Tracer

liked

$NIO Inc (NIO.US)$Those who think Nio is rubbish better exit to Tesla, Li or Huawei, those who think Nio can grow, need to wait for quite some time.

Those who want to swing must know how. I know someone that keeps cursing is not a Nio investor, he just comes to take profits "In and Out" within a few hours and they hate me.. Hahahaha..

Those who want to swing must know how. I know someone that keeps cursing is not a Nio investor, he just comes to take profits "In and Out" within a few hours and they hate me.. Hahahaha..

20

18

Tracer

voted

$TENCENT (00700.HK)$

Sound Investment or Not?

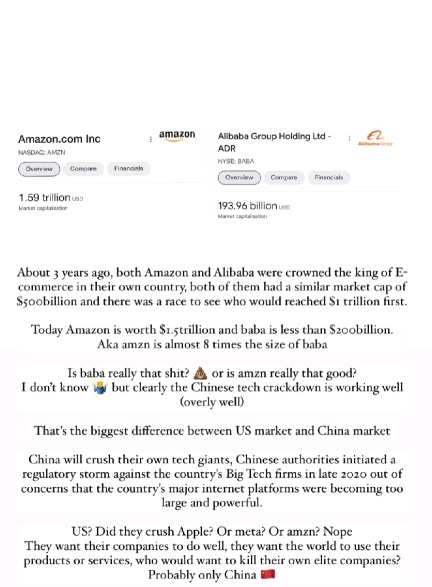

Yet again, another great chinese company whose share price has been performing poorly over the past few years. Tencent has a very strong balance sheet, and they make billions of dollars every quarter. It is only natural to think that this company would be a sound investment. So why has the share price been falling for so long, and when is a good time to buy in?

The chinese economy has been performing poorly over the past few yea...

Sound Investment or Not?

Yet again, another great chinese company whose share price has been performing poorly over the past few years. Tencent has a very strong balance sheet, and they make billions of dollars every quarter. It is only natural to think that this company would be a sound investment. So why has the share price been falling for so long, and when is a good time to buy in?

The chinese economy has been performing poorly over the past few yea...

+3

2

13

Tracer

liked

$TENCENT (00700.HK)$ $Alibaba (BABA.US)$ why xi jinping why you wanna kill your own domestic companies when they are doing well racking in billions in profit.

4

7

Tracer

liked

$SIA (C6L.SG)$ bought during covid at a low of 3.8 and after close to 4 years to get back to 6 plus dollar. What a crawl. if you want to buy in at this price, i would not go in if you are an active investor.

