Victor靓汤

commented on

$TOPGLOV (7113.MY)$ nxt 2 qr will see the result plunge due to increase material cost which only shown nxt qr. most likely people who read the report like me wil sell later once start

1

5

Victor靓汤

voted

Hi mooers! ![]()

$Alibaba (BABA.US)$ is releasing its Q2 FY2025 earnings on November 15 before the bell. Unlock insights with BABA Earnings Hub>>

Amid Trump victory, Chinese stocks and ETFs are sliding, as higher tariffs are anticipated. $Alibaba (BABA.US)$'s share price has been dropping ever since its peak of $308 per share in 2020. In the wake of recent Double 11 Shopping Festival competition in China, what outlook will Alibaba's man...

$Alibaba (BABA.US)$ is releasing its Q2 FY2025 earnings on November 15 before the bell. Unlock insights with BABA Earnings Hub>>

Amid Trump victory, Chinese stocks and ETFs are sliding, as higher tariffs are anticipated. $Alibaba (BABA.US)$'s share price has been dropping ever since its peak of $308 per share in 2020. In the wake of recent Double 11 Shopping Festival competition in China, what outlook will Alibaba's man...

67

110

10

Victor靓汤

voted

Author: toby siew

Upload coordinator: @Jungle lee

The 60th US presidential election will kick off on November 5th this year. At that time, the Republican Trump and the Democrat Harris will compete for the US presidency.

Due to its leading global position in economy, technology, and military power, coupled with the significant role of the US dollar, this election is not a domestic affair of the United States alone, but a crucial subject affecting global political and economic changes.

As for Malaysia, due to the close economic and trade ties with the United States over the years, it cannot remain indifferent and must closely monitor and consider the changes in this election, strategically positioning for opportunities and risks early.

What impact will the tight US presidential election have on Malaysia's economy? After discussions with political and economic experts, and comprehensive analysis of various data, "Nanyang Business Paper" will dissect it for readers.

The United States is Malaysia's second largest export market

Analyze the advantages and disadvantages from three perspectives.

On November 5 of this year, the United States will welcome the 60th presidential election. This election is being closely watched globally, and Malaysia is no exception.

What potential impacts will this election bring to Malaysia? What should the political and business communities as well as investors pay attention to?

As time passes, the presidential race intensifies. The representative sent by the Republican Party is the former president, Trump, who is known for his exaggerated and sharp language.

During his tenure from 2017 to early 2021, Donald Trump also occasionally communicated...

Upload coordinator: @Jungle lee

The 60th US presidential election will kick off on November 5th this year. At that time, the Republican Trump and the Democrat Harris will compete for the US presidency.

Due to its leading global position in economy, technology, and military power, coupled with the significant role of the US dollar, this election is not a domestic affair of the United States alone, but a crucial subject affecting global political and economic changes.

As for Malaysia, due to the close economic and trade ties with the United States over the years, it cannot remain indifferent and must closely monitor and consider the changes in this election, strategically positioning for opportunities and risks early.

What impact will the tight US presidential election have on Malaysia's economy? After discussions with political and economic experts, and comprehensive analysis of various data, "Nanyang Business Paper" will dissect it for readers.

The United States is Malaysia's second largest export market

Analyze the advantages and disadvantages from three perspectives.

On November 5 of this year, the United States will welcome the 60th presidential election. This election is being closely watched globally, and Malaysia is no exception.

What potential impacts will this election bring to Malaysia? What should the political and business communities as well as investors pay attention to?

As time passes, the presidential race intensifies. The representative sent by the Republican Party is the former president, Trump, who is known for his exaggerated and sharp language.

During his tenure from 2017 to early 2021, Donald Trump also occasionally communicated...

Translated

+4

37

4

11

Victor靓汤

commented on

ALLIANZ: If Ho Chin Lee wins, it could help the Ringgit rise by 5%.

(Kuala Lumpur, 24th news) As the US presidential election heats up, economists are predicting the impact of candidates on the Ringgit. Ludovic Subran, Chief Economist of the insurance institution Allianz, expressed that if Ho Chin Lee is elected, then the Ringgit will regain its strength and could rise by another 5% by the end of the year.

The 2024 US presidential election falls on November 5th. With less than 3 weeks remaining, the world is eagerly anticipating who will be elected as the new US president.

Subran pointed out that the current exchange rates are fluctuating significantly. It is generally believed in the market that if former President Trump is elected, the US dollar will strengthen further. If Vice President Ho Chin Lee is elected, the US dollar will weaken.

On the contrary, if Trump is elected, the ringgit will further depreciate by 5% to 10% in 2025; if Ho Jinli is elected, the depreciation is expected to be controlled at 2 to 3%.

