Saini Choth Mal

Set a live reminder

[Synopsis]

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

A Pivotal Year: Strategies for Capturing Income

Jun 28 17:00

24

3

Saini Choth Mal

Set a live reminder

[Synopsis]

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Asia Fixed Income: A Window of Opportunity

Jun 28 15:00

7

2

Saini Choth Mal

Set a live reminder

[Synopsis]

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

US Interest rate cycle overview by CSOP Asset Management

Jun 27 17:00

8

2

Saini Choth Mal

Set a live reminder

[Synopsis]

As we head into the mid-year, what is the assessment of the current economy and will interest rates take a turn? With a year of global elections, US rate changes, continued geopolitical risks, and potential stablization of the Chinese market - learn the analysis as we hit the emergence of a new season with our expert from Fullerton Fund Management. Tune in as well for potential quiz giveaways and stand a chance to be rewarded f...

As we head into the mid-year, what is the assessment of the current economy and will interest rates take a turn? With a year of global elections, US rate changes, continued geopolitical risks, and potential stablization of the Chinese market - learn the analysis as we hit the emergence of a new season with our expert from Fullerton Fund Management. Tune in as well for potential quiz giveaways and stand a chance to be rewarded f...

Emergence of a new season, in current interest rates cycle

Jun 27 15:00

7

1

1

Saini Choth Mal

Set a live reminder

[Synopsis]

Kickstarting our live webinar fund series for 2024, we check-in with technology stocks and beyond - covering insights into the global market outlook, potential "controlled stabilisation" of the China market and potential strategies to employ beyond the Technology rally. Tune in and stand a chance to be rewarded for being with us on the show as we learn the analysis from our experts at Fidelity International. Olivia Higgins will guide you toward...

Kickstarting our live webinar fund series for 2024, we check-in with technology stocks and beyond - covering insights into the global market outlook, potential "controlled stabilisation" of the China market and potential strategies to employ beyond the Technology rally. Tune in and stand a chance to be rewarded for being with us on the show as we learn the analysis from our experts at Fidelity International. Olivia Higgins will guide you toward...

Beyond the Technology rally, what's next?

Jun 27 11:00

9

2

Saini Choth Mal

liked

The U.S. Department of Commerce reported a stronger-than-anticipated GDP growth of 3.2% for the second quarter of 2024, surpassing economists' forecasts of 2.7%. This growth has been attributed to a significant increase in consumer spending and robust business investments.

3

Saini Choth Mal

liked

by Luzi Ann Santos | moomoo News

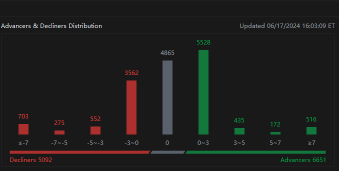

The S&P 500 and Nasdaq resumed their rally to fresh all-time highs, buoyed by gains in tech giants Apple and Microsoft.

The $S&P 500 Index (.SPX.US)$ rose to a new intra-day record of 5488.50, before paring gains to close at 5473.27, also an all-time high. The $Nasdaq Composite Index (.IXIC.US)$ rose to as high as 17935.99, before trimming the advance to 17,857. The indexes turned higher,...

The S&P 500 and Nasdaq resumed their rally to fresh all-time highs, buoyed by gains in tech giants Apple and Microsoft.

The $S&P 500 Index (.SPX.US)$ rose to a new intra-day record of 5488.50, before paring gains to close at 5473.27, also an all-time high. The $Nasdaq Composite Index (.IXIC.US)$ rose to as high as 17935.99, before trimming the advance to 17,857. The indexes turned higher,...

