Up all the way

liked

Q2 earnings season is almost coming to an end. Which company impressed you the most in the past Q2 earnings season?

But this time we invite you to draw it! We've prepared a 「You Draw, I Guess」 event for you. You can either make puzzles or solve puzzles to participate. Plenty of rewards awaits!

* Note:

1. Have no idea? Tap here and check out our updated Earnings Calendar to recall your memory of Q2 earni...

119

37

Up all the way

liked

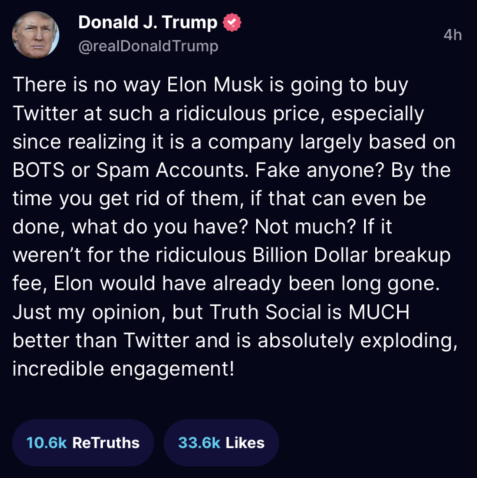

Former President Donald Trump responded to the news that $Tesla (TSLA.US)$ CEO Elon Musk's planned $Twitter (Delisted) (TWTR.US)$ buyout is temporarily on hold.

"There is no way Elon Musk is going to buy Twitter at such a ridiculous price, especially since realizing it is a company largely based on BOTS or Spam Accounts," Trump posted on his social media platform, Truth Social.

"Fake anyone?" Trump posted, Mashable reports. "...

"There is no way Elon Musk is going to buy Twitter at such a ridiculous price, especially since realizing it is a company largely based on BOTS or Spam Accounts," Trump posted on his social media platform, Truth Social.

"Fake anyone?" Trump posted, Mashable reports. "...

757

510

Up all the way

voted

Welcome back Mooers! ![]()

In today discussion, we will be highlighting some special events that had happen in the past 5 trading days (31 Jan 2022 to 4 Feb 2022).![]()

Without further ado, let’s begin!![]()

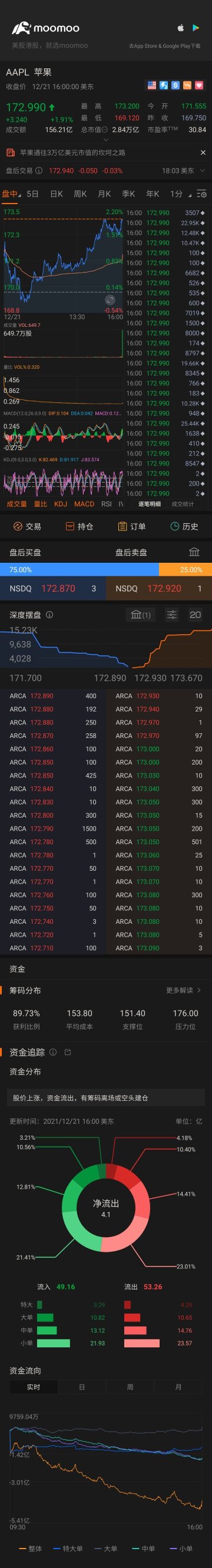

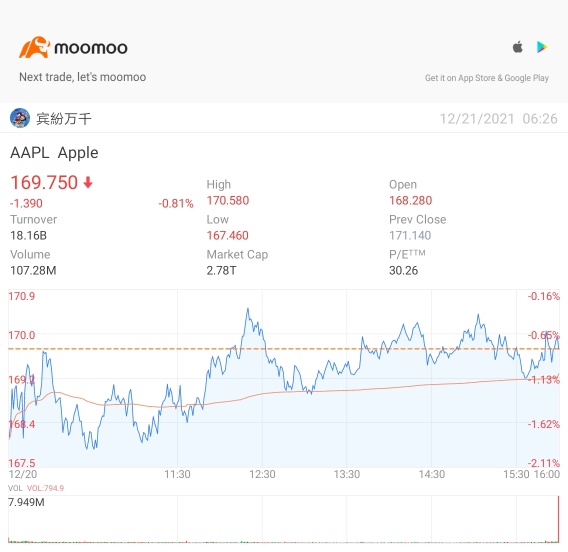

On 31 Jan 2022, which is Lunar New Year’s eve, we see $Apple (AAPL.US)$ reach an ATH (all time high) revenue record of $123.9 billion for its fiscal ended on 25 Dec 2021. This record is way above the $118.6 billion revenue estimates by more t...

In today discussion, we will be highlighting some special events that had happen in the past 5 trading days (31 Jan 2022 to 4 Feb 2022).

Without further ado, let’s begin!

On 31 Jan 2022, which is Lunar New Year’s eve, we see $Apple (AAPL.US)$ reach an ATH (all time high) revenue record of $123.9 billion for its fiscal ended on 25 Dec 2021. This record is way above the $118.6 billion revenue estimates by more t...

20

7

Up all the way

liked

10

Up all the way

liked

2021 is a year of recovery. In Jan 2021, the world is promised with an effective vaccine for Covid and the reopening of economy. Fast forward to Dec 2021, we have battled the Delta variant and now battling the Omicron.

With the Covid as backdrop, the world has been kept busy. Some of the key events in the market include:

* Reddit trying to take on Wall Street. This marks the beginning of meme stocks in a big way. $GameStop (GME.US)$ $AMC Entertainment (AMC.US)$

* China and her common prosperity policies which have impacted the Chinese listed companies, especially Chinese Tech. $BABA-W (09988.HK)$ $TENCENT (00700.HK)$

* $Bitcoin (BTC.CC)$ hit all time high of ~$67K and the growing popularity of NFT.

