takoyakimitaiyane

liked

$USD/JPY(USDJPY.FX$

The dollar, let's go up~

The dollar, let's go up~

Translated

7

takoyakimitaiyane

liked

Experts analyze the “20 million yen problem of old age” as “40 million yen,” depreciation of yen and high prices hit directly (TV Asahi (ANN)) - Yahoo! news

If the inflation rate continues at 3.5%, 20 million yen will be 40 million yen, isn't it?

It is simply a “number derived by arithmetic after making assumptions.”

I don't want to be made to dance because of this.

In times of deflation, “it's deflation!” I made a fuss, and when it became inflation, they said, “It's inflation!” Wouldn't it be a shame to just make a fuss?

So is the depreciation of the yen and the appreciation of the yen.

There are many people in the world who think about other responsibility, which is strongly steeped in anti-government ideology, and since the media promotes it, complaints come up no matter how they turn.

No, if there is a policy you are dissatisfied with, you should raise your voice.

For me, too, “let's do it” or “go over there?!” There is a policy I think like that.

There are no supporting political parties in particular.

However, “it's all the government's fault that I'm unhappy!” Something like that is the kind of conspiracy theory that doesn't make sense.

In the first place, it is impossible for “all citizens to live fully in their old age with only a pension.”

“Promises are different!” I think there is an assertion that...

If the inflation rate continues at 3.5%, 20 million yen will be 40 million yen, isn't it?

It is simply a “number derived by arithmetic after making assumptions.”

I don't want to be made to dance because of this.

In times of deflation, “it's deflation!” I made a fuss, and when it became inflation, they said, “It's inflation!” Wouldn't it be a shame to just make a fuss?

So is the depreciation of the yen and the appreciation of the yen.

There are many people in the world who think about other responsibility, which is strongly steeped in anti-government ideology, and since the media promotes it, complaints come up no matter how they turn.

No, if there is a policy you are dissatisfied with, you should raise your voice.

For me, too, “let's do it” or “go over there?!” There is a policy I think like that.

There are no supporting political parties in particular.

However, “it's all the government's fault that I'm unhappy!” Something like that is the kind of conspiracy theory that doesn't make sense.

In the first place, it is impossible for “all citizens to live fully in their old age with only a pension.”

“Promises are different!” I think there is an assertion that...

Translated

13

takoyakimitaiyane

voted

Good morning to all moomoo users!![]() Here are the key points of this morning's first report.

Here are the key points of this morning's first report.

● [Tokyo Stock Exchange Rate Forecast Range] 38,000 yen - 38,500 yen (closing price on the 24th 38,460 yen 08 sen)

● Yen is 155 yen to 30 yen against the dollar, reaching intervention alert level for the first time in 34 years

● Meta, sales forecasts did not reach market expectations - stock prices plummeted

● Boeing had a final deficit in January-March due to cash on hand cut in half and production cuts

● Prohibition laws are “unconstitutional,” TikTok announces legal battle - “we will win in the end”

● A “buy” signal for US stocks lights up, suggests the JP Morgan model

— MooMoo News Kathy

Market Overview

In the US stock market on the 24th, the NY Dow Jones Industrial Average fell 42 dollars 77 cents lower than the previous business day to 38,460 dollars 92 cents for the first time in 5 days. The Nasdaq Composite Stock Price Index rose 16.109 points to 15712.749. The Tokyo stock market on the 25th developed a sales advantage, and the Nikkei Stock Average is likely to fall and be in a soft position with a view to attacking and defending the 38,000 yen mark.

Top news

The yen is 155 yen to 30 yen against the dollar, reaching intervention alert level for the first time in 34 years

...

● [Tokyo Stock Exchange Rate Forecast Range] 38,000 yen - 38,500 yen (closing price on the 24th 38,460 yen 08 sen)

● Yen is 155 yen to 30 yen against the dollar, reaching intervention alert level for the first time in 34 years

● Meta, sales forecasts did not reach market expectations - stock prices plummeted

● Boeing had a final deficit in January-March due to cash on hand cut in half and production cuts

● Prohibition laws are “unconstitutional,” TikTok announces legal battle - “we will win in the end”

● A “buy” signal for US stocks lights up, suggests the JP Morgan model

— MooMoo News Kathy

Market Overview

In the US stock market on the 24th, the NY Dow Jones Industrial Average fell 42 dollars 77 cents lower than the previous business day to 38,460 dollars 92 cents for the first time in 5 days. The Nasdaq Composite Stock Price Index rose 16.109 points to 15712.749. The Tokyo stock market on the 25th developed a sales advantage, and the Nikkei Stock Average is likely to fall and be in a soft position with a view to attacking and defending the 38,000 yen mark.

