Turan No

liked

Recently, the US stock market has experienced severe volatility, among which $Palantir (PLTR.US)$ (PLTR) has become the focus of the market. This company, which focuses on Big Data and AI, saw its stock price drop significantly in a short period of time 31%, while the CEO Alexander Karp Selling off 3.75 million shares, raising concerns in the market. At the same time, Palantir also announced a partnership with Databricks for AI, trying to enhance its competitiveness in the enterprise-level AI sector.

Does PLTR still have long-term investment value? This article will analyze Palantir's latest dynamics through financial data, market trends, and competitive analysis, helping investors assess its future potential.Want to grasp more strategies for investing in US stocks? Remember to follow "US Stocks 101" to enhance your investment perspective!

Insiders sold 3.75 million shares, is market confidence undermined?

Insider selling is often seen as an important signal from the market regarding the future prospects of a company. This time, Palantir CEO Kaplan sold 3.75 million shares, the market reacted violently, leading to a rapid decline in stock price. However, it is worth noting whether this transaction belongs to a pre-arranged 10b5-1 plan, or if the CEO carried it out due to concerns about the company's future.

Does PLTR still have long-term investment value? This article will analyze Palantir's latest dynamics through financial data, market trends, and competitive analysis, helping investors assess its future potential.Want to grasp more strategies for investing in US stocks? Remember to follow "US Stocks 101" to enhance your investment perspective!

Insiders sold 3.75 million shares, is market confidence undermined?

Insider selling is often seen as an important signal from the market regarding the future prospects of a company. This time, Palantir CEO Kaplan sold 3.75 million shares, the market reacted violently, leading to a rapid decline in stock price. However, it is worth noting whether this transaction belongs to a pre-arranged 10b5-1 plan, or if the CEO carried it out due to concerns about the company's future.

Translated

10

1

Turan No

liked

Turan No

liked

$D-Wave Quantum (QBTS.US)$ Sold most of it, keeping some to see if it will rise again~ Trying my luck with the profits.

Translated

9

Turan No

liked

Market is facing mixed movements with tech stocks under pressure while broader indices remain relatively stable. Federal Reserve concerns, upcoming economic data, and sector rotations are key themes shaping today’s session.

Key Market Movements:

• S&P 500 ( $S&P 500 Index (.SPX.US)$): +0.05% – Slight gains, showing resilience despite tech weakness.

• NASDAQ (Tech-heavy stocks): Declining due to sell-offs in major tech names.

• VIX ( $CBOE Volatility S&P 500 Index (.VIX.US)$): -2.89% ...

Key Market Movements:

• S&P 500 ( $S&P 500 Index (.SPX.US)$): +0.05% – Slight gains, showing resilience despite tech weakness.

• NASDAQ (Tech-heavy stocks): Declining due to sell-offs in major tech names.

• VIX ( $CBOE Volatility S&P 500 Index (.VIX.US)$): -2.89% ...

16

1

Turan No

liked

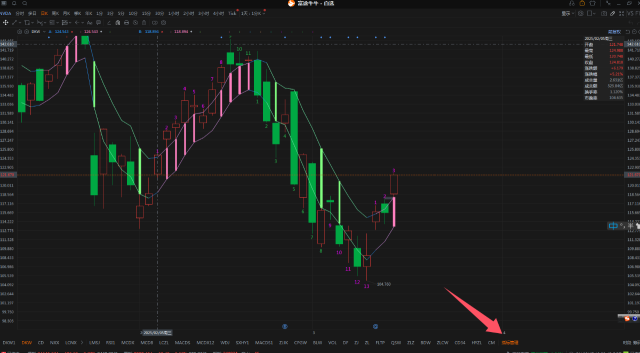

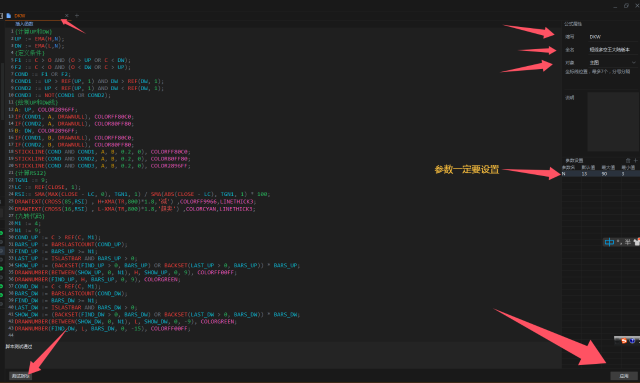

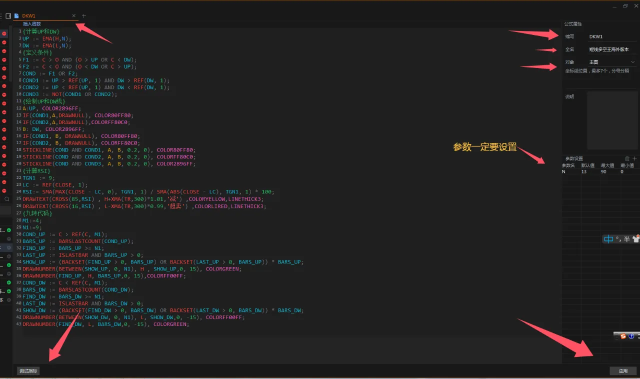

Columns Supports custom periods, the brand new Short-term Bull and Bear King (DKW) Indicators are here!

