Tak ashi

liked

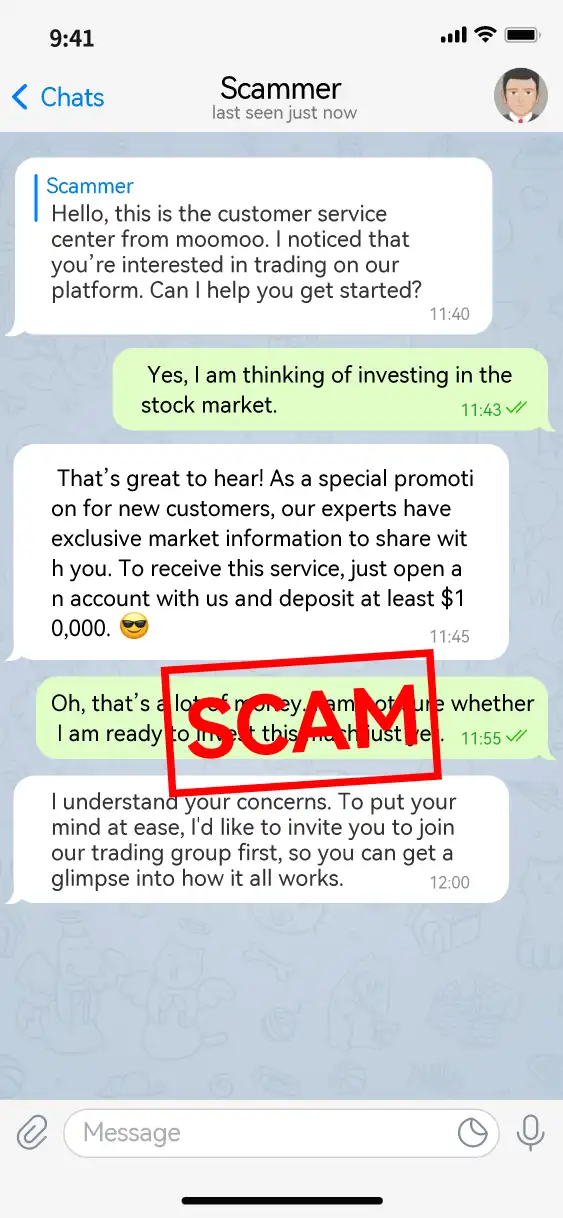

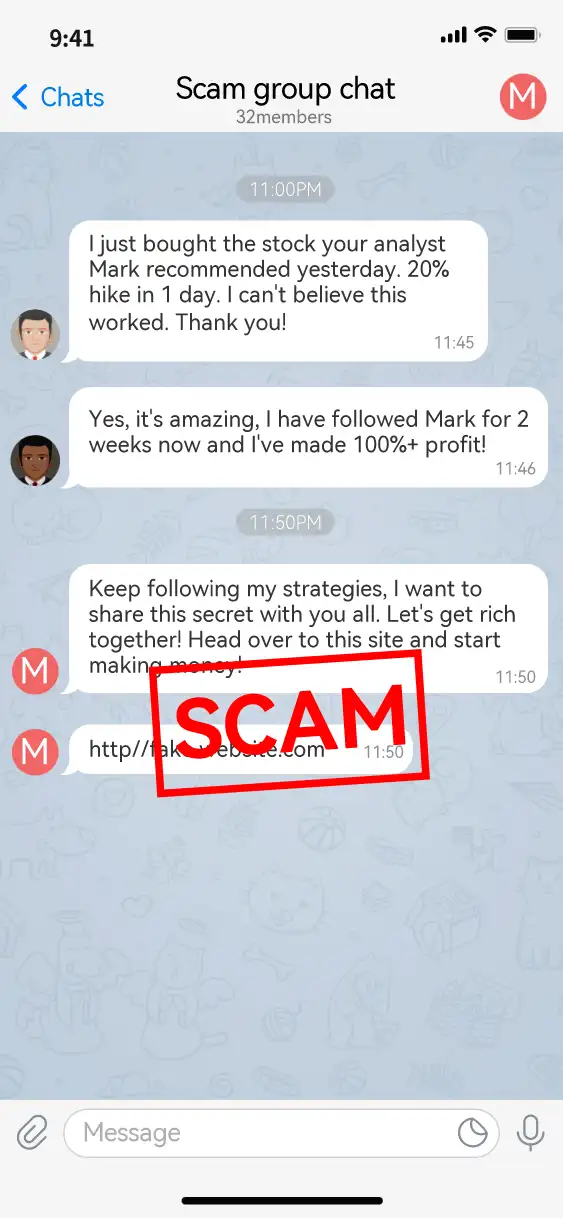

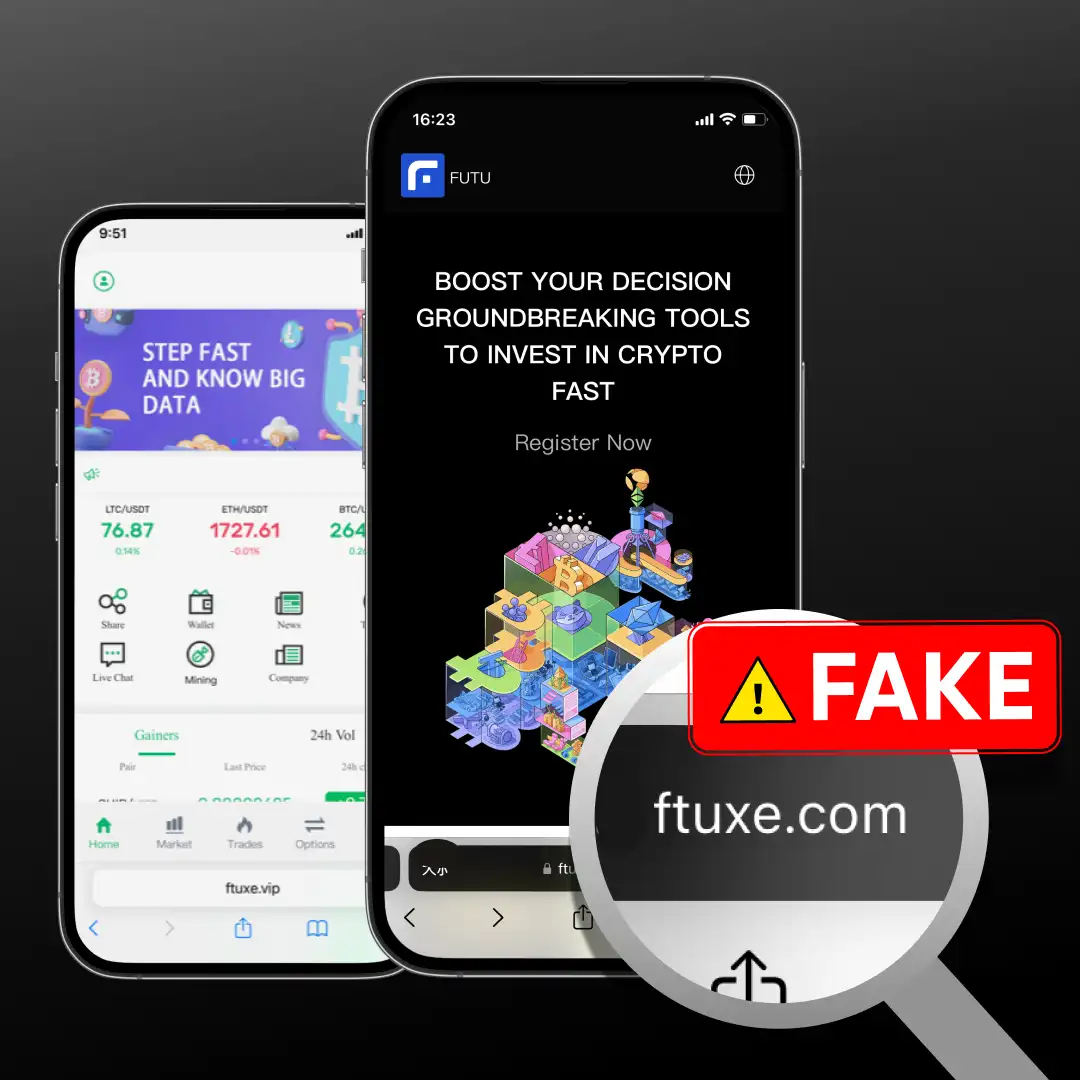

Moomoo advises our users and the general public to be alert to online investment scams. Recently, we have taken note of an increasing number of scam incidents in multiple markets where moomoo operates, including the U.S., Australia, Canada, Singapore, Malaysia, and Japan. The impact that fraud and scams can have on their victims is devastating. In the last month alone, we have seen three cases of the general public becoming victims of scams and identifie...

