$L'OCCITANE (00973.HK)$

To all you chartists, do you think this looks like a cup and handle on the daily? if so, does it look like if it clears 30 it will break upside with about a “cup” depth of upside?

To all you chartists, do you think this looks like a cup and handle on the daily? if so, does it look like if it clears 30 it will break upside with about a “cup” depth of upside?

Sean McFarland

voted

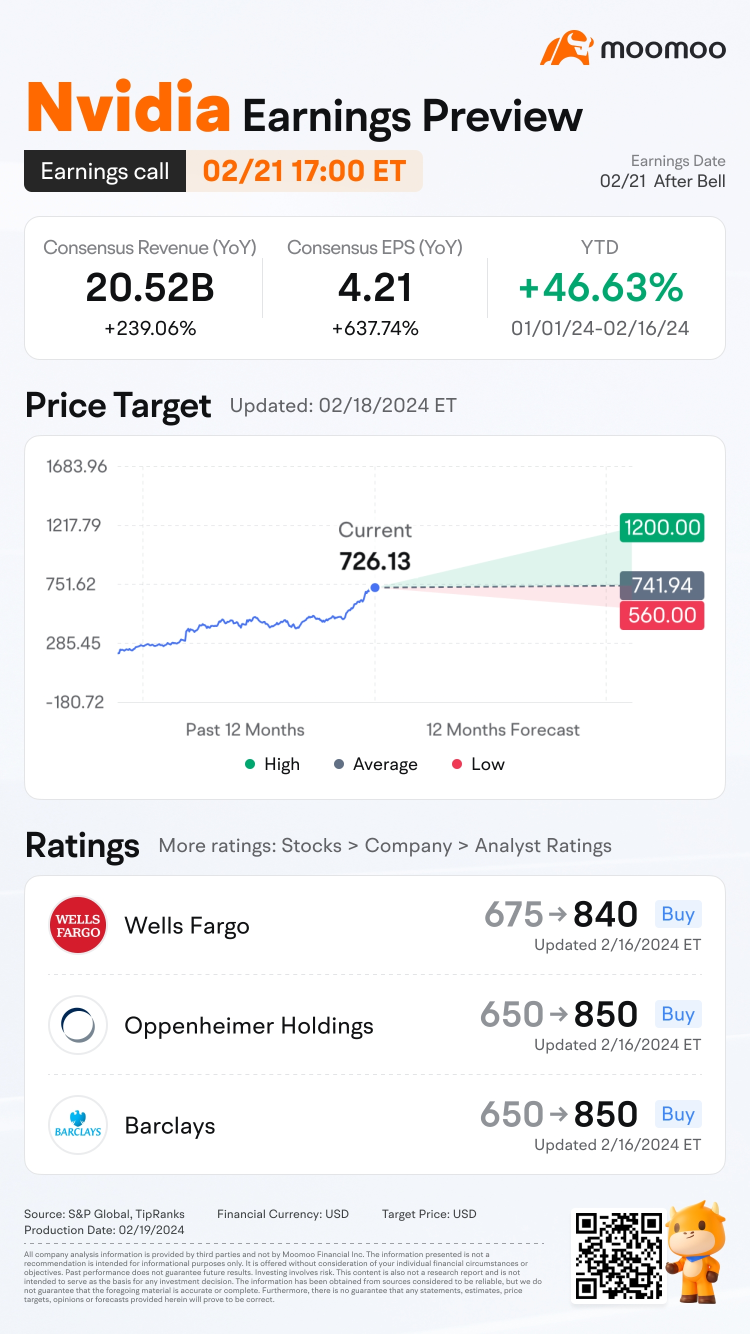

$NVIDIA (NVDA.US)$ is releasing its Q4 FY24 earnings on Feburary 21, after the U.S. stock market close. How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

● An equal share of 10,000 points: For mooers who correctly guess the price range of $NVIDIA (NVDA.US)$'s opening price at 9:30 AM ET Feb 22 (e.g., If 50 mooers make a correct guess, each of them will get 200 points!...

Rewards

● An equal share of 10,000 points: For mooers who correctly guess the price range of $NVIDIA (NVDA.US)$'s opening price at 9:30 AM ET Feb 22 (e.g., If 50 mooers make a correct guess, each of them will get 200 points!...

