Suk San

commented on

BNPL (Buy Now Pay Later)is growing in popularity globally. On Sep 9, $Affirm Holdings (AFRM.US)$ , leading BNPL company, released its Q4 FY21 earnings thatbeats the estimates, following a surge of 20% in stock price during post-market.

Let's take a quick look at some key takeaways.

Operating Highlights

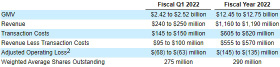

GMV ( Gross merchandise volume) for Q4 FY21 was $2.5 billion, an increase of106%; GMV for fiscal year 2021 was $8.3 billion, an increase of79%.

Active merchants grew by412%to nearly 29,000; Active consumers grew97%to 7.1 million.

Transactions per active consumer increased8%to approximately 2.3.

Financial Highlights

Total revenue was $261.8 million, a71%increase, driven by increases in network revenue and interest income.

Net loss for the Q4 2021 was $128.2 million compared to net income of $34.8 million in Q4 2020.

Business Highlights

In August 2021, the Company announced a non-exclusive partnership with $Affirm Holdings (AFRM.US)$to offer Affirm's flexible payment solutions, and Amazon plans to make Affirm morebroadly availableto its customers.

In June 2021, the Company advanced itsexclusive partnershipwith $Shopify (SHOP.US)$ by making Affirm's Shop Pay Installments available to all eligible Shopify merchants in the US.

Financial Outlook

The company gives apositive outlook. In FY22, Affirm expects GMV to grow faster than revenue. The outlook also reflects its strategy to drivegrowth in its network through continued investment, prioritizing increased investments in both its product and engineering teams, while also increasing its brand and direct response marketing efforts.

These investments are expected to benefit the Company'sproduct innovation capabilities and brand awareness in support of its long-term growth objectives.

Click to see the original report>>

What’s your thoughtson Affirm's Q4 FY21 earnings? Is there any number or move thathits you? Is now a good time to buy or sell?

We can't wait to see your comments.

Let's take a quick look at some key takeaways.

Operating Highlights

GMV ( Gross merchandise volume) for Q4 FY21 was $2.5 billion, an increase of106%; GMV for fiscal year 2021 was $8.3 billion, an increase of79%.

Active merchants grew by412%to nearly 29,000; Active consumers grew97%to 7.1 million.

Transactions per active consumer increased8%to approximately 2.3.

Financial Highlights

Total revenue was $261.8 million, a71%increase, driven by increases in network revenue and interest income.

Net loss for the Q4 2021 was $128.2 million compared to net income of $34.8 million in Q4 2020.

Business Highlights

In August 2021, the Company announced a non-exclusive partnership with $Affirm Holdings (AFRM.US)$to offer Affirm's flexible payment solutions, and Amazon plans to make Affirm morebroadly availableto its customers.

In June 2021, the Company advanced itsexclusive partnershipwith $Shopify (SHOP.US)$ by making Affirm's Shop Pay Installments available to all eligible Shopify merchants in the US.

Financial Outlook

The company gives apositive outlook. In FY22, Affirm expects GMV to grow faster than revenue. The outlook also reflects its strategy to drivegrowth in its network through continued investment, prioritizing increased investments in both its product and engineering teams, while also increasing its brand and direct response marketing efforts.

These investments are expected to benefit the Company'sproduct innovation capabilities and brand awareness in support of its long-term growth objectives.

Click to see the original report>>

What’s your thoughtson Affirm's Q4 FY21 earnings? Is there any number or move thathits you? Is now a good time to buy or sell?

We can't wait to see your comments.

33

13

5

Suk San

commented on

$TENCENT (00700.HK)$ $Apple (AAPL.US)$ The moat of a company is very important. Good companies have their own moat, which is mainly reflected in intangible assets, conversion costs, scale effect, cost advantages and other related situations

Intangible assets: mainly refers to the non-actual assets, but the part of value, the conventional brand value, patent, science and technology, franchise mainly.

Take Apple as an example: The product has high brand value and strong user stickiness, which is mainly reflected in the large number of apple repurchases (replacing old iphones with new ones). The specific reference data can be based on the market share.

The judgment of brand moat can be seen from the following aspects: when buying a certain kind of product, will you be unable to get rid of this brand or think of it at the first time, often be recommended by others to this brand, whether the people around know this brand, even if you do not use it.

Intangible assets: mainly refers to the non-actual assets, but the part of value, the conventional brand value, patent, science and technology, franchise mainly.

Take Apple as an example: The product has high brand value and strong user stickiness, which is mainly reflected in the large number of apple repurchases (replacing old iphones with new ones). The specific reference data can be based on the market share.

The judgment of brand moat can be seen from the following aspects: when buying a certain kind of product, will you be unable to get rid of this brand or think of it at the first time, often be recommended by others to this brand, whether the people around know this brand, even if you do not use it.

1

6

Suk San

commented on

$TENCENT (00700.HK)$ $XIWANG STEEL (01266.HK)$ Hong Kong shares although the market is not so, but the stock is still relatively strong. I own a lot of stocks, and that's basically telling, because I've got about half of my stocks up and half of my stocks down, but my overall market value is still up.

4

3

Suk San

commented on

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Suk San :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)