Signature Holdings

commented on and voted

Hi mooers! ![]()

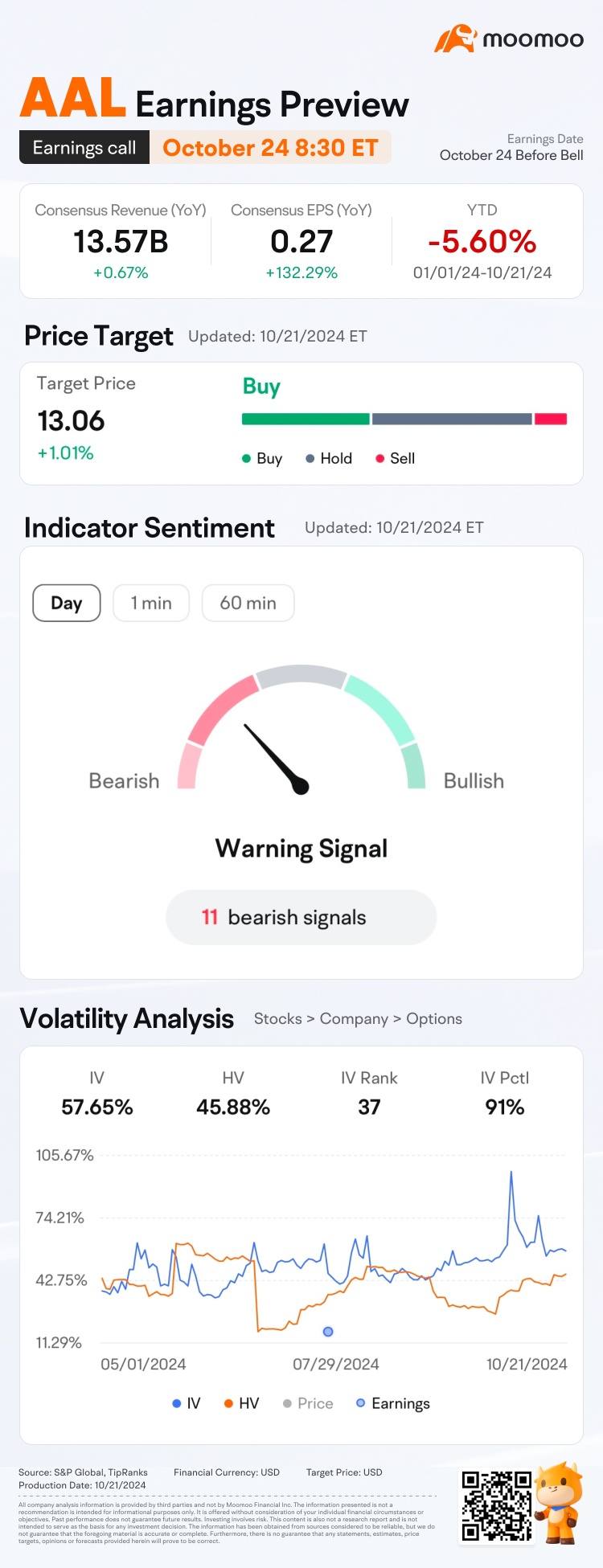

$American Airlines (AAL.US)$ is releasing its Q3 earnings on October 24 before the bell. Unlock insights with AAL Earnings Hub>>

With recent oil price falling and air-travel demand recovery going on, airline stocks are attracting market's attention. As of October 21, $Delta Air Lines (DAL.US)$'s stock price has gone up 9% since its Q3 earnings release, $United Airlines (UAL.US)$ stock has surged 15% since its Q3 earnin...

$American Airlines (AAL.US)$ is releasing its Q3 earnings on October 24 before the bell. Unlock insights with AAL Earnings Hub>>

With recent oil price falling and air-travel demand recovery going on, airline stocks are attracting market's attention. As of October 21, $Delta Air Lines (DAL.US)$'s stock price has gone up 9% since its Q3 earnings release, $United Airlines (UAL.US)$ stock has surged 15% since its Q3 earnin...

31

47

5

Signature Holdings

voted

The recovery momentum of the Malaysian glove industry is gradually improving, market experts believe that this is a good opportunity to accumulate glove stocks, and specifically mentioned the high-yield Chen Pi Industry and Hershey. $KOSSAN (7153.MY)$ and Hershey. $HARTA (5168.MY)$ 。

The research report by Volkswagen Investment Bank on Monday indicated a good sign of recovery in the glove industry, as both product sales and average selling prices are rising, which will all be drivers of revenue growth for industry players.

In the latest quarterly performance, the glove industry players we are focusing on all saw an increase in product sales, leading to a sequential revenue growth.

According to data from the Department of Statistics Malaysia (DOSM), our country's glove exports grew by 14% year-on-year in the first half of the year, while production volume increased by 6% year-on-year. Therefore, analysts predict that overall glove sales will continue to rise.

Despite the losses incurred by Top Glove $TOPGLOV (7113.MY)$ still incurring losses, but Hartalega and Kossan Rubber Industries respectively recorded core net profits of 36.7 million ringgit and 26.8 million ringgit.

Better pricing position.

"We understand that the average selling price for every 1000 gloves fluctuates between 20 to 21 US dollars, slightly higher than the 17 to 18 US dollars at which Chinese industry players sell."

The analyst continued, as customer inventories are depleted, they are more willing to accept price increases, which narrows the price gap between Malaysian and Chinese players, indicating that market price competition will become more intense.

However, we are bullish on Malaysian industry players being able to continue raising their average...

The research report by Volkswagen Investment Bank on Monday indicated a good sign of recovery in the glove industry, as both product sales and average selling prices are rising, which will all be drivers of revenue growth for industry players.