3

2

Tracer

voted

1

Tracer

liked

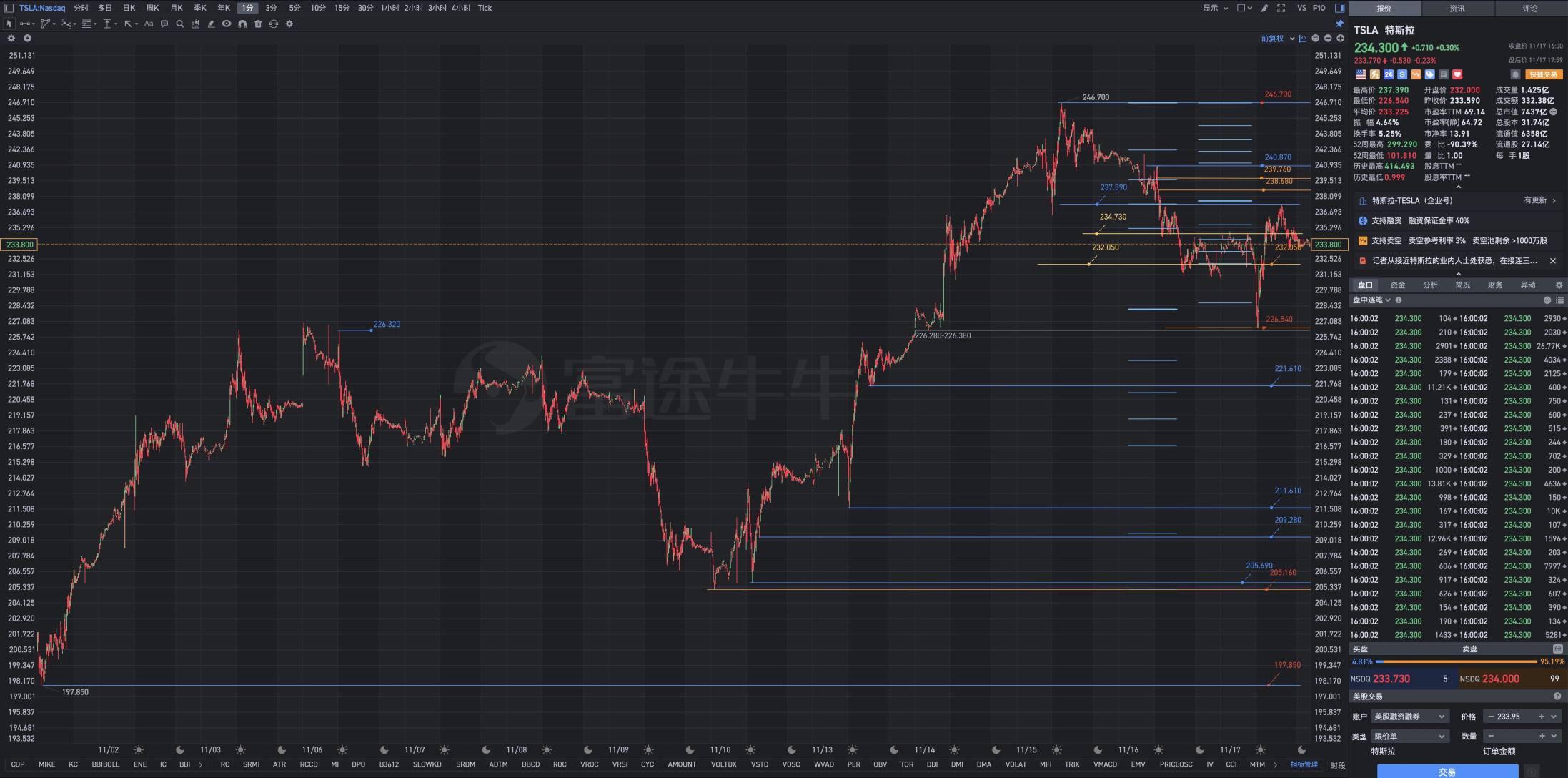

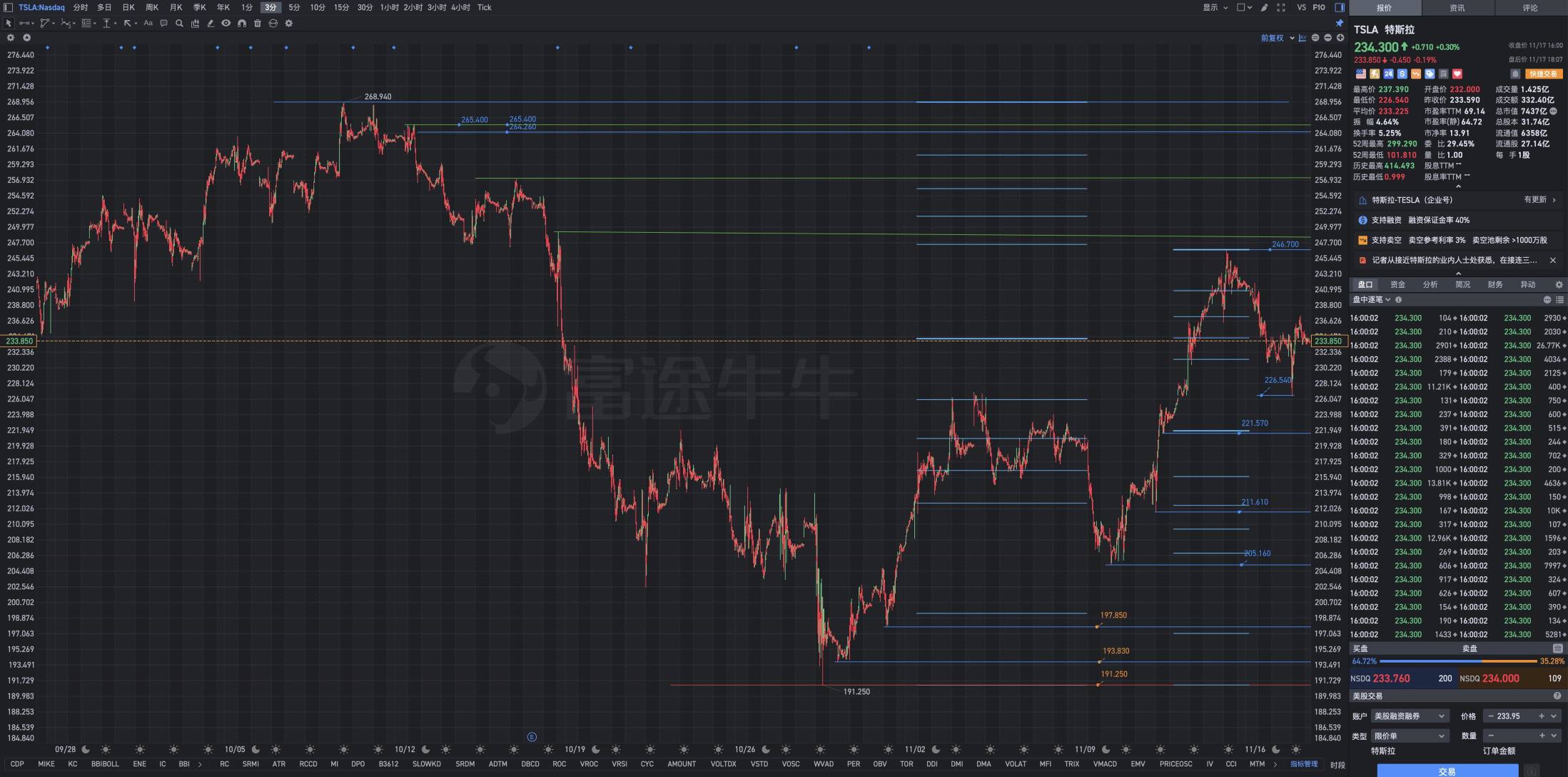

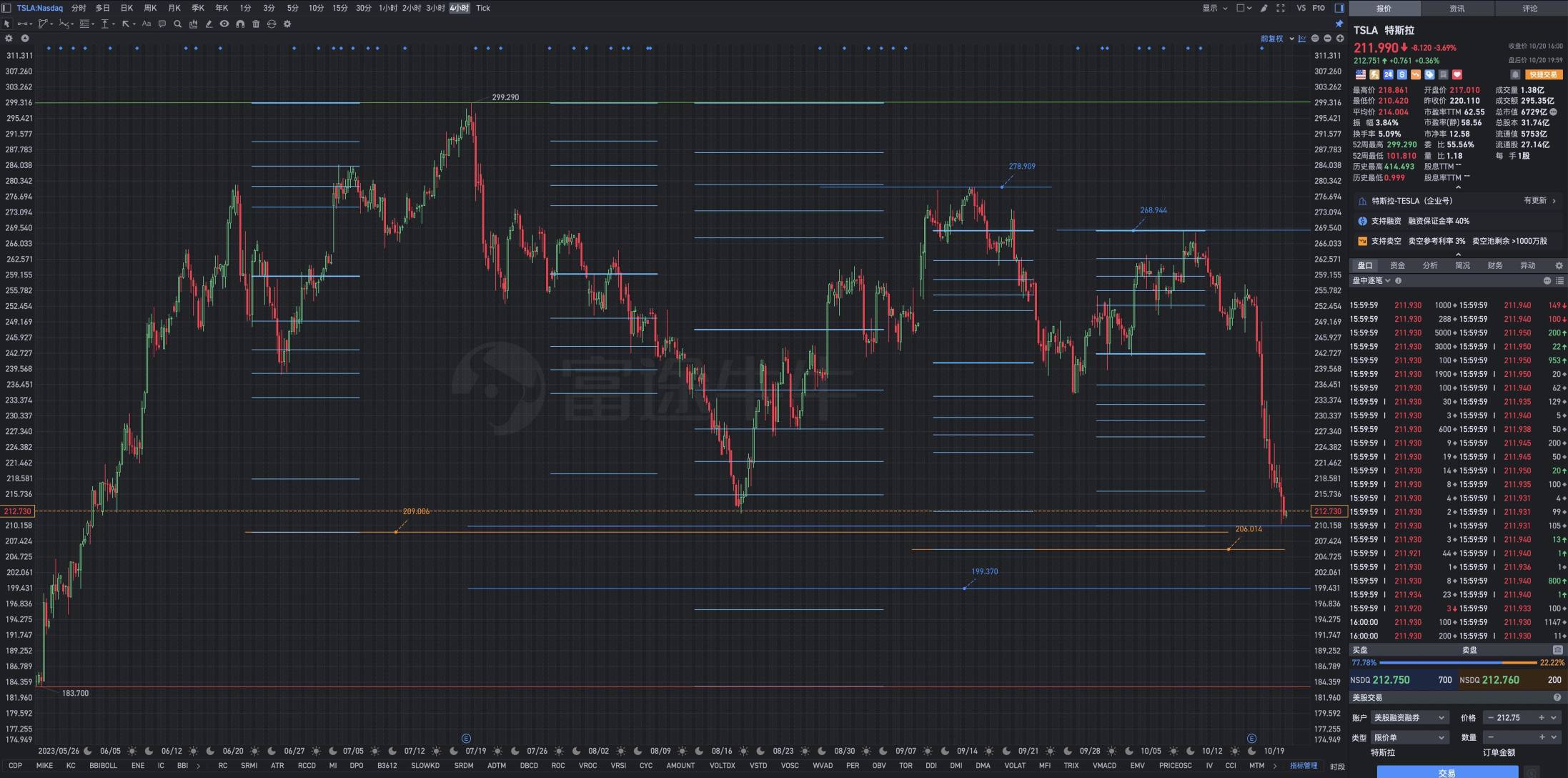

$Tesla (TSLA.US)$

1. JC is optimistic about the US index and is even more bullish on Tesla. If there is a decline, especially if there are unexpected bearish news and continuous large-scale declines, JC will conduct in-depth research on it, and gradually and accurately build positions. Why emphasize relative accuracy? Due to the respect for the "uncertainty principle" in the financial market, JC can only approach the median value of the extreme value area infinitely.

2. Next week, we will implement a new modeling quantitative analysis and carry out surgical and relatively accurate framework shotgun trading.

3. Divide the positions into two parts, with 60% for medium and long-term holding and 40% for surgical and relatively accurate low-buy high-sell arbitrage trading. Elastic positions, dynamic holdings.

The chart tells us everything, and JC's views are all revealed in the chart.

5. The iron law of trading battles in the JC family (emphasis cannot be repeated too much):

Win in bear markets; win in amplitudes; win in courage; win in wisdom; win in tolerance; win in learning; win in change; win in adaptation; win in mathematics; win in physics; win in models; win in functions; win in vibrations; win in quantification; win in frameworks; win in moderation; win in probabilities; win in technology; win in psychology; win in agility; win in flexibility; win in oscillations; win in long-term; win in investments; win in mentality; win in resilience.

Losing in closure, losing in self, losing in solidification, losing in self-abandonment, losing in self-deception, losing in chasing high, losing in chasing strength, losing in chasing high, losing in stagnation...

