Raj Minnakanti

voted

We've been riding the wave from 34 St—Herald Sq to Grand Central Station, and we captured all the moo-mania at our new location! Dive into the excitement with our latest video 🎥 showcasing the vibrant energy and spirit of our NYC subway takeover at Grand Central 📍.

Here's how to keep the wave rolling

🎁 Score Rewards!

Fin...

1802

573

469

Raj Minnakanti

liked

Raj Minnakanti

liked

Wow! What a strong market rally in the stock markets today! S&P 500 (SPY) is now up 8% just from last Monday’s price. This is insane move in less than 2 weeks. This morning both retail sales and jobless claims report came in better than expectations. However does these 2 reports together with last days reports on CPI and PPI already confirm the economy is fine and we are going to all time high? I wish it was that easy! US debit issues, rising credit card debits reaching all...

17

5

2

Raj Minnakanti

voted

Columns Tomorrow is a big data day

I hope everybody makes some money out there 🙏🏽 $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

With that being said, what are we thinking fellas?

With that being said, what are we thinking fellas?

1

Raj Minnakanti

liked

Columns CPI, Fed, and Recession

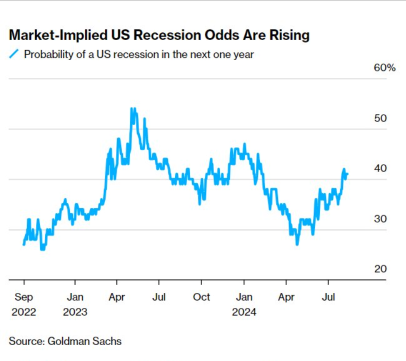

1. Goldman Sachs has raised the risk of a U.S. recession to over 40%.

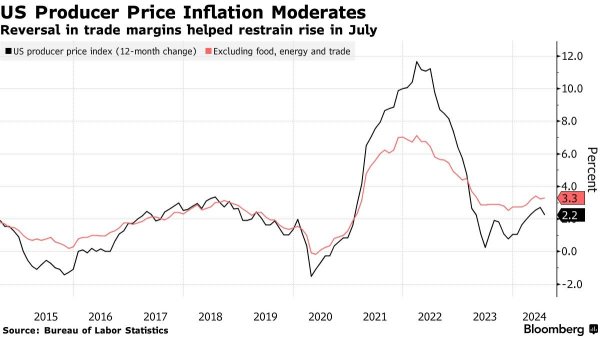

2. PPI data continued to decline (up 2.2% YoY; core PPI up 3.3%). Ahead of today’s CPI report, the market is betting on a Fed rate cut in September.

3. JPMorgan sees rising recession risk across asset classes, with 5-year Treasuries and base metals being the most vulnerable, while high-credit and high-yield bonds may perform better. Small caps like Russell 2000 and cyclical/defensive stocks have lower re...

2. PPI data continued to decline (up 2.2% YoY; core PPI up 3.3%). Ahead of today’s CPI report, the market is betting on a Fed rate cut in September.

3. JPMorgan sees rising recession risk across asset classes, with 5-year Treasuries and base metals being the most vulnerable, while high-credit and high-yield bonds may perform better. Small caps like Russell 2000 and cyclical/defensive stocks have lower re...

2

1

Raj Minnakanti

voted

Recent weeks have witnessed notable market fluctuations due to a confluence of factors, including corporate earnings releases, economic indicators, and political events. Amidst this tumultuous backdrop, August stands out as a month teeming with key topics and decisions that could shape the trajectory of global markets. Investors are observing the Federal Reserve's annual Jackson Hole symposium with interest, staying informed on politic...

53

12

10

Raj Minnakanti

liked

$SPDR S&P 500 ETF (SPY.US)$ From the initial breakdown and selloff below the lower support line of the over a year long rising wedge pattern, we are now close to the 61.8% Fib retracement, upper Bollinger Band, the 50 simple moving average, near a volume gap, AND at the top of the upper resistance line of this short term channel we appear to be in on the 4-hour time frame. ~537-538 is ALSO the base line of the Ichimoku Cloud on the daily time frame, and where there are often battles to try to cha...

7

Raj Minnakanti

liked

Buffett has ~$277 Billion.

The Fed has $195 Billion.

Warren Buffett is now a larger holder of US Treasury Bills than the Federal Reserve.

$Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ $Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$

The Fed has $195 Billion.

Warren Buffett is now a larger holder of US Treasury Bills than the Federal Reserve.

$Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ $Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$

7

3

Raj Minnakanti

liked

One of the reasons for the sell-off in the US stock market and market crashes worldwide was due to an interest rate hike in Japan. Japan had maintained a 0% interest rate for a long time, allowing many investors and institutions to borrow money from Japan to invest elsewhere. With the interest rate hike, these investors now have to pay interest, which could be very heavy for them as they have borrowed substantial amounts. This leads to a significant sell-off in the stoc...

32

3

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)