therapy studies following reporting of a chromosomal abnormality in a treated patient.

ChemoCentryx, Inc. (NASDAQ:CCXI) shares benefitted from a positive FDA decision for its avacopan as a treatment for ANCA-associated vasculitis.

Three healthcare companies debuted on Wall Street, raising a combined $452 million.

$ChemoCentryx (CCXI.US)$ $Allogene Therapeutics (ALLO.US)$ $Xenon Pharmaceuticals (XENE.US)$

2

Niuniu88

liked

$LENOVO GROUP LTD (LNVGY.US)$ The industry believes that Lenovo Group’s withdrawal of the Sci-tech Innovation Board IPO application in such a short period of time is likely not to request the withdrawal, but to be asked to withdraw it. In the past, Lenovo was not the only company that withdrew its application for listing on the Science and Technology Innovation Board due to inconsistent positioning. It was just that Lenovo's withdrawal time was relatively short and there were more gimmicks. Because of the price-to-earnings ratio restriction on the main board, the science and technology innovation board can raise more money; and the main board issuance review time is longer. It usually takes about 1 year for the main board, and the approval can be obtained within 100 days at the earliest for the registration system of the Sci-tech Innovation Board.

4

Niuniu88

liked

$Alibaba (BABA.US)$ Munger bottom alibaba's investment company, position accounted for more than 30%, more fell more buy, techniques like Mr. Munger himself, that Mr. Munger before this year, China's Internet industry adjustment cycle bottom, contrarian bullish on the future development of China's Internet industry, I also so think, I this year a new buy direction everything is connected, The adjustment of the Internet industry this year is a long-term opportunity to get on the bus.

1

Niuniu88

liked

China's $Meituan(ADR) (MPNGF.US)$ has comfortably digested a crackdown serving from Beijing. The $200 billion food delivery company’s shares rallied as much as 8% on Monday following an antitrust fine from the country's market watchdog. At just 3% of domestic 2020 sales, the $528 million financial penalty falls well short of the maximum 10% permitted and is less severe than $Alibaba (BABA.US)$ 's.There may be a bitter aftertaste, though. Because of boss Wang Xing's investments in groceries and ride-hailing, the company is forecast to generate an operating loss of $3 billion this year.

1

Niuniu88

liked

Munger's investment style has always been cautious, and his investment is almost concentrated in traditional high-dividend stocks. However, it is worth noting that in the first and third quarters of 2021, Munger suddenly "buy the bottom" and increase Alibaba's position against the trend. This investment made the market unexpected.

This year, $Alibaba (BABA.US)$ stocks topped the highest share price of US$274.29. But as of the close of trading on October 8, the stock price has fallen to US$161.52, a year-to-date drop of nearly 31%.

Faced with Munger's bucking the trend and doubled his bet on Alibaba, shall we follow?

This year, $Alibaba (BABA.US)$ stocks topped the highest share price of US$274.29. But as of the close of trading on October 8, the stock price has fallen to US$161.52, a year-to-date drop of nearly 31%.

Faced with Munger's bucking the trend and doubled his bet on Alibaba, shall we follow?

2

4

1

Niuniu88

liked

$CapLand Ascott T (HMN.SG)$ hurray broke 1, 6 % increase now, still going up. don't miss the boat .

2

1

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)