stabilorrr

voted

Hi, mooers! 👋

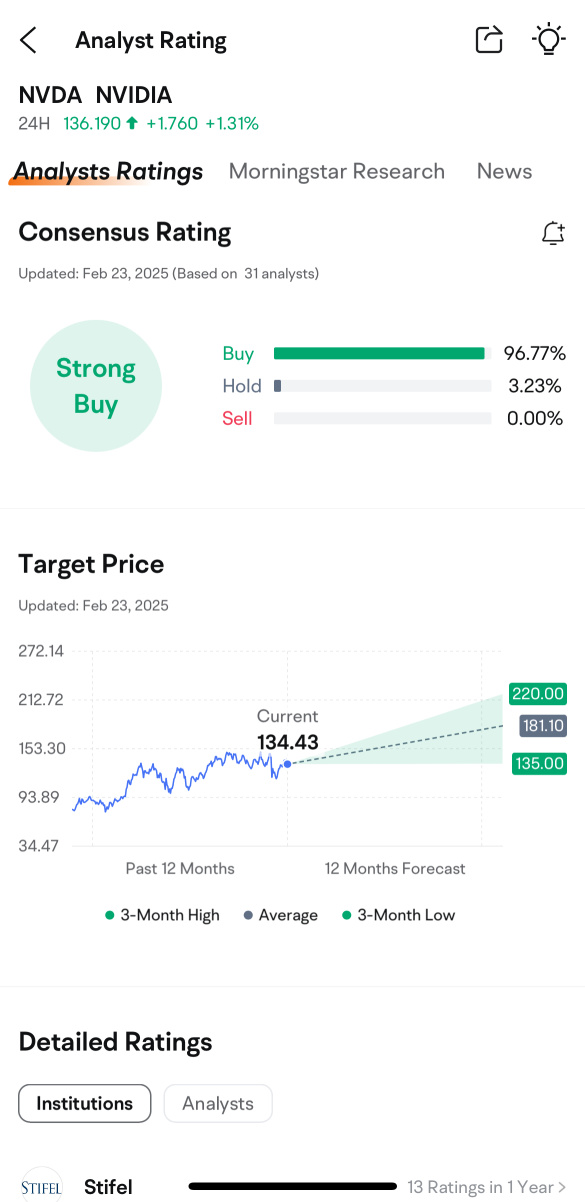

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

645

1022

40

stabilorrr

commented on

Hi, mooers! 👋

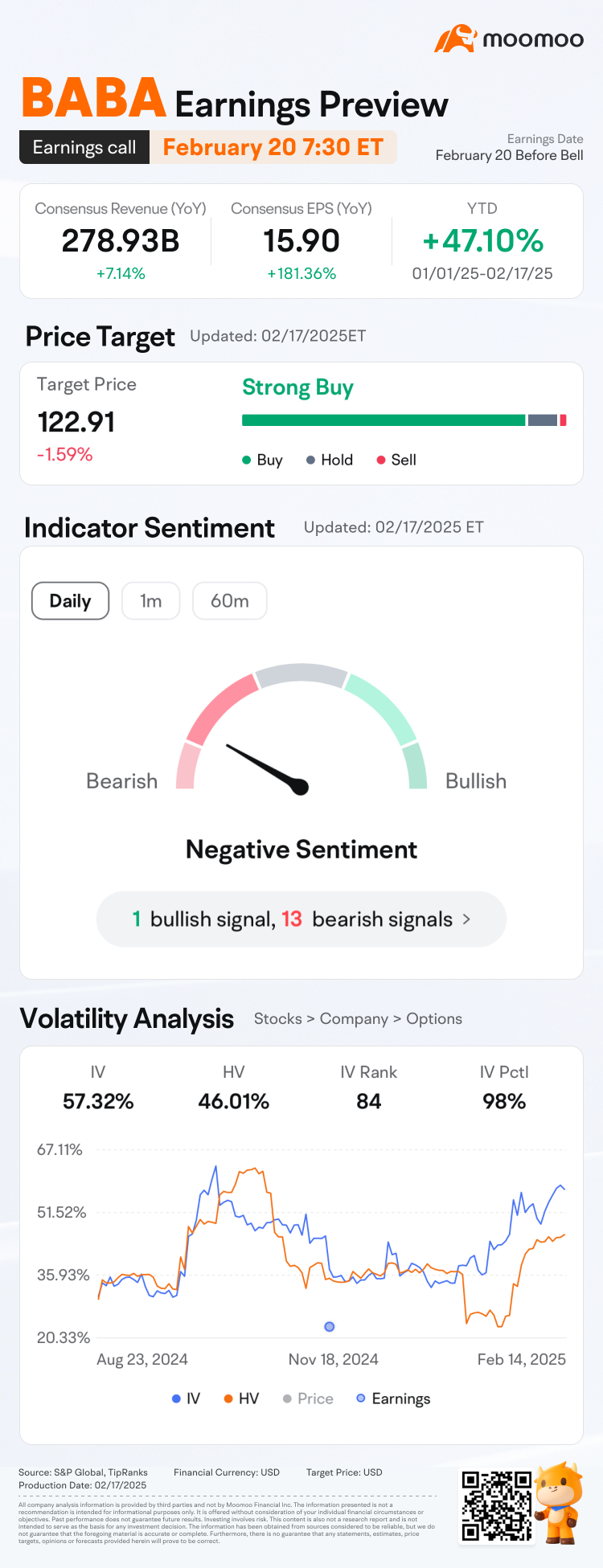

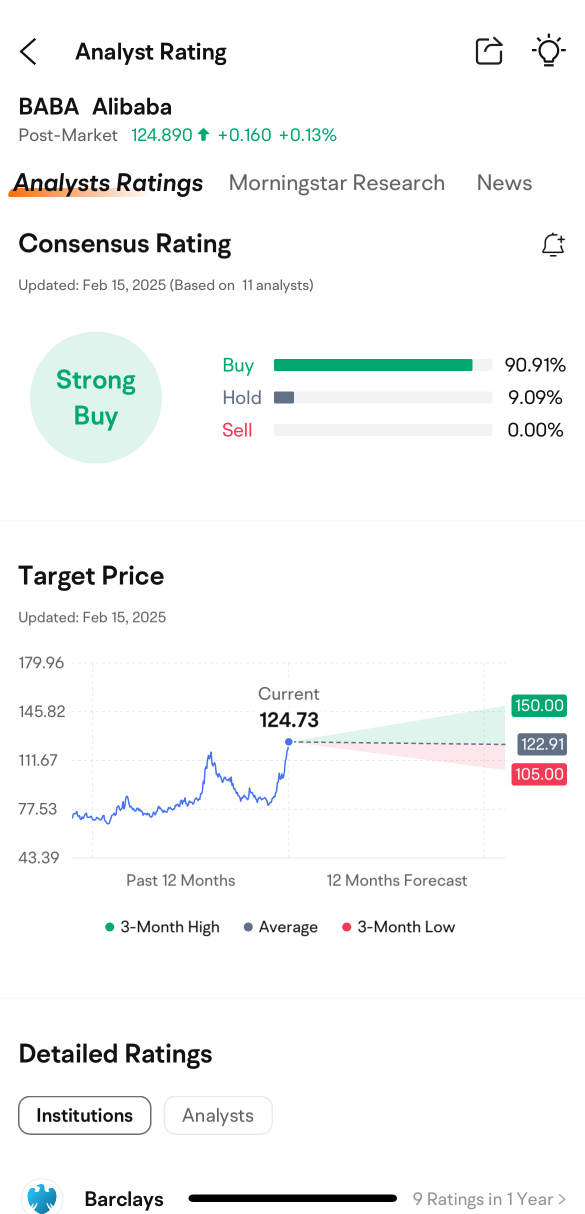

The countdown is on! $Alibaba (BABA.US)$ will release its Q4 FY2024 earnings on February 20, just before the market opens. This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and the live earnings conference stream. Book your spot NOW and be the first to hear the news!

👉 Subscribe Here

Re...

The countdown is on! $Alibaba (BABA.US)$ will release its Q4 FY2024 earnings on February 20, just before the market opens. This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and the live earnings conference stream. Book your spot NOW and be the first to hear the news!

👉 Subscribe Here

Re...

