★株神★

reacted to

Many people are probably concerned about when a significant upward breakout will occur.

Therefore, I will briefly explain the conditions necessary for the rise.

I highly recommend taking notes.

A chance to buy in large quantities arises when the following conditions are simultaneously met.

1. The profit growth of Japanese companies continues.

Key indicators:

Quarterly financial results of listed companies (especially major exporting companies).

ROE (Return on Equity)

The growth trend of EPS (Earnings Per Share)

Conditions:

If ROE continues to be above 10% and the annual growth rate of EPS is between 8% to 10% or more, it will contribute to the increase of the index.

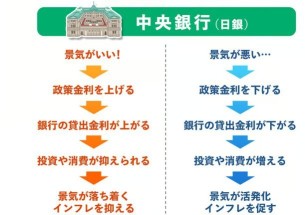

② Loose monetary policy + Aggressive fiscal policy = Factors for the rise of the stock market.

Important signals:

Whether the Bank of Japan maintains a low interest rate policy or postpones interest rate hikes.

Whether the government will announce large-scale economic stimulus measures (e.g., investment in green Energy, digitalization, and the Semiconductors industry).

Purchases of ETFs by government pension funds and the Bank of Japan.

The progression of Yen depreciation.

The Nikkei 225 includes many exporting companies, ...

Therefore, I will briefly explain the conditions necessary for the rise.

I highly recommend taking notes.

A chance to buy in large quantities arises when the following conditions are simultaneously met.

1. The profit growth of Japanese companies continues.

Key indicators:

Quarterly financial results of listed companies (especially major exporting companies).

ROE (Return on Equity)

The growth trend of EPS (Earnings Per Share)

Conditions:

If ROE continues to be above 10% and the annual growth rate of EPS is between 8% to 10% or more, it will contribute to the increase of the index.

② Loose monetary policy + Aggressive fiscal policy = Factors for the rise of the stock market.

Important signals:

Whether the Bank of Japan maintains a low interest rate policy or postpones interest rate hikes.

Whether the government will announce large-scale economic stimulus measures (e.g., investment in green Energy, digitalization, and the Semiconductors industry).

Purchases of ETFs by government pension funds and the Bank of Japan.

The progression of Yen depreciation.

The Nikkei 225 includes many exporting companies, ...

Translated

111

4

★株神★

reacted to

This is something you want to know when studying the market, so let's make an effort.

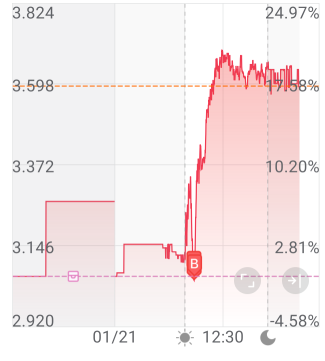

Have you ever heard the term "Flash Crash".

I will explain in detail, so please take a look at the image below.

In the Foreign Exchange market, the dollar-yen pair has shown significant volatility and is experiencing a major crash. The sudden drop in the market for stock investment and FX ETC is referred to as a "flash crash."

On January 3, 2019, Japan was on New Year's holiday with few market participants, but early that morning, the dollar-yen experienced a major crash. In just a few minutes, it plummeted from the 108 yen range to the 103 yen range.

The major cause of this is said to be the downward revision of revenue estimates announced by American Apple Inc. Due to fundamental factors, a flash crash occurred.

I will also explain an example of a flash crash in the stock market.

On May 6, 2010, there was a massive crash in the American stock market where the Dow Inc. average stock price plummeted by more than 1000 points in just about 10 minutes. At that time, it was the largest decline in history.

In an instant, about ...

Have you ever heard the term "Flash Crash".

I will explain in detail, so please take a look at the image below.

In the Foreign Exchange market, the dollar-yen pair has shown significant volatility and is experiencing a major crash. The sudden drop in the market for stock investment and FX ETC is referred to as a "flash crash."

On January 3, 2019, Japan was on New Year's holiday with few market participants, but early that morning, the dollar-yen experienced a major crash. In just a few minutes, it plummeted from the 108 yen range to the 103 yen range.

The major cause of this is said to be the downward revision of revenue estimates announced by American Apple Inc. Due to fundamental factors, a flash crash occurred.

I will also explain an example of a flash crash in the stock market.

On May 6, 2010, there was a massive crash in the American stock market where the Dow Inc. average stock price plummeted by more than 1000 points in just about 10 minutes. At that time, it was the largest decline in history.

In an instant, about ...