+5

79

20

22

Tak ashi

liked

Currently holding five stocks:

・ $Mitsubishi (8058.JP)$

$Mitsubishi UFJ Financial Group (8306.JP)$

$Sumitomo Mitsui Financial Group (8316.JP)$

I bought for long-term holding and dividend purposes:Mitsubishi Corporation, Mitsubishi UFJ Financial Group, and Sumitomo Mitsui Financial Group.are the three stocks.

・ $Tesla (TSLA.US)$

The earnings reports will be released soon. I originally planned to increase my shareholding after the stock price plummeted, but instead the stock price went up. It seems unlikely to experience a significant increase in the short term, and I believe that it won't be easy to find a good buying opportunity.

・ $Nippon Telegraph & Telephone (9432.JP)$

A few days ago, it hit the lowest price of the year, but the closing price on 4/24 has risen significantly, although it is less volatile than the Nikkei Average.

I hope the stock market will stabilize soon so that I can buy various stocks!![]()

・ $Mitsubishi (8058.JP)$

$Mitsubishi UFJ Financial Group (8306.JP)$

$Sumitomo Mitsui Financial Group (8316.JP)$

I bought for long-term holding and dividend purposes:Mitsubishi Corporation, Mitsubishi UFJ Financial Group, and Sumitomo Mitsui Financial Group.are the three stocks.

・ $Tesla (TSLA.US)$

The earnings reports will be released soon. I originally planned to increase my shareholding after the stock price plummeted, but instead the stock price went up. It seems unlikely to experience a significant increase in the short term, and I believe that it won't be easy to find a good buying opportunity.

・ $Nippon Telegraph & Telephone (9432.JP)$

A few days ago, it hit the lowest price of the year, but the closing price on 4/24 has risen significantly, although it is less volatile than the Nikkei Average.

I hope the stock market will stabilize soon so that I can buy various stocks!

Translated

13

2

Tak ashi

liked and voted

Tak ashi

liked

As of April 5th, the situation in the Middle East where this decision⁉️ has been changing back and forth, with Iran retaliating against Israel, will undoubtedly have some impact on crude oil, as well as the global economy. 💦

Depending on the situation in the Middle East, if crude oil prices surge

Looking back at inflation, there is concern that it will be more than just a question of lowering interest rates 🥺🥵

Depending on the situation in the Middle East, if crude oil prices surge

Looking back at inflation, there is concern that it will be more than just a question of lowering interest rates 🥺🥵

Translated

7

Tak ashi

liked

The first investment in US stocks is currently in the positive.

Translated

5

1

Tak ashi

liked

I want to benefit from sector rotation, so I hold State Street's sector ETFs to some extent, and I think it's good because capital goods and finance are quite high in unrealized gains.

Translated

18

2

Tak ashi

liked

Good evening Kyoe~![]()

![]()

![]()

From last night until early in the morning Japan time

US 🇺🇸 futures... huh![]() It felt like, and I had no choice but to burst into tears throughout the hall

It felt like, and I had no choice but to burst into tears throughout the hall

No ❗️ I won't cry because of something like this lol

The Middle East is unstable, and China should use only its own semiconductor chips ⁉️. Of each federal bank president

A statement that is ruthless and makes me feel like I understand it.

The fact that there is no interest rate hike is a slight one, but I have to engrave it in my mind. Interest rate cuts were a tailwind for stock prices

There's nothing better than being happy, but even if you don't cut interest rates, you won't be able to cut interest rates,

I've been told many times that America 🇺🇸 is a big country 💪 has a strong economy 💪

It's proof. I feel once again that it is a truly amazing country. FRB sticks up to 2%, but if that were to happen 🐙🦑 it would become a whiny economy

I wonder if that's why the economy will recession ⁉️ The terminal rate is high in the first place.

