PZ实盘

liked

$NVIDIA (NVDA.US)$

After today's rise, the probability of nvda falling to two digits sharply decreased. The daily chart is forming a w-bottom. Once the w-bottom is completed, breaking through the neckline will inevitably break the new high, it's just a matter of time. I hope it can slow down a bit, spend more time building the bottom, and not rush to break through in September. After breaking through the neckline, it's best to follow the textbook, pull back a bit, and then rise again. The more stable the bottom, the better the rise.

I did not add to my positions after two bottom attempts, but it doesn't matter. After adjusting my positions, I currently only hold nvda, a chip stock, and it's already my largest position.

Some of the utility stocks I bought before have recently performed well. I expect to receive a sell signal within a month, or at most two months. At that time, I will switch to technology stocks and try to catch the year-end market trends.

After today's rise, the probability of nvda falling to two digits sharply decreased. The daily chart is forming a w-bottom. Once the w-bottom is completed, breaking through the neckline will inevitably break the new high, it's just a matter of time. I hope it can slow down a bit, spend more time building the bottom, and not rush to break through in September. After breaking through the neckline, it's best to follow the textbook, pull back a bit, and then rise again. The more stable the bottom, the better the rise.

I did not add to my positions after two bottom attempts, but it doesn't matter. After adjusting my positions, I currently only hold nvda, a chip stock, and it's already my largest position.

Some of the utility stocks I bought before have recently performed well. I expect to receive a sell signal within a month, or at most two months. At that time, I will switch to technology stocks and try to catch the year-end market trends.

Translated

8

6

PZ实盘

liked

$NVIDIA (NVDA.US)$

I think today's non-farm payroll data is not bad, but obviously, it has been interpreted as bearish news. I think it is to force Powell to cut interest rates by 50 basis points.

However, regardless of the situation, once nvda falls back to double digits, the bulls need to quickly start buying, just like last time. If it rebounds above 100, that would be even better.

In a bull market, investors should have the feeling that they need to get on the train as soon as it arrives, otherwise they will miss it. Otherwise, the market sentiment will dissipate. Once nvda falls below 90 and continues to decline, this wave is basically over.

Once the leader of this bull market, nvda falls, the bull market will come to an end. You'll see, it's already starting to crumble. $Tesla (TSLA.US)$ Today, it just directly shriveled up. The seesaw is also malfunctioning. In this bull market, some stocks may rise better than nvda, but no one can replace nvda's leading position.

My plan: If nvda falls to around 90-95, I will decisively buy more stocks. If I buy at this level, and the bear market really comes, then I can quickly cut losses without a big loss. If the bull market continues, nvda will at least return to 140, with a very good risk-reward ratio.

I think today's non-farm payroll data is not bad, but obviously, it has been interpreted as bearish news. I think it is to force Powell to cut interest rates by 50 basis points.

However, regardless of the situation, once nvda falls back to double digits, the bulls need to quickly start buying, just like last time. If it rebounds above 100, that would be even better.

In a bull market, investors should have the feeling that they need to get on the train as soon as it arrives, otherwise they will miss it. Otherwise, the market sentiment will dissipate. Once nvda falls below 90 and continues to decline, this wave is basically over.

Once the leader of this bull market, nvda falls, the bull market will come to an end. You'll see, it's already starting to crumble. $Tesla (TSLA.US)$ Today, it just directly shriveled up. The seesaw is also malfunctioning. In this bull market, some stocks may rise better than nvda, but no one can replace nvda's leading position.

My plan: If nvda falls to around 90-95, I will decisively buy more stocks. If I buy at this level, and the bear market really comes, then I can quickly cut losses without a big loss. If the bull market continues, nvda will at least return to 140, with a very good risk-reward ratio.

Translated

20

5

2

PZ实盘

liked

$Tesla (TSLA.US)$

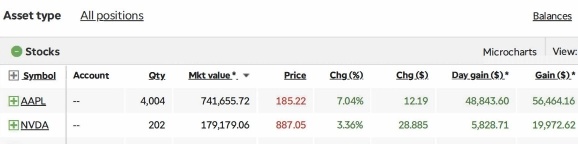

Recently, my top three holdings have always been nvda, xlu, and tsla.

With the recent rise in stock prices these days, tsla has become my largest position now.![]() Suddenly became the leader, it's really a case of when the wind changes direction.

Suddenly became the leader, it's really a case of when the wind changes direction.

$NVIDIA (NVDA.US)$ Performance is relatively poor, holding the second position in positions.