Translated

135

3

★株神★

reacted to

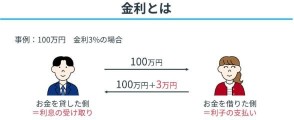

Many questions have been received asking, 'What are Interest Rates?'.

Interest rates refer to the fees incurred when borrowing or lending money.

What everyone is familiar with is the interest rate on Residence loans. For example, let's say you want a house that costs 45 million yen. Very few people can pay 45 million yen all at once, so typically, money is borrowed from a Bank and paid back to the Bank little by little over many years.

In fact, there are two conditions for interest rates.

Long-term interest rate: the interest rate on financial Assets for over one year. A typical example is a 10-year government bond.

Short-term interest rate: the interest rate on financial assets with a maturity of less than one year. A typical example is the policy interest rate.

Short-term interest rates are controlled by the Bank of Japan's monetary policy, while long-term interest rates fluctuate due to various factors such as supply and demand balance, changes in short-term interest rates, and price fluctuations. Among them, the four factors considered to be closely related are domestic economic conditions, domestic prices, exchange rates, and overseas interest rates.

By the way, variable interest rates for residential loans are based on short-term interest rates, while fixed interest rates are set based on long-term interest rates.

Interest rates and economic conditions are closely related and cannot be separated. Generally, when the economy is booming, interest rates rise, and during a recession, they decline...

Interest rates refer to the fees incurred when borrowing or lending money.

What everyone is familiar with is the interest rate on Residence loans. For example, let's say you want a house that costs 45 million yen. Very few people can pay 45 million yen all at once, so typically, money is borrowed from a Bank and paid back to the Bank little by little over many years.

In fact, there are two conditions for interest rates.

Long-term interest rate: the interest rate on financial Assets for over one year. A typical example is a 10-year government bond.

Short-term interest rate: the interest rate on financial assets with a maturity of less than one year. A typical example is the policy interest rate.

Short-term interest rates are controlled by the Bank of Japan's monetary policy, while long-term interest rates fluctuate due to various factors such as supply and demand balance, changes in short-term interest rates, and price fluctuations. Among them, the four factors considered to be closely related are domestic economic conditions, domestic prices, exchange rates, and overseas interest rates.

By the way, variable interest rates for residential loans are based on short-term interest rates, while fixed interest rates are set based on long-term interest rates.

Interest rates and economic conditions are closely related and cannot be separated. Generally, when the economy is booming, interest rates rise, and during a recession, they decline...

Translated

122

2

★株神★

reacted to

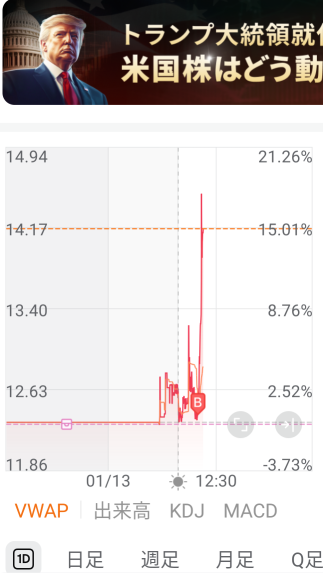

$Mitsubishi Heavy Industries (7011.JP)$

The expansion of gas turbine demand and the fulfillment of defense-related orders are driving profits higher, and record profits are expected. The stock price has surpassed the daily 5MA (2,234 yen) and 25MA (2,199 yen), entering an upward trend. If it can break through the recent Support near 2,300 yen, further upside potential is anticipated. Given the strong performance, Buy on dips is effective. A quality stock that one would want to hold for the medium to long term. The robust orders in Electrical Utilities and defense are driving performance, with both the nuclear and defense sectors also doing well. As the government promotes an increase in defense spending, it will undoubtedly rise as one of the Hot Stocks.

The expansion of gas turbine demand and the fulfillment of defense-related orders are driving profits higher, and record profits are expected. The stock price has surpassed the daily 5MA (2,234 yen) and 25MA (2,199 yen), entering an upward trend. If it can break through the recent Support near 2,300 yen, further upside potential is anticipated. Given the strong performance, Buy on dips is effective. A quality stock that one would want to hold for the medium to long term. The robust orders in Electrical Utilities and defense are driving performance, with both the nuclear and defense sectors also doing well. As the government promotes an increase in defense spending, it will undoubtedly rise as one of the Hot Stocks.

Translated

114

★株神★

reacted to

★株神★

reacted to

★株神★

reacted to

★株神★

reacted to

★株神★

reacted to

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)