I got a lucky fortune sign in the New Year angbao event! Check out your investment fortune for 2025 via https://j.moomoo.com/023slj

pancherry29

Set a live reminder

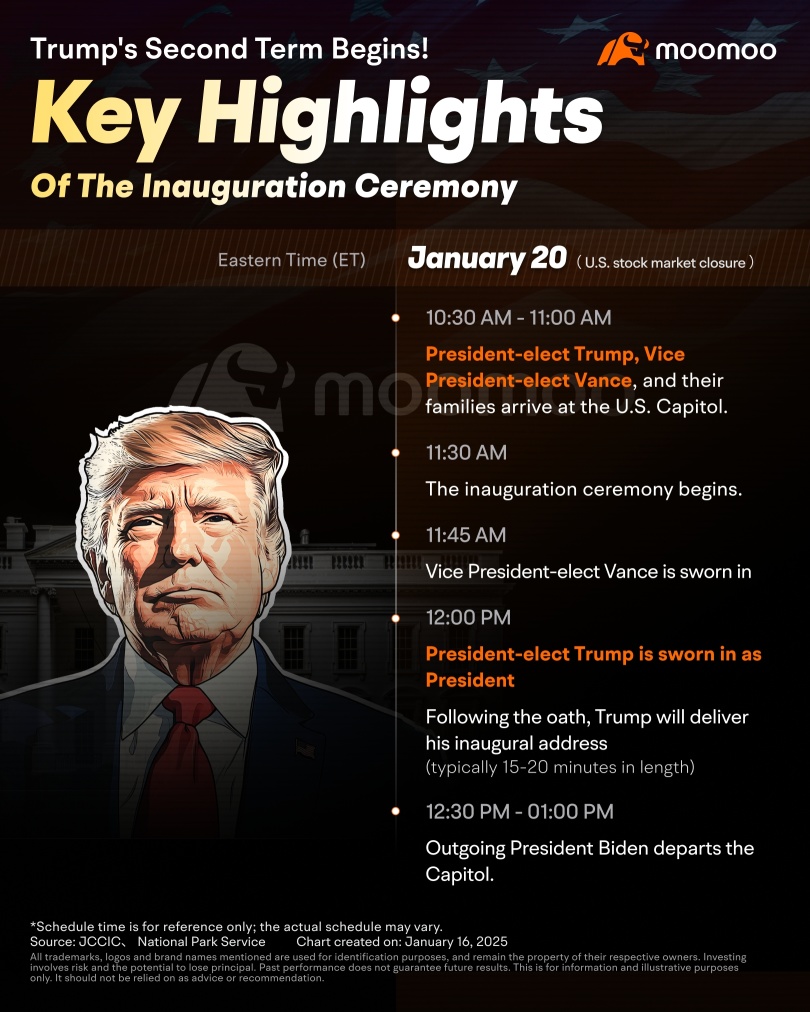

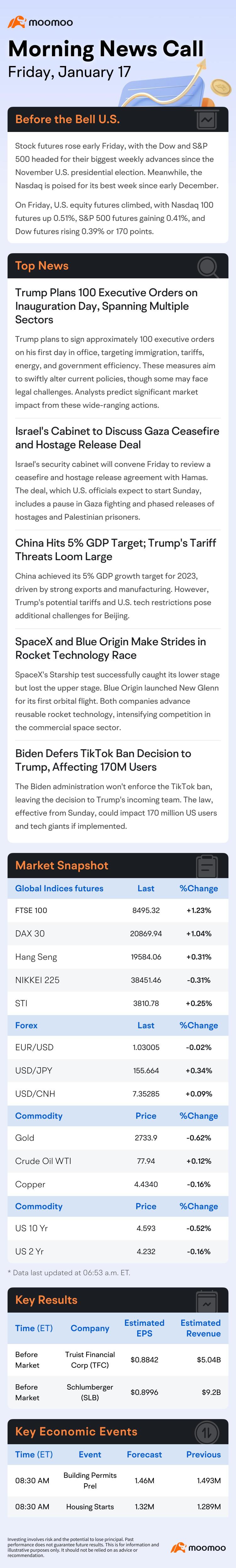

Donald Trump will be inaugurated as the 47th president of the United States on Monday, January 20. The inauguration ceremony will be held at the U.S. Capitol in Washington, D.C.

