OT Impressive

voted

$Bitcoin (BTC.CC)$

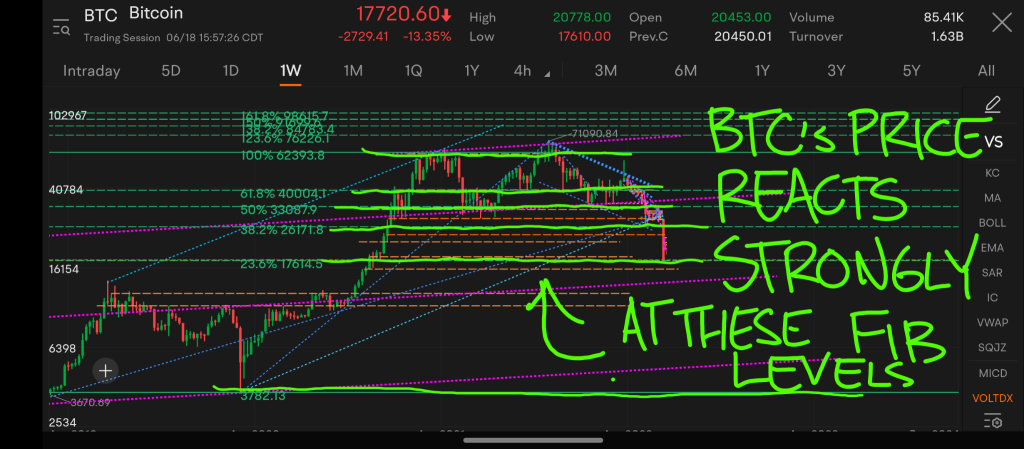

It is obvious that BTC and other major Alt coins have not had a good go the first half of the year. They fell with most other asset classes on recession fears. They still haven't recovered technically. How will the second half of the year go for the cryptocurrencies. They surely cant go to zero you would think. Unless you believe they will get killed by regulation or just people will lose faith and the market will just dissolve. This may happen to s...

It is obvious that BTC and other major Alt coins have not had a good go the first half of the year. They fell with most other asset classes on recession fears. They still haven't recovered technically. How will the second half of the year go for the cryptocurrencies. They surely cant go to zero you would think. Unless you believe they will get killed by regulation or just people will lose faith and the market will just dissolve. This may happen to s...

+3

13

22

2

OT Impressive

liked

$Microsoft (MSFT.US)$released its Windows 11 on Tuesday. People are excited about its visual makeover and new productivity tricks. Are you interested in the new upgrade?![]()

![]()

![]()

For me, I would only update my computer system when I have to or when there's really something revolutionary. But, is Windows 11 that game-changing? I doubt that.![]()

![]()

![]() What about you? What do you think of Windows 11?

What about you? What do you think of Windows 11?

Anyway, I think the upgrade would help Microsoft and its partners to sell more computers and software. Thus, Microsoft might be a good buy. What do you say?![]()

![]()

![]()

Rewards calling! Comment to win rewards!

Moomoo news team and I hold the event together for a month! I will post discussions every day and Moomoo news team will support the event with reward points! We will pick the top 2 'liked' and top 3 'insightful' comments every weekday& top 10 'liked' and top 10 'insightful' comments every weekend to be the winners.![]()

![]()

![]()

For more details, clickhere.

Follow me to join the latest discussion!

For me, I would only update my computer system when I have to or when there's really something revolutionary. But, is Windows 11 that game-changing? I doubt that.

Anyway, I think the upgrade would help Microsoft and its partners to sell more computers and software. Thus, Microsoft might be a good buy. What do you say?

Rewards calling! Comment to win rewards!

Moomoo news team and I hold the event together for a month! I will post discussions every day and Moomoo news team will support the event with reward points! We will pick the top 2 'liked' and top 3 'insightful' comments every weekday& top 10 'liked' and top 10 'insightful' comments every weekend to be the winners.

For more details, clickhere.

Follow me to join the latest discussion!

![[Rewards Calling] Win 11 is coming! Are you a go-getter or a put-it-off-er?](https://sgsnsimg.moomoo.com/5744099717450633074.png/thumb)

65

133

16

OT Impressive

liked

Hi, mooers! We recently found out that a mooer, The Boxing Ring, is presenting interesting investment ideas every day. For example, his discussion on time-traveling got our attention. We are surprised about the events it holds and would love to support the events.

