The supply chain order information for NVIDIA's Blackwell GB200 chip indicates that Microsoft is currently the world's largest customer for the GB200. In the fourth quarter of this year, Microsoft's orders have surged 3 to 4 times, with the volume surpassing the combined total of all other cloud service providers.

The production capacity expansion for the Blackwell chips is expected to begin at the start of the fourth quarter of 2024, with an estimated shipment volume b...

The production capacity expansion for the Blackwell chips is expected to begin at the start of the fourth quarter of 2024, with an estimated shipment volume b...

4

Here are five key takeaways from today’s briefing by Chinese Minister of Finance Lan Fo’an and his colleagues.

1. China will borrow more to raise money and help local governments finance their “hidden debt,” or off-balance-sheet borrowing. This could ease debt pressures for regional authorities, which have struggled to raise funds from traditional avenues like land sales, and allow them to better focus on helping the economy. More details on th...

1. China will borrow more to raise money and help local governments finance their “hidden debt,” or off-balance-sheet borrowing. This could ease debt pressures for regional authorities, which have struggled to raise funds from traditional avenues like land sales, and allow them to better focus on helping the economy. More details on th...

13

9

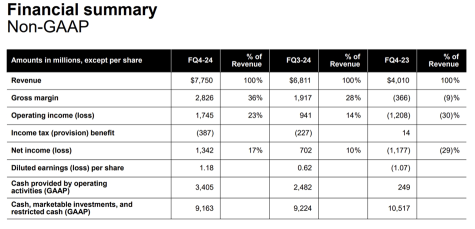

In the last week of September, the Chinese stock market experienced a strong rebound, with Chinese assets globally rising across the board. From September 23 to September 30, the Hang Seng Index rose by 15.75%, and the Nasdaq Golden Dragon China Index increased by 24.5%, significantly outperforming global markets. Among the top ten Chinese stocks in terms of gains over the past five trading days were Lexin (LX), Lufax Holding (LU), D...

18

11

31

Currently, the high volatility in the U.S. stock market is expected to persist, highlighting the resilience of the "cash cow" investment style. In the context of "expansive fiscal policy + loose monetary policy," the economy is anticipated to recover, and trading styles are converging further toward cyclicals. Over the past few months, the U.S. Cash Cow Index has risen against the trend during periods of high volatility, ...

20

3

According to sources cited by Bloomberg, China's Ministry of Finance is set to introduce the largest economic stimulus policy in history, marking another significant adjustment in fiscal policy following actions by the central bank.

Informed sources indicate that China is considering a large-scale fiscal stimulus of unprecedented scale, referred to as the "three arrows" of the strongest measures in history.

(1) Increase public budget expenditures, with an expected addition of 1.3 trillion yuan i...

Informed sources indicate that China is considering a large-scale fiscal stimulus of unprecedented scale, referred to as the "three arrows" of the strongest measures in history.

(1) Increase public budget expenditures, with an expected addition of 1.3 trillion yuan i...

13

4

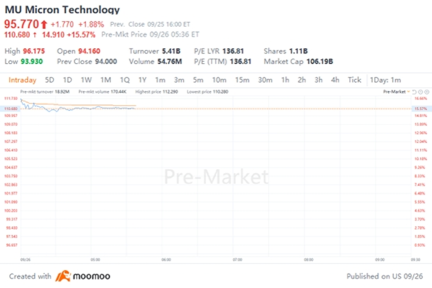

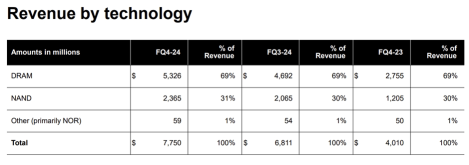

Global memory chip giant Micron Technology has released its performance results for FY24 Q4. Benefiting from the strong demand for HBM (High Bandwidth Memory) driven by the AI boom, the overall performance significantly surpassed market expectations, with Q4 revenue growing 93.3% year-over-year to $7.75 billion, and Non-GAAP diluted EPS increasing 210.28% year-over-year to $1.18.

As a result of this positive perf...

As a result of this positive perf...

+1

12

Affected by the Federal Reserve's interest rate cuts, the Chinese government has also eased its monetary policy.

The Chinese government announced three significant policies: First, it will lower the reserve requirement ratio and policy interest rates, which will drive down market benchmark rates. Second, it will reduce existing mortgage rates and unify the minimum down payment ratio for home loans. Third, it will create new polic...

The Chinese government announced three significant policies: First, it will lower the reserve requirement ratio and policy interest rates, which will drive down market benchmark rates. Second, it will reduce existing mortgage rates and unify the minimum down payment ratio for home loans. Third, it will create new polic...

7

3

2

The problem of AI computing power affecting huge electricity consumption still needs to be solved.

According to a foreign research institute report, ChatGPT responds to about 200 million requests per day and consumes more than 500,000 kilowatt-hours of electricity, equivalent to the electricity consumption of 17,000 American homes. Not only that, but the International Energy Agency (IEA) reports that if fully integrated with AI, Google searches, for ...

According to a foreign research institute report, ChatGPT responds to about 200 million requests per day and consumes more than 500,000 kilowatt-hours of electricity, equivalent to the electricity consumption of 17,000 American homes. Not only that, but the International Energy Agency (IEA) reports that if fully integrated with AI, Google searches, for ...

9

1

I. First Major Rate Cut (January 2001 to June 2003)

– Duration: January 2001 to June 2003

– Rate Reduction: From 6.5% to 1.0%

– Reasons for Rate Cut: 1) Burst of the Internet bubble. 2) Impact of the 9/11 attacks.

– Russell 2000 vs. S&P 500: Russell 2000 outperformed.

II. Second Major Rate Cut (September 2007 to December 2008)

– Duration: September 2007 to December 2008

– Rate Reduction: From 5.25% to 0.25%

– Reasons for Rate Cut: 1) ...

– Duration: January 2001 to June 2003

– Rate Reduction: From 6.5% to 1.0%

– Reasons for Rate Cut: 1) Burst of the Internet bubble. 2) Impact of the 9/11 attacks.

– Russell 2000 vs. S&P 500: Russell 2000 outperformed.

II. Second Major Rate Cut (September 2007 to December 2008)

– Duration: September 2007 to December 2008

– Rate Reduction: From 5.25% to 0.25%

– Reasons for Rate Cut: 1) ...

8

3

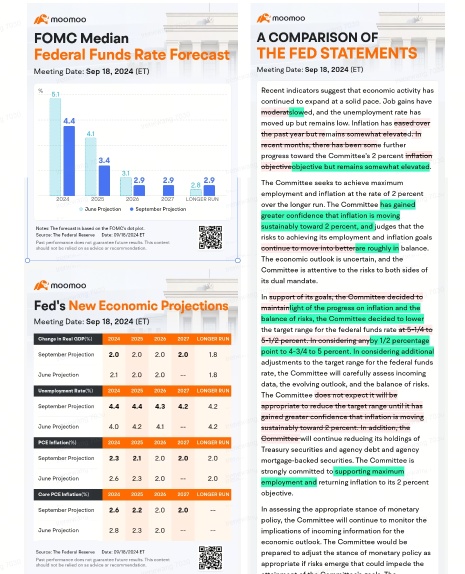

Amid worries about an economic recession and eager expectations for interest rate cuts, the Federal Reserve has initiated a rate cut as anticipated. This marks the first rate cut since the outbreak of the pandemic in 2020 and signals the end of the tightening cycle that began in March 2022 and paused in July 2023. However, the magnitude of the rate cut surprised the market, as an initial reduction of 50 basis points is histori...

12

13

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)