the great white

voted

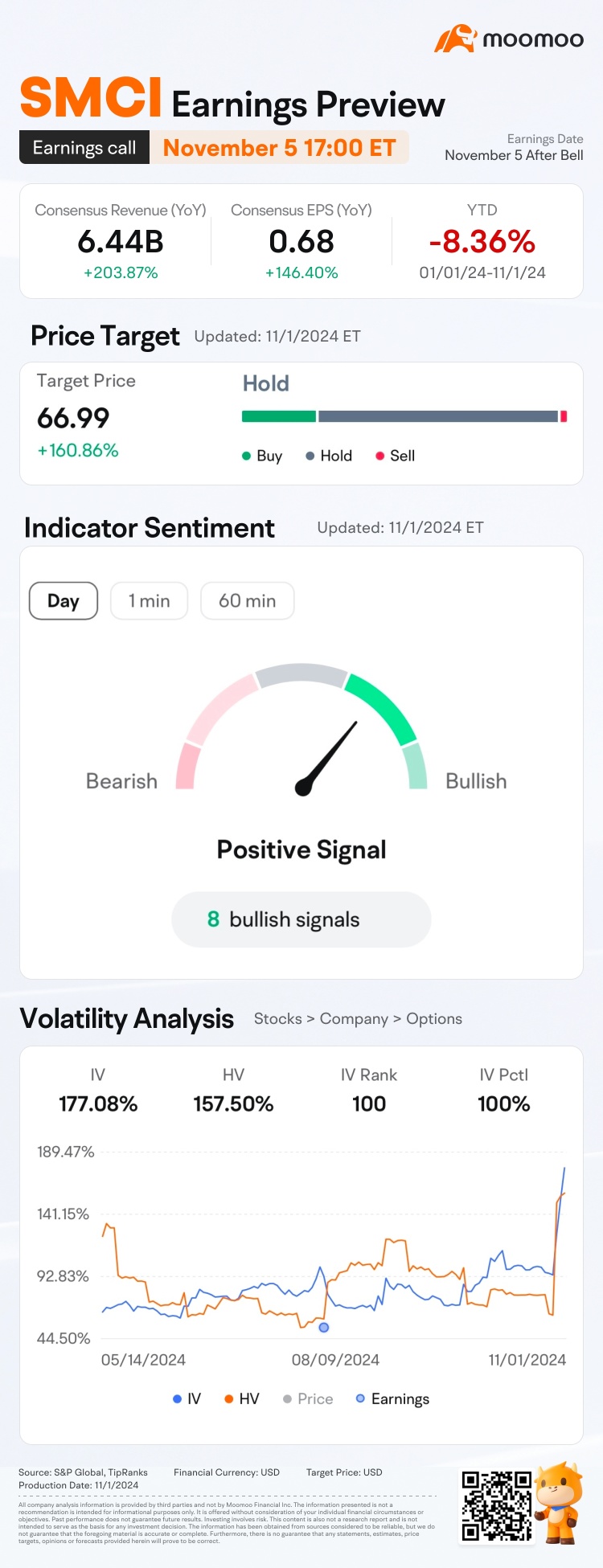

$Super Micro Computer (SMCI.US)$ Earnings call live stream is coming up! Based on the recent performance of SMCI, I have made predictions for 3 scenarios:

Best-case scenario forecast

Probability: 30%

In the best-case scenario, SMCI can successfully turn the situation around by:

1. Quickly finding and cooperating with a new auditing firm, and rebuilding market confidence through improved financial transparency.

2. Strengthening governance structure to ensure the independence and compliance of management and the board, and improving internal controls.

3. Maintaining technological innovation in AI servers and liquid cooling technology, seizing current market demand, and continuing to expand market share.

As these measures rely on internal efforts, the cooperation of external audit institutions, and the stability of market demands, the likelihood is around 30%. This probability takes into account the significant impact of the current negative news on the company, but its technological advantage in the AI and high-performance server fields may still bring the company a turnaround opportunity.

