somebodylegend

liked

$NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$

Yesterday, Nvidia declined sharply, and rumors suggested that a document from the Peking Development and Reform Commission stated that H20 does not meet energy-saving standards, causing market panic. What exactly is this standard?

According to the "Energy Efficiency 'Leader' Evaluation Requirements for Servers and Data Storage Devices," GPUs need to achieve an energy-saving level of 0.5 TFLOPS/W, with 1.0 TFLOPS/W being considered advanced. H20's FP16 computing power, after calculation, only reaches 0.37 TFLOPS/W, which is deemed "non-compliant."

But the problem arises:

✅ This standard was released in May last year and reported by the media in July last year; why is it only being hyped now?

✅ This standard is not applicable to double-precision GPUs over 20T/s; the H100 is compliant, but the H20 is not.

✅ Last year, major Technology giants were still frantically purchasing H20; in February this year, prices even increased by 10%. Currently, the price of a single card is about 0.08-0.1 million yuan, with Byte, Tencent, Alibaba, and Baidu all purchasing in large quantities.

So is this policy really aimed at Nvidia?

In fact, it's not just Nvidia; all chips weakened by export bans may not comply, more of a coordination with local replacement. But the problem is, Deepseek is booming, and the production capacity of Ascend 910B can't keep up, the giants simply can't stop!

Unless the authorities really start to impose penalties, who dares to be the first to jump out and say, 'I support energy saving and won't use H20'? Even...

Yesterday, Nvidia declined sharply, and rumors suggested that a document from the Peking Development and Reform Commission stated that H20 does not meet energy-saving standards, causing market panic. What exactly is this standard?

According to the "Energy Efficiency 'Leader' Evaluation Requirements for Servers and Data Storage Devices," GPUs need to achieve an energy-saving level of 0.5 TFLOPS/W, with 1.0 TFLOPS/W being considered advanced. H20's FP16 computing power, after calculation, only reaches 0.37 TFLOPS/W, which is deemed "non-compliant."

But the problem arises:

✅ This standard was released in May last year and reported by the media in July last year; why is it only being hyped now?

✅ This standard is not applicable to double-precision GPUs over 20T/s; the H100 is compliant, but the H20 is not.

✅ Last year, major Technology giants were still frantically purchasing H20; in February this year, prices even increased by 10%. Currently, the price of a single card is about 0.08-0.1 million yuan, with Byte, Tencent, Alibaba, and Baidu all purchasing in large quantities.

So is this policy really aimed at Nvidia?

In fact, it's not just Nvidia; all chips weakened by export bans may not comply, more of a coordination with local replacement. But the problem is, Deepseek is booming, and the production capacity of Ascend 910B can't keep up, the giants simply can't stop!

Unless the authorities really start to impose penalties, who dares to be the first to jump out and say, 'I support energy saving and won't use H20'? Even...

Translated

23

14

somebodylegend

liked

$Tesla (TSLA.US)$

Yes, an hour is enough for the market to determine its trend. (Normal)

If today's market trading price is higher than yesterday's highest price, then we can expect today's market to show a positive trend.

If today's market trading price is lower than yesterday's lowest price, then we can expect today's market to show a declining trend.

To obtain more confirmation, we can include the 10-day EMA.

– If the market trading price is above the previous day's high and remains above the 10-day EMA, the likelihood of a positive trend occurring that day increases.

– Conversely, if the market trading price is below the previous day's low and remains below the 10-day EMA, it will enhance the likelihood of a Put trend.

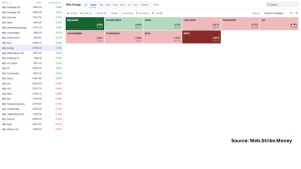

If you want to determine which Sectors are declining, which Sectors are rising, and how the Stocks within those Sectors are performing after an hour.

The heat map is one of the best tools for market analysis. The image below visually presents the Industry and Stocks trends in one frame. It can help quickly assess overall market trends, making the analysis more efficient and insightful.

One hour after the market opens, the heat map can be viewed to determine the overall market trend.

– If negative signs appear in the market, focus on the weakest Sector and identify the weakest Stocks to look for potential Short Sell opportunities.

– Conversely, if the market looks strong, target the strongest Sectors and their leading Stocks to look for Buy opportunities.

10% of traders own...

Yes, an hour is enough for the market to determine its trend. (Normal)

If today's market trading price is higher than yesterday's highest price, then we can expect today's market to show a positive trend.

If today's market trading price is lower than yesterday's lowest price, then we can expect today's market to show a declining trend.

To obtain more confirmation, we can include the 10-day EMA.

– If the market trading price is above the previous day's high and remains above the 10-day EMA, the likelihood of a positive trend occurring that day increases.

– Conversely, if the market trading price is below the previous day's low and remains below the 10-day EMA, it will enhance the likelihood of a Put trend.

If you want to determine which Sectors are declining, which Sectors are rising, and how the Stocks within those Sectors are performing after an hour.

