Sophia Lim Lim

voted

Hi, mooers! 👋

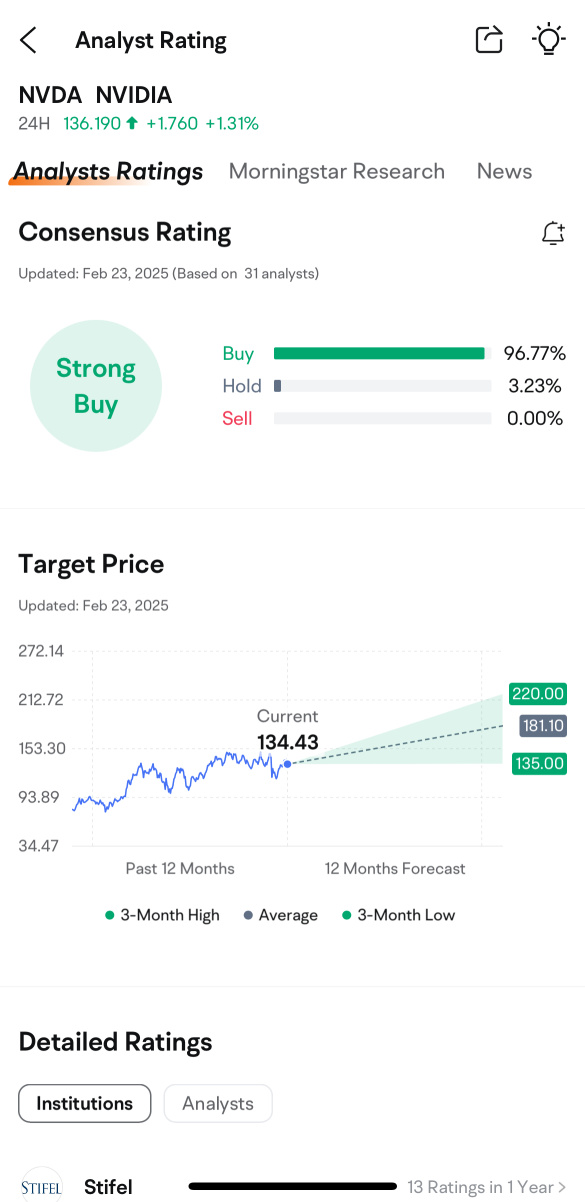

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

645

1022

40

Sophia Lim Lim

voted

Wondering if you can use financing for IPO subscriptions? Curious about interest charges? We've got you covered!

With Moomoo's IPO Financing, you can amplify your chances of getting new stock allocations. Here’s how it works:

💡 If you want to subscribe to more IPO shares, you can use moomoo's margin financing feature to enhance your subscription. This means you can use NOT ONLY CASH but also the buying power generated from your eligible ...

With Moomoo's IPO Financing, you can amplify your chances of getting new stock allocations. Here’s how it works:

💡 If you want to subscribe to more IPO shares, you can use moomoo's margin financing feature to enhance your subscription. This means you can use NOT ONLY CASH but also the buying power generated from your eligible ...

257

142

77

Sophia Lim Lim

commented on and voted

Hi, mooers! ![]()

Tenaga Nasional Bhd $TENAGA (5347.MY)$ is expected to release its latest quarterly earnings on November 28*. How will the market react to the power company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

![]() An equal share of 5,000 points: For mooers who correctly guess the price range of $TENAGA (5347.MY)$'s closing price on 28 November!

An equal share of 5,000 points: For mooers who correctly guess the price range of $TENAGA (5347.MY)$'s closing price on 28 November!

(Vot...

Tenaga Nasional Bhd $TENAGA (5347.MY)$ is expected to release its latest quarterly earnings on November 28*. How will the market react to the power company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

(Vot...