Disclaimer:This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Before investing, please consult a licensed professional. Please have a look at this link for more information.

Moomoo...

Disclaimer:This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Before investing, please consult a licensed professional. Please have a look at this link for more information.

Moomoo...

Donald Trump's 2025 Inauguration

Jan 21 01:00

124

37

20

pancherry29

liked

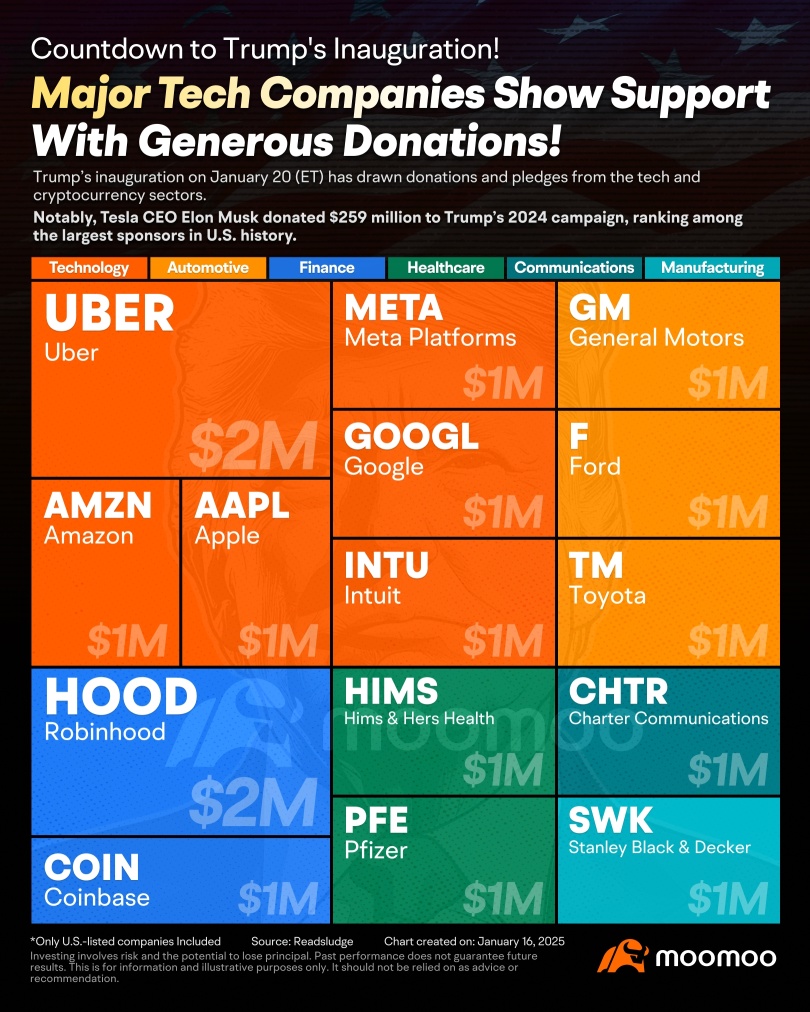

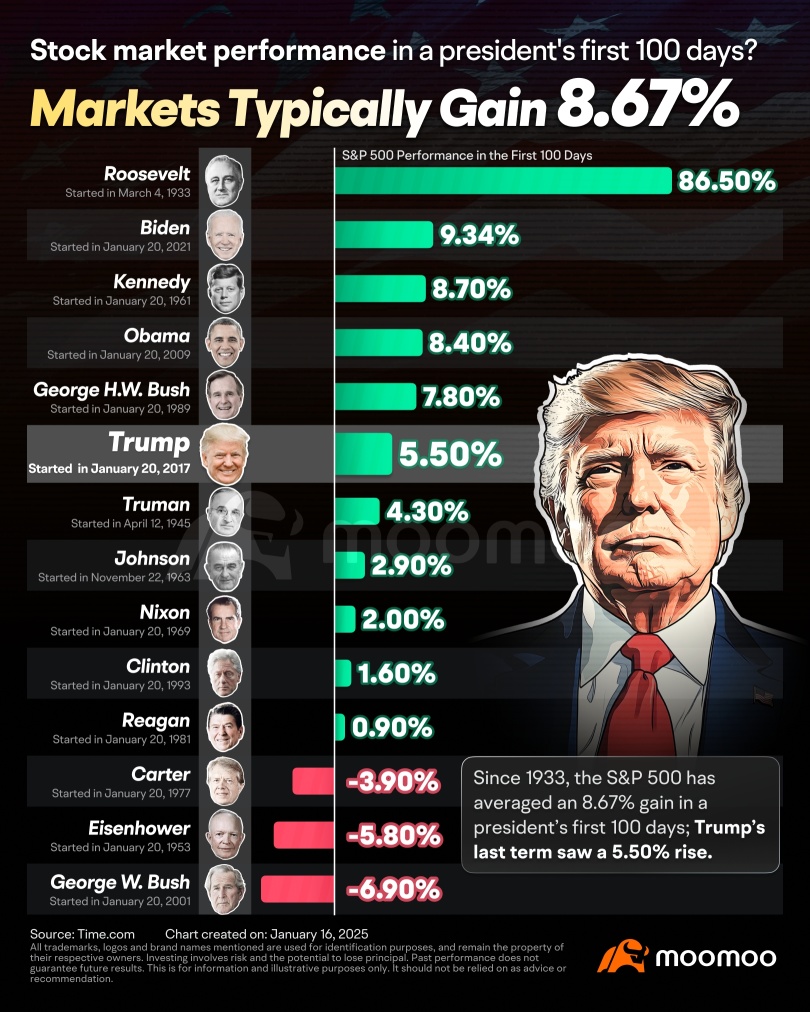

As Donald Trump prepares for his inauguration as the 47th President of the United States on January 20, 2025, investors are keenly observing the potential impacts on financial markets. Historically, the early days of a presidential term can significantly influence market dynamics, with policy announcements and economic indicators setting the tone for months to come. This pivotal moment offers a...

+1

128

19

60

I won the God of Wealth frame and S$8.80 in the [Lunar New Year] event. You should join & check out what your New Year fortune is like! https://j.moomoo.com/01Rx3B

pancherry29

liked

Today's review focuses on: pressure