136

156

17

stabilorrr

voted

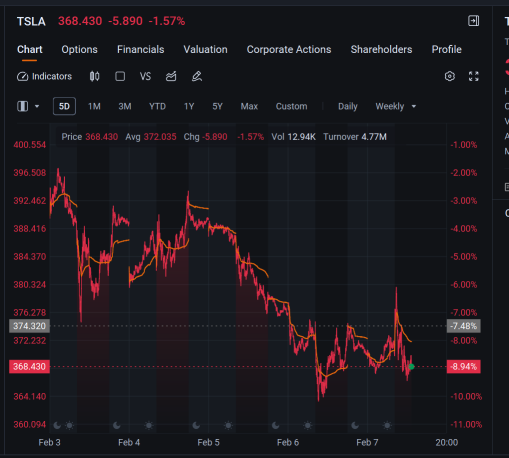

Happy weekend investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Click here for more moomoo produced news!!

Make Your Choice

Follow me on Twitter! @kevobt

Weekly Buzz

The week started in a rough spot- tariffs from President Trump going out to nearly half of everything the U.S. buys from the outside world, ...

Click here for more moomoo produced news!!

Make Your Choice

Follow me on Twitter! @kevobt

Weekly Buzz

The week started in a rough spot- tariffs from President Trump going out to nearly half of everything the U.S. buys from the outside world, ...

+10

53

35

21

huat ar! Happy New Year, everything goes well! 🎉🧧 Congratulations and prosperity, bring on the red packets! 💰🧧 Wishing you good health, with the spirit of dragon and horse! 💪🐉🐎 May you have surplus every year, advancing step by step! 🐟📈 May your family be happy and your wishes come true! 🏠❤️✨ Wish you great luck and great profit, with abundant wealth flowing in! 🍊💸 Wishing you a prosperous, healthy, and joyful Chinese New Year!

Translated

stabilorrr

voted

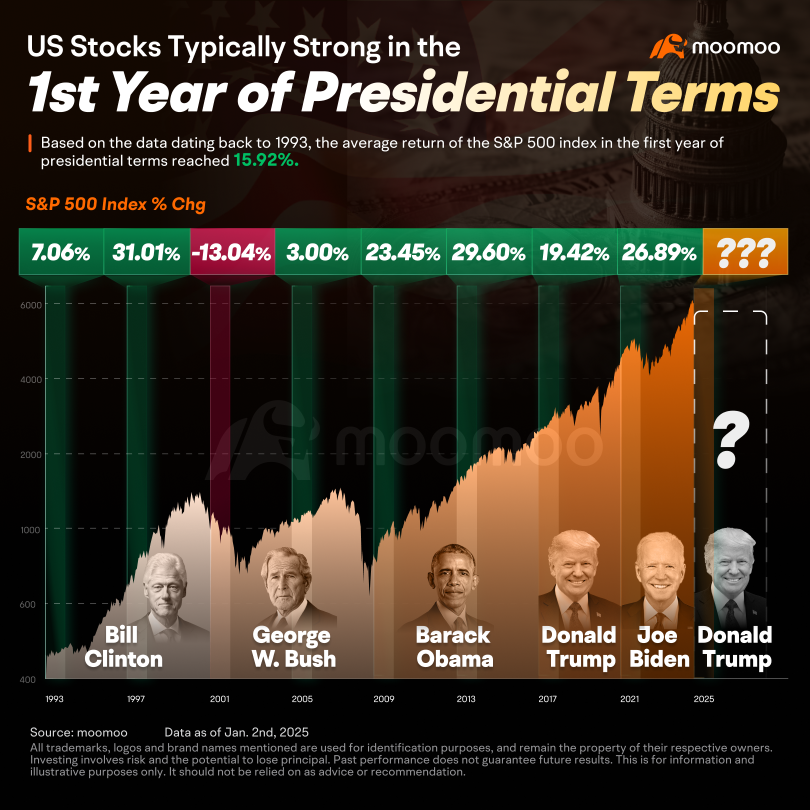

With Trump on the verge of beginning his second term, the fervor for the “Trump Trade” in global financial markets shows no sign of abating. However, the S&P 500 witnessed a significant pullback in the last three trading days of 2024, prompting investors to closely scrutinize the market trends in 2025.

Although there is significant uncertainty ahead, we can look back at history to explore some interesting pheno...

Although there is significant uncertainty ahead, we can look back at history to explore some interesting pheno...

