Trillion Gamer

voted

Last week, the markets were dominated by escalating trade tensions, with tariffs on steel and aluminum imports sparking fears of a global trade war. The European Union retaliated with counter-tariffs on $28 billion worth of U.S. goods, further spooking investors. Meanwhile, concerns over valuations and earnings continued to weigh on the tech sector, with $Adobe (ADBE.US)$ and $Intel (INTC.US)$ making headlines f...

+13

2072

359

23

Trillion Gamer

voted

Week 2's curtain falls, but the drama's just beginning!

Who's ruling our top 10 paper trading leaderboard this week?

Brace yourself for the big reveal! 📈💰

👏Congratulations to the top 10 trading titans!

@iamshf @103226286 @105405816 @ChangHorng @103178067 @105227245 @105386639 @Kenwoo @ALAN86 @Ckent2213

*The profit/loss (P/L) data is based on trading activity from March 10th to March 15th.

Last week, the standout performances of top traders revealed s...

Who's ruling our top 10 paper trading leaderboard this week?

Brace yourself for the big reveal! 📈💰

👏Congratulations to the top 10 trading titans!

@iamshf @103226286 @105405816 @ChangHorng @103178067 @105227245 @105386639 @Kenwoo @ALAN86 @Ckent2213

*The profit/loss (P/L) data is based on trading activity from March 10th to March 15th.

Last week, the standout performances of top traders revealed s...

+4

183

110

13

Trillion Gamer

voted

Hey mooer! Attention AI enthusiasts, $NVIDIA (NVDA.US)$ GTC 2025 is coming! 🚀

NVIDIA GTC 2025 is returning to San Jose from March 17-21, bringing together industry leaders to explore the future of quantum computing and AI. This premier event offers a unique opportunity to dive deep into cutting-edge technologies that are shaping our future.

Highlights:

– Keynote speech by NVIDIA CEO Jensen Huang (March 18, 10:00 a.m. PT) on the topic "Driving t...

NVIDIA GTC 2025 is returning to San Jose from March 17-21, bringing together industry leaders to explore the future of quantum computing and AI. This premier event offers a unique opportunity to dive deep into cutting-edge technologies that are shaping our future.

Highlights:

– Keynote speech by NVIDIA CEO Jensen Huang (March 18, 10:00 a.m. PT) on the topic "Driving t...

GTC Keynote With NVIDIA CEO Jensen Huang

Mar 19 01:00

368

340

61

Trillion Gamer

voted

$NVIDIA (NVDA.US)$

Jensen Huang, Founder and CEO of Nvidia, will deliver the keynote at GTC 2025. This event, scheduled for March 18 at 1:00 PM ET / March 19 at 1:00 AM SGT / March 19 at 4:00 AM AEST, will cover groundbreaking advancements in AI, digital twins, cloud technologies, and sustainable computing.

Huang's keynote will provide a visionary roadmap of Nvidia's role in shaping the AI-driven world. Subscribe to join the live NOW!

NVIDIA Stock Predicti...

Jensen Huang, Founder and CEO of Nvidia, will deliver the keynote at GTC 2025. This event, scheduled for March 18 at 1:00 PM ET / March 19 at 1:00 AM SGT / March 19 at 4:00 AM AEST, will cover groundbreaking advancements in AI, digital twins, cloud technologies, and sustainable computing.

Huang's keynote will provide a visionary roadmap of Nvidia's role in shaping the AI-driven world. Subscribe to join the live NOW!

NVIDIA Stock Predicti...

GTC Keynote With NVIDIA CEO Jensen Huang

Mar 19 01:00

431

331

65

Trillion Gamer

liked and commented on

I want to be honest on how i lose a fortune, so you can learn.

I’m sharing this to warn others. I lost RM100k trading stocks like $ECOWLD (8206.MY)$ $SIMEPROP (5288.MY)$ and $NATGATE (0270.MY)$ on Moomoo. My biggest mistake? Trusting a conman’s “tips” to gamble on NationGate. I ignored my own doubts, got greedy, and kept throwing money into stocks I didn’t fully understand. Now I’m paying the price.

Property stocks like EcoWorld and Simeprop looked stable at first, b...

I’m sharing this to warn others. I lost RM100k trading stocks like $ECOWLD (8206.MY)$ $SIMEPROP (5288.MY)$ and $NATGATE (0270.MY)$ on Moomoo. My biggest mistake? Trusting a conman’s “tips” to gamble on NationGate. I ignored my own doubts, got greedy, and kept throwing money into stocks I didn’t fully understand. Now I’m paying the price.

Property stocks like EcoWorld and Simeprop looked stable at first, b...