$Utilities Select Sector SPDR Fund (XLU.US)$ Showing strong momentum, previously briefly became my largest holding position, but I later reduced part of it. Currently, it ranks third in positions. Reason for reduction: Let xlu be the largest, seemed a bit too conservative in a bull market.

Currently, my determination is in the later stages of a bull market. The bull market doesn't speak of its peak, so it's not advisable to easily escape the peak or give up chips. But it probably won't be for too long, so cherish the rise while it lasts.

Recently, my top three holdings have always been nvda, xlu, and tsla.

With the recent rise in stock prices these days, tsla has become my largest position now.

$NVIDIA (NVDA.US)$ Performance is relatively poor, holding the second position in positions.

$Utilities Select Sector SPDR Fund (XLU.US)$ Showing strong momentum, previously briefly became my largest holding position, but I later reduced part of it. Currently, it ranks third in positions. Reason for reduction: Let xlu be the largest, seemed a bit too conservative in a bull market.

Currently, my determination is in the later stages of a bull market. The bull market doesn't speak of its peak, so it's not advisable to easily escape the peak or give up chips. But it probably won't be for too long, so cherish the rise while it lasts.

Translated

7

4

PZ实盘

liked

Reducing positions $NVIDIA (NVDA.US)$ Because it surged to the support, take partial profits first and observe. If the breakout is confirmed, buy back on the right side. If there is no breakout, buy back at the bottom. Currently, it is still the second largest position hold.

Initiate a buy position. $Occidental Petroleum (OXY.US)$ The reason: it has dropped to the 200-week moving average. Unless there is an economic recession, it should not break through. The daily chart opened lower, showing signs of exhaustion gap. Let's see if it will be filled soon. Choose oxy for energy stocks, pay tribute to Buffet 🫡, my cost is even lower than Buffet's, what am I afraid of? If Buffet doesn't sell, I won't sell.

Considering reducing positions. $Tesla (TSLA.US)$ However, tesla is considered as a semi-Chinese concept stock. Recently, Chinese concept stocks are gaining momentum, I will continue to observe. Compared to Chinese concept stocks, I am more bullish on Tesla.

Closely observe. $Bitcoin (BTC.CC)$ Can it break through the key level of 65,000? Watch for two more days. If it can hold above 65,000 next Monday, I will consider adding positions on the right side, targeting 80,000-90,000. If it cannot hold and turns downwards, then wait for opportunities to buy at lower levels.

Initiate a buy position. $Occidental Petroleum (OXY.US)$ The reason: it has dropped to the 200-week moving average. Unless there is an economic recession, it should not break through. The daily chart opened lower, showing signs of exhaustion gap. Let's see if it will be filled soon. Choose oxy for energy stocks, pay tribute to Buffet 🫡, my cost is even lower than Buffet's, what am I afraid of? If Buffet doesn't sell, I won't sell.

Considering reducing positions. $Tesla (TSLA.US)$ However, tesla is considered as a semi-Chinese concept stock. Recently, Chinese concept stocks are gaining momentum, I will continue to observe. Compared to Chinese concept stocks, I am more bullish on Tesla.

Closely observe. $Bitcoin (BTC.CC)$ Can it break through the key level of 65,000? Watch for two more days. If it can hold above 65,000 next Monday, I will consider adding positions on the right side, targeting 80,000-90,000. If it cannot hold and turns downwards, then wait for opportunities to buy at lower levels.

