Patience is the Key

liked

Columns Moo Picks in July

Hey mooers,

Inflation is still hot, but July's CPI may not tell the whole story for investors. Did anyone catch a ride of the rocketing inflation? Let's find out here. Don't panic, and we're going to get through this!

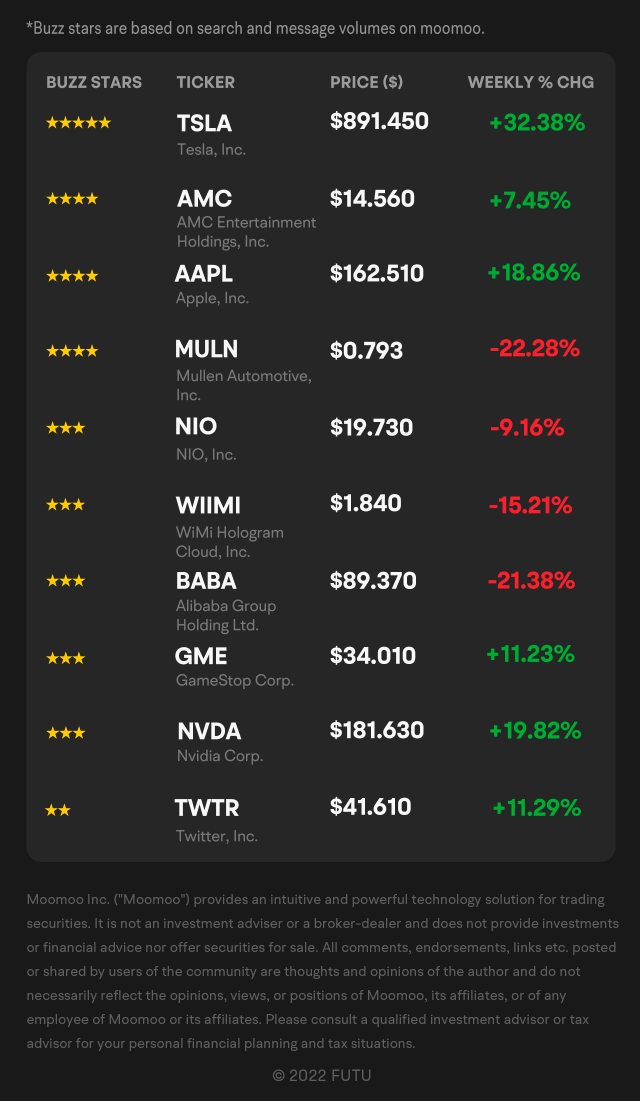

Monthly Buzz

Did you read the breaking news about the stocks in which you invest? Is there any company on the list that you didn't follow? Check out the buzzing stocks you may have missed out on!

Buzzing Stocks List

July Picks

@iamiam

Stop trying to calm the storm...

Inflation is still hot, but July's CPI may not tell the whole story for investors. Did anyone catch a ride of the rocketing inflation? Let's find out here. Don't panic, and we're going to get through this!

Monthly Buzz

Did you read the breaking news about the stocks in which you invest? Is there any company on the list that you didn't follow? Check out the buzzing stocks you may have missed out on!

Buzzing Stocks List

July Picks

@iamiam

Stop trying to calm the storm...

+1

195

74

As a newbie to investment. I try watch out for stocks with dividend yields. Just in case the stocks I chose drops in value and I can’t dispose it. I will still have some consolation in that. That being said, we still have to do some checks on the companies background and who are the major investors are before we “board the ship”. The summaries provided are helpful and we are able to compare them with our own checks. Patience is always the key to long term investment.

Patience is the Key

liked

Tuesday, December 21, 2021

By Danilo

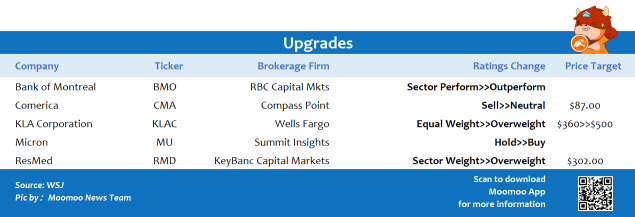

$Bank of Montreal(BMO.US$ $Micron Technology(MU.US$ $Alibaba(BABA.US$ $Oracle(ORCL.US$ $Vuzix(VUZI.US$ $GoodRx(GDRX.US$

