My strategy is built around a core concept: identifying the balance between supply and demand, anticipating price action when this balance shifts. This reflects basic economic theory in practice. The market, in my view, operates in microcycles, and recognizing these can present profitable opportunities.

Extreme Volatility (Red Zone):

Characterized by sudden surges in supply or demand, creating a significant imbalance that squeezes the order book. This ...

Extreme Volatility (Red Zone):

Characterized by sudden surges in supply or demand, creating a significant imbalance that squeezes the order book. This ...

10

1

I don’t want to waste your time, so here’s a quick summary. If you want more details, keep reading below.

Why I started trading:

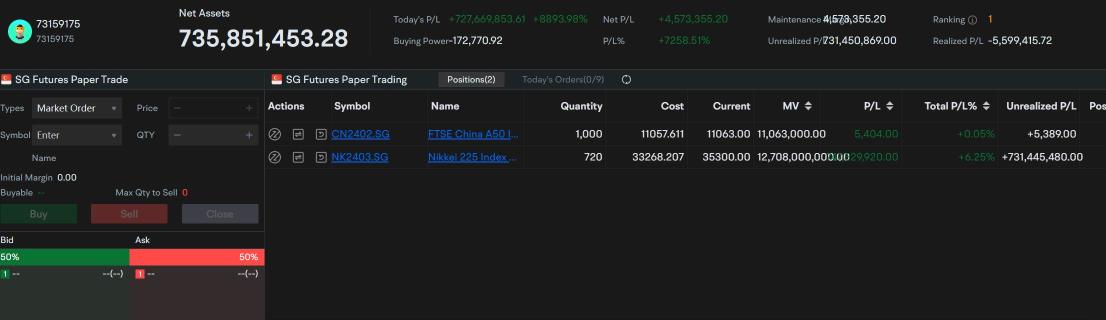

My main motivation was to earn money, driven by my interest in stocks and numbers. I began with minimal knowledge, doing equity day/swing trading based on technical analysis. Along the way, I learned more about complex instruments like futures and options through friends and by analyzing the underlying of product...

Why I started trading:

My main motivation was to earn money, driven by my interest in stocks and numbers. I began with minimal knowledge, doing equity day/swing trading based on technical analysis. Along the way, I learned more about complex instruments like futures and options through friends and by analyzing the underlying of product...

27

1

Identifying whther you are a trader or an investor is crucial to aligning your decisions with your goals and strategy. Traders Speculate, Investors Valuate.

It may sound straightforward, but in realisty, many people dont clearly define their approach when they initiate a position. This lack of clarity often leads to decisions that contradict their intended strategy, resulting in uncecessary losses.

As a trader, specul...

It may sound straightforward, but in realisty, many people dont clearly define their approach when they initiate a position. This lack of clarity often leads to decisions that contradict their intended strategy, resulting in uncecessary losses.

As a trader, specul...

5

1

Shi Zheng

liked

4

Shi Zheng

commented on

$Bed Bath & Beyond Inc (BBBY.US)$

if you are a currently a buy, can try a covered call.

i treat it as a dollar miner, 0.14 sell call premium for 0.46 share price 2weeks, and thats 30% in premium collected.

7-8 weeks if share price didnt go to zero and you will be in profit.

of course if you are thinking its going to delist soon, then my advice is not to do it.

if you are a currently a buy, can try a covered call.

i treat it as a dollar miner, 0.14 sell call premium for 0.46 share price 2weeks, and thats 30% in premium collected.

7-8 weeks if share price didnt go to zero and you will be in profit.

of course if you are thinking its going to delist soon, then my advice is not to do it.

1

1

Shi Zheng

voted

Spoiler:

![]() At the end of this post, there is a chance for you to win points!

At the end of this post, there is a chance for you to win points!

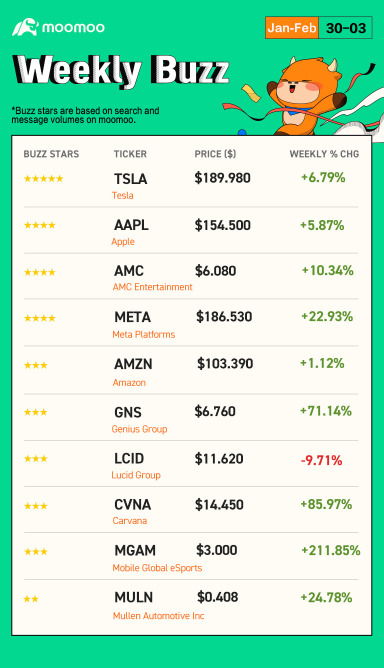

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on the moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

What an amazing week! Fed announced a smaller rate rise on Wednesday as inflation cooled...

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on the moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

What an amazing week! Fed announced a smaller rate rise on Wednesday as inflation cooled...

+8

44

53

Shi Zheng

voted

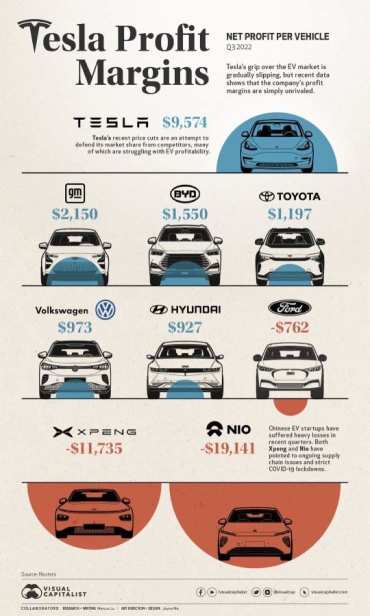

At the beginning of 2022, the FED started the quantitative tightening policy. Since then, the stock market has gone all the way down without any hesitation. But a shocking plot twist happened in the first month of 2023. Almost everything went up crazily.

Some investors are benefiting from the upward trend. However, others with negative expectations might feel like taking a mighty punch right in their faces.

@Johnsh: Powell Pummeling Puts Visual $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

���������...

Some investors are benefiting from the upward trend. However, others with negative expectations might feel like taking a mighty punch right in their faces.

@Johnsh: Powell Pummeling Puts Visual $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

���������...

+10

57

78

Shi Zheng

voted

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Shi Zheng : What do you think?