He still believes that the ringgit's trend correction and other factors still bring some downside pressure to the ringgit. Nevertheless, the ringgit is not significantly overvalued, the real issue is external adverse factors.

He said that Malaysia relies crucially on foreign capital to drive economic growth.

I remain optimistic, believing that under Ho Jinli's election, a 2 to 3% decline in the ringgit is manageable. In the short term, the ringgit still has appreciation opportunities and will stabilize by 2025. The main concern is Trump; if he is elected, it will lead to further depreciation.

Since October, the Ringgit to the US Dollar $USD/MYR (USDMYR.FX)$ has dropped by more than 5...

(Kuala Lumpur, 24th news) As the US presidential election heats up, economists are predicting the impact of candidates on the Ringgit. Ludovic Subran, Chief Economist of the insurance institution Allianz, expressed that if Ho Chin Lee is elected, then the Ringgit will regain its strength and could rise by another 5% by the end of the year.

The 2024 US presidential election falls on November 5th. With less than 3 weeks remaining, the world is eagerly anticipating who will be elected as the new US president.

Subran pointed out that the current exchange rates are fluctuating significantly. It is generally believed in the market that if former President Trump is elected, the US dollar will strengthen further. If Vice President Ho Chin Lee is elected, the US dollar will weaken.

On the contrary, if Trump is elected, the ringgit will further depreciate by 5% to 10% in 2025; if Ho Jinli is elected, the depreciation is expected to be controlled at 2 to 3%.

He still believes that the ringgit's trend correction and other factors still bring some downside pressure to the ringgit. Nevertheless, the ringgit is not significantly overvalued, the real issue is external adverse factors.

He said that Malaysia relies crucially on foreign capital to drive economic growth.

I remain optimistic, believing that under Ho Jinli's election, a 2 to 3% decline in the ringgit is manageable. In the short term, the ringgit still has appreciation opportunities and will stabilize by 2025. The main concern is Trump; if he is elected, it will lead to further depreciation.

Since October, the Ringgit to the US Dollar $USD/MYR (USDMYR.FX)$ has dropped by more than 5...

Translated

25

4

1

Victor靓汤

voted

Hi mooers! ![]()

$Coca-Cola (KO.US)$ is releasing its Q3 earnings on October 23 before the bell. Unlock insights with KO Earnings Hub>>

$Coca-Cola (KO.US)$'s stock price has reached a historical high of $73.029 this year. It is also one of Warren Buffett's top 5 investments. What outlook would management provide for the company's future performance? Subscribe to @Moo Live and stay tuned!

For the details of indicator sentiment, p...

$Coca-Cola (KO.US)$ is releasing its Q3 earnings on October 23 before the bell. Unlock insights with KO Earnings Hub>>

$Coca-Cola (KO.US)$'s stock price has reached a historical high of $73.029 this year. It is also one of Warren Buffett's top 5 investments. What outlook would management provide for the company's future performance? Subscribe to @Moo Live and stay tuned!

For the details of indicator sentiment, p...

70

116

8

Victor靓汤

voted

Hi mooers! ![]()

