Rising Star Sunny

liked and voted

This is a common question that comes up among investors. There is no right or wrong answer but for those who are not adept at timing the market or who have no time or energy to monitor the market everyday, I feel dollar cost averaging (DCA) is an easier and safer approach as it averages out the per unit cost over time. Putting aside a set amount of money for investment at regular intervals is analogous to a form of regular savings (albeit with a higher level of risk tha...

47

15

5

Rising Star Sunny

voted

Hi, mooers!

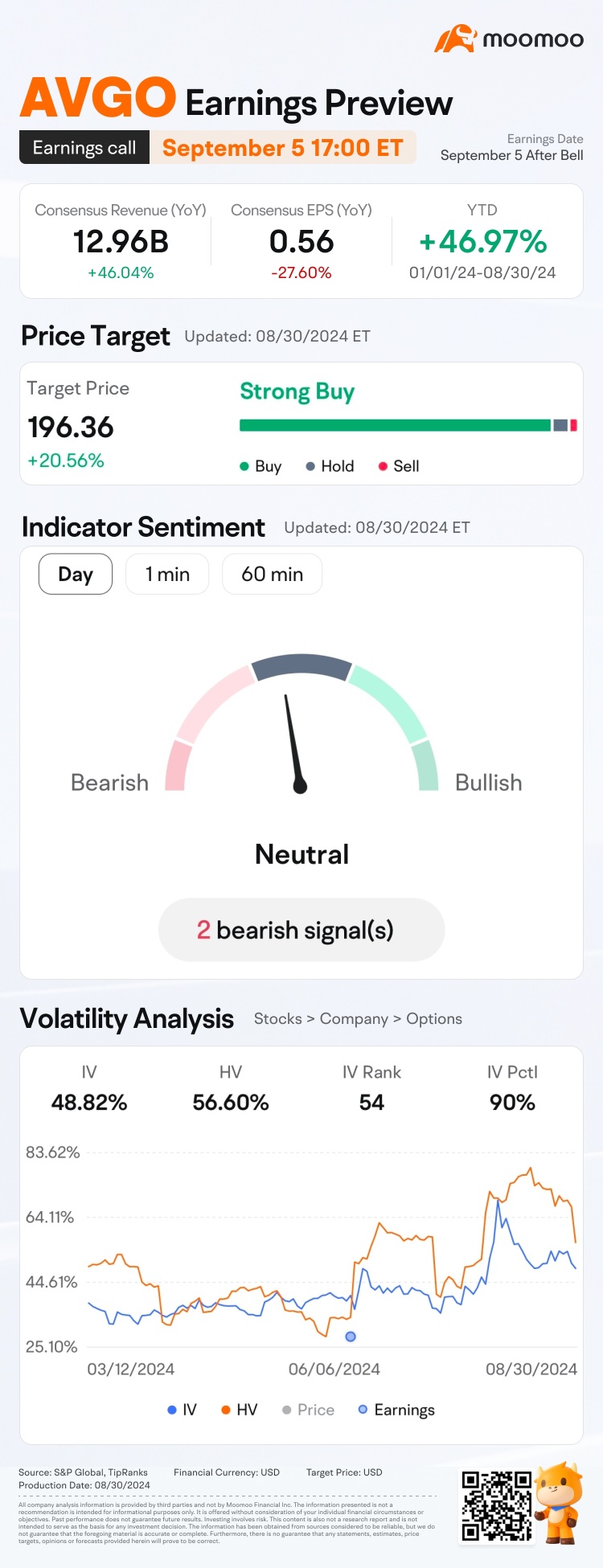

$Broadcom (AVGO.US)$ is releasing its Q3 earnings on September 5 after the bell. Unlock insights with AVGO Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 earnings release, shares of $Broadcom (AVGO.US)$ have seen an increase of 9.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who corr...

$Broadcom (AVGO.US)$ is releasing its Q3 earnings on September 5 after the bell. Unlock insights with AVGO Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 earnings release, shares of $Broadcom (AVGO.US)$ have seen an increase of 9.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who corr...

Expand

Expand 80

114

12

Rising Star Sunny

liked and commented on

Follow Stephen “Sarge” Guilfoyle on moomoo

Dear mooers,

![]()

![]() Exciting news! We're kicking off a fresh chapter in our "Invest with Sarge" video series. Starting this Wednesday, our first broadcast of each month will spotlight key upcoming news events and dissect what they could mean for your investments.