By Danilo

$Bank of Montreal(BMO.US$ $Micron Technology(MU.US$ $Alibaba(BABA.US$ $Oracle(ORCL.US$ $Vuzix(VUZI.US$ $GoodRx(GDRX.US$

+1

74

4

Patience is the Key

liked

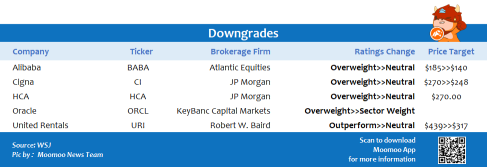

$Moderna(MRNA.US$ Vaccine maker Moderna said on Monday that its COVID-19 booster shot protected against the fast-spreading omicron strain in laboratory tests. Moderna also said that development of a vaccine for Omicron would continue and that it was expected to enter clinical trials in early 2022. Moderna shares rose more than 6.5% in pre-market trading after the announcement.

10

Patience is the Key

liked

$PayPal(PYPL.US$ $Block(SQ.US$

The digital payment industry has been on a steady climb for many years given the e-commerce revolution. The Covid 19 situation, has further led to new users who usually would not have shopped online to come onboard. All these bode well for a good runway for further consistent growth ahead.

With the coming of the new era of Metaverse by Meta, where the future could be split between your virtual and physical world, the need for a digital wallet would be essential. The digital wallet could be used for keeping your digital currency, digital assets (NFTs) and other digital-related items.

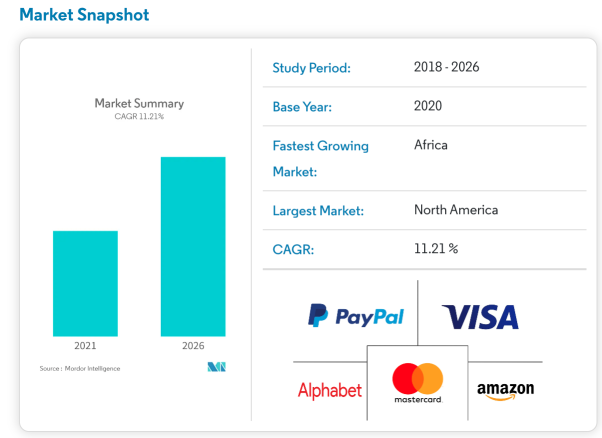

Source: Mordor Intelligence

The transaction value of the digital payments market was USD 5.44 trillion in 2020, and it is projected to be worth USD 11.29 trillion by 2026, registering a CAGR of 11.21% from 2021 to 2026

Source: Mordor Intelligence

The global payments market is expected to grow from $466.29 billion in 2020 to $517.68 billion in 2021 at a compound annual growth rate (CAGR) of 11%. The market is expected to reach $735.39 billion in 2025 at a CAGR of 9.2%.

Source: Businesswire.com

The growth as predicted by both Modor Intelligence and Businesswire for the digital payment industry would be in the region of around 11% for the next 5 years. This is consistent growth rather than exceptional growth but one thing is for sure, it is still a sunrise sector. Hence, it is going to be a good place to look for potential investments.