Hello everyone, after updating to the second version in July 2024, this time there is another optimization update for the DKW Indicators with the brand new Short-term Bull and Bear King (DKW) Indicators coming.

The updates are as follows:

1. The original five-color column code has been removed, and the Candlestick colors are no longer filled, making it more suitable for naked Candlestick traders.

2. The original overbought and oversold symbols have been optimized to display as text.

3. A brand new nine-turn code, numbers can start displaying from 1, and as the trend remains unchanged, the numbers continuously increase.

4. Optimize text and number display, normalizing minute-level display.

5. Support custom periods, the full line DKW introduces parameter N, adjusting parameters and customizable ladder periods to meet different user needs.

6. To meet the needs of different cohorts, an overseas version has been added this time.

Indicator introduction: This indicator consists of three parts: Long and Short Ladder, Nine Turns, and Overbought Oversold text reminders. Based on the different cohorts of users, two versions are provided this time: the Mainland version and the Overseas version. The Mainland version shows red for gains and green for losses, while the Overseas version shows red for losses and green for gains. Aside from the difference in colors, the algorithms are the same.

The first step is to download the moomoo PC version.

Step 2 Click on the "Indicator Management" in the lower right corner

DRAWNUMBER(FIND_UP, H, BARS_UP, 0, 9), COLORGREEN;

COND_DW := C < REF(C, M1);

BARS_DW := BARSLA...

The updates are as follows:

1. The original five-color column code has been removed, and the Candlestick colors are no longer filled, making it more suitable for naked Candlestick traders.

2. The original overbought and oversold symbols have been optimized to display as text.

3. A brand new nine-turn code, numbers can start displaying from 1, and as the trend remains unchanged, the numbers continuously increase.

4. Optimize text and number display, normalizing minute-level display.

5. Support custom periods, the full line DKW introduces parameter N, adjusting parameters and customizable ladder periods to meet different user needs.

6. To meet the needs of different cohorts, an overseas version has been added this time.

Indicator introduction: This indicator consists of three parts: Long and Short Ladder, Nine Turns, and Overbought Oversold text reminders. Based on the different cohorts of users, two versions are provided this time: the Mainland version and the Overseas version. The Mainland version shows red for gains and green for losses, while the Overseas version shows red for losses and green for gains. Aside from the difference in colors, the algorithms are the same.

The first step is to download the moomoo PC version.

Step 2 Click on the "Indicator Management" in the lower right corner

DRAWNUMBER(FIND_UP, H, BARS_UP, 0, 9), COLORGREEN;

COND_DW := C < REF(C, M1);

BARS_DW := BARSLA...

Translated

+4

15

4

Turan No

liked

Recently, Tesla (TSLA) has once again become a hot topic in the market, with several Analysts warning that the stock price may face further correction risks. $Tesla (TSLA.US)$ Since 2024, Tesla's stock price has fallen nearly 30% from its peak, and bearish forecasts suggest that over the next few quarters, the stock price could drop another 50%. Investors need to closely monitor delivery data, Financial Indicators, competitive landscape, and Elon Musk's market influence. This article will dive deep into Tesla's current investment value from the perspectives of financial data, Industry trends, and market risks, providing strategic recommendations to help investors find the best entry points in a volatile market.

Declining delivery volumes, slowing market demand?

One of Tesla's core growth factors has been the increase in global Electric Vehicles sales, but the latest data indicates that the company's delivery volumes may face a bottleneck. The market originally estimated that the number of vehicles to be delivered in the first quarter of 2024 would be about 0.43 million, but actual figures may only reach 0.36 million, lower than 0.387 million in the same period last year. This trend reflects that market demand may have slowed down or that Tesla is facing issues with supply chain and production capacity management.

If delivery volume continues to be lower than expected, it will directly affect Tesla's revenue and profitability. According to Tesla's 2023 fourth quarter Earnings Reports, the company's revenue reached 25.1 billion USD , with a year-on-year growth3%, but gross margin continues to decline to 17.6%, far lower than in 2022.25% . Following...

Declining delivery volumes, slowing market demand?

One of Tesla's core growth factors has been the increase in global Electric Vehicles sales, but the latest data indicates that the company's delivery volumes may face a bottleneck. The market originally estimated that the number of vehicles to be delivered in the first quarter of 2024 would be about 0.43 million, but actual figures may only reach 0.36 million, lower than 0.387 million in the same period last year. This trend reflects that market demand may have slowed down or that Tesla is facing issues with supply chain and production capacity management.

If delivery volume continues to be lower than expected, it will directly affect Tesla's revenue and profitability. According to Tesla's 2023 fourth quarter Earnings Reports, the company's revenue reached 25.1 billion USD , with a year-on-year growth3%, but gross margin continues to decline to 17.6%, far lower than in 2022.25% . Following...

Translated

18

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)