Exciting news! We're kicking off a fresh chapter in our "Invest with Sarge" video series. Starting this Wednesday, our first broadcast of each month will spotlight key upcoming news events and dissect what they could mean for your investments.

Join the live, as Stephen "Sarge" Guilfoyle will navigate the intersection of politics and market trends this August. With the Democratic National Conventio...

Dear mooers,

Join the live, as Stephen "Sarge" Guilfoyle will navigate the intersection of politics and market trends this August. With the Democratic National Conventio...

What Investors Might Watch for in August?

Aug 7 21:00

71

40

4

Rising Star Sunny

voted

TSM is releasing its Q2 earnings on July 18 before the bell.

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 22.28%.![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Taiwan Semiconductor (TSM.US)$'s opening...

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 22.28%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Taiwan Semiconductor (TSM.US)$'s opening...

Expand

Expand 153

260

29

Rising Star Sunny

liked

$Amkor Technology (AMKR.US)$In March 2022 analysis, it was still in the semiconductor sector, but now it has been reclassified into the equipment and materials sector. It was selected due to a large discount relative to the growth rate, resulting in a 32.3% increase in stock price to date.

Listed in 1998, mainly engaged in outsourcing semiconductor packaging and testing business, with 59% of the market in the USA. The current price is 30.81.

Over the past 5 years, the revenue shrank in the first and last year, with growth in the middle 3 years, averaging at an 8.6% growth rate. The operating profit in 2023 shrank by 47.6% due to the decline in gross margin, averaging a 12.7% growth rate. The net income in 2023 shrank by 52.8%, averaging a 22.8% growth rate. The interest expense in 2023 accounted for 2.2% of the operating profit, indicating a very light interest burden. The gross margin decreased from 16% to 20% in the past 5 years, then declined to 14.5%. The return on equity dropped from a high point of 24.4% in 2021 to 9.4%.

The asset-liability ratio has decreased from 57.6% to 41% in the past 5 years. The proportion and growth rate of accounts receivable and inventory are relatively normal, with very little goodwill and other intangible assets. Long-term borrowings are 1.072 billion, accounting for 26.8% of the net assets of 3.995 billion, and the leverage ratio is not high. There are 0.222 billion treasury stocks.

Currently, there is 1.6 billion in cash, with sufficient liquidity.

The net operating cash flow has slightly exceeded the net investment cash flow in the past 5 years, generating a small proportion of shareholder surplus.

The current PE ratio is 21.1, and the 5-year average net profit of 0.45 billion corresponds to a PE ratio of 16.8, which is relatively reasonable in valuation, so it's advised to maintain the position.

Listed in 1998, mainly engaged in outsourcing semiconductor packaging and testing business, with 59% of the market in the USA. The current price is 30.81.

Over the past 5 years, the revenue shrank in the first and last year, with growth in the middle 3 years, averaging at an 8.6% growth rate. The operating profit in 2023 shrank by 47.6% due to the decline in gross margin, averaging a 12.7% growth rate. The net income in 2023 shrank by 52.8%, averaging a 22.8% growth rate. The interest expense in 2023 accounted for 2.2% of the operating profit, indicating a very light interest burden. The gross margin decreased from 16% to 20% in the past 5 years, then declined to 14.5%. The return on equity dropped from a high point of 24.4% in 2021 to 9.4%.

The asset-liability ratio has decreased from 57.6% to 41% in the past 5 years. The proportion and growth rate of accounts receivable and inventory are relatively normal, with very little goodwill and other intangible assets. Long-term borrowings are 1.072 billion, accounting for 26.8% of the net assets of 3.995 billion, and the leverage ratio is not high. There are 0.222 billion treasury stocks.

Currently, there is 1.6 billion in cash, with sufficient liquidity.

The net operating cash flow has slightly exceeded the net investment cash flow in the past 5 years, generating a small proportion of shareholder surplus.

The current PE ratio is 21.1, and the 5-year average net profit of 0.45 billion corresponds to a PE ratio of 16.8, which is relatively reasonable in valuation, so it's advised to maintain the position.

Translated

1

Rising Star Sunny

voted

I don’t shop online as much as I used to in my youth. At that time, e-commerce was not that developed in Singapore but Amazon was already a name to be reckoned with in the US with locals starting threads to share deals during its sales and package forwarding service was fast taking off to feed the burgeoning consumer demand for shopping overseas. I would scour ebay and Amazon for items to add to my collection. I was intimately familiar with the airmail rates for USPS.

Now I’m past...

Now I’m past...

25

12

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)