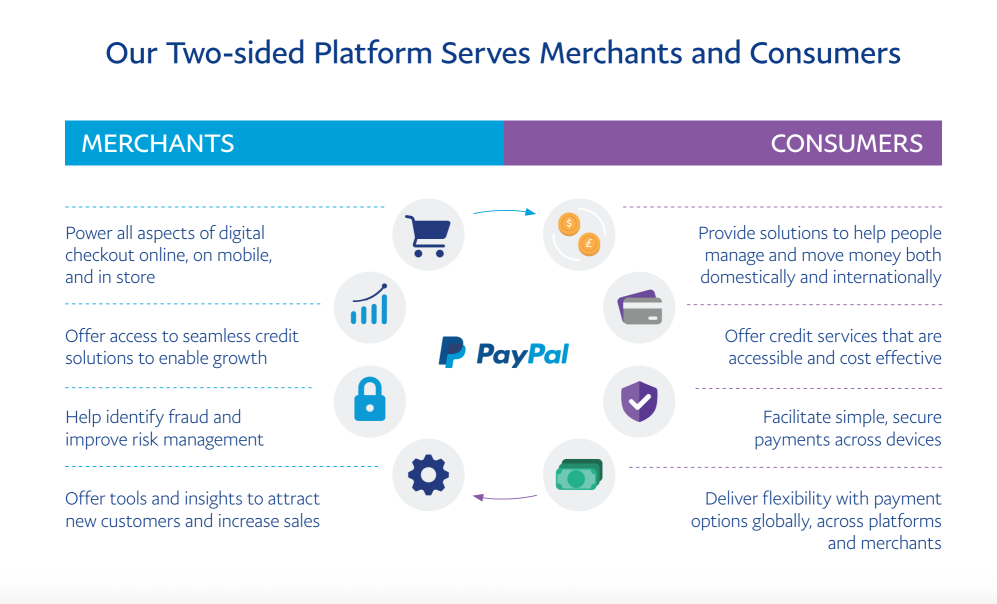

Paypal- The Gateway to Digital Payments

PayPal would need no introduction as it has been around since 1998 where their famous co-founder, Elon Musk, is now the richest man in the world; courtesy of Tesla's stake. It was part of eBay from 2002 till it was hived off in 2015 through an IPO. PayPal is therefore well entrenched internationally and not just in the US.

It has since evolved to include not only a payment mode but also a digital wallet, Venmo. You could use their app to trade cryptocurrencies and they are looking into shares trading too in the future. You are also able to store your digital assets (NFTs).

Paypal has also recently launched their digital credit card, Venmo Visa, where they have recently announced a collaboration with Amazon. They are also having their own Buy Now Pay Later solution to be up to par with competitors.

The vision for PayPal is to be a super app fighting the likes of Wechat, Alipay, Grab and Sea.

Financial Metrics

Based on the analysis of the Financial Metrics which we compared to their competitor Square which was set up in 2009. Their co-founder is Jack Dorsey who also helm Twitter. Given the earlier industry growth outlook of teens in the next 5 years, a PE of 46 would not be exactly in the bargain zone.

Nonetheless, comparing the average PE since 2016 of 57 (source: YCharts), we might be heading into a reasonable valuation zone based on the historical PE range.

Though they have a debt to equity of 0.36, if we include the cash holdings, it is in a net cash position. This gives PayPal a strong financial position. On the whole, it is a safer bet than Square in the payment sector but Square is growing at a much faster pace, they have also not expanded their base in the international markets yet.

PayPal has been the better capital allocator given its stellar return on equity and invested capital numbers.

Paypal Historical Growth

Source: Reuters

Looking at the revenue growth from 2016 to 2020, the compounded growth rate was 18.6%. The growth in earnings outshoots the revenue growth by growing at a compounding rate of 31.6%. It was more commendable given their gradual loss of eBay business since 2018.

The payment agreement between eBay and PayPal was till June 2020- 5 years after their spin-off. At their spin-off (2015), eBay makes up to 50% of the profits for PayPal. It is just less than 4% of their total revenue and it could go to nil by 2023 as eBay is coming up with their payment solutions.

Why has PayPal fallen almost 37% from the Peak?

Based on the latest Q3 results, their growth quarter on quarter has slowed to around 13% for their revenue- factoring in a reduction of 46% revenue from eBay. Excluding eBay, revenue has grown at around the 25% mark over the past 2 years. Nonetheless, there was a reduction in guidance for Q4.

PayPal expects fourth-quarter adjusted earnings to be about $1.12 per share versus the estimate of $1.27 per share. The company expects fourth-quarter revenue to be in a range of $6.85 billion to $6.95 billion versus the estimate of $7.24 billion.

Also, PayPal expects growth for 2022 to be around 18% which falls short of analysts estimates at 22%. This disappointing outlook has led to the recent share price weakness.

Their recent interest in Pinterest has also gathered mixed reactions with some critics highlighting that PayPal’s growth could be filtering off as they have to acquire non-core business to generate growth. Also, a move into e-commerce when they have spun off from eBay earlier seems to highlight the synergies might not work.

At 45 billion dollars, it is buying growth at a hefty price tag of 20x Price to Sales. Moreover, the co-founder, Evan Sharp, would be leaving Pinterest for LoveForm. Also, Pinterest was listed in April 2019 at just a valuation of 10 billion dollars but the deal would value it at 45 billion dollars.