Worst-case scenario prediction

Probability: 50%

In the worst case scenario, the risks faced by SMCI are as follows:

1. Failure to effectively rectify financial and governance issues, leading to further escalation of audit issues, potentially triggering in-depth investigations by regulatory authorities and more severe financial reviews.

2. Loss of confidence from customers and investors, potentially resulting in customers switching to competitors, leading to a decrease in company revenue and market share.

3. The continuous low stock price or further decline may lead to financing difficulties, affecting future business expansion and technology...

Best-case scenario forecast

Probability: 30%

In the best-case scenario, SMCI can successfully turn the situation around by:

1. Quickly finding and cooperating with a new auditing firm, and rebuilding market confidence through improved financial transparency.

2. Strengthening governance structure to ensure the independence and compliance of management and the board, and improving internal controls.

3. Maintaining technological innovation in AI servers and liquid cooling technology, seizing current market demand, and continuing to expand market share.

As these measures rely on internal efforts, the cooperation of external audit institutions, and the stability of market demands, the likelihood is around 30%. This probability takes into account the significant impact of the current negative news on the company, but its technological advantage in the AI and high-performance server fields may still bring the company a turnaround opportunity.

Worst-case scenario prediction

Probability: 50%

In the worst case scenario, the risks faced by SMCI are as follows:

1. Failure to effectively rectify financial and governance issues, leading to further escalation of audit issues, potentially triggering in-depth investigations by regulatory authorities and more severe financial reviews.

2. Loss of confidence from customers and investors, potentially resulting in customers switching to competitors, leading to a decrease in company revenue and market share.

3. The continuous low stock price or further decline may lead to financing difficulties, affecting future business expansion and technology...

Translated

18

1

the great white

Set a live reminder

$Super Micro Computer (SMCI.US)$Super Micro Computer Q1 FY2025 earnings conference call is scheduled for November 5 at 5:00 PM ET /November 6 at 6:00 AM SGT /November 6 9:00 AM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from SMCI's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what managements have to say!

Disclaimer:

This presentation is for inf...

Beat or Miss?

What do you expect from SMCI's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what managements have to say!

Disclaimer:

This presentation is for inf...

SMCI Q1 FY2025 earnings conference call

Nov 5 16:00

11

5

the great white

voted

Hi mooers! ![]()

$Super Micro Computer (SMCI.US)$ is releasing its Q1 FY2025 earnings on November 5 after the bell. Unlock insights with SMCI Earnings Hub>>

On October 30, SMCI's audit firm EY resigned during their review, citing concerns about the company's governance and transparency. $Super Micro Computer (SMCI.US)$ 's share price dropped over 30% on that day. Do you expect any comment from SMCI's management? Subscribe to @Moo Live a...

$Super Micro Computer (SMCI.US)$ is releasing its Q1 FY2025 earnings on November 5 after the bell. Unlock insights with SMCI Earnings Hub>>

On October 30, SMCI's audit firm EY resigned during their review, citing concerns about the company's governance and transparency. $Super Micro Computer (SMCI.US)$ 's share price dropped over 30% on that day. Do you expect any comment from SMCI's management? Subscribe to @Moo Live a...

69

104

the great white

voted

$Broadcom (AVGO.US)$, which has soared 52% this year, will officially implement a 10-for-1 stock split plan after market close on July 12th (this Friday). This move follows $NVIDIA (NVDA.US)$, another major AI player, and has sparked market speculation.

Let's compare the recent stock trends of NVIDIA and Broadcom. From the announcement to the actual split, NVIDIA's share price jumped about 27%, and it has risen an additi...

Let's compare the recent stock trends of NVIDIA and Broadcom. From the announcement to the actual split, NVIDIA's share price jumped about 27%, and it has risen an additi...