Thus, we are very excited to invite you to join the discussion and claim big rewards!

Before we start, let us give you a "spoiler": There will be 5 winners per weekday and 20 winners every weekend, that is, 45 winners every week. Since The Boxing Ring posts every day, I'm sure that you will have a chance to win the rewards!

How to join this event?

Step 1: Follow 'The Boxing Ring'.

Step 2: Join the latest discussion and comment on the posts to express your thoughts.

Every day, The Boxing Ring will present you with new trading ideas.

Special hints for you

We choose the top 2 'liked' comments and top 3 'insightful' comments to be the day-winners. Please feel free to discuss your trading ideas with other mooers!

You can either make the most insightful comment or win other people's attention to get more 'likes'.

Rewards:

288 moomoo points/person. Limited 1 entry per user per week.

Moomoo will announce last week's winners every Friday.

The first event starts next Monday (Sept 27).

Now, follow The Boxing Ring to join the events!

Thus, we are very excited to invite you to join the discussion and claim big rewards!

Before we start, let us give you a "spoiler": There will be 5 winners per weekday and 20 winners every weekend, that is, 45 winners every week. Since The Boxing Ring posts every day, I'm sure that you will have a chance to win the rewards!

How to join this event?

Step 1: Follow 'The Boxing Ring'.

Step 2: Join the latest discussion and comment on the posts to express your thoughts.

Every day, The Boxing Ring will present you with new trading ideas.

Special hints for you

We choose the top 2 'liked' comments and top 3 'insightful' comments to be the day-winners. Please feel free to discuss your trading ideas with other mooers!

You can either make the most insightful comment or win other people's attention to get more 'likes'.

Rewards:

288 moomoo points/person. Limited 1 entry per user per week.

Moomoo will announce last week's winners every Friday.

The first event starts next Monday (Sept 27).

Now, follow The Boxing Ring to join the events!

![[Giveaway] You're invited! Join the discussion and earn rewards](https://sgsnsimg.moomoo.com/1992840384017466868.png/thumb)

![[Giveaway] You're invited! Join the discussion and earn rewards](https://sgsnsimg.moomoo.com/7473838653236933331.jpg/thumb)

218

298

55

OT Impressive

liked

Debt is the causes hyperinflation and is the reason currencies fail. The structure of government has taught its societies the worse money structure possible. In the US it all started because of the Great Depression. It has been downhill ever since giving the people the idea debt is ok because you can just kick the can down the road further. The Generation that runs out of road is going to be in for a big wake up call because it’s going to a time when the most drastic of changes will be experienced. Very few take responsibility for their debt and instead of blaming themselves for bad choices, its society’s fault or the circumstances I was born into. Society has the “Its owed to me” complex when it’s really you’re a freeloader characteristic. You enjoyed the goods or the services so pay for them. Not paying your debt is stealing the most precious thing from someone- their Time. So remember stay away from debt or you may end up on the pole. ...

17

21

OT Impressive

reacted to

Want to redeem the privileged moomoo coupons or figures?![]()

![]()

Need more moomoo points?![]()

![]()

The long-awaited event is finally coming!

We’re giving away 14K+ Points to help you achieve your goals.![]()

![]()

Don’t miss the new lessons on Courses this week. Video version, you are gonna love it!

![]() How to join this event?

How to join this event?

Only two steps needed.

1. Learn the new lessons:

Where to attend:

🔗 https://live.moomoo.com/course/36078

2. Comment on THIS post

Share you...

Need more moomoo points?

The long-awaited event is finally coming!

We’re giving away 14K+ Points to help you achieve your goals.

Don’t miss the new lessons on Courses this week. Video version, you are gonna love it!

Only two steps needed.

1. Learn the new lessons:

Where to attend:

🔗 https://live.moomoo.com/course/36078

2. Comment on THIS post

Share you...

![[Free Gifts] Back to Courses. Learn new lessons for 999 points!](https://sgsnsimg.moomoo.com/2021090100001230362694db9a5.png/thumb)

![[Free Gifts] Back to Courses. Learn new lessons for 999 points!](https://sgsnsimg.moomoo.com/2021090100001232132f0dbedaa.png/thumb)

![[Free Gifts] Back to Courses. Learn new lessons for 999 points!](https://sgsnsimg.moomoo.com/20210901000012339353586e4a7.png/thumb)

281

345

89

OT Impressive

liked

Buffett Indicator is the percentage of the total market cap relative to the US GDP. According to Warren Buffett, such an indicator is probably the best single measure of where valuations stand at any given moment.