From another angle, the social media investment could be a good move to capture more customers for their payment app with a whole new demographics. Also, social commerce is up and coming. The acquisition would help PayPal gain a foothold in this lucrative market, hence taking a step closer to the goal of being a super app with numerous features.

On the whole, we find the no-deal on Pinterest would be a net positive for PayPal, as it is not within their core business of digital payments.

Chartist Point of View

Looking at the charts, it is an ugly sight where it has fallen almost 37% from their peak of 310. It has just broken through the psychological 200 level last Friday. This is what catching a falling knife will look like.

Nonetheless, looking at the historical valuation from price to book and price to earnings, a bottom could be established soon as we are near their average and even below-average historical valuation.

Support would be found at firstly the 175–185 region. The next support would be the 145–160 region which coincides with our box method projection- price range of 240–310 forming the box used.

Summing Up

Given the digital payments industry outlook, the sector is still on a secular uptrend. The growth could be in the healthy teens’ region. With so much talk about Metaverse, it will likely lead to more growth if the scenario where virtual and augmented reality takes over a portion of our daily life.

PayPal, with their recent price drop, would be a safer proxy to invest in this sector given their pedigree and great track record.

PayPal is currently trading at forward PE of 36, which is the average mean for the past 5 years. We are therefore getting it at a reasonable valuation based on historical metrics. Moreover, it is in a net cash position and generating healthy positive free cash flow.

With eBay making up just less than 4% of their revenue, they are embarking and ready for an eBay-less form going into 2022. Without an agreement with eBay, they could have more latitude to tie up with other e-commerce platforms. This was shown through their recent collaboration with Amazon announced in the Q3 results briefing.

However, the chart is akin to a falling knife now. Potential attractive entry region would be firstly the 175–185 region followed by 145–160 region based on our charting analysis.

From a fundamental angle, if valuation drops below forward PE of 30, that could be another indicator that we will be investing in this established payment provider at a good price.

The fall in PayPal price could be seen as an optimal opportunity to pick up a great consistent growth stock at a reasonable valuation.

The digital payment industry has been on a steady climb for many years given the e-commerce revolution. The Covid 19 situation, has further led to new users who usually would not have shopped online to come onboard. All these bode well for a good runway for further consistent growth ahead.

With the coming of the new era of Metaverse by Meta, where the future could be split between your virtual and physical world, the need for a digital wallet would be essential. The digital wallet could be used for keeping your digital currency, digital assets (NFTs) and other digital-related items.

Source: Mordor Intelligence

The transaction value of the digital payments market was USD 5.44 trillion in 2020, and it is projected to be worth USD 11.29 trillion by 2026, registering a CAGR of 11.21% from 2021 to 2026

Source: Mordor Intelligence

The global payments market is expected to grow from $466.29 billion in 2020 to $517.68 billion in 2021 at a compound annual growth rate (CAGR) of 11%. The market is expected to reach $735.39 billion in 2025 at a CAGR of 9.2%.

Source: Businesswire.com

The growth as predicted by both Modor Intelligence and Businesswire for the digital payment industry would be in the region of around 11% for the next 5 years. This is consistent growth rather than exceptional growth but one thing is for sure, it is still a sunrise sector. Hence, it is going to be a good place to look for potential investments.

Paypal- The Gateway to Digital Payments

PayPal would need no introduction as it has been around since 1998 where their famous co-founder, Elon Musk, is now the richest man in the world; courtesy of Tesla's stake. It was part of eBay from 2002 till it was hived off in 2015 through an IPO. PayPal is therefore well entrenched internationally and not just in the US.

It has since evolved to include not only a payment mode but also a digital wallet, Venmo. You could use their app to trade cryptocurrencies and they are looking into shares trading too in the future. You are also able to store your digital assets (NFTs).

Paypal has also recently launched their digital credit card, Venmo Visa, where they have recently announced a collaboration with Amazon. They are also having their own Buy Now Pay Later solution to be up to par with competitors.

The vision for PayPal is to be a super app fighting the likes of Wechat, Alipay, Grab and Sea.

Financial Metrics

Based on the analysis of the Financial Metrics which we compared to their competitor Square which was set up in 2009. Their co-founder is Jack Dorsey who also helm Twitter. Given the earlier industry growth outlook of teens in the next 5 years, a PE of 46 would not be exactly in the bargain zone.