Hit Ishibashi in a moderate way

Why don't you cut interest rates at least once this year

What do you think. Of course ❗️ it depends on the data, but isn't that data just Uesumi ⁉️

Current situation ❗️ scene ❗️ are you watching ⁉️

There must be a lot of people who would be saved by cutting interest rates.

Also, it's still dependent on China

There's a place![]() I have to think it's something I don't have. This also applies to the Japanese government and companies.

I have to think it's something I don't have. This also applies to the Japanese government and companies.

Rather, Japan is more dependent...

From last night until early in the morning Japan time

US 🇺🇸 futures... huh

No ❗️ I won't cry because of something like this lol

The Middle East is unstable, and China should use only its own semiconductor chips ⁉️. Of each federal bank president

A statement that is ruthless and makes me feel like I understand it.

The fact that there is no interest rate hike is a slight one, but I have to engrave it in my mind. Interest rate cuts were a tailwind for stock prices

There's nothing better than being happy, but even if you don't cut interest rates, you won't be able to cut interest rates,

I've been told many times that America 🇺🇸 is a big country 💪 has a strong economy 💪

It's proof. I feel once again that it is a truly amazing country. FRB sticks up to 2%, but if that were to happen 🐙🦑 it would become a whiny economy

I wonder if that's why the economy will recession ⁉️ The terminal rate is high in the first place.

Hit Ishibashi in a moderate way

Why don't you cut interest rates at least once this year

What do you think. Of course ❗️ it depends on the data, but isn't that data just Uesumi ⁉️

Current situation ❗️ scene ❗️ are you watching ⁉️

There must be a lot of people who would be saved by cutting interest rates.

Also, it's still dependent on China

There's a place

Rather, Japan is more dependent...

Translated

12

3

Tak ashi

liked

Despite a decrease in sales for pharmaceutical company Humira, the company has raised its full-year profit forecast.

On Friday, AbbVie announced better-than-expected first-quarter earnings despite the continued decline in sales of its blockbuster autoimmune drug Humira due to competition from lower-priced new drugs.

The company reported net profit of 1.369 billion dollars (77 cents per share) for the first quarter, compared to 0.239 billion dollars (13 cents per share) in the same period last year. Adjusted earnings per share were $2.31, surpassing FactSet's consensus estimate of $2.26, but down from $2.46 in the same period last year. First-quarter revenue totaled $12.310 billion, a 0.7% increase from the same period last year, surpassing FactSet's consensus of $11.930 billion.

AbbVie raised its full-year profit forecast. The company now expects adjusted earnings per share to range from $11.13 to $11.33 for 2024, up from the previous forecast range of $10.97 to $11.17.

Humira, which is facing competition from new biosimilars, posted revenue of 2.27 billion dollars in the same quarter, a decrease of nearly 36% compared to the same period last year, but still exceeded FactSet's consensus of 2.21 billion dollars.

On Friday, AbbVie announced better-than-expected first-quarter earnings despite the continued decline in sales of its blockbuster autoimmune drug Humira due to competition from lower-priced new drugs.

The company reported net profit of 1.369 billion dollars (77 cents per share) for the first quarter, compared to 0.239 billion dollars (13 cents per share) in the same period last year. Adjusted earnings per share were $2.31, surpassing FactSet's consensus estimate of $2.26, but down from $2.46 in the same period last year. First-quarter revenue totaled $12.310 billion, a 0.7% increase from the same period last year, surpassing FactSet's consensus of $11.930 billion.

AbbVie raised its full-year profit forecast. The company now expects adjusted earnings per share to range from $11.13 to $11.33 for 2024, up from the previous forecast range of $10.97 to $11.17.

Humira, which is facing competition from new biosimilars, posted revenue of 2.27 billion dollars in the same quarter, a decrease of nearly 36% compared to the same period last year, but still exceeded FactSet's consensus of 2.21 billion dollars.

Translated

9

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)