* $Meta Platforms (FB.US)$ changed its name to Meta and the entire metaverse ecosystem.

* The sell off of growth stock in Dec (probably still ongoing now). We have seen some of the growth stocks came down more than 50% from its all time high. $Sea (SE.US)$ $Zoom Video Communications (ZM.US)$

At a personal level, 2021 has been a year of learning. I shifted my focus from Singapore dividend stocks such as $DBS Group Holdings (D05.SG)$ to US growth stocks. The learning curve is steep but satisfying. My take away from my investing journey this year:

1. Build strong conviction

Conviction is build after you have done your research. Having a strong conviction about the companies you owned helps you through volatility and prevent panic selling. For example, $Pinterest (PINS.US)$ has not done well recently. I went through my checklist and the thesis still looks intact. So despite the draw down, I have decided to hold.

2. Be Patient

Companies need time to execute and that will be reflected in their share price if they execute well. Very often this does not happen overnight. Sometimes the share price may not go up in a straight line, you may have to endure some drawdown before it is up again. It is therefore important to have patience.

By being patient, it help us to find the next 100 baggers.

$Apple (AAPL.US)$

$Amazon (AMZN.US)$

3. Be humble and keep learning

The more I learn, the more I know that I do not know. Sometimes I thought I have it all covered and Mr Market threw me a curveball.

I am grateful for the great community that @Investing with moomoo @Meta Moo @moomoo Singapore have built, allow us to exchange ideas and learn from one another. We may not agree with all the points, but having an open mind and exchanging ideas will make you a better investor.

@HopeAlways @Mcsnacks H Tupack @GratefulPanda @Dadacai @NANA123 @Mars Mooo

4. Do not FOMO and hindsight is always 20/20

Fear of Missing Out (FOMO) can wipe you out if you tried to chase any of the stocks. I resisted very hard to not jump into $GameStop (GME.US)$.

Hindsight is a common feeling when we invest. Sometimes I did not buy a stock and it rocket and vice versa. I tell myself that hindsight is 20/20 and I can’t catch all the winners. Looking forward is better than regretting what have happened.

5. Have a journal

It can be an old fashioned notebook, Microsoft word, video or a post in Moomoo.

Have a journal and record my investing journey helps to crystallize my thoughts. I wrote down my reason of starting or exiting a position, my target and my thoughts.

With the virus living among us, 2021 has not been easy. We have certainly grown in resilient and hope that the resilience can be also shown in our investing journey.

Wish that 2022 will be a better year for all of us.

Cheers![]()

![]()

![]()

With the Covid as backdrop, the world has been kept busy. Some of the key events in the market include:

* Reddit trying to take on Wall Street. This marks the beginning of meme stocks in a big way. $GameStop (GME.US)$ $AMC Entertainment (AMC.US)$

* China and her common prosperity policies which have impacted the Chinese listed companies, especially Chinese Tech. $BABA-W (09988.HK)$ $TENCENT (00700.HK)$

* $Bitcoin (BTC.CC)$ hit all time high of ~$67K and the growing popularity of NFT.

* $Meta Platforms (FB.US)$ changed its name to Meta and the entire metaverse ecosystem.

* The sell off of growth stock in Dec (probably still ongoing now). We have seen some of the growth stocks came down more than 50% from its all time high. $Sea (SE.US)$ $Zoom Video Communications (ZM.US)$

At a personal level, 2021 has been a year of learning. I shifted my focus from Singapore dividend stocks such as $DBS Group Holdings (D05.SG)$ to US growth stocks. The learning curve is steep but satisfying. My take away from my investing journey this year:

1. Build strong conviction

Conviction is build after you have done your research. Having a strong conviction about the companies you owned helps you through volatility and prevent panic selling. For example, $Pinterest (PINS.US)$ has not done well recently. I went through my checklist and the thesis still looks intact. So despite the draw down, I have decided to hold.

2. Be Patient

Companies need time to execute and that will be reflected in their share price if they execute well. Very often this does not happen overnight. Sometimes the share price may not go up in a straight line, you may have to endure some drawdown before it is up again. It is therefore important to have patience.

By being patient, it help us to find the next 100 baggers.

$Apple (AAPL.US)$

$Amazon (AMZN.US)$

3. Be humble and keep learning

The more I learn, the more I know that I do not know. Sometimes I thought I have it all covered and Mr Market threw me a curveball.

I am grateful for the great community that @Investing with moomoo @Meta Moo @moomoo Singapore have built, allow us to exchange ideas and learn from one another. We may not agree with all the points, but having an open mind and exchanging ideas will make you a better investor.

@HopeAlways @Mcsnacks H Tupack @GratefulPanda @Dadacai @NANA123 @Mars Mooo

4. Do not FOMO and hindsight is always 20/20

Fear of Missing Out (FOMO) can wipe you out if you tried to chase any of the stocks. I resisted very hard to not jump into $GameStop (GME.US)$.

Hindsight is a common feeling when we invest. Sometimes I did not buy a stock and it rocket and vice versa. I tell myself that hindsight is 20/20 and I can’t catch all the winners. Looking forward is better than regretting what have happened.

5. Have a journal

It can be an old fashioned notebook, Microsoft word, video or a post in Moomoo.

Have a journal and record my investing journey helps to crystallize my thoughts. I wrote down my reason of starting or exiting a position, my target and my thoughts.

With the virus living among us, 2021 has not been easy. We have certainly grown in resilient and hope that the resilience can be also shown in our investing journey.

Wish that 2022 will be a better year for all of us.

Cheers

191

13

Up all the way

liked

14

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)