Real笑寒

liked

$Disney (DIS.US)$ I expect disney to take off soon as likely traders might bargain hunt.

Disney NFT was sold 1 week back and it is overlooked by investors.

10-20% uplift - NFT hopefully - looking forward to disney NFT.

Disney NFT was sold 1 week back and it is overlooked by investors.

10-20% uplift - NFT hopefully - looking forward to disney NFT.

19

Real笑寒

commented on

$Disney (DIS.US)$ Ema 5 will upward from now on

11

1

Real笑寒

liked

$Tesla (TSLA.US)$ Regardless of the strength of the callback, the callback is a good opportunity to increase the position. 10% have to digest for two days. Participate in batches. The long-term impact will not be big.

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$ $Lucid Group (LCID.US)$ $RTX Corp (RTX.US)$ These three are also relatively stable. Lcid will sometimes be a demon, but the concept of the upcoming electric car will be another round of short-term speculation.

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$ $Lucid Group (LCID.US)$ $RTX Corp (RTX.US)$ These three are also relatively stable. Lcid will sometimes be a demon, but the concept of the upcoming electric car will be another round of short-term speculation.

4

Real笑寒

commented on

Initially, I was afraid investing would mean losing my hard-earned money. Thus, I do not invest. That mistake ended up causing me to lose XX of dollars in potential investment gains. Miss the boat on $Amazon (AMZN.US)$ ![]()

43

4

Real笑寒

commented on

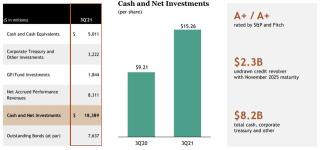

$Blackstone (BX.US)$At the end of Q3-31, Blackstone had $8.2 billion in total cash, cash equivalents, corporate treasury, and other investments. It also had $18.4 billion of cash and net investments, or $15.26 per share.

The company also has a $2.3 billion undrawn credit revolver and maintains A level ratings.

On August 5, 2021, it issued $650 million of seven-year notes at a 1.625% coupon… $800 million of 10.5-year notes at a 2.0% coupon… and $550 million of 30-year notes at a 2.85% coupon.

BX generated LTM fee-related earnings of $2.47 per share in Q3, a 36% increase year-over-year. And its LTM total segment distributable earnings were $6 billion, a 97% increase.

Analysts expect it will generate 58% earnings-per-share (EPS) growth in 2021, an extremely impressive forecast to say the least.

BX declared a $1.09 quarterly dividend to record holders as of November 1, 2021 - to be paid on November 8. And the payout has been $3.57 over the LTM.

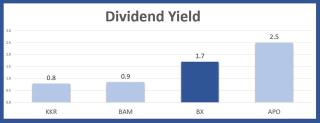

Also, it repurchased 2.9 million common shares in Q3-21 and 6 million over the LTM. The dividend yield is currently 1.7%.

BX's price-to-earnings (P/E) is 35.4x compared to the peer group average of 21x:

Although I'll admit I don't put a lot of credence into private equity growth estimates… I thought it would be interesting to compare analyst estimates for BX and its public peers.

So here you go:

Clearly, BX's moat is getting wider by the day, as the 35x P/E valuation appears to be stretched. Nonetheless, it's hitting on all cylinders.

And thanks to its C-corp structure, average investors can invest alongside some of the greatest real estate investors on the planet.

$SPDR S&P 500 ETF (SPY.US)$ $E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$ $E-mini Dow Futures(MAR5) (YMmain.US)$

The company also has a $2.3 billion undrawn credit revolver and maintains A level ratings.

On August 5, 2021, it issued $650 million of seven-year notes at a 1.625% coupon… $800 million of 10.5-year notes at a 2.0% coupon… and $550 million of 30-year notes at a 2.85% coupon.

BX generated LTM fee-related earnings of $2.47 per share in Q3, a 36% increase year-over-year. And its LTM total segment distributable earnings were $6 billion, a 97% increase.

Analysts expect it will generate 58% earnings-per-share (EPS) growth in 2021, an extremely impressive forecast to say the least.

BX declared a $1.09 quarterly dividend to record holders as of November 1, 2021 - to be paid on November 8. And the payout has been $3.57 over the LTM.

Also, it repurchased 2.9 million common shares in Q3-21 and 6 million over the LTM. The dividend yield is currently 1.7%.

BX's price-to-earnings (P/E) is 35.4x compared to the peer group average of 21x:

Although I'll admit I don't put a lot of credence into private equity growth estimates… I thought it would be interesting to compare analyst estimates for BX and its public peers.

So here you go:

Clearly, BX's moat is getting wider by the day, as the 35x P/E valuation appears to be stretched. Nonetheless, it's hitting on all cylinders.

And thanks to its C-corp structure, average investors can invest alongside some of the greatest real estate investors on the planet.

$SPDR S&P 500 ETF (SPY.US)$ $E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$ $E-mini Dow Futures(MAR5) (YMmain.US)$

+2

20

8

Real笑寒

commented on

$Futu Holdings Ltd (FUTU.US)$ Why do so many buyers keep falling

Translated

1

9

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)