Top news

The yen is 155 yen to 30 yen against the dollar, reaching intervention alert level for the first time in 34 years

...

Translated

![[Morning Report] The yen broke through 155 yen against the dollar, the first meta in 34 years, sales forecasts did not reach market expectations, and stock prices plummeted](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240425/7a52eaf223dc7249e21661d0c2a78b34.png/thumb?area=105&is_public=true)

![[Morning Report] The yen broke through 155 yen against the dollar, the first meta in 34 years, sales forecasts did not reach market expectations, and stock prices plummeted](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240425/df75c6e5e53242ff6d53924f8e748b50.png/thumb?area=105&is_public=true)

![[Morning Report] The yen broke through 155 yen against the dollar, the first meta in 34 years, sales forecasts did not reach market expectations, and stock prices plummeted](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240425/c3f0aeae25cc4bf947fff7f33d0f6a3a.png/thumb?area=105&is_public=true)

22

1

takoyakimitaiyane

voted

This article uses automatic translation for some of its parts

The fundamentals of AI-related stocks will drive further big tech performance

● While investors are closely watching the financial results announcements of approximately 180 S&P 500 companies, including major high-tech companies, they are also paying attention to geopolitical tension in the Middle East.

● As demand for AI expands and contributes greatly to the profits of high-tech companies, there is a possibility that global data center capital investment in 2024 will be underestimated at 300 billion US dollars.

● Despite recent sales, valuations in the tech sector are seen as attractive. Since the current predicted PER for Big Tech is still low, there is a possibility that it will exceed expectations.

Is the fall in semiconductor stocks not over yet?

● Semiconductor stocks have skyrocketed since the beginning of this year. Even after the recent decline, the year-to-date increase rate has exceeded 20%. Valuations are also extremely expensive, and PER (TTM, trailing twelve months) for March has reached 56 times. In addition to these factors, interest rate increases due to higher-than-expected inflation and geopolitical concerns...

The fundamentals of AI-related stocks will drive further big tech performance

● While investors are closely watching the financial results announcements of approximately 180 S&P 500 companies, including major high-tech companies, they are also paying attention to geopolitical tension in the Middle East.

● As demand for AI expands and contributes greatly to the profits of high-tech companies, there is a possibility that global data center capital investment in 2024 will be underestimated at 300 billion US dollars.

● Despite recent sales, valuations in the tech sector are seen as attractive. Since the current predicted PER for Big Tech is still low, there is a possibility that it will exceed expectations.

Is the fall in semiconductor stocks not over yet?

● Semiconductor stocks have skyrocketed since the beginning of this year. Even after the recent decline, the year-to-date increase rate has exceeded 20%. Valuations are also extremely expensive, and PER (TTM, trailing twelve months) for March has reached 56 times. In addition to these factors, interest rate increases due to higher-than-expected inflation and geopolitical concerns...

Translated

+2

31

9

takoyakimitaiyane

liked

$Tesla(TSLA.US$ 最高の買い場まであと少し!失望売り大歓迎ですね。

5

3

takoyakimitaiyane

liked and commented on

At the time of 2010, Elon Musk predicted that Japan would become Tesla's largest market outside the US.

However, now that more than 10 years have passed since then, EV manufacturers are not doing as well in Japan as Musk expected.

“There are regions like Japan where market share is significantly lower,” Musk said at the fourth quarter earnings briefing earlier this week. “At the very least, we should have a market share comparable to other non-Japanese automakers like Mercedes and BMW.”

However, Tesla has already faced off against major Japanese automobile manufacturers such as Toyota, Honda, Suzuki, and Nissan, but in reality, all EV manufacturers are struggling to make an impact in Japan.

In recent years, the number of EVs sold has increased rapidly in America and Europe, but despite Japan being one of the largest automobile markets in the world, sales of all-electric vehicles have been delayed.

One reason for this is that hybrid cars tend to dominate the Japanese market. Bloomberg reports that the sales volume of hybrid vehicles surpassed the total market share of gasoline cars and diesel cars for the first time in 2023.

Bloomberg...

However, now that more than 10 years have passed since then, EV manufacturers are not doing as well in Japan as Musk expected.

“There are regions like Japan where market share is significantly lower,” Musk said at the fourth quarter earnings briefing earlier this week. “At the very least, we should have a market share comparable to other non-Japanese automakers like Mercedes and BMW.”