46

63

6

Sophia Lim Lim

voted

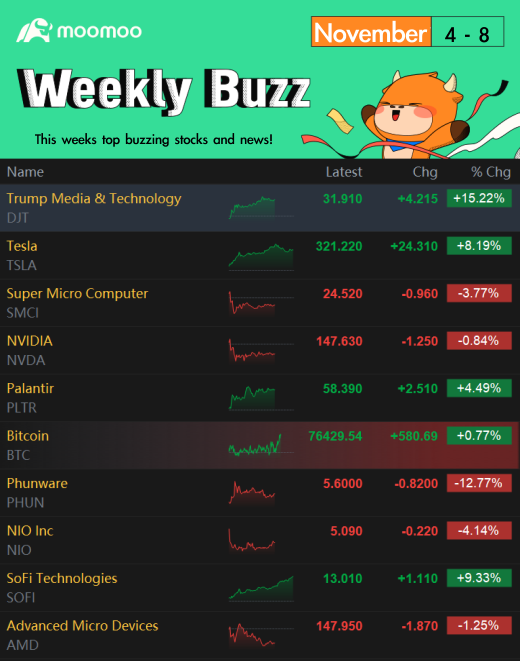

Happy weekend, investors! Welcome back to Weekly Buzz, where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

It was an extreme week in the U.S. stock market: a match-up months in the making that culminated Tuesday night. In an extremely close race and with a relatively furious pace of vote counting, Former Pr...

Make Your Choice

Weekly Buzz

It was an extreme week in the U.S. stock market: a match-up months in the making that culminated Tuesday night. In an extremely close race and with a relatively furious pace of vote counting, Former Pr...

+10

83

28

4

Sophia Lim Lim

liked

$DNEX (4456.MY)$

Keep up the good work, go for it.

Keep up the good work, go for it.

