TJ HWW

voted

Hi, mooers!

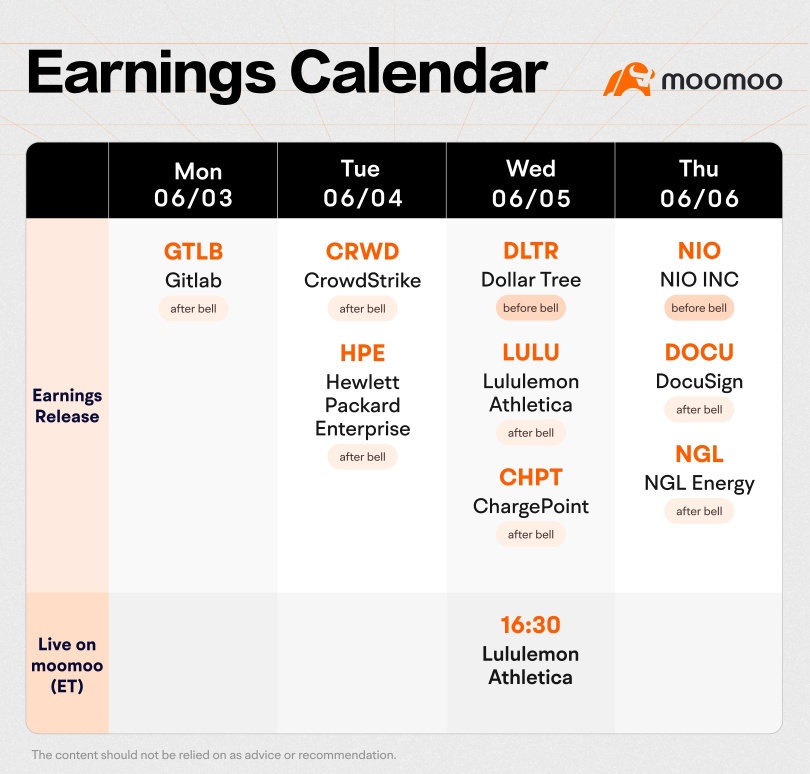

Check out moomoo's fresh earnings calendar to start this week!![]()

This week, various companies including $Lululemon Athletica (LULU.US)$, $NIO Inc (NIO.US)$, $CrowdStrike (CRWD.US)$ and $DocuSign (DOCU.US)$ are releasing their earnings. Will they bring good results and boost the stock prices? Let's make a guess!

Rewards

![]() An equal share of 3,000 points: For mooers who correctly guess the stock who makes the biggest g...

An equal share of 3,000 points: For mooers who correctly guess the stock who makes the biggest g...

Check out moomoo's fresh earnings calendar to start this week!

This week, various companies including $Lululemon Athletica (LULU.US)$, $NIO Inc (NIO.US)$, $CrowdStrike (CRWD.US)$ and $DocuSign (DOCU.US)$ are releasing their earnings. Will they bring good results and boost the stock prices? Let's make a guess!

Rewards

17

11

2

TJ HWW

liked

$DraftKings (DKNG.US)$ Today we will take the last year of price quotation and we will work on all the relevant levels we will e paying attention

a) The main aspect we can see are the exteriors support and resistance levels (these are our framework)

b) Inside our range, we can draw a trendline that may work as a relevant support level . From there, we can expect a bounce and the following correction (Trading Opportunity 1). As we are breakout traders, these corrections are what we are looking for before entering the market

c) If the price breaks the previously mentioned level, we will aim to see the price on the next support level (lower zone of our range) at 35USD. From there, we will expect the same sequence: bounce + the following correction.

d) Both trading opportunities will share the same target 64USD, however, it is important to mention the inner resistance level at 56.00 USD (there we should be open to possible corrections)

e) Final Idea: Remember, the best way of developing high-quality setups is by waiting for the price to reach high-quality zones. Working setups from there increase your odds of success

Thanks for reading!

a) The main aspect we can see are the exteriors support and resistance levels (these are our framework)

b) Inside our range, we can draw a trendline that may work as a relevant support level . From there, we can expect a bounce and the following correction (Trading Opportunity 1). As we are breakout traders, these corrections are what we are looking for before entering the market

c) If the price breaks the previously mentioned level, we will aim to see the price on the next support level (lower zone of our range) at 35USD. From there, we will expect the same sequence: bounce + the following correction.

d) Both trading opportunities will share the same target 64USD, however, it is important to mention the inner resistance level at 56.00 USD (there we should be open to possible corrections)

e) Final Idea: Remember, the best way of developing high-quality setups is by waiting for the price to reach high-quality zones. Working setups from there increase your odds of success

Thanks for reading!

