suhaimisarip

liked

suhaimisarip

liked

Although $FTSE Bursa Malaysia KLCI Index (.KLSE.MY)$ retraced and closed red around the 1629 points region, the overall market sentiment was still a pretty good one. Daily trading volume was also able to surge back towards the 3.69 billion mark, which is a pretty good start for the year.

Main stocks that showed strong buying momentum would be the likes of MYEG, DNEX, WCT, UEMS, SIMEPROP, EKOVEST, MRCB, WINSTAR, YTL, IWCITY, GENETEC, CARLORINO, SCGBHD, MA...

Main stocks that showed strong buying momentum would be the likes of MYEG, DNEX, WCT, UEMS, SIMEPROP, EKOVEST, MRCB, WINSTAR, YTL, IWCITY, GENETEC, CARLORINO, SCGBHD, MA...

18

1

suhaimisarip

commented on

$JTGROUP (0292.MY)$

Key Observations:

1. Current Price:

• 0.520 (up +7.22%).

2. High of the Day:

• 0.525 – The price continues to test this level but hasn’t broken through.

3. Volume:

• 8.44M – Higher than before, indicating sustained interest and buying activity.

4. Turnover Ratio:

• 13.39% – A strong indicator of active trading, suggesting liquidity and investor confidence.

5. Resistance and Support:

• Immediate Resistance: 0.525 – If broken, the next resistance could be 0.5...

Key Observations:

1. Current Price:

• 0.520 (up +7.22%).

2. High of the Day:

• 0.525 – The price continues to test this level but hasn’t broken through.

3. Volume:

• 8.44M – Higher than before, indicating sustained interest and buying activity.

4. Turnover Ratio:

• 13.39% – A strong indicator of active trading, suggesting liquidity and investor confidence.

5. Resistance and Support:

• Immediate Resistance: 0.525 – If broken, the next resistance could be 0.5...

1

1

suhaimisarip

voted

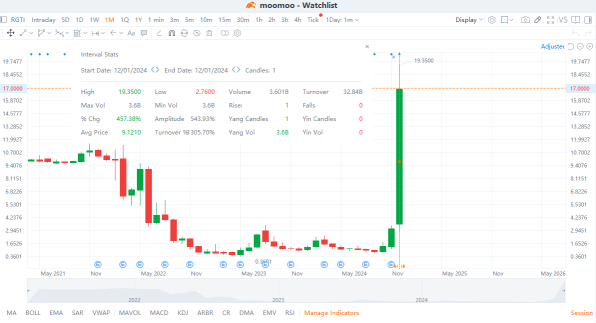

The quantum computing sector has been the talk of the town these days, with companies like $Quantum Computing (QUBT.US)$, $Rigetti Computing (RGTI.US)$, and $D-Wave Quantum (QBTS.US)$ posting extraordinary returns. For instance, $Quantum Computing (QUBT.US)$ has surged nearly 19 times in value this year alone! 😮 This surge isn't just driven by impressive numbers—market sentiment is also riding high, bolstered by significant advan...

64

9

25

suhaimisarip

liked

Columns Banks are expected to face a downturn next year. Analysts suggest reducing shareholding of MAYBANK!

Due to limited expansion of return on equity (roe), coupled with possible interest rate cuts next year, local banks may face pressure on net interest margin. Analysts believe that the prospects of bank stocks are mediocre, especially for the leading Maybank. $MAYBANK (1155.MY)$ Cautioning investors, suggesting reducing holdings!

The latest analysis report from Malaysian investment banks suggests that the banking industry may cool down next year, with a sector rating of only 'neutral'. Maybank, with a high valuation, is likely to be the first to feel the impact, with the target price plummeting from the original 10.80 ringgit to 8.85 ringgit; the rating has also been downgraded to 'shareholding'.

The analyst stated that the reason for slashing the target price of the bank was not only due to the pressure on the return on equity, but also because the stock price of the bank was at a relatively high level compared to its book value.

In addition, the bank's operating income, compared to 6.9% in the 2024 fiscal year, is expected to drop significantly to 3% in the 2025 fiscal year, mainly due to a slowdown in funding and market income.

Therefore, in view of the various downside risks, analysts have lowered the target price and rating of Ma Bank.

Investing in banks with high roe is the strategy.

Overall, in the banking sector, analysts believe that banks with high return on equity and high liquidity will be one of the key investment focuses given the current situation.

Analysts pointed out that by the 2025 fiscal year, the return on equity (ROE) had only increased from 9.4% to 9.7%, mainly due to the core net profit of banks, expected to decrease from this year's 7% to 6....

The latest analysis report from Malaysian investment banks suggests that the banking industry may cool down next year, with a sector rating of only 'neutral'. Maybank, with a high valuation, is likely to be the first to feel the impact, with the target price plummeting from the original 10.80 ringgit to 8.85 ringgit; the rating has also been downgraded to 'shareholding'.

The analyst stated that the reason for slashing the target price of the bank was not only due to the pressure on the return on equity, but also because the stock price of the bank was at a relatively high level compared to its book value.

In addition, the bank's operating income, compared to 6.9% in the 2024 fiscal year, is expected to drop significantly to 3% in the 2025 fiscal year, mainly due to a slowdown in funding and market income.

Therefore, in view of the various downside risks, analysts have lowered the target price and rating of Ma Bank.

Investing in banks with high roe is the strategy.

Overall, in the banking sector, analysts believe that banks with high return on equity and high liquidity will be one of the key investment focuses given the current situation.

Analysts pointed out that by the 2025 fiscal year, the return on equity (ROE) had only increased from 9.4% to 9.7%, mainly due to the core net profit of banks, expected to decrease from this year's 7% to 6....

Translated

39

21

59

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)