Translated

2

Sophia Lim Lim

liked

$DNEX (4456.MY)$ It will rise up immediately

3

3

Sophia Lim Lim

voted

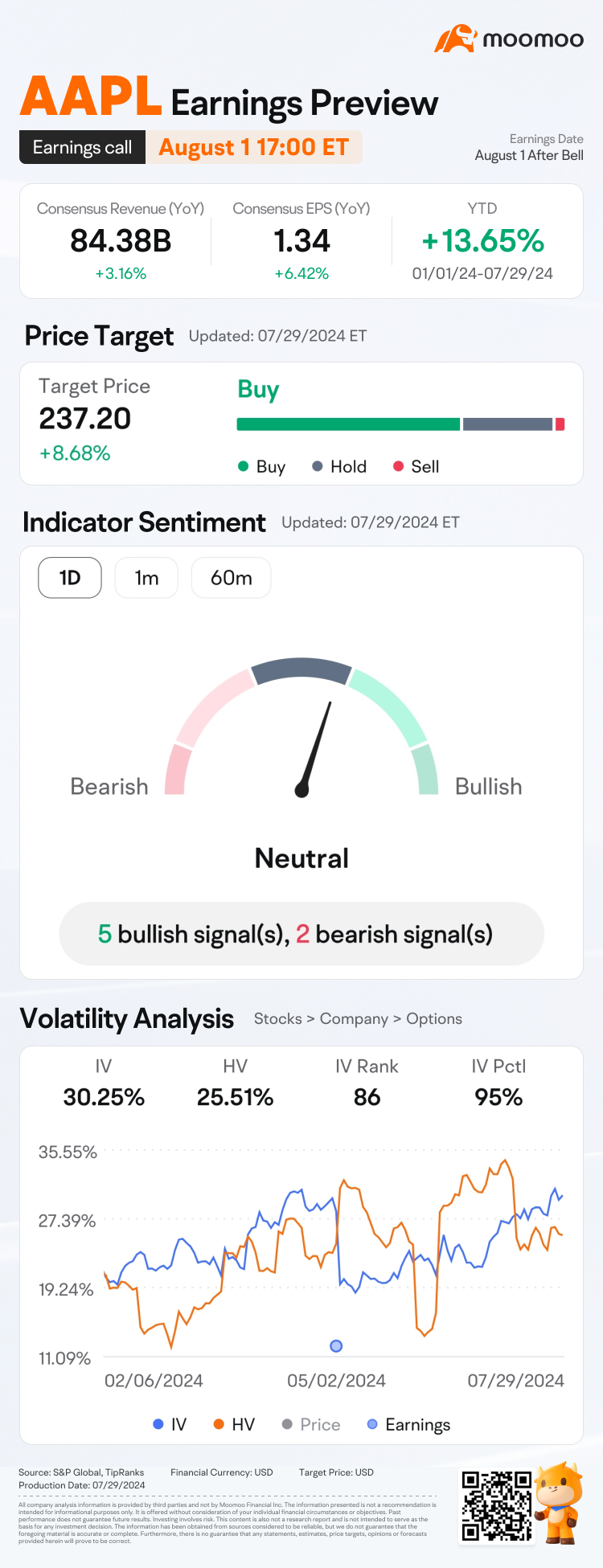

Hi, mooers!

Just a heads-up:

Earnings Challenge is in full swing! What's your take on Apple's earnings and its stock performance? Now join the challenge, leverage moomoo's handy features to support your views on Apple and earn plenty of rewards! Don't miss the chance to win big>>

$Apple (AAPL.US)$ is releasing its Q3 FY2024 earnings on August 1 after the bell. Unlock insights with Apple Earnings Hub>>

For the details of i...

Just a heads-up:

Earnings Challenge is in full swing! What's your take on Apple's earnings and its stock performance? Now join the challenge, leverage moomoo's handy features to support your views on Apple and earn plenty of rewards! Don't miss the chance to win big>>

$Apple (AAPL.US)$ is releasing its Q3 FY2024 earnings on August 1 after the bell. Unlock insights with Apple Earnings Hub>>

For the details of i...

103

191

19

Sophia Lim Lim

voted

$GENTING (3182.MY)$

As the domestic tourism industry continues to recover, Fenglong Investment Bank believes that Genting, which is currently undervalued, is one of the major beneficiaries and worth the attention of investors.

Fenglong Investment Bank analyst pointed out that Genting Malaysia and Genting Sing hold strategic equity interests, and can benefit from the recovery of the tourism industry in Malaysia and Singapore respectively. $GENM (4715.MY)$Genting Sing $Genting Sing (G13.SG)$Genting, which holds strategic equity interests in both Malaysia and Singapore, can benefit from the recovery of the tourism industry in both countries.

Below are the company's range buying points, short-term upward targets, and stop-loss points.

$GENTING (3182.MY)$

Source: Nanyang Business Daily

Disclaimer: This content is for reference and educational purposes only and does not constitute any specific investment, investment strategy, or recommendation. Readers should assume any risks and responsibilities resulting from relying on this content. Before making any investment decisions, please conduct your own independent research and evaluation, and consult with professionals when necessary. The author and related contributors are not responsible for any losses or damages incurred as a result of using or relying on the information contained in this article.

As the domestic tourism industry continues to recover, Fenglong Investment Bank believes that Genting, which is currently undervalued, is one of the major beneficiaries and worth the attention of investors.

Fenglong Investment Bank analyst pointed out that Genting Malaysia and Genting Sing hold strategic equity interests, and can benefit from the recovery of the tourism industry in Malaysia and Singapore respectively. $GENM (4715.MY)$Genting Sing $Genting Sing (G13.SG)$Genting, which holds strategic equity interests in both Malaysia and Singapore, can benefit from the recovery of the tourism industry in both countries.

Below are the company's range buying points, short-term upward targets, and stop-loss points.

$GENTING (3182.MY)$

Source: Nanyang Business Daily

Disclaimer: This content is for reference and educational purposes only and does not constitute any specific investment, investment strategy, or recommendation. Readers should assume any risks and responsibilities resulting from relying on this content. Before making any investment decisions, please conduct your own independent research and evaluation, and consult with professionals when necessary. The author and related contributors are not responsible for any losses or damages incurred as a result of using or relying on the information contained in this article.

Translated

20

4

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)