42

2

11

Saini Choth Mal

liked

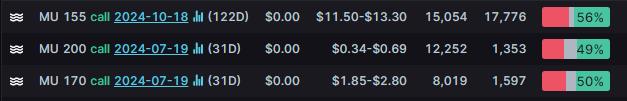

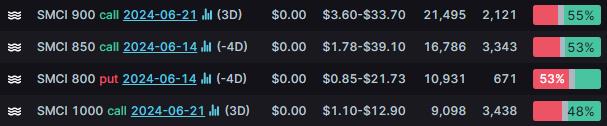

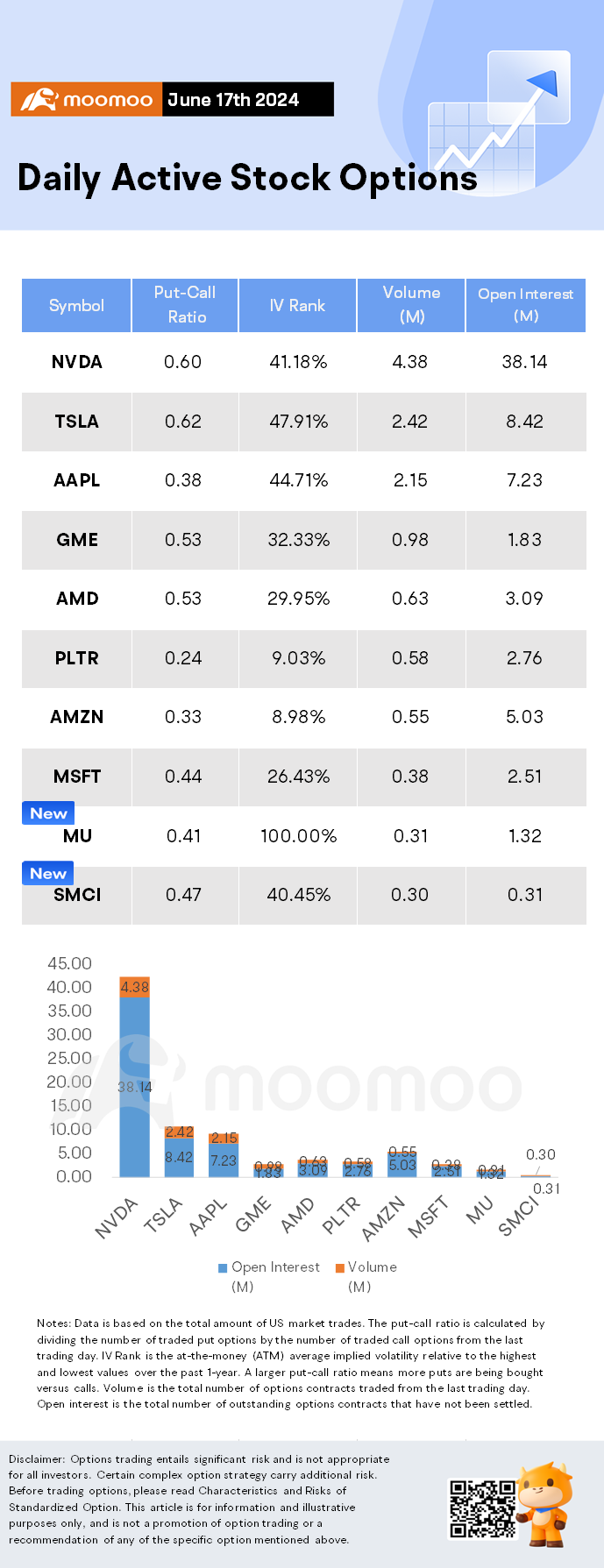

Columns Options Market Statistics: Micron's Stock Gets a Target Boost Ahead of Earnings, Options Pop

News Highlights

$NVIDIA (NVDA.US)$ shares ended 0.68% lower. Its options trading volume was 4.38 million. Call contracts account for 62.5% of the total trading volume.

Nvidia stock gained 9% last week. Shares of the artificial intelligence leader pared some early gains but remained near new highs on Monday.

At the visual Generative AI event this week, Computer Vision and Pattern Recognition Conference, Nv...

$NVIDIA (NVDA.US)$ shares ended 0.68% lower. Its options trading volume was 4.38 million. Call contracts account for 62.5% of the total trading volume.

Nvidia stock gained 9% last week. Shares of the artificial intelligence leader pared some early gains but remained near new highs on Monday.

At the visual Generative AI event this week, Computer Vision and Pattern Recognition Conference, Nv...

+2

39

19

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)