Nonetheless, comparing the average PE since 2016 of 57 (source: YCharts), we might be heading into a reasonable valuation zone based on the historical PE range.

Though they have a debt to equity of 0.36, if we include the cash holdings, it is in a net cash position. This gives PayPal a strong financial position. On the whole, it is a safer bet than Square in the payment sector but Square is growing at a much faster pace, they have also not expanded their base in the international markets yet.

PayPal has been the better capital allocator given its stellar return on equity and invested capital numbers.

Paypal Historical Growth

Source: Reuters

Looking at the revenue growth from 2016 to 2020, the compounded growth rate was 18.6%. The growth in earnings outshoots the revenue growth by growing at a compounding rate of 31.6%. It was more commendable given their gradual loss of eBay business since 2018.

The payment agreement between eBay and PayPal was till June 2020- 5 years after their spin-off. At their spin-off (2015), eBay makes up to 50% of the profits for PayPal. It is just less than 4% of their total revenue and it could go to nil by 2023 as eBay is coming up with their payment solutions.

Why has PayPal fallen almost 37% from the Peak?

Based on the latest Q3 results, their growth quarter on quarter has slowed to around 13% for their revenue- factoring in a reduction of 46% revenue from eBay. Excluding eBay, revenue has grown at around the 25% mark over the past 2 years. Nonetheless, there was a reduction in guidance for Q4.

PayPal expects fourth-quarter adjusted earnings to be about $1.12 per share versus the estimate of $1.27 per share. The company expects fourth-quarter revenue to be in a range of $6.85 billion to $6.95 billion versus the estimate of $7.24 billion.

Also, PayPal expects growth for 2022 to be around 18% which falls short of analysts estimates at 22%. This disappointing outlook has led to the recent share price weakness.

Their recent interest in Pinterest has also gathered mixed reactions with some critics highlighting that PayPal’s growth could be filtering off as they have to acquire non-core business to generate growth. Also, a move into e-commerce when they have spun off from eBay earlier seems to highlight the synergies might not work.

At 45 billion dollars, it is buying growth at a hefty price tag of 20x Price to Sales. Moreover, the co-founder, Evan Sharp, would be leaving Pinterest for LoveForm. Also, Pinterest was listed in April 2019 at just a valuation of 10 billion dollars but the deal would value it at 45 billion dollars.

From another angle, the social media investment could be a good move to capture more customers for their payment app with a whole new demographics. Also, social commerce is up and coming. The acquisition would help PayPal gain a foothold in this lucrative market, hence taking a step closer to the goal of being a super app with numerous features.

On the whole, we find the no-deal on Pinterest would be a net positive for PayPal, as it is not within their core business of digital payments.

Chartist Point of View

Looking at the charts, it is an ugly sight where it has fallen almost 37% from their peak of 310. It has just broken through the psychological 200 level last Friday. This is what catching a falling knife will look like.

Nonetheless, looking at the historical valuation from price to book and price to earnings, a bottom could be established soon as we are near their average and even below-average historical valuation.

Support would be found at firstly the 175–185 region. The next support would be the 145–160 region which coincides with our box method projection- price range of 240–310 forming the box used.

Summing Up

Given the digital payments industry outlook, the sector is still on a secular uptrend. The growth could be in the healthy teens’ region. With so much talk about Metaverse, it will likely lead to more growth if the scenario where virtual and augmented reality takes over a portion of our daily life.

PayPal, with their recent price drop, would be a safer proxy to invest in this sector given their pedigree and great track record.

PayPal is currently trading at forward PE of 36, which is the average mean for the past 5 years. We are therefore getting it at a reasonable valuation based on historical metrics. Moreover, it is in a net cash position and generating healthy positive free cash flow.

With eBay making up just less than 4% of their revenue, they are embarking and ready for an eBay-less form going into 2022. Without an agreement with eBay, they could have more latitude to tie up with other e-commerce platforms. This was shown through their recent collaboration with Amazon announced in the Q3 results briefing.

However, the chart is akin to a falling knife now. Potential attractive entry region would be firstly the 175–185 region followed by 145–160 region based on our charting analysis.

From a fundamental angle, if valuation drops below forward PE of 30, that could be another indicator that we will be investing in this established payment provider at a good price.

The fall in PayPal price could be seen as an optimal opportunity to pick up a great consistent growth stock at a reasonable valuation.