152

111

18

Sean McFarland

commented on

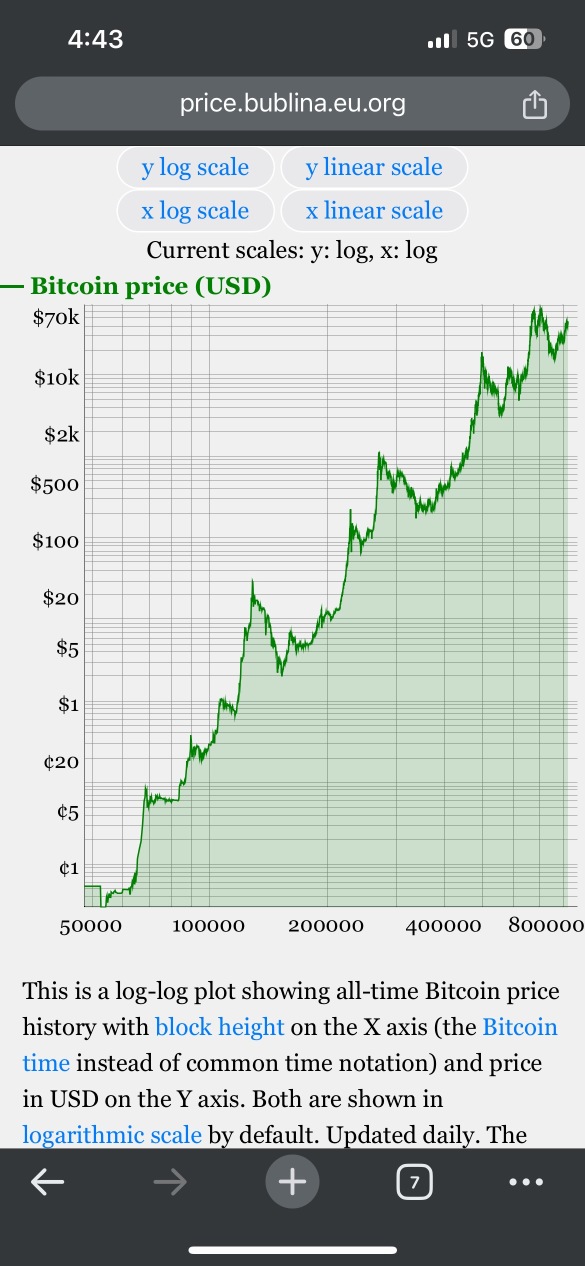

BTC (part 4)

So if youve been following me, why buy Bitcoin? There are four reasons everyone should own Bitcoin at least 5% ones net worth.

1) It is off risk. It is not correlated to any other asset class.

2) Its 100% liquid.

3) Its trading in a log/log power law channel and it has never traded outside that channel.

(as a fun excercise, hold you phone flat in your hand. look at the edge of your phone where you can barely see the chart and look parallel to the increasing chart and you will ...

So if youve been following me, why buy Bitcoin? There are four reasons everyone should own Bitcoin at least 5% ones net worth.

1) It is off risk. It is not correlated to any other asset class.

2) Its 100% liquid.

3) Its trading in a log/log power law channel and it has never traded outside that channel.

(as a fun excercise, hold you phone flat in your hand. look at the edge of your phone where you can barely see the chart and look parallel to the increasing chart and you will ...

4

8

1

BTC (part 3)

Bitcoin being an asset class of its own, has begun to trade in a range many consider following an exponential power law and has been range bound. some say it trades based on the STF principle. i am not sure if either is true but this i know…

i believe all assets will be value based on BTC in 6-10 years. in other words, BTC has begun to reprice all other assets. why? just look at the fundamentals. BTC is not inflated like currencies and/or fiat currencies. (as a proof, ...

Bitcoin being an asset class of its own, has begun to trade in a range many consider following an exponential power law and has been range bound. some say it trades based on the STF principle. i am not sure if either is true but this i know…

i believe all assets will be value based on BTC in 6-10 years. in other words, BTC has begun to reprice all other assets. why? just look at the fundamentals. BTC is not inflated like currencies and/or fiat currencies. (as a proof, ...

5

Sean McFarland

commented on

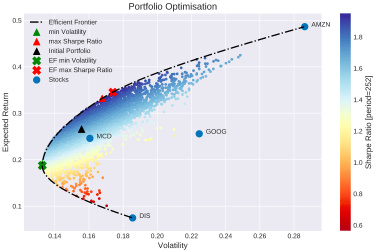

Yesterday I laid a foundation for my BTC position. I pointed out ARKs Kathy Woods sharpe ratio portfolio holding of almost 20% BTC.

In just a few years BTC has gone from a scam used by drug dealers (incidentally read this report how wrong they have been about BTC vs USD illicet trade: forbes.com/site...) to a portfolio requires 2% to balance a portfolio on sharpes risk/reward basis to Kathy Woods group giving it a 19.4% allocation.

Well hate to bust your balloon but Blackrock, ...

In just a few years BTC has gone from a scam used by drug dealers (incidentally read this report how wrong they have been about BTC vs USD illicet trade: forbes.com/site...) to a portfolio requires 2% to balance a portfolio on sharpes risk/reward basis to Kathy Woods group giving it a 19.4% allocation.

Well hate to bust your balloon but Blackrock, ...

9

3

Sean McFarland

liked and commented on

I purchased my first BTC on April 17th 2017. I purchased 1.0 BTC for $1250. By the end of 2019 I had a meager 10.0 BTC worth $68k.

Covid caused everything to tank and by March of 2020 BTC was down 80% from its highs to just over $3k. I had 17.0k.

I dollar cost average BTC every week since. I now have almost 27.0 BTC. $1,130,000.

BTC is a store of value. look at thia Kathy Wood article Re: BTC Sharps ratio and future portfolio hedging of risk off asset…. 19.4% BTC.

medium.com/@cry...

���������...

Covid caused everything to tank and by March of 2020 BTC was down 80% from its highs to just over $3k. I had 17.0k.

I dollar cost average BTC every week since. I now have almost 27.0 BTC. $1,130,000.

BTC is a store of value. look at thia Kathy Wood article Re: BTC Sharps ratio and future portfolio hedging of risk off asset…. 19.4% BTC.

medium.com/@cry...

���������...

10

5

guys check this out. L’Occutane owns Sol del Janeiro “bum bum creme”. Their division alone was up 200% yoy qoq.

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)