Translated

22

14

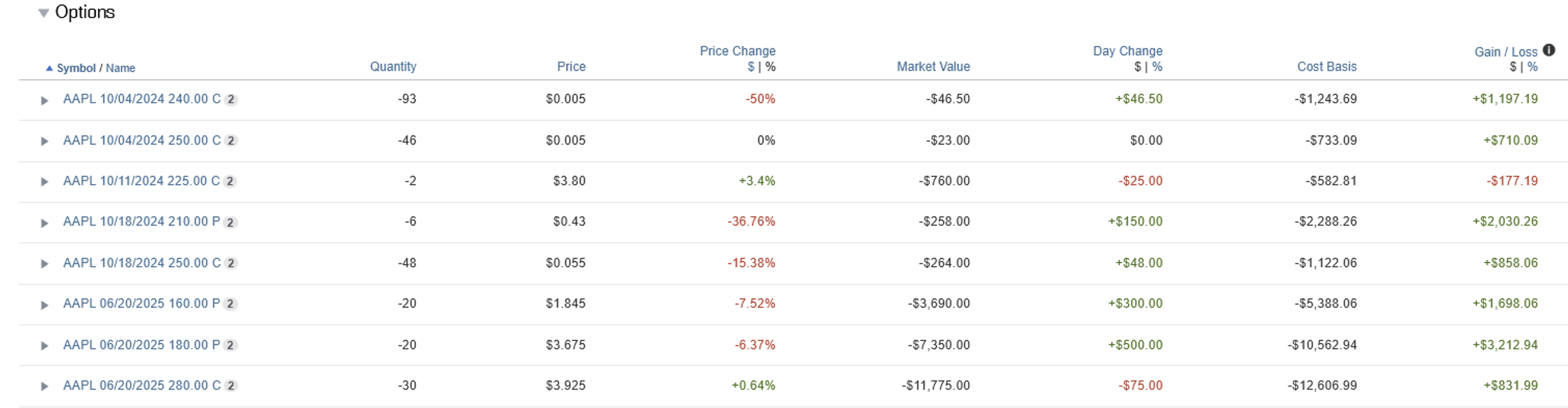

$Apple (AAPL.US)$

Let everyone see how to collect rent on tens of thousands of shares of apples.

Not the kind of loser who does Paper Trading.![]()

Let everyone see how to collect rent on tens of thousands of shares of apples.

Not the kind of loser who does Paper Trading.