+4

10

Patience is the Key

liked

$Apple(AAPL.US$ Will it hit $210 as targeted?

2

4

Patience is the Key

liked

Retail traders from Singapore / HK - for us it’s night time so intraday ( night ) for that matter is tricky , especially if you are doing it part time and hence I would advise against it .

I would rather suggest to invest in fundamentally strong stocks and use technical analysis for entry points

however there are stocks which have made big money over night

example $Moderna(MRNA.US$ $Longeveron(LGVN.US$ $Rivian Automotive(RIVN.US$ $Sono Group(SEV.US$ and many other examples

stocks like $Longeveron(LGVN.US$ have some times increased 5-10 times over night or in 3-5 days duration …

many stocks like $Moderna(MRNA.US$ and $Rivian Automotive(RIVN.US$ have gained as much as 30% or even more over night — hence always keep some spare money in your account .. which you can use for Intra day trade ..

in US markets - there is practically no upper circuit .. and stocks can go as high as it can …

do not set a limit order , put market if limit reached or a trailing stop loss … before you goto sleep

you can easily make good money on these stocks

US market rallys in 2-3 days time frame for news based stocks before it starts to fall.

you can make money both when it rises and also when it falls ( by short selling ). sometimes Futu doesn’t allow you to short sell - this is why you need to have multiple accounts .. with multiple brokers

I would rather suggest to invest in fundamentally strong stocks and use technical analysis for entry points

however there are stocks which have made big money over night

example $Moderna(MRNA.US$ $Longeveron(LGVN.US$ $Rivian Automotive(RIVN.US$ $Sono Group(SEV.US$ and many other examples

stocks like $Longeveron(LGVN.US$ have some times increased 5-10 times over night or in 3-5 days duration …

many stocks like $Moderna(MRNA.US$ and $Rivian Automotive(RIVN.US$ have gained as much as 30% or even more over night — hence always keep some spare money in your account .. which you can use for Intra day trade ..

in US markets - there is practically no upper circuit .. and stocks can go as high as it can …

do not set a limit order , put market if limit reached or a trailing stop loss … before you goto sleep

you can easily make good money on these stocks

US market rallys in 2-3 days time frame for news based stocks before it starts to fall.

you can make money both when it rises and also when it falls ( by short selling ). sometimes Futu doesn’t allow you to short sell - this is why you need to have multiple accounts .. with multiple brokers

36

1

Patience is the Key

liked

There are many different types of traders: Day traders, Swing traders, Long term traders, etc.. Each trader type has different strategies that work for them. I am going to discuss good trading habits generally...

You can read many books, articles, etc. for building good trading habits. Many people will provide how you should go about trading and their experience (failure or success). The key is, this works nicely for them. They know the inner workings of their strategy. But if you try to replicate for yourself it may not work for you. So what do you do? Find someone else to follow, scramble, give up?

Well you may not have to give up, because that is the last thing you want to do. You need to prove to yourself that you can do this. Here are some tips that can help, hopefully:

1. Create a plan

2. Do your due diligence (research, articles, news, etc.)

3. Trade with a positive attitude

4. Don't act impulsively or react

5. Use stop-loss to limit from losing trades

6. Learn from your losses

7. Don't be greedy and take profits

From what I understand and this is what I have put in play in my account is to keep investing in small amounts (known as power of compound interest). Right now you will not see much return, but let's say 10 years from now it will grow dramatically. Then if you look back 10 years, you will realize the power of compound interest. To get successful in this part, you have to invest in well known & successful stocks like $Apple(AAPL.US$, $Amazon(AMZN.US$, $Microsoft(MSFT.US$, $Alphabet-A(GOOGL.US$, $Netflix(NFLX.US$, $Coca-Cola(KO.US$, etc.. You don't need to buy full shares nowadays as many brokers allow you to purchase slices (which is a piece of a share). Now if you purchase in this manner automatically, eventually this will start growing fast. In addition, if stocks pay dividends, then you should reinvest in purchasing a piece of stock rather than cashing it out. This also helps as part of compounding interest.

The one note to keep in mind is not to be discouraged if you have a bad hour, day, week, or month. Keep investing as each day is different. Everyone has a strategy and that works for them. You should review their idea and see if it works for you. If it does not, you will have to make adjustments so that it works for you. Do some more due diligence (research, articles, news, etc.). Try to figure out what went wrong in your execution. Try again by making the required changes. If it does not work again, keep trying by making changes until it works for you. You will see that things will change and you will be successful. But you need to keep trying and not get discouraged on the first, second, third, etc. failure.

