NoviceInvest

Set a live reminder

$Micron Technology (MU.US)$

Micron Q1 FY2025 earnings conference call is scheduled for December 18 at 4:30 PM ET /December 19 at 5:30 AM SGT /December 19 at 8:30 AM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Micron's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what managements have to say!

Disclaimer:

This presentation is for inf...

Micron Q1 FY2025 earnings conference call is scheduled for December 18 at 4:30 PM ET /December 19 at 5:30 AM SGT /December 19 at 8:30 AM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Micron's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what managements have to say!

Disclaimer:

This presentation is for inf...

Micron Q1 FY2025 earnings conference call

Dec 19 05:30

10

4

NoviceInvest

commented on and voted

Morning, mooers! ![]()

This week, $MAYBANK (1155.MY)$ (11/26) and $PBBANK (1295.MY)$ (11/27) are said to report their quarterly earnings. After the recent pullback, investors are focusing on the performance of these two local banking giants. Who will be the winner of earnings week? Make your choice and grab some point rewards!![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guessed the winner who makes the biggest % gains in...

This week, $MAYBANK (1155.MY)$ (11/26) and $PBBANK (1295.MY)$ (11/27) are said to report their quarterly earnings. After the recent pullback, investors are focusing on the performance of these two local banking giants. Who will be the winner of earnings week? Make your choice and grab some point rewards!

Rewards

● An equal share of 5,000 points: For mooers who correctly guessed the winner who makes the biggest % gains in...

73

67

22

NoviceInvest

commented on

Hi, mooers! ![]()

YTL Power $YTLPOWR (6742.MY)$ is expected to release its latest quarterly earnings on November 26*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

![]() An equal share of 5,000 points: For mooers who correctly guess the price range of $YTLPOWR (6742.MY)$'s closing price on 26 November!

An equal share of 5,000 points: For mooers who correctly guess the price range of $YTLPOWR (6742.MY)$'s closing price on 26 November!

(Vote will clos...

YTL Power $YTLPOWR (6742.MY)$ is expected to release its latest quarterly earnings on November 26*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

(Vote will clos...

61

91

16

NoviceInvest

Set a live reminder

The feverish post-Trump victory stock market rally came to halt last week, as persistent inflation and a cautious statement from Fed Chair Jerome Powell weighed on markets. Investors are now grappling with uncertainty over the path and pace of the Fed’s rate cut cycle, drowning out the previous excitment over the President-Elect Trump’s potential policy agenda and its impliacation on stock markets.

Earnings are back in focus this, wit...

Earnings are back in focus this, wit...

[Trader’s Talk] Nvidia - Setting the Tone for the US Market?

Nov 19 11:00

12

1

1

NoviceInvest

Set a live reminder

After the dust settles from the election, how will political changes in the USA affect the Malaysian market? Let's delve into the adjustments and opportunities it brings. Stay tuned on November 13 (Wednesday) at 8 pm, when Nanyang Commercial will join moomoo guests to provide live commentary on the US presidential election situation, market reactions, dynamic tracking, and forward-looking analysis of the Malaysian market.

Translated

特朗普重掌白宫,探亚洲马股喜忧

Nov 13 20:00

177

71

14

Join this Positive Yield Challenge with global traders and compete for a share of $100,000 in cash rewards! Tap this link to begin>>

Participate in Guess for Prizes and become eligible for a share of $100,000 in cash rewards! Tap this link to begin >>

NoviceInvest

voted

Hi mooers! ![]()