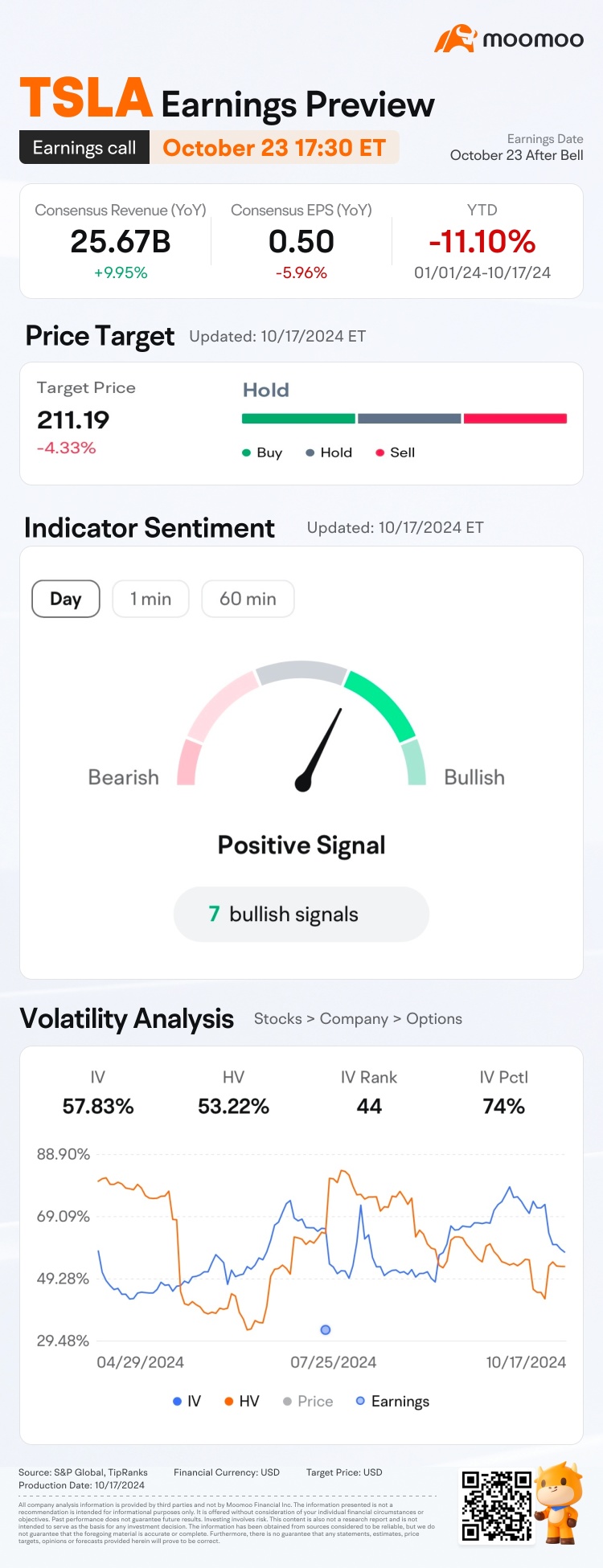

$Tesla (TSLA.US)$ is releasing its Q3 earnings on October 23 after the bell. Unlock insights with TSLA Earnings Hub>>

Don't want to miss the first-hand information? Subscribe to @Moo Live and book the earnings conference live stream NOW!

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Tesla (TSLA.US)$ have seen a decrease of 10.34%.![]() How will the ma...

How will the ma...

$Tesla (TSLA.US)$ is releasing its Q3 earnings on October 23 after the bell. Unlock insights with TSLA Earnings Hub>>

Don't want to miss the first-hand information? Subscribe to @Moo Live and book the earnings conference live stream NOW!

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Tesla (TSLA.US)$ have seen a decrease of 10.34%.

75

158

14

Victor靓汤

voted

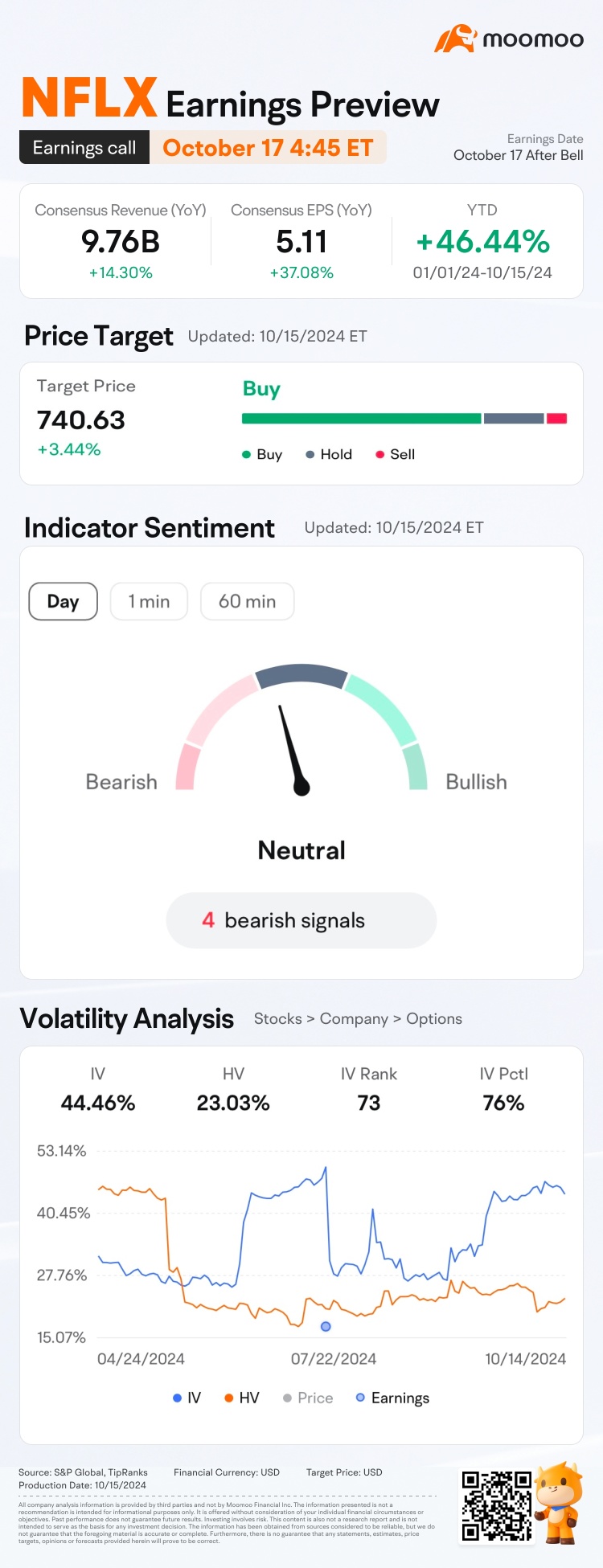

$Netflix (NFLX.US)$ is releasing its Q3 earnings on October 18 after the bell. Netflix's stock price went up over 45% this year![]() , fueled by robust subscription growth.