Translated

1

PZ实盘

voted

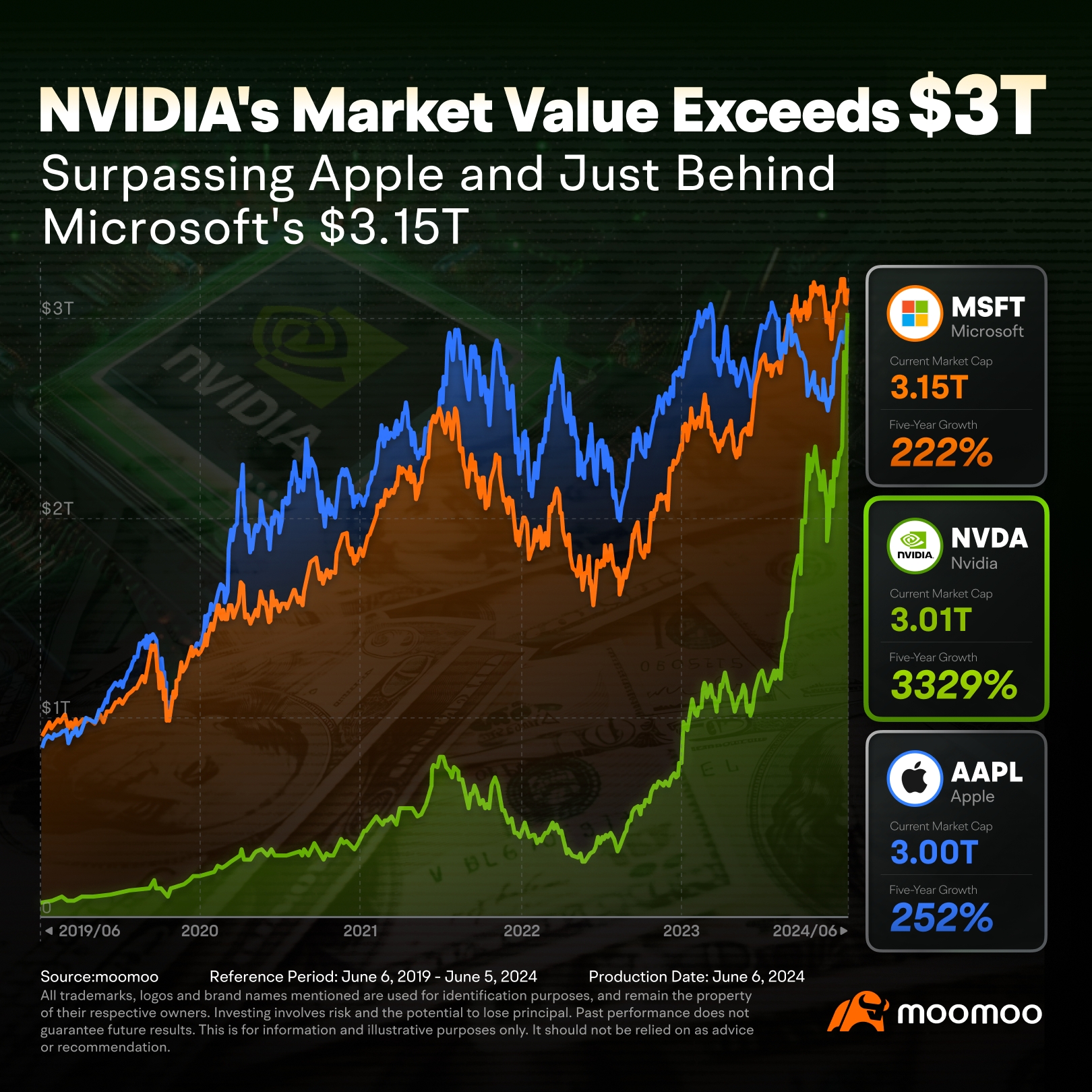

$NVIDIA (NVDA.US)$'s market capitalization reached $3.01 trillion, surpassing $Apple (AAPL.US)$'s $3 trillion and making it the second-largest publicly traded company in the US, just behind $Microsoft (MSFT.US)$'s $3.15 trillion.

On Wednesday, Nvidia shares rose 5.2% to $1,224.4, while Apple's shares increased 0.8% to $196, helping both the $S&P 500 Index (.SPX.US)$ and $NASDAQ 100 Index (.NDX.US)$ reach new record ...

On Wednesday, Nvidia shares rose 5.2% to $1,224.4, while Apple's shares increased 0.8% to $196, helping both the $S&P 500 Index (.SPX.US)$ and $NASDAQ 100 Index (.NDX.US)$ reach new record ...

38

12

38

PZ实盘

liked

$Lululemon Athletica (LULU.US)$

I haven't worn their clothes, but many people around me do, and they seem to be good. I used to pay attention, but have never bought this stock. The stock price has dropped to a critical resistance level of 300. If it falls a little further, once it breaks the previous low, it's basically a bottomless pit. In this situation, the probability of a rebound is high.

But I haven't bought too much because I am better at trading on the right side, and often buy at the halfway point on the left.![]()

![]() Anyway, it doesn't matter, let's just buy some to relieve the wait. $NVIDIA (NVDA.US)$ Anxiety about financial reports.

Anyway, it doesn't matter, let's just buy some to relieve the wait. $NVIDIA (NVDA.US)$ Anxiety about financial reports.

Anxiety mainly comes from position size. I have relatively large positions in stocks. Nothing I can do, investing real silver into the stock market, it's not gaming, mentality will definitely be affected. Try to relax as much as possible. $Taiwan Semiconductor (TSM.US)$ and $NVIDIA (NVDA.US)$ However, I'm still bullish on nvda's performance. If unfortunately it really falls, as long as it doesn't break 860-870, I will consider adding more positions. As mentioned before, big technology companies have good financial reports and will continue to increase AI spending this year. That's enough.![]()

But I'm still very bullish on nvda's performance. If, unfortunately, it really drops, as long as it doesn't break 860-870, I will consider increasing my position. The reason I mentioned earlier is that big technology companies have good financial reports and will continue to increase AI spending this year. That's enough.

I haven't worn their clothes, but many people around me do, and they seem to be good. I used to pay attention, but have never bought this stock. The stock price has dropped to a critical resistance level of 300. If it falls a little further, once it breaks the previous low, it's basically a bottomless pit. In this situation, the probability of a rebound is high.

But I haven't bought too much because I am better at trading on the right side, and often buy at the halfway point on the left.

Anxiety mainly comes from position size. I have relatively large positions in stocks. Nothing I can do, investing real silver into the stock market, it's not gaming, mentality will definitely be affected. Try to relax as much as possible. $Taiwan Semiconductor (TSM.US)$ and $NVIDIA (NVDA.US)$ However, I'm still bullish on nvda's performance. If unfortunately it really falls, as long as it doesn't break 860-870, I will consider adding more positions. As mentioned before, big technology companies have good financial reports and will continue to increase AI spending this year. That's enough.

But I'm still very bullish on nvda's performance. If, unfortunately, it really drops, as long as it doesn't break 860-870, I will consider increasing my position. The reason I mentioned earlier is that big technology companies have good financial reports and will continue to increase AI spending this year. That's enough.

Translated

7

6

PZ实盘

commented on

$Tesla (TSLA.US)$ It seems like TSLA needs to learn from Apple's direct announcement of a share buyback in order to make another push.

Translated

9

PZ实盘

commented on

3

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)