Venita Fair

liked

Colform IPO 讲解

1) - YouTube

Figure 1: IPO timetable of Colform Group Berhad

-Will be listed on the ACE Board

Info of IPO

Enlarged no. of shares upon listing: 600 million

IPO price: RM0.36

Market capitalization: RM216 million

Estimated funds to raise from Public Issue: RM41.19 million

PE ratio = 16.95x (based on FYE2023)

Figure 2: Business model of Colform Group Berhad

Source: Colform Group Berhad IPO prospectus

Figure 3: Segmentation of Steel Industry...

1) - YouTube

Figure 1: IPO timetable of Colform Group Berhad

-Will be listed on the ACE Board

Info of IPO

Enlarged no. of shares upon listing: 600 million

IPO price: RM0.36

Market capitalization: RM216 million

Estimated funds to raise from Public Issue: RM41.19 million

PE ratio = 16.95x (based on FYE2023)

Figure 2: Business model of Colform Group Berhad

Source: Colform Group Berhad IPO prospectus

Figure 3: Segmentation of Steel Industry...

+7

18

2

Venita Fair

liked

Columns 1.16Individual stock analysis

$Tesla (TSLA.US)$

Clearly, the key level at $400 did not prevent the stock from breaking through, and there is still room for further upside in the short term. Looking at the chart, Tesla's stock price has broken the $405 resistance level. As mentioned yesterday, the Bollinger Band lower bound ($380) provided strong support, and the price action has clearly confirmed this. Not only has the stock stabilized above $405, but it has also successfully broken through the Boll...

Clearly, the key level at $400 did not prevent the stock from breaking through, and there is still room for further upside in the short term. Looking at the chart, Tesla's stock price has broken the $405 resistance level. As mentioned yesterday, the Bollinger Band lower bound ($380) provided strong support, and the price action has clearly confirmed this. Not only has the stock stabilized above $405, but it has also successfully broken through the Boll...

+1

13

1

Venita Fair

liked

Venita Fair

liked

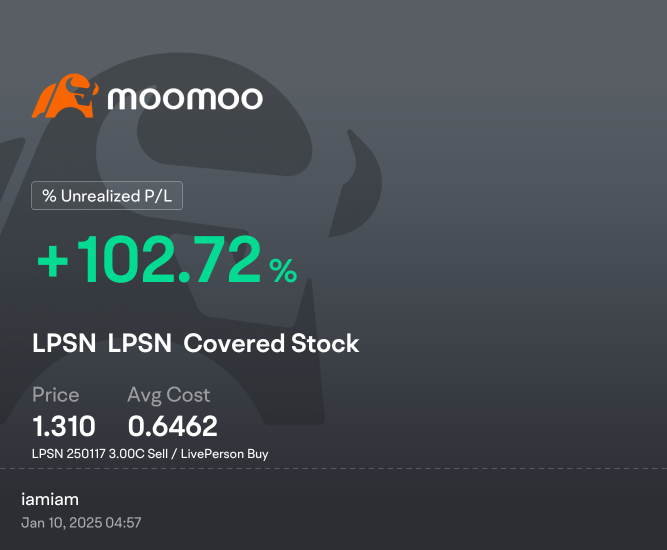

$LivePerson (LPSN.US)$

if this price range doesn't hold 1.07 is next and then around 1 dollar. I have both long and short positions. long term bullish short term bearish. Price could drop all the way to my green trendline at about .90. I would buy the 💩 out of that 🤣

$LivePerson (LPSN.US)$

BE SAFE, BE CAREFUL, BE WISE

and as always

GOOD LUCK 🙏

if this price range doesn't hold 1.07 is next and then around 1 dollar. I have both long and short positions. long term bullish short term bearish. Price could drop all the way to my green trendline at about .90. I would buy the 💩 out of that 🤣

$LivePerson (LPSN.US)$

BE SAFE, BE CAREFUL, BE WISE

and as always

GOOD LUCK 🙏

Unsupported feature.

Please use the mobile app.

8

2

Venita Fair

liked

Perfect time to buy! $Office Properties Income Trust (OPI.US)$

Office Properties Income Trust (OPI) is taking proactive steps to enhance its portfolio and boost long-term growth potential. While it recently reduced its dividend to improve liquidity and address current market challenges, OPI is focused on optimizing its property management, reducing debt, and strategically positioning itself for a rebound. With a strong foundation of long-term leases and a diver...

Office Properties Income Trust (OPI) is taking proactive steps to enhance its portfolio and boost long-term growth potential. While it recently reduced its dividend to improve liquidity and address current market challenges, OPI is focused on optimizing its property management, reducing debt, and strategically positioning itself for a rebound. With a strong foundation of long-term leases and a diver...

6

Venita Fair

liked

Columns 1.8Individual stock analysis

$NVIDIA (NVDA.US)$

This "flash crash" felt like a sudden storm out of nowhere. Closing at $140.140 with a steep drop of 6.22%, NVIDIA delivered a rude awakening to many investors. Reports indicate that traders were massively offloading call options, and the lack of short-term catalysts shifted market sentiment from "euphoria" to "ice cold" in an instant.

The reasons behind NVIDIA's sharp decline can be summed up in three key points:

Missed Market Expectations: Despite the...

This "flash crash" felt like a sudden storm out of nowhere. Closing at $140.140 with a steep drop of 6.22%, NVIDIA delivered a rude awakening to many investors. Reports indicate that traders were massively offloading call options, and the lack of short-term catalysts shifted market sentiment from "euphoria" to "ice cold" in an instant.

The reasons behind NVIDIA's sharp decline can be summed up in three key points:

Missed Market Expectations: Despite the...

+2

23

3

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)