+4

736

468

the great white

voted

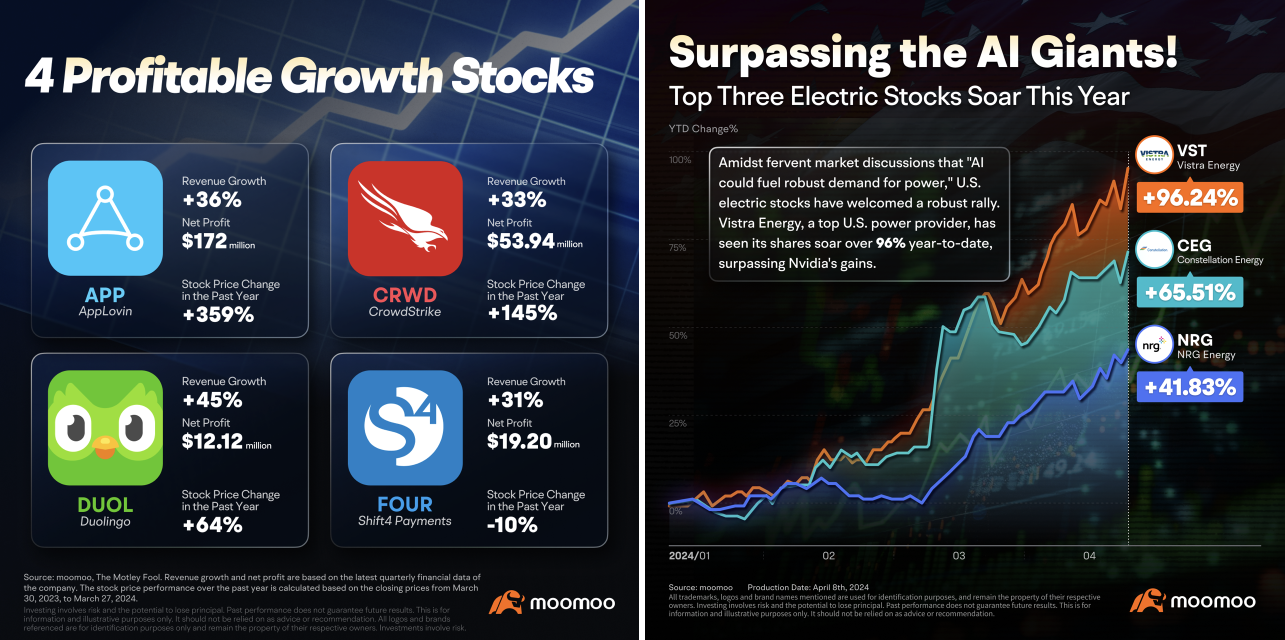

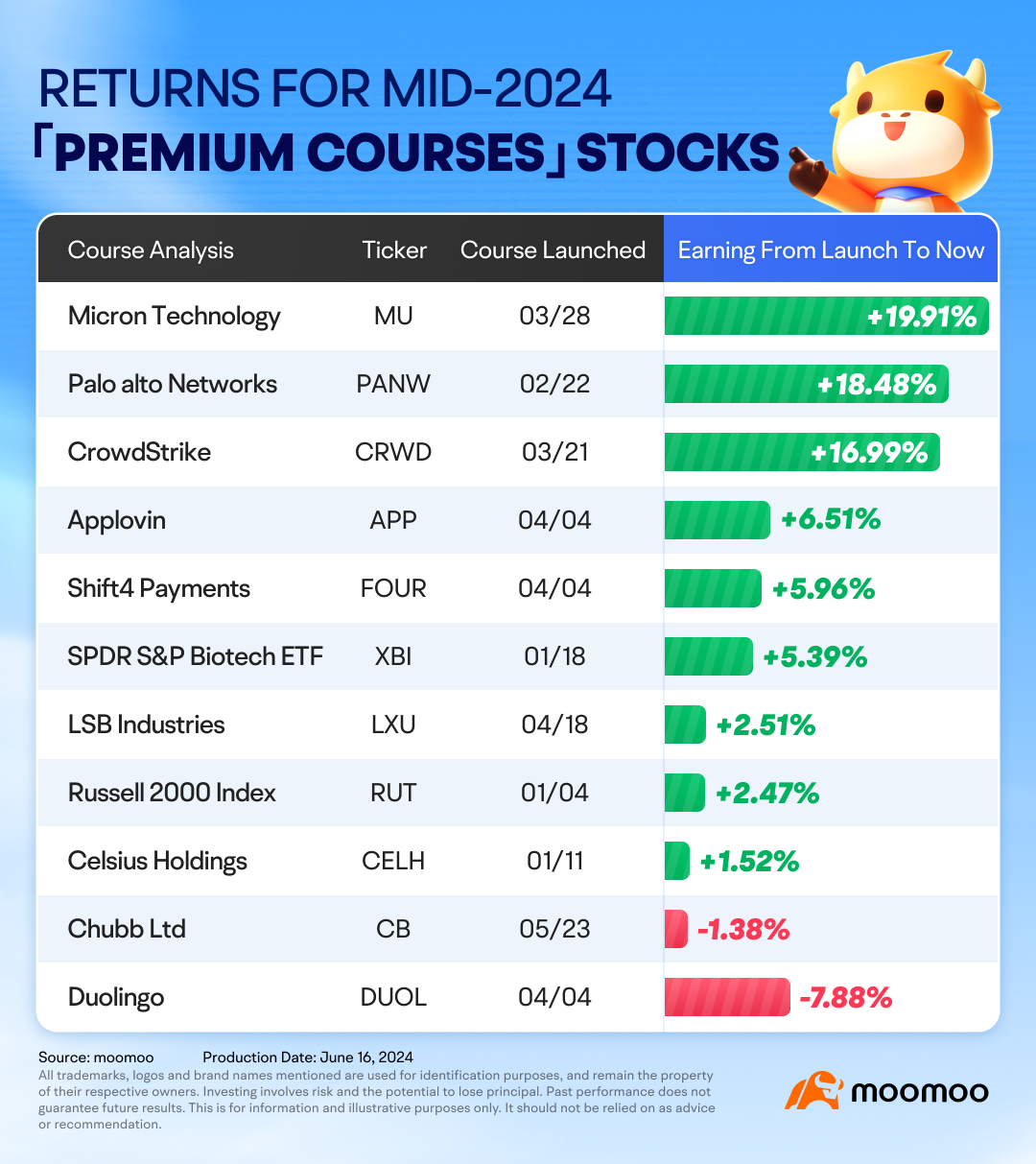

The U.S. stock market has hit new highs again! Congrats!👏 If you started investing in the US market at the beginning of the year and haven't made any major mistakes, you've probably seen some gains! 🎉

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have repeatedly reached new highs over...

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have repeatedly reached new highs over...

+5

437

226

2023 was a good year for stocks which were bought prior to that year.

the great white

commented on

I was exposed to stocks and shares when I worked for a brokerage firm. The interest in investment grew steadily. But it was like a roller coaster experience, up and down and sideways. I had my share of euphoria and heartaches too. 2020 was my turning point. I took the courageous step of buying when the market appears to be in its darkest moments

2

the great white

voted

Hey mooers,

After learning how to look for divergences between price and volume in the previous post, it's time to learn how to use on-balance volume (OBV) to confirm the underlying trend.

Traders often use the OBV to look for trend confirmations or try to correctly identify the strength and the direction of the ongoing trend. The OBV line's slope is also helpful. A trend accompanied by an OBV line with a steeper slope ...

After learning how to look for divergences between price and volume in the previous post, it's time to learn how to use on-balance volume (OBV) to confirm the underlying trend.

Traders often use the OBV to look for trend confirmations or try to correctly identify the strength and the direction of the ongoing trend. The OBV line's slope is also helpful. A trend accompanied by an OBV line with a steeper slope ...

58

19

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)