1. JC is optimistic about the US index and is even more bullish on Tesla. If there is a decline, especially if there are unexpected bearish news and continuous large-scale declines, JC will conduct in-depth research on it, and gradually and accurately build positions. Why emphasize relative accuracy? Due to the respect for the "uncertainty principle" in the financial market, JC can only approach the median value of the extreme value area infinitely.

2. Next week, we will implement a new modeling quantitative analysis and carry out surgical and relatively accurate framework shotgun trading.

3. Divide the positions into two parts, with 60% for medium and long-term holding and 40% for surgical and relatively accurate low-buy high-sell arbitrage trading. Elastic positions, dynamic holdings.

The chart tells us everything, and JC's views are all revealed in the chart.

5. The iron law of trading battles in the JC family (emphasis cannot be repeated too much):

Win in bear markets; win in amplitudes; win in courage; win in wisdom; win in tolerance; win in learning; win in change; win in adaptation; win in mathematics; win in physics; win in models; win in functions; win in vibrations; win in quantification; win in frameworks; win in moderation; win in probabilities; win in technology; win in psychology; win in agility; win in flexibility; win in oscillations; win in long-term; win in investments; win in mentality; win in resilience.

Losing in closure, losing in self, losing in solidification, losing in self-abandonment, losing in self-deception, losing in chasing high, losing in chasing strength, losing in chasing high, losing in stagnation...

Translated

+1

2

Tracer

voted

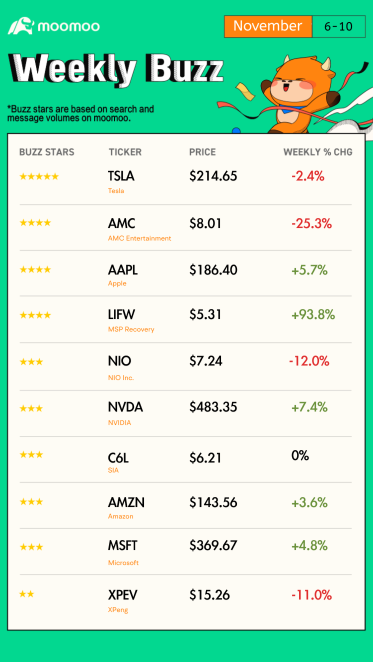

Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of this week! Answer the Weekly Topic question for a chance to win an award next week!

Make Your Choice

Weekly Buzz: Has Powell closed the door on early rate cut hopes?

Wall Street saw another dizzying week. As usual, the debate conti...

Make Your Choice

Weekly Buzz: Has Powell closed the door on early rate cut hopes?

Wall Street saw another dizzying week. As usual, the debate conti...

37

21

13

Tracer

liked

$Tesla (TSLA.US)$ Is there a possibility of 150-160?

Translated

1

1

Tracer

liked

$Tesla (TSLA.US)$

During this period, various hints suggest that the index is luring short sellers, either explicitly or implicitly. The M-top and W-bottom are twin siblings that often undergo cyclical changes. Tesla's almost vertical decline itself implies that the end of the bear market could come at any time.

Block orders at the level of large orders have this ability, but the main force did not do so. Instead, they dumped and warehoused in high-performance stocks, which is conducive to buying lower chips and making more profits.

There is a way to stop this short-selling force, but it hasn't appeared yet...

...

They have already settled on Nvidia, so Nvidia will be the first to set an example and launch a counterattack.

During this period, various hints suggest that the index is luring short sellers, either explicitly or implicitly. The M-top and W-bottom are twin siblings that often undergo cyclical changes. Tesla's almost vertical decline itself implies that the end of the bear market could come at any time.

Block orders at the level of large orders have this ability, but the main force did not do so. Instead, they dumped and warehoused in high-performance stocks, which is conducive to buying lower chips and making more profits.

There is a way to stop this short-selling force, but it hasn't appeared yet...

...

They have already settled on Nvidia, so Nvidia will be the first to set an example and launch a counterattack.

Translated

5

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)