97

16

5

Trillion Gamer

voted

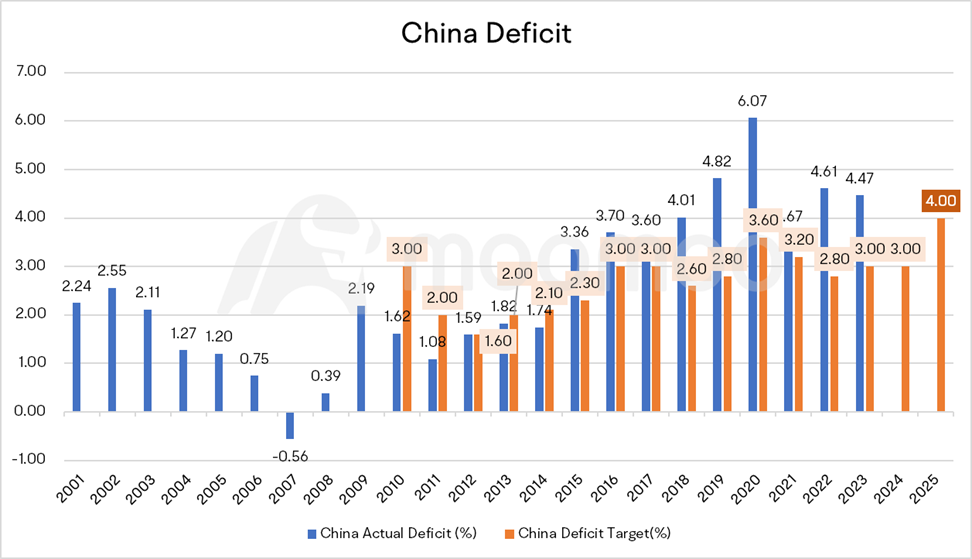

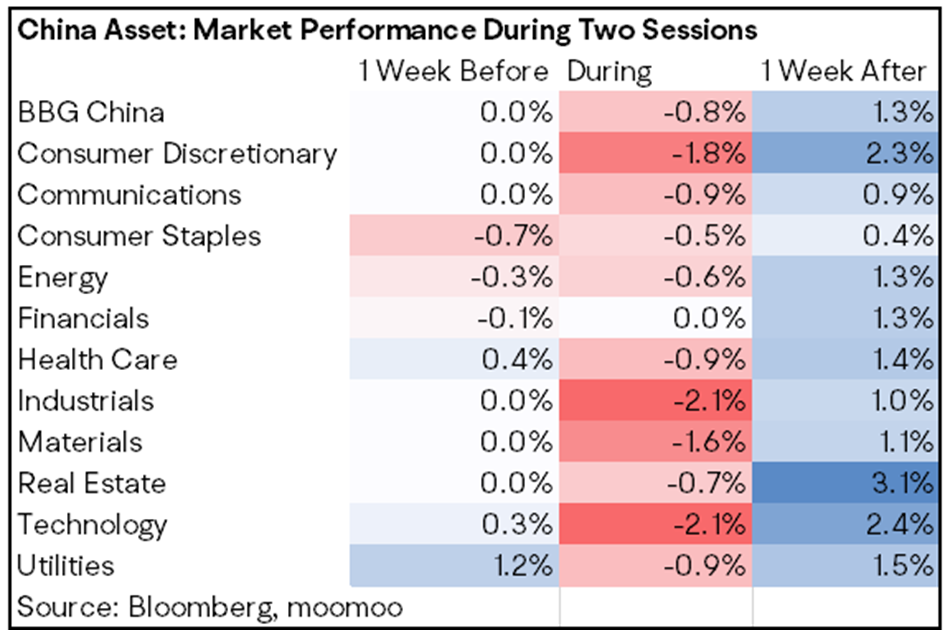

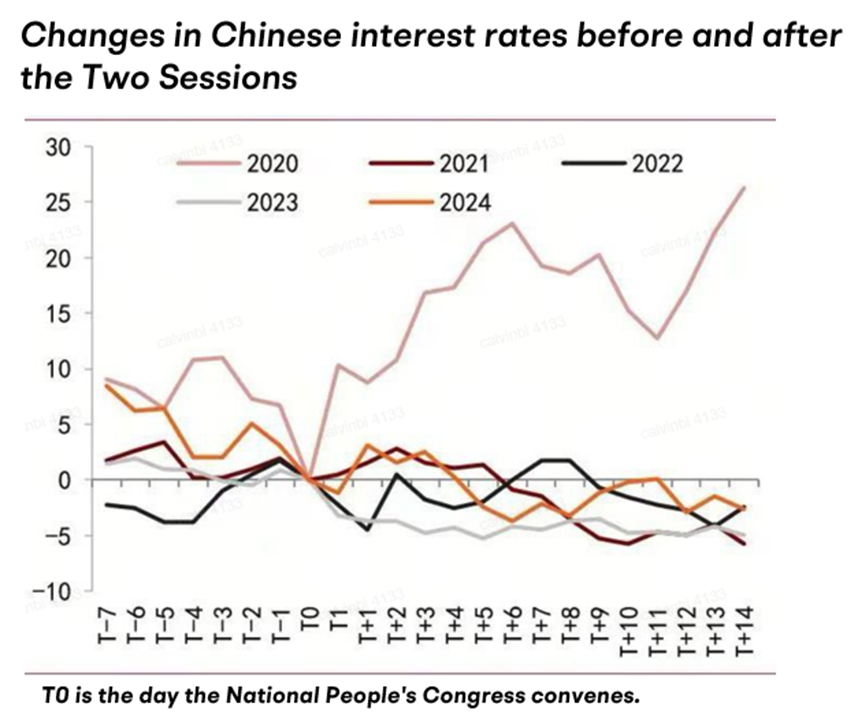

On Tuesday, China's political leadership is convening at the Great Hall of the People in Beijing for the year's most significant event, known as the "Two Sessions." These closed-door meetings are the annual plenary sessions of both the National People's Congress and the Chinese People's Political Consultative Conference, typically held simultaneously in March. The sessions generally last for about ten days....

27

2

16

$NATGATE (0270.MY)$ It seems that another group of inexperienced investors is about to be taken advantage of, better come back to check in a few days! A short-term rebound has no real significance.

Translated

2

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)