WANDD88

voted

Market Overview

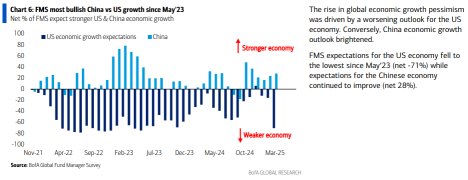

Starting from February 19, U.S. stocks experienced a significant pullback, with the $S&P 500 Index (.SPX.US)$ dropping from its high of 6,147.43 points to 5,521.52 points by March 13, before stabilizing and starting to recover. This correction can be attributed to several factors:

![]() Changes in Global Tariff Policies

Changes in Global Tariff Policies

According to insights from Goldman Sachs' Macro Weekend Call, the recent market correction is partly due to uncertaint...

Starting from February 19, U.S. stocks experienced a significant pullback, with the $S&P 500 Index (.SPX.US)$ dropping from its high of 6,147.43 points to 5,521.52 points by March 13, before stabilizing and starting to recover. This correction can be attributed to several factors:

According to insights from Goldman Sachs' Macro Weekend Call, the recent market correction is partly due to uncertaint...

+5

69

11

20

WANDD88

voted