The heat map is one of the best tools for market analysis. The image below visually presents the Industry and Stocks trends in one frame. It can help quickly assess overall market trends, making the analysis more efficient and insightful.

One hour after the market opens, the heat map can be viewed to determine the overall market trend.

– If negative signs appear in the market, focus on the weakest Sector and identify the weakest Stocks to look for potential Short Sell opportunities.

– Conversely, if the market looks strong, target the strongest Sectors and their leading Stocks to look for Buy opportunities.

10% of traders own...

Translated

4

1

somebodylegend

liked

Tariff-induced inflation has the potential to prolong a market correction, depending on the scale of the tariffs, how central banks respond, and broader economic conditions.

If we looked at how $S&P 500 Index (.SPX.US)$ have reclaimed the 200-day moving average, but there is a risk for S&P 500 dropping with the latest tariff announcement on the auto industry before the 02 April liberation day.

So if we were to mon...

If we looked at how $S&P 500 Index (.SPX.US)$ have reclaimed the 200-day moving average, but there is a risk for S&P 500 dropping with the latest tariff announcement on the auto industry before the 02 April liberation day.

So if we were to mon...

+1

13

1

somebodylegend

liked

Hey Mooers! ![]()

![]()

Recently I am thinking of an options strategy and my AI just make a weird joke!

This joke is about options and wheel strategy 🎡

Then I decided to move into creating a dynamic options wheel strategy.

Then something happened![]()

![]()

![]()

![]()

![]()

![]()

🚨 Disclaimer: The Bacon Churn Strategy™, Market Bacon™, and Triple-Fried Premium Hustle™ are all for humor and entertainment purposes only. 😆 Options trading involves substantial risk, and this strategy is not financial ad...

Recently I am thinking of an options strategy and my AI just make a weird joke!

This joke is about options and wheel strategy 🎡

Then I decided to move into creating a dynamic options wheel strategy.

Then something happened

🚨 Disclaimer: The Bacon Churn Strategy™, Market Bacon™, and Triple-Fried Premium Hustle™ are all for humor and entertainment purposes only. 😆 Options trading involves substantial risk, and this strategy is not financial ad...

9

2

somebodylegend

liked

💡 Is Nvidia about to spark another AI stock explosion? GTC 2025 is here, and the stakes have never been higher! Lock in your Calendar 📆 17 - 21 March.

🔥 What’s Coming at GTC 2025?

🔹 GeForce RTX 50 Series Expansion 🚀

📌 Expect new RTX 5070 Ti & 5070 GPUs, powered by Blackwell architecture—rumored to deliver next-gen AI & gaming performance. Could this redefine GPU dominance?

🔹 Project DIGITS AI Supercomputer 🤯

📌 1 peta...

🔥 What’s Coming at GTC 2025?

🔹 GeForce RTX 50 Series Expansion 🚀

📌 Expect new RTX 5070 Ti & 5070 GPUs, powered by Blackwell architecture—rumored to deliver next-gen AI & gaming performance. Could this redefine GPU dominance?

🔹 Project DIGITS AI Supercomputer 🤯

📌 1 peta...

+8

41

10

1

somebodylegend

liked

Recently, $Citigroup (C.US)$ (Citi, NYSE: C) The decision to reduce executive bonuses tied to the transformation plan has attracted widespread market attention. As one of the global financial giants, Citi's transformation plan was supposed to enhance competitiveness, but the latest data shows that the bank's reform progress has not met expectations, with the completion rate of some regulatory targets even declining from 94% in 2022 to 53% in 2024.This data reflects that Citi's reforms face significant resistance, and investors need to reassess the bank's prospects. This article will analyze Earnings Reports data, industry comparisons, stock price impacts, and market trends.This will help investors determine whether Citi is still worth holding for the long term.

The transformation is not meeting expectations, and regulatory pressures are hindering business development.

Citi's transformation plan aims to improve operation efficiency, reduce risk management loopholes, and enhance the regulatory assessment of its compliance. However, according to Citi's latest Earnings Reports, the transformation process is much more difficult than expected. By 2024, the bank has paid 0.136 billion USD in fines due to regulatory issues, which directly affects its profitability.

From a Financial Indicators perspective, Citibank's Q4 2023 revenue was 17.72 billion USD , a year-on-year decline 3.4%, while during the same period JP Morgan Chase (JPM, NYSE: JPM) had revenue growth 7%, reaching 39.65 billion US dollars。...

The transformation is not meeting expectations, and regulatory pressures are hindering business development.

Citi's transformation plan aims to improve operation efficiency, reduce risk management loopholes, and enhance the regulatory assessment of its compliance. However, according to Citi's latest Earnings Reports, the transformation process is much more difficult than expected. By 2024, the bank has paid 0.136 billion USD in fines due to regulatory issues, which directly affects its profitability.

From a Financial Indicators perspective, Citibank's Q4 2023 revenue was 17.72 billion USD , a year-on-year decline 3.4%, while during the same period JP Morgan Chase (JPM, NYSE: JPM) had revenue growth 7%, reaching 39.65 billion US dollars。...

Translated

11

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)