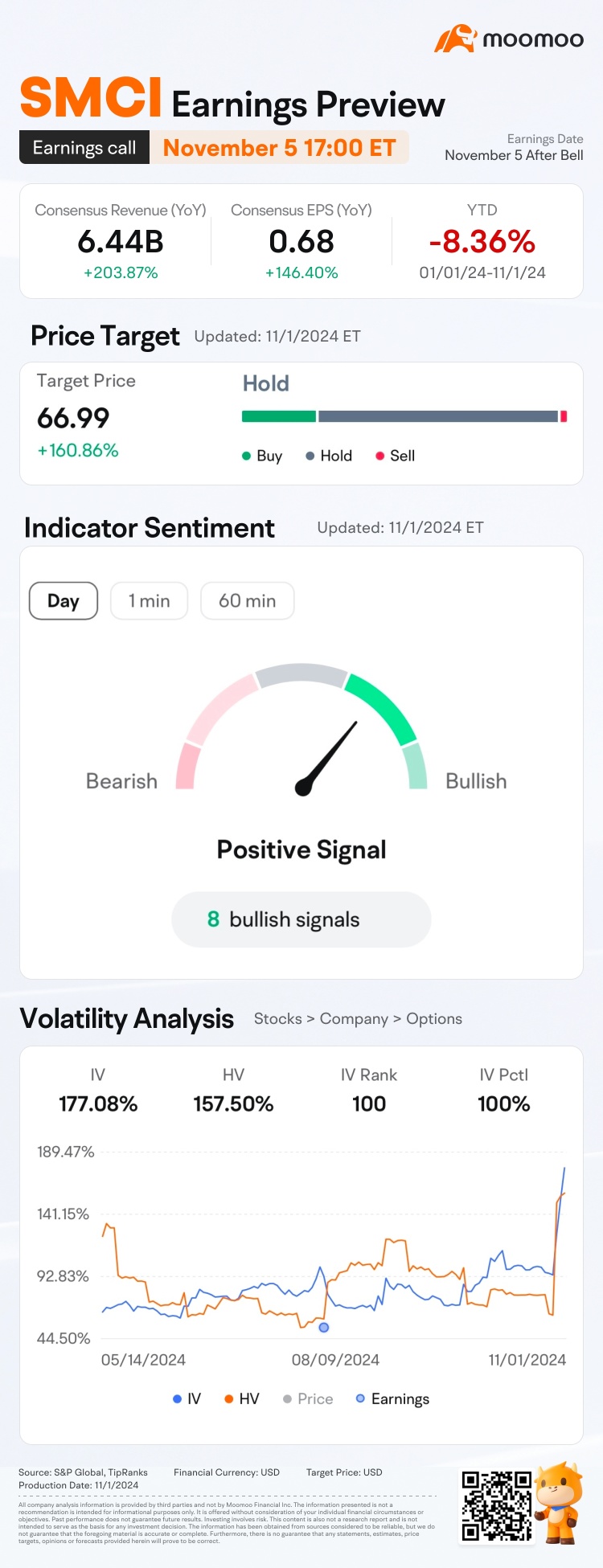

$Super Micro Computer (SMCI.US)$ is releasing its Q1 FY2025 earnings on November 5 after the bell. Unlock insights with SMCI Earnings Hub>>

On October 30, SMCI's audit firm EY resigned during their review, citing concerns about the company's governance and transparency. $Super Micro Computer (SMCI.US)$ 's share price dropped over 30% on that day. Do you expect any comment from SMCI's management? Subscribe to @Moo Live a...

$Super Micro Computer (SMCI.US)$ is releasing its Q1 FY2025 earnings on November 5 after the bell. Unlock insights with SMCI Earnings Hub>>

On October 30, SMCI's audit firm EY resigned during their review, citing concerns about the company's governance and transparency. $Super Micro Computer (SMCI.US)$ 's share price dropped over 30% on that day. Do you expect any comment from SMCI's management? Subscribe to @Moo Live a...

70

107

9

NoviceInvest

voted

Hi mooers! ![]()

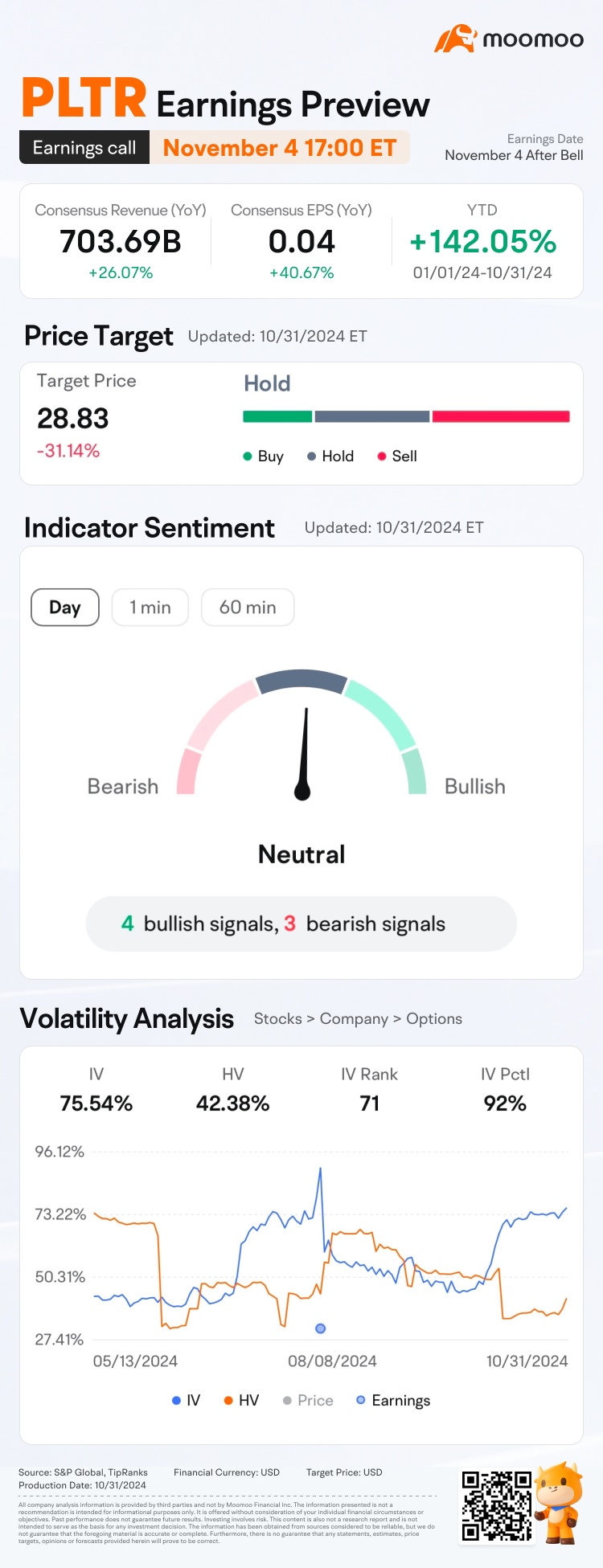

$Palantir (PLTR.US)$ is releasing its Q3 earnings on November 4 after the bell. Unlock insights with PLTR Earnings Hub>>

$Palantir (PLTR.US)$ recently joined the S&P 500 index. The company has been riding the AI and big data wave recently, and gained +140% increase on its share price. PLTR's current market cap is standing near $100 billion.![]()

What will the company's future performance look like? Subscribe to @Moo Live...

$Palantir (PLTR.US)$ is releasing its Q3 earnings on November 4 after the bell. Unlock insights with PLTR Earnings Hub>>

$Palantir (PLTR.US)$ recently joined the S&P 500 index. The company has been riding the AI and big data wave recently, and gained +140% increase on its share price. PLTR's current market cap is standing near $100 billion.

What will the company's future performance look like? Subscribe to @Moo Live...

91

142

9

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)