Okay, so I don't want to bore anyone out. In a short summary, the best way to build good trading habits is to do research on your investment, pick a strategy that works for you, execute it, and try to use the compounding interest method. This works well in my case as a conservative investor. I highly think that everyone can benefit from this strategy. DO NOT try to copy someone else's idea as that works for them. You need to get insight about it and try it on your own. This is what will make you successful. Practice makes perfect, which is the words you may have heard in the past. This is absolutely true. Hope this helps you out.

Please feel free to leave any comments or suggestions you may have regarding this subject. I am also more than happy to help anyone who might want to speak more about this subject or need any help.

Wishing you great success in your investments.

You can read many books, articles, etc. for building good trading habits. Many people will provide how you should go about trading and their experience (failure or success). The key is, this works nicely for them. They know the inner workings of their strategy. But if you try to replicate for yourself it may not work for you. So what do you do? Find someone else to follow, scramble, give up?

Well you may not have to give up, because that is the last thing you want to do. You need to prove to yourself that you can do this. Here are some tips that can help, hopefully:

1. Create a plan

2. Do your due diligence (research, articles, news, etc.)

3. Trade with a positive attitude

4. Don't act impulsively or react

5. Use stop-loss to limit from losing trades

6. Learn from your losses

7. Don't be greedy and take profits

From what I understand and this is what I have put in play in my account is to keep investing in small amounts (known as power of compound interest). Right now you will not see much return, but let's say 10 years from now it will grow dramatically. Then if you look back 10 years, you will realize the power of compound interest. To get successful in this part, you have to invest in well known & successful stocks like $Apple(AAPL.US$, $Amazon(AMZN.US$, $Microsoft(MSFT.US$, $Alphabet-A(GOOGL.US$, $Netflix(NFLX.US$, $Coca-Cola(KO.US$, etc.. You don't need to buy full shares nowadays as many brokers allow you to purchase slices (which is a piece of a share). Now if you purchase in this manner automatically, eventually this will start growing fast. In addition, if stocks pay dividends, then you should reinvest in purchasing a piece of stock rather than cashing it out. This also helps as part of compounding interest.

The one note to keep in mind is not to be discouraged if you have a bad hour, day, week, or month. Keep investing as each day is different. Everyone has a strategy and that works for them. You should review their idea and see if it works for you. If it does not, you will have to make adjustments so that it works for you. Do some more due diligence (research, articles, news, etc.). Try to figure out what went wrong in your execution. Try again by making the required changes. If it does not work again, keep trying by making changes until it works for you. You will see that things will change and you will be successful. But you need to keep trying and not get discouraged on the first, second, third, etc. failure.

Okay, so I don't want to bore anyone out. In a short summary, the best way to build good trading habits is to do research on your investment, pick a strategy that works for you, execute it, and try to use the compounding interest method. This works well in my case as a conservative investor. I highly think that everyone can benefit from this strategy. DO NOT try to copy someone else's idea as that works for them. You need to get insight about it and try it on your own. This is what will make you successful. Practice makes perfect, which is the words you may have heard in the past. This is absolutely true. Hope this helps you out.

Please feel free to leave any comments or suggestions you may have regarding this subject. I am also more than happy to help anyone who might want to speak more about this subject or need any help.

Wishing you great success in your investments.

39

4

Patience is the Key

liked

Hello Mooers, welcome back. ![]()

In this discussion, I would like to share some of my habits in helping me to trade better.

When I open my $Futu Holdings Ltd(FUTU.US$ MooMoo app, the first thing that I do is to check the quotes of those stocks that I am interested in.

I will click on the 'Comments' section to get to know how Mooers feels about the stock. (Example: $AMC Entertainment(AMC.US$ has Mooers fighting against the hedge fund almost everyday. The strong bonding between Apes and HODLing for fellow Apes. Together, Apes STRONG.![]() )

)

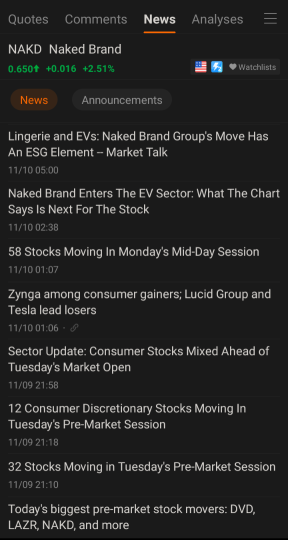

Next, I will click on the 'News' section to get the latest news on the stock. This will help me to gauge if the stock have growth potential such as new innovative products and services coming. (Example: $Naked Brand(NAKD.US$ enter the EV sector.)

