T_shares

liked

$NVIDIA (NVDA.US)$ didnt trade at all on friday so i missed the chance to call but its alright! i see you're going strong uptrend ![]()

5

T_shares

liked

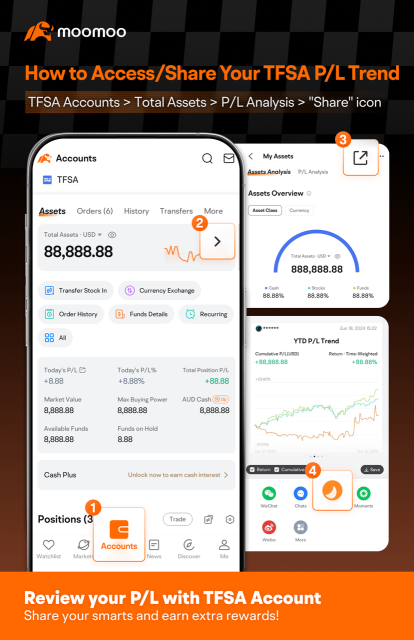

👋 Yooooo mooers,

As the year-end bells ring in, we are not only welcomed by a snowy winter but also stepping into the important tax season!

We know that opening a TFSA account with moomoo allows us to enjoy the tax-free benefits of U.S. stock investments and extraordinarily low foreign exchange rates! Looking back at 2024, did your TFSA journey result in a wealth of gains? Let’s highlight this star account and celebrate your...

As the year-end bells ring in, we are not only welcomed by a snowy winter but also stepping into the important tax season!

We know that opening a TFSA account with moomoo allows us to enjoy the tax-free benefits of U.S. stock investments and extraordinarily low foreign exchange rates! Looking back at 2024, did your TFSA journey result in a wealth of gains? Let’s highlight this star account and celebrate your...

37

5

1

T_shares

liked

Individual retail investors in stock trading often experience significant emotional fluctuations, this is because their trading decisions are often influenced by external market information, personal psychological factors, and trading experience.

Individual retail investors in stock trading often experience significant emotional fluctuations, this is because their trading decisions are often influenced by external market information, personal psychological factors, and trading experience. Below are several typical manifestations of the emotions of individual retail investors and their impact on trading:

---

1. Greed and Fear

Emotional Behavior:

1. Greed: During rapid stock market growth, retail investors tend to have a 'fear of missing out' mentality (FOMO) and rush to buy high.

2. Fear: During stock market declines, retail investors often hastily cut losses due to fear of further expansion of losses.

Impact:

Greed leads to buying at high levels, ignoring risks.

Fear leads to selling at low levels, missing out on rebound opportunities.

Recommendation:

Develop a trading plan and strictly adhere to stop-loss and take-profit.

Avoid emotional trading and maintain rationality.

---

2. Herd Mentality

Emotional performance:

Many retail investors tend to blindly follow the "majority" or "hot trends" when investing, thinking what everyone else is buying must be right.

Keen on chasing after "limit up stocks" and "hot sectors", even relying on recommendations from social media or WeChat groups.

Impact:

容易在市场高峰时买入,低谷时卖出。

缺乏独立分析,依赖他人导致决策失误。

建...

Individual retail investors in stock trading often experience significant emotional fluctuations, this is because their trading decisions are often influenced by external market information, personal psychological factors, and trading experience. Below are several typical manifestations of the emotions of individual retail investors and their impact on trading:

---

1. Greed and Fear

Emotional Behavior:

1. Greed: During rapid stock market growth, retail investors tend to have a 'fear of missing out' mentality (FOMO) and rush to buy high.

2. Fear: During stock market declines, retail investors often hastily cut losses due to fear of further expansion of losses.

Impact:

Greed leads to buying at high levels, ignoring risks.

Fear leads to selling at low levels, missing out on rebound opportunities.

Recommendation:

Develop a trading plan and strictly adhere to stop-loss and take-profit.

Avoid emotional trading and maintain rationality.

---

2. Herd Mentality

Emotional performance:

Many retail investors tend to blindly follow the "majority" or "hot trends" when investing, thinking what everyone else is buying must be right.

Keen on chasing after "limit up stocks" and "hot sectors", even relying on recommendations from social media or WeChat groups.

Impact:

容易在市场高峰时买入,低谷时卖出。

缺乏独立分析,依赖他人导致决策失误。

建...

Translated

19

T_shares

liked

Okay, so today was an absolutely WILD day after the FOMC meeting.

There are many things to discuss...but here's the bottom line:

It kind of feels like a mini-August 5th.

Let's get into it....

So, why did the market go down across the board after the meeting?

First off, the market was upset that the Fed is only going to do 2 cuts instead of 3 cuts in 2025. However, it's not just about the lack of cuts...it's about the lac...

There are many things to discuss...but here's the bottom line:

It kind of feels like a mini-August 5th.

Let's get into it....

So, why did the market go down across the board after the meeting?

First off, the market was upset that the Fed is only going to do 2 cuts instead of 3 cuts in 2025. However, it's not just about the lack of cuts...it's about the lac...

7

T_shares

liked

$Tesla (TSLA.US)$ yesterday lowest at 457, i think may not be a good price to get on board still by looking at post market is red. probably got more room to wait for better pricing before on board

5

2

T_shares

liked

8

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)