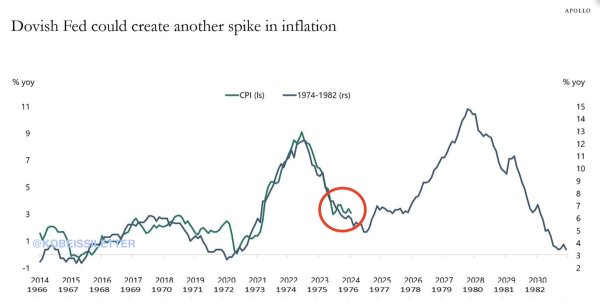

A Fed pivot could be devastating:

Since the Fed turned dovish in December, financial conditions have eased dramatically.

We have seen the S&P 500 make new all time highs, IPO activity is up, credit spreads have tightened and M&A is back.

Consumers have benefitted from a rise in asset prices and investors are piling into stocks.

Apollo says this is similar to what we saw in the 1970s when inflation rebounded to well over 10%.

If we are really on track for a "soft landing," why do we need lower ra...

Since the Fed turned dovish in December, financial conditions have eased dramatically.

We have seen the S&P 500 make new all time highs, IPO activity is up, credit spreads have tightened and M&A is back.

Consumers have benefitted from a rise in asset prices and investors are piling into stocks.

Apollo says this is similar to what we saw in the 1970s when inflation rebounded to well over 10%.

If we are really on track for a "soft landing," why do we need lower ra...

2

High-grade bond US issuers are on track to break first-quarter issuance records, with $27 billion issued this week and year-to-date volume reaching $466 billion. The $510 billion record for the first three months of a year is within reach if the current pace continues.

Despite higher Treasury yields, robust demand and favorable pricing conditions are driving corporate borrowers to tap the market before potential economic uncertainties arise. Is...

Despite higher Treasury yields, robust demand and favorable pricing conditions are driving corporate borrowers to tap the market before potential economic uncertainties arise. Is...

1

New York Community Bancorp (NYCB) late Monday said it closed a $1 billion equity investment from a group of firms led by former Treasury Secretary Steven Mnuchin's Liberty Capital.

The bank announced its intention to propose a one-for-three reverse stock split to shareholders.

Mnuchin and fellow investors Milton Berlinski and Allen Puwalski, as well as former Comptroller of the Currency Joseph Otting, joined the troubled lender's...

The bank announced its intention to propose a one-for-three reverse stock split to shareholders.

Mnuchin and fellow investors Milton Berlinski and Allen Puwalski, as well as former Comptroller of the Currency Joseph Otting, joined the troubled lender's...

3

no_totti_no_party

liked

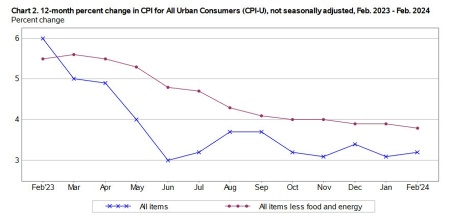

US February 2024 consumer price index data

Headline measures:

CPI y/y +3.2% versus 3.1% expected

Prior y/y 3.1%

CPI m/m +0.4% versus +0.4% expected

Prior m/m 0.3%

Core measures:

Core CPI m/m +0.4% versus +0.3% expected. Last month 0.4%

Unrounded core was +0.358%

Core CPI y/y 3.8% versus 3.7% expected. Last month was 3.9%

Shelter +0.4% versus +0.6% last month

Shelter y/y +5.7% vs +6.0% prior

Services less rent of shelter +0.6% m/m vs +0.6% pri...

Headline measures:

CPI y/y +3.2% versus 3.1% expected

Prior y/y 3.1%

CPI m/m +0.4% versus +0.4% expected

Prior m/m 0.3%

Core measures:

Core CPI m/m +0.4% versus +0.3% expected. Last month 0.4%

Unrounded core was +0.358%

Core CPI y/y 3.8% versus 3.7% expected. Last month was 3.9%

Shelter +0.4% versus +0.6% last month

Shelter y/y +5.7% vs +6.0% prior

Services less rent of shelter +0.6% m/m vs +0.6% pri...

5

no_totti_no_party

liked

Wall Street's Waning Influence

Sell-side ratings from Wall Street banks have increasingly been viewed as "useless" for investment guidance, a study by Trivariate Research reveals. Over the past 25 years, contrarian strategies, especially in the tech sector, have rewarded investors by going against the consensus of sell-side opinions. Adam Parker of Trivariate highlights the diminishing value of analyst recommendations, noting that price ta...

Sell-side ratings from Wall Street banks have increasingly been viewed as "useless" for investment guidance, a study by Trivariate Research reveals. Over the past 25 years, contrarian strategies, especially in the tech sector, have rewarded investors by going against the consensus of sell-side opinions. Adam Parker of Trivariate highlights the diminishing value of analyst recommendations, noting that price ta...