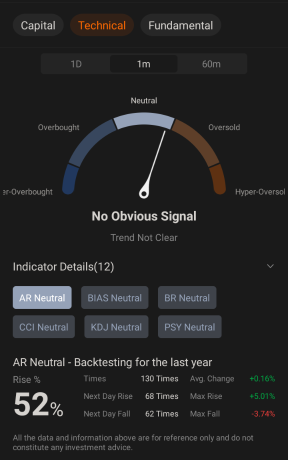

After that, I will go to the 'Analyses' section to see how the trend for the stock. This help me to see if the stock is oversold or overbought and whether is it bullish or bearish. (Example: COVID concept stocks, $Moderna(MRNA.US$ is bullish and rise 20.57% on 26 Nov 2021 Black Friday due to new COVID variant 'omicron'.)

This will follow by going to the 'Financial' section to view the revenue estimated by financial analysts. If the higher revenue estimates are supported by at least 25 financial analysts, the higher the accuracy of the estimates will be. (Example: $Advanced Micro Devices(AMD.US$ has 29 financial analysts for their revenue estimates.)

Lastly, I will go to the 'Summary' section to view how many institutions is holding the stock and whether are there more institutions getting the stock too. (Example: $Apple(AAPL.US$ has 4816 institutions holding it as on 25 Nov 2021.)

These habits have helped me to get useful insights about the stocks that I am interested in, and assisted me in my portfolio rebalancing decisions. I am thankful to $Futu Holdings Ltd(FUTU.US$ for coming out with these awesome features and looking for more in the future.

I hope that Mooers find my sharing useful in your stock tradings.![]()

Before we end this discussion, I would like you to vote which section(s) that you will check them up and add into your trading habits.

That's all for this discussion. Please show your support if you like this post.![]()

Thank you and see you all soon.![]()

In this discussion, I would like to share some of my habits in helping me to trade better.

When I open my $Futu Holdings Ltd(FUTU.US$ MooMoo app, the first thing that I do is to check the quotes of those stocks that I am interested in.

I will click on the 'Comments' section to get to know how Mooers feels about the stock. (Example: $AMC Entertainment(AMC.US$ has Mooers fighting against the hedge fund almost everyday. The strong bonding between Apes and HODLing for fellow Apes. Together, Apes STRONG.

Next, I will click on the 'News' section to get the latest news on the stock. This will help me to gauge if the stock have growth potential such as new innovative products and services coming. (Example: $Naked Brand(NAKD.US$ enter the EV sector.)

After that, I will go to the 'Analyses' section to see how the trend for the stock. This help me to see if the stock is oversold or overbought and whether is it bullish or bearish. (Example: COVID concept stocks, $Moderna(MRNA.US$ is bullish and rise 20.57% on 26 Nov 2021 Black Friday due to new COVID variant 'omicron'.)

This will follow by going to the 'Financial' section to view the revenue estimated by financial analysts. If the higher revenue estimates are supported by at least 25 financial analysts, the higher the accuracy of the estimates will be. (Example: $Advanced Micro Devices(AMD.US$ has 29 financial analysts for their revenue estimates.)

Lastly, I will go to the 'Summary' section to view how many institutions is holding the stock and whether are there more institutions getting the stock too. (Example: $Apple(AAPL.US$ has 4816 institutions holding it as on 25 Nov 2021.)

These habits have helped me to get useful insights about the stocks that I am interested in, and assisted me in my portfolio rebalancing decisions. I am thankful to $Futu Holdings Ltd(FUTU.US$ for coming out with these awesome features and looking for more in the future.

I hope that Mooers find my sharing useful in your stock tradings.

Before we end this discussion, I would like you to vote which section(s) that you will check them up and add into your trading habits.

That's all for this discussion. Please show your support if you like this post.

Thank you and see you all soon.

+3

55

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)