2

TJ HWW

liked

$SIA (C6L.SG)$ Get a cup of coffee and enjoy the day. Go back to your work or classes.

Stop looking at SIA if you are not investing for quick cash. There are lot of quick cash stocks out there .

Set a rise alert +10 to +15% then forget about it. Don't let SIA spoil the mood. It going to fluctuate non-stop till the whole world open up..

Stop looking at SIA if you are not investing for quick cash. There are lot of quick cash stocks out there .

Set a rise alert +10 to +15% then forget about it. Don't let SIA spoil the mood. It going to fluctuate non-stop till the whole world open up..

15

9

TJ HWW

liked

$SIA (C6L.SG)$ Disappointing closed today at $5.08 despite all the good news. Lots of patience is required as the world infection rate seem increasing very rapidly with no sign of stabilising yet.

Currently, the world infection rate stands at 704,930 new cases per day, just yesterday alone.

However, technically, an ascending triangle is forming. May need another few more days before breaking on the upside. For the time being, may be ranging around $4.96 to $5.18, base on the chart.

Currently, the world infection rate stands at 704,930 new cases per day, just yesterday alone.

However, technically, an ascending triangle is forming. May need another few more days before breaking on the upside. For the time being, may be ranging around $4.96 to $5.18, base on the chart.

7

4

TJ HWW

liked

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Apple (AAPL.US)$ $Advanced Micro Devices (AMD.US)$ $Alphabet-A (GOOGL.US)$ $Meta Platforms (FB.US)$ $Tesla (TSLA.US)$ $Microsoft (MSFT.US)$ $Alphabet-C (GOOG.US)$ $Alibaba (BABA.US)$ $Boeing (BA.US)$ $Moderna (MRNA.US)$

39

13

41

TJ HWW

commented on and voted

Yooo my mooers,

How have you been![]() ? Welcome to join mooSchool Summer Camp S4!

? Welcome to join mooSchool Summer Camp S4!

I would like to share with you a formula, can you recognize it?

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Bingo! It's the so called the 'option value formula', which means the total value of option premium equals to the sum of intrinsic value and time value.

If you have traded or plan to trade US options in the future, there is a feature of moomoo that you can't miss: Unusual US Option...

How have you been

I would like to share with you a formula, can you recognize it?

Bingo! It's the so called the 'option value formula', which means the total value of option premium equals to the sum of intrinsic value and time value.

If you have traded or plan to trade US options in the future, there is a feature of moomoo that you can't miss: Unusual US Option...

+2

131

87

28

TJ HWW

commented on

$Tesla (TSLA.US)$ $Alibaba (BABA.US)$ $Apple (AAPL.US)$ $Amazon (AMZN.US)$ $Moderna (MRNA.US)$ $Microsoft (MSFT.US)$ $Meta Platforms (FB.US)$ $Alphabet-A (GOOGL.US)$ $NVIDIA (NVDA.US)$ $Snap Inc (SNAP.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

52

15

33

TJ HWW

liked

Options flow started the Friday session extremely messy as both call and put buyers were active nearly at an even pace. That being said, a big chunk of morning protection steemed from China-related issues and once that activity dried up, flow had a much cleaner look to it into the afternoon.

Mega-cap tech and secular growth(lower rates related) were once again where buyers maintained focus. Players were on the hunt for that lower yields theme needing more exposure into tech earnings, but also because of an expectation for a more dovish Fed this week, coming off a spike in worldwide health conditions.

On the sentiment front

Short-term sentiment finally pushed higher off Friday's rally but finished short of landing in the "caution zone", many intermediate-term indicators hardly budged last week.

...

Mega-cap tech and secular growth(lower rates related) were once again where buyers maintained focus. Players were on the hunt for that lower yields theme needing more exposure into tech earnings, but also because of an expectation for a more dovish Fed this week, coming off a spike in worldwide health conditions.

On the sentiment front

Short-term sentiment finally pushed higher off Friday's rally but finished short of landing in the "caution zone", many intermediate-term indicators hardly budged last week.

...

+2

74

20

151

TJ HWW

liked

Also known as : How to withdraw funds from moomoo to my bank account? How to withdraw my money from Funds/Unit Trusts?

This is written from the perspective of a moomoo Singapore customer. If you are in other countries, the information regarding conversion to SGD and withdrawing to a bank account in Singapore is not applicable to you.

Withdrawal FAQ for those in the US

Click the link and scroll down to FAQ on Deposits and...

This is written from the perspective of a moomoo Singapore customer. If you are in other countries, the information regarding conversion to SGD and withdrawing to a bank account in Singapore is not applicable to you.

Withdrawal FAQ for those in the US

Click the link and scroll down to FAQ on Deposits and...

217

183

368

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)