3

💡3/12

$SPDR S&P 500 ETF (SPY.US)$

After spy rejected 509/510 demand near open, spy perfectly touched 508 demand zone here it bounced but closed under 511.66. Now inside a fresh supply after hours.

📈above 514.18 ➡️ 528c 3/22 can work

📉below 509.82 ➡️ 506p 3/13 can work

$SPDR S&P 500 ETF (SPY.US)$

After spy rejected 509/510 demand near open, spy perfectly touched 508 demand zone here it bounced but closed under 511.66. Now inside a fresh supply after hours.

📈above 514.18 ➡️ 528c 3/22 can work

📉below 509.82 ➡️ 506p 3/13 can work

1

no_totti_no_party

liked

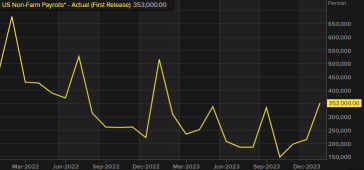

February 2024 US employment data from the non-farm payrolls report

Prior +353K (revised to 229K)

Two-month net revision -167K vs +126K prior

Unemployment rate 3.9% vs 3.7% expected

Prior unemployment rate 3.7%

Participation rate 62.5% vs 62.5% prior

U6 underemployment rate 7.3% vs 7.2% prior

Average hourly earnings +0.1% m/m vs +0.3% expected

Prior avg hourly earnings +0.6% m/m (revised to +0.5%)

Average hourly earnings +4.3% y/y vs +4.4% expe...

Prior +353K (revised to 229K)

Two-month net revision -167K vs +126K prior

Unemployment rate 3.9% vs 3.7% expected

Prior unemployment rate 3.7%

Participation rate 62.5% vs 62.5% prior

U6 underemployment rate 7.3% vs 7.2% prior

Average hourly earnings +0.1% m/m vs +0.3% expected

Prior avg hourly earnings +0.6% m/m (revised to +0.5%)

Average hourly earnings +4.3% y/y vs +4.4% expe...

4

no_totti_no_party

liked

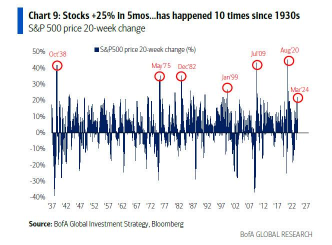

The S&P 500 is officially up 25%, adding 1,000 points, since its low in October 2023.

This has only happened 10 times dating back to 1930, according to Bank of America.

The last 3 times this happened?

August 2020, July 2009 and January 1999.

However, the Magnificent 7 are currently *only* up 149% since the run began in December 2022.

This percentage gain is lower than every "bubble" dating back to 1930 except for one.

History says the Magnificent 7 aren't done yet.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

This has only happened 10 times dating back to 1930, according to Bank of America.

The last 3 times this happened?

August 2020, July 2009 and January 1999.

However, the Magnificent 7 are currently *only* up 149% since the run began in December 2022.

This percentage gain is lower than every "bubble" dating back to 1930 except for one.

History says the Magnificent 7 aren't done yet.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

2

no_totti_no_party

liked

Key Takeaway

CPI data pivotal for bond yield rally and equity highs.

Japanese yen strengthens on BOJ policy shift anticipation.

Junk bond market thrives amid rate cut expectations, but risks loom.

CPI Data: The Linchpin for Market Sentiment

US equities are on the brink of setting new records, with all eyes on the upcoming CPI data. The market is ripe for a bond yield rally, contingent on the data underscoring a return to disinflation. Recent indica...

CPI data pivotal for bond yield rally and equity highs.

Japanese yen strengthens on BOJ policy shift anticipation.

Junk bond market thrives amid rate cut expectations, but risks loom.

CPI Data: The Linchpin for Market Sentiment

US equities are on the brink of setting new records, with all eyes on the upcoming CPI data. The market is ripe for a bond yield rally, contingent on the data underscoring a return to disinflation. Recent indica...

4

no_totti_no_party

liked

Key Takeaway

Dow Jones dips 100 points, with NASDAQ and S&P 500 also trading lower, indicating a cautious market sentiment.

Materials sector outperforms with a 0.6% rise, while information technology shares drop by 0.9%.

Eltek Ltd. misses earnings expectations at 22 cents per share against estimates of 31 cents, highlighting potential concerns in the tech sector.

Market Dips Amid Inflation Anticipation

U.S. stocks experienced a downturn in ...

Dow Jones dips 100 points, with NASDAQ and S&P 500 also trading lower, indicating a cautious market sentiment.

Materials sector outperforms with a 0.6% rise, while information technology shares drop by 0.9%.

Eltek Ltd. misses earnings expectations at 22 cents per share against estimates of 31 cents, highlighting potential concerns in the tech sector.

Market Dips Amid Inflation Anticipation

U.S. stocks experienced a downturn in ...

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)