In the latest quarterly performance, the glove industry players we are focusing on all saw an increase in product sales, leading to a sequential revenue growth.

According to data from the Department of Statistics Malaysia (DOSM), our country's glove exports grew by 14% year-on-year in the first half of the year, while production volume increased by 6% year-on-year. Therefore, analysts predict that overall glove sales will continue to rise.

Despite the losses incurred by Top Glove $TOPGLOV (7113.MY)$ still incurring losses, but Hartalega and Kossan Rubber Industries respectively recorded core net profits of 36.7 million ringgit and 26.8 million ringgit.

Better pricing position.

"We understand that the average selling price for every 1000 gloves fluctuates between 20 to 21 US dollars, slightly higher than the 17 to 18 US dollars at which Chinese industry players sell."

The analyst continued, as customer inventories are depleted, they are more willing to accept price increases, which narrows the price gap between Malaysian and Chinese players, indicating that market price competition will become more intense.

However, we are bullish on Malaysian industry players being able to continue raising their average...

Translated

26

15

5

Signature Holdings

commented on and voted

Hi, mooers!

Just a heads-up:

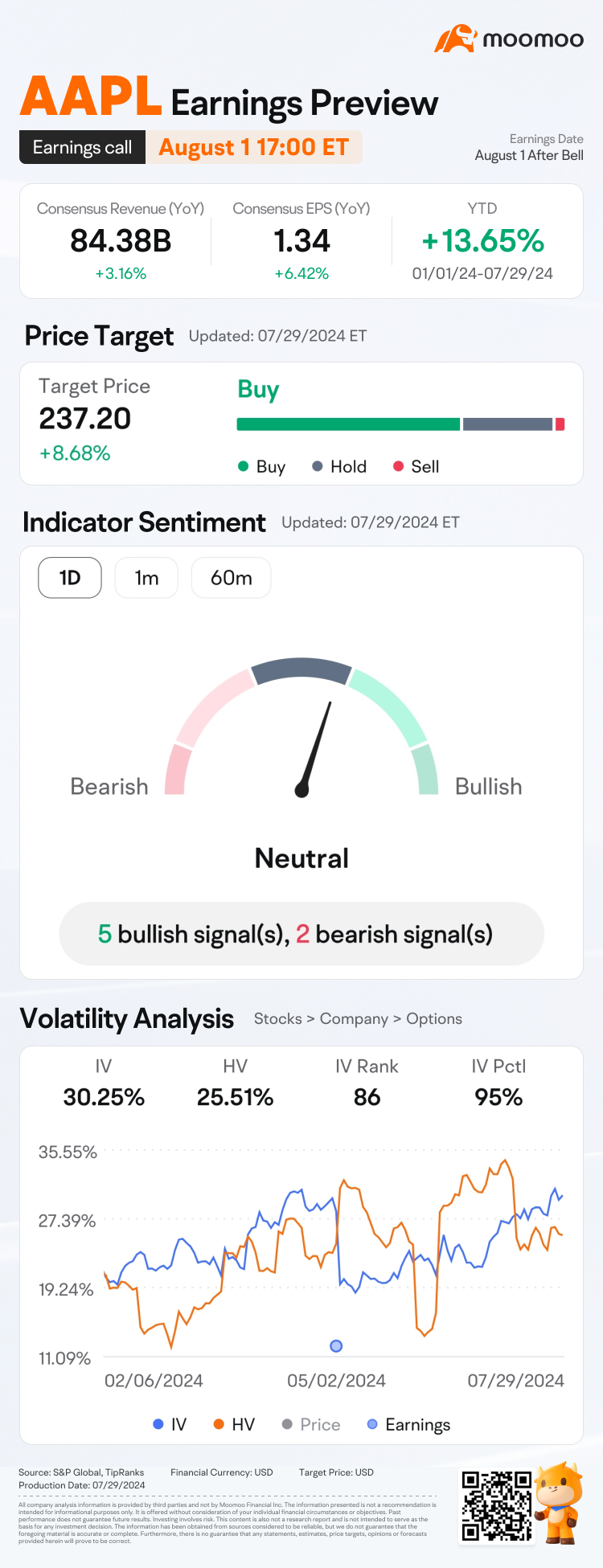

Earnings Challenge is in full swing! What's your take on Apple's earnings and its stock performance? Now join the challenge, leverage moomoo's handy features to support your views on Apple and earn plenty of rewards! Don't miss the chance to win big>>

$Apple (AAPL.US)$ is releasing its Q3 FY2024 earnings on August 1 after the bell. Unlock insights with Apple Earnings Hub>>

For the details of i...

Just a heads-up:

Earnings Challenge is in full swing! What's your take on Apple's earnings and its stock performance? Now join the challenge, leverage moomoo's handy features to support your views on Apple and earn plenty of rewards! Don't miss the chance to win big>>

$Apple (AAPL.US)$ is releasing its Q3 FY2024 earnings on August 1 after the bell. Unlock insights with Apple Earnings Hub>>

For the details of i...

103

191

19

Signature Holdings

voted

TSM is releasing its Q2 earnings on July 18 before the bell.

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 22.28%.![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Taiwan Semiconductor (TSM.US)$'s opening...

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 22.28%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Taiwan Semiconductor (TSM.US)$'s opening...

Expand

Expand 153

260

29

Signature Holdings

commented on

2

1

Signature Holdings

commented on

Signature Holdings

Set a live reminder

[Synopsis]

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

A Pivotal Year: Strategies for Capturing Income

Jun 28 17:00

24

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Signature Holdings : Let's see