, fueled by robust subscription growth.

Need more details of their earning release? >> Unlock insights with NFLX Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Netflix (NFLX.US)$ have seen an increase of 8.62%.![]() How wil...

How wil...

Need more details of their earning release? >> Unlock insights with NFLX Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Netflix (NFLX.US)$ have seen an increase of 8.62%.

Expand

Expand 87

103

10

Victor靓汤

voted

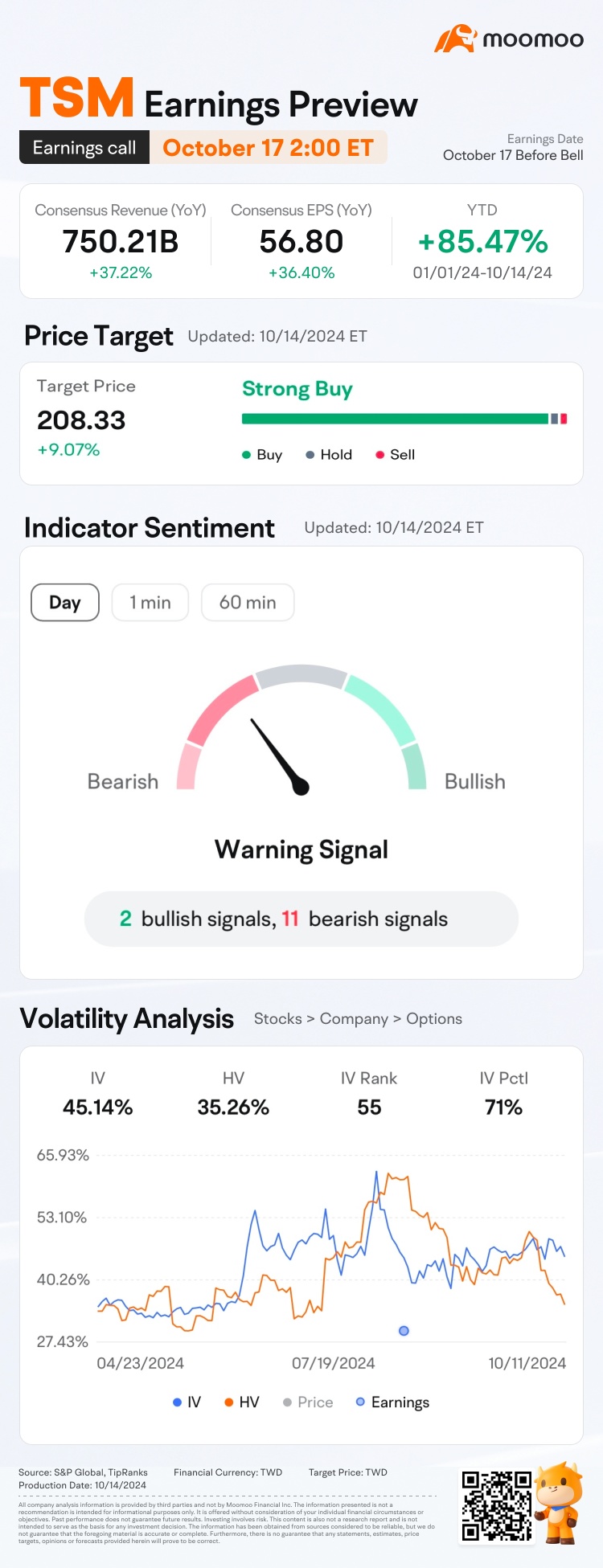

Hi, mooers!

$Taiwan Semiconductor (TSM.US)$ is releasing its Q3 2024 earnings on October 17 before the bell. Unlock insights with TSM Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 11.42%.![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 ...

$Taiwan Semiconductor (TSM.US)$ is releasing its Q3 2024 earnings on October 17 before the bell. Unlock insights with TSM Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 11.42%.

Rewards

● An equal share of 5,000 ...

Expand

Expand 134

212

16

Victor靓汤

commented on

24

8

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Victor靓汤 : LOL,ppl invest company because increasing of profit not because of material cost decrease.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)