However, Tesla has already faced off against major Japanese automobile manufacturers such as Toyota, Honda, Suzuki, and Nissan, but in reality, all EV manufacturers are struggling to make an impact in Japan.

In recent years, the number of EVs sold has increased rapidly in America and Europe, but despite Japan being one of the largest automobile markets in the world, sales of all-electric vehicles have been delayed.

One reason for this is that hybrid cars tend to dominate the Japanese market. Bloomberg reports that the sales volume of hybrid vehicles surpassed the total market share of gasoline cars and diesel cars for the first time in 2023.

Bloomberg...

Translated

6

4

takoyakimitaiyane

voted

[Present]

To the 3 users whose predictions for the closing price of the S&P 500 index at the end of 2023 were close to the actual closing price,1000 yen Amazon gift cardI will give it as a present.

[How to participate]

Japan timeUntil 23:59 p.m. on 12/29On, 12/30'sPredict the closing price of the S&P 500, please post! (Example: the closing price is expected to be $5,000).

To all Moo users

While the US stock market in 2023 is facing complex changes such as the global economy and monetary policy,Effects of the generative AI boomIt was a year that greatly boosted the average stock price. On the delicate balance of inflation, interest rates, and economic growth, a strong upward trend was formed in the US stock market. While experiencing periods of optimism and pessimism throughout the year, going forwardFederal Reserve System (Fed)Attention is drawn to its actions and its impact on the economy as a whole.

Before the beginning of 2024, let's take a break and forecast the closing price of the S&P 500 in 2023. The new year is just around the corner. Everyone'sHopes and aspirations, and the year so farReflections I have looked back on, expectations for myself in the future, etc.Let's also share it with each other....

To the 3 users whose predictions for the closing price of the S&P 500 index at the end of 2023 were close to the actual closing price,1000 yen Amazon gift cardI will give it as a present.

[How to participate]

Japan timeUntil 23:59 p.m. on 12/29On, 12/30'sPredict the closing price of the S&P 500, please post! (Example: the closing price is expected to be $5,000).

To all Moo users

While the US stock market in 2023 is facing complex changes such as the global economy and monetary policy,Effects of the generative AI boomIt was a year that greatly boosted the average stock price. On the delicate balance of inflation, interest rates, and economic growth, a strong upward trend was formed in the US stock market. While experiencing periods of optimism and pessimism throughout the year, going forwardFederal Reserve System (Fed)Attention is drawn to its actions and its impact on the economy as a whole.

Before the beginning of 2024, let's take a break and forecast the closing price of the S&P 500 in 2023. The new year is just around the corner. Everyone'sHopes and aspirations, and the year so farReflections I have looked back on, expectations for myself in the future, etc.Let's also share it with each other....

Translated

![[2023 Review] Get benefits: What is the closing price of the S&P 500 Index at the end of 2023?](https://sgsnsimg.moomoo.com/181000777/editor_image/9f433a51887b380a87b42d6df17d060f.jpg/thumb)

![[2023 Review] Get benefits: What is the closing price of the S&P 500 Index at the end of 2023?](https://sgsnsimg.moomoo.com/181000777/editor_image/1839b7592a1039dab577190e52dc8ad9.png/thumb)

68

202

takoyakimitaiyane

voted

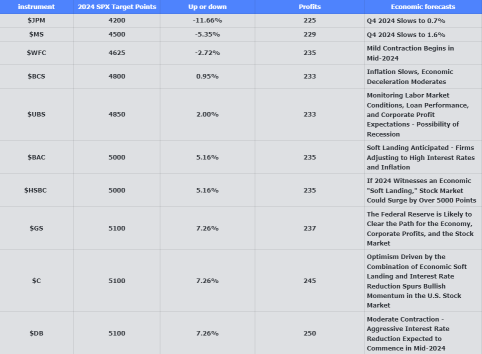

Perhaps, as we approach the end of 2022, most investment banks did not anticipate the robust performance of the U.S. stock market in 2023 amid the "fire" of interest rate hikes. As of the closing on December 22nd, the S&P 500 index and the Nasdaq 100 index have surged by over 24% and 54% respectively this year.

Data reveals that the gains in the S&P 500 this year are primarily driven by the "Big Seven" in the tech sector—Apple, Microsoft, Google, Amaz...

Data reveals that the gains in the S&P 500 this year are primarily driven by the "Big Seven" in the tech sector—Apple, Microsoft, Google, Amaz...

5

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)