How does the Buffett Indicator work?

In 2001, Warren Buffett said 75% to 90% are reasonable; over 120% suggests the stock market is overvalued.

As of Aug 28 2021, the Total Market Index is at US$ 46.88 trillion, about 206% of the US GDP, signaling the market is heavily overvalued.

Did Buffett Indicator work well?

Let's see the historical chart of the Buffett Indicator. The ratio reached 140% in 2000, portending the dot-com bubble which eventually burst. The NASDAQ fell by 75% from March 2000 to October 2002.

The ratio also reached 155% in Feb 2020, followed by the pandemic crash that caused the S&P500 Index to drop from 3393 to 2192, a 35% correction. However, stock market quickly bounced, doubling from the dip.

And when the ratio breaks 200%, we are witnessing history undoubtedly.

Will this time be different?

With interest rates at historic lows, there is a voice in the market that "this time is different".

Cathie Wood said: GDP statistics evolved during the Industrial Age and do not seem to be keeping up with the digital age. Thanks to productivity, real GDP growth probably is higher and inflation lower than reported, suggesting that the quality of earnings has increased significantly.

Overall, if the stock market is a game, you have to stay in the game before you beat the game. The Buffett Indicator can be a tool to relocate where we are in the stock market. It's never too late to do our due diligence and control the risk to gain a long-term return.

Do you think the Buffett Indicator is useful? Should we pay close attention or just ignore it? What should we do in response to such an indicator?

Rewards:

Click "Enter Now" to post before Sep 3, and based on the quality and originality,

5 mooers will win 2,000 points

10 mooers will win 1,000 points

Don't forget to click "Enter Now" to win!

How does the Buffett Indicator work?

In 2001, Warren Buffett said 75% to 90% are reasonable; over 120% suggests the stock market is overvalued.

As of Aug 28 2021, the Total Market Index is at US$ 46.88 trillion, about 206% of the US GDP, signaling the market is heavily overvalued.

Did Buffett Indicator work well?

Let's see the historical chart of the Buffett Indicator. The ratio reached 140% in 2000, portending the dot-com bubble which eventually burst. The NASDAQ fell by 75% from March 2000 to October 2002.

The ratio also reached 155% in Feb 2020, followed by the pandemic crash that caused the S&P500 Index to drop from 3393 to 2192, a 35% correction. However, stock market quickly bounced, doubling from the dip.

And when the ratio breaks 200%, we are witnessing history undoubtedly.

Will this time be different?

With interest rates at historic lows, there is a voice in the market that "this time is different".

Cathie Wood said: GDP statistics evolved during the Industrial Age and do not seem to be keeping up with the digital age. Thanks to productivity, real GDP growth probably is higher and inflation lower than reported, suggesting that the quality of earnings has increased significantly.

Overall, if the stock market is a game, you have to stay in the game before you beat the game. The Buffett Indicator can be a tool to relocate where we are in the stock market. It's never too late to do our due diligence and control the risk to gain a long-term return.

Do you think the Buffett Indicator is useful? Should we pay close attention or just ignore it? What should we do in response to such an indicator?

Rewards:

Click "Enter Now" to post before Sep 3, and based on the quality and originality,

5 mooers will win 2,000 points

10 mooers will win 1,000 points

Don't forget to click "Enter Now" to win!

50

12

47

OT Impressive

liked

We are in a very tough trading environment. There is not much edge being provided by options flow, indicators, and entries. With indices, specifically $S&P 500 Index (.SPX.US)$, continually pushing to new highs in a healthy matter, one would think that all names are moving the same way. However, that has not been the case, there is still no full participation in the market. We have seen rotation continually into and out of specific sectors. Usually, these types of Fed-induced bull markets end poorly.

With this tricky atmosphere, we continue to emphasize that the best way to stay involved in the market is to play very tactically and play short-term signals such as tactical sentiment.

...

With this tricky atmosphere, we continue to emphasize that the best way to stay involved in the market is to play very tactically and play short-term signals such as tactical sentiment.

...

+2

66

13

24

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)