49

8

36

stabilorrr

liked

I’m really curious whether it is good to hold any long-term ETFs. Or should I settle an RSP for ETFs like $SPDR S&P 500 ETF (SPY.US)$, $Invesco QQQ Trust (QQQ.US)$ , or $Vanguard S&P 500 ETF (VOO.US)$?

How about you?![]()

Recently, I’ve been planning to start a regular investment in $SPDR S&P 500 ETF (SPY.US)$!! However, I found out that $SPDR S&P500 US$ (S27.SG)$ is quite similar to it and is listed in both the US and SG. Would it be a better choice for me?

Actually, I'm re...

How about you?

Recently, I’ve been planning to start a regular investment in $SPDR S&P 500 ETF (SPY.US)$!! However, I found out that $SPDR S&P500 US$ (S27.SG)$ is quite similar to it and is listed in both the US and SG. Would it be a better choice for me?

Actually, I'm re...

9

3

stabilorrr

commented on

from the chart, it looks like Bull charge for $LionGlobal Singapore Trust Fund (SG9999002406.MF)$. with rate cuts sreits surge but came back down recently. with stellar results banks soared to record highs. Singapore strong and stable policies. incentives as headquarters.

$Eastspring Investments - Japan Dynamic Fund (LU1019494514.MF)$ took the early lead. but with Japan raising rate, things took an about turn.

China and HK stocks came alive with stimulus package announced prior to golden week. to...

$Eastspring Investments - Japan Dynamic Fund (LU1019494514.MF)$ took the early lead. but with Japan raising rate, things took an about turn.

China and HK stocks came alive with stimulus package announced prior to golden week. to...

8

1

stabilorrr

voted

Without looking at charts, you won't think that China's three other main indices are right behind their US counterparts.

Remember that China's markets underwent a major correction in October. We already had the Trump bump this month.

On a side note: Is the Dow Jones Industrial Average still relevant in this day and age?

$BABA-W (09988.HK)$ $TENCENT (00700.HK)$ $XIAOMI-W (01810.HK)$ $MEITUAN-W (03690.HK)$ $JD-SW (09618.HK)$ $BIDU-SW (09888.HK)$ $LI AUTO-W (02015.HK)$ $Hang Seng TECH Index (800700.HK)$ $Hang Seng Index (800000.HK)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $iShares MSCI Hong Kong ETF (EWH.US)$ $Kraneshares Tr Bosera Msci China A Sh Etf (KBA.US)$ $iShares MSCI China ETF (MCHI.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

Remember that China's markets underwent a major correction in October. We already had the Trump bump this month.

On a side note: Is the Dow Jones Industrial Average still relevant in this day and age?

$BABA-W (09988.HK)$ $TENCENT (00700.HK)$ $XIAOMI-W (01810.HK)$ $MEITUAN-W (03690.HK)$ $JD-SW (09618.HK)$ $BIDU-SW (09888.HK)$ $LI AUTO-W (02015.HK)$ $Hang Seng TECH Index (800700.HK)$ $Hang Seng Index (800000.HK)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $iShares MSCI Hong Kong ETF (EWH.US)$ $Kraneshares Tr Bosera Msci China A Sh Etf (KBA.US)$ $iShares MSCI China ETF (MCHI.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

stabilorrr

commented on

$Seatrium Ltd (5E2.SG)$

My coffee time...

Recycle the funds for next opportunities

Enough to buy Kopi with milk![]()

My coffee time...

Recycle the funds for next opportunities

Enough to buy Kopi with milk

18

13

stabilorrr

liked

Life is Better with up to 7%*p.a.

new promo for funds! read terms n conditions properly.

did fund recycling to gain from 6% 7days coupon. glad to report the bond fund is coming back up, a lousy Oct outing.

sadly the us tech related funds sunk again. so yes it pays to review weekly the funds and take a little profit to pamper yourself.

guess which fund I added?

yes going to add positions to fidelity dividend and bgf technology due to the recent huge drop.

new promo for funds! read terms n conditions properly.

did fund recycling to gain from 6% 7days coupon. glad to report the bond fund is coming back up, a lousy Oct outing.

sadly the us tech related funds sunk again. so yes it pays to review weekly the funds and take a little profit to pamper yourself.

guess which fund I added?

yes going to add positions to fidelity dividend and bgf technology due to the recent huge drop.

14

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)