First of all, do you still remember the continuous decline from yesterday? Many negative emotions and thoughts may have come to mind. The most common question in the comments section yesterday was whether to stop loss. However, my Moo friends who pay attention all know that my response is always: If you feel pressure, you should stop loss; if not, you can wait. And I provide hints whether I have positions or not, so that you can think for yourselves. (I want to tell you that if you feel pressure, you shouldn't buy because you're not ready. So when you encounter unknown situations, you keep trying to find excuses for yourself, which is actually meaningless.)![]()

![]()

![]()

So how to avoid this pressure? Let me share my own logic: Fear comes from the unknown of things.![]()

![]()

![]() 。

。

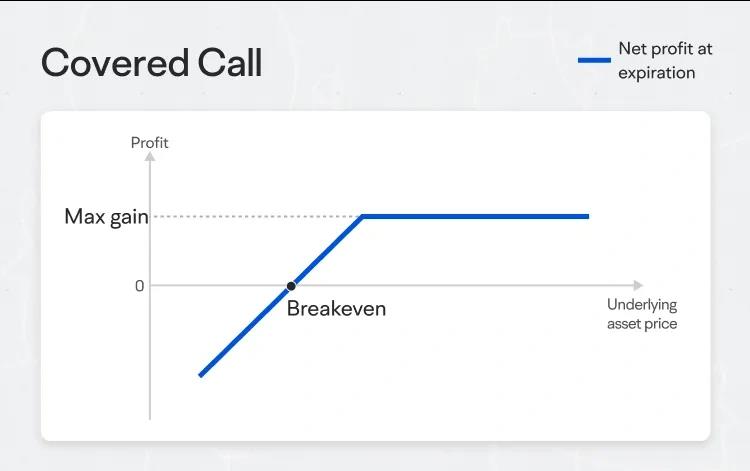

What does this sentence mean? Fans of Moo should all know that I often say to you: in Options Trading, if I lack confidence, I will set a stop loss at 1%. If I am confident, I basically trade without a stop loss, even if the loss exceeds 50%. This stems from the recognition of my professionalism and stock selection, bringing confidence, so I have no fear. After all, I have been active in the market for 11 years, so I have seen almost every situation, that's why you see me comfortable despite losses.![]()

![]()

![]()

![]()

Finally, based on the two arguments above, if you have been following my posts yesterday, you would have noticed that I have been adding some Options of TSLA against the market trend, and the options I fell asleep on the day before yesterday didn't take profit at 50%, until yesterday in the end...

First of all, do you still remember the continuous decline from yesterday? Many negative emotions and thoughts may have come to mind. The most common question in the comments section yesterday was whether to stop loss. However, my Moo friends who pay attention all know that my response is always: If you feel pressure, you should stop loss; if not, you can wait. And I provide hints whether I have positions or not, so that you can think for yourselves. (I want to tell you that if you feel pressure, you shouldn't buy because you're not ready. So when you encounter unknown situations, you keep trying to find excuses for yourself, which is actually meaningless.)

So how to avoid this pressure? Let me share my own logic: Fear comes from the unknown of things.

What does this sentence mean? Fans of Moo should all know that I often say to you: in Options Trading, if I lack confidence, I will set a stop loss at 1%. If I am confident, I basically trade without a stop loss, even if the loss exceeds 50%. This stems from the recognition of my professionalism and stock selection, bringing confidence, so I have no fear. After all, I have been active in the market for 11 years, so I have seen almost every situation, that's why you see me comfortable despite losses.

Finally, based on the two arguments above, if you have been following my posts yesterday, you would have noticed that I have been adding some Options of TSLA against the market trend, and the options I fell asleep on the day before yesterday didn't take profit at 50%, until yesterday in the end...

Translated

+5

226

154

16

pancherry29

voted

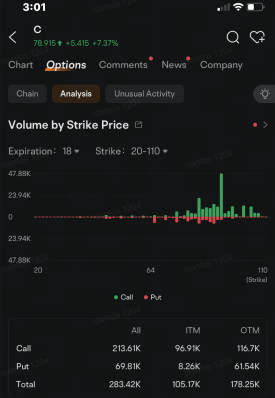

$Citigroup (C.US)$ 's options volume jump as the stock headed for its highest close in more than three years after the bank announced a $20 billion share buyback and reported fourth quarter financial results that beat analysts' estimates.

As of 3:01 p.m. in New York Wednesday, about 283,400 options changed hands, more than triple the 20-day average volume of 92,689, according to data compiled by Bloomberg. Call options t...

As of 3:01 p.m. in New York Wednesday, about 283,400 options changed hands, more than triple the 20-day average volume of 92,689, according to data compiled by Bloomberg. Call options t...

14

4

2

pancherry29

liked

The U.S. stock market has gotten off to a challenging start in 2025, with the three major stock indices recording their worst performance for this period since 2016. The Nasdaq index $Nasdaq Composite Index (.IXIC.US)$ , S&P 500 index $S&P 500 Index (.SPX.US)$ , and Dow Jones index $Dow Jones Industrial Average (.DJI.US)$ have each fallen approximately 0.77%, 0.93%, and 1.42% respectively since the beginning of the year.

Analysts widely agree that the sharp rise in U.S. Tre...

Analysts widely agree that the sharp rise in U.S. Tre...

34

1

12

pancherry29

liked

In the first session for 2025 moomoo's market strategist discusses the potential moves that could result from the installation of the new President of the USA. Mr Trump has promised action on his first day in office. Oil and gas stocks, cryptocurrencies, Tesla, and the US and global economies are all on the radar. Join the discussion, ask questions and have your say as we explore the potential market impacts and the possible course of markets over 2025. Feel f...

Ask a strategist - Trump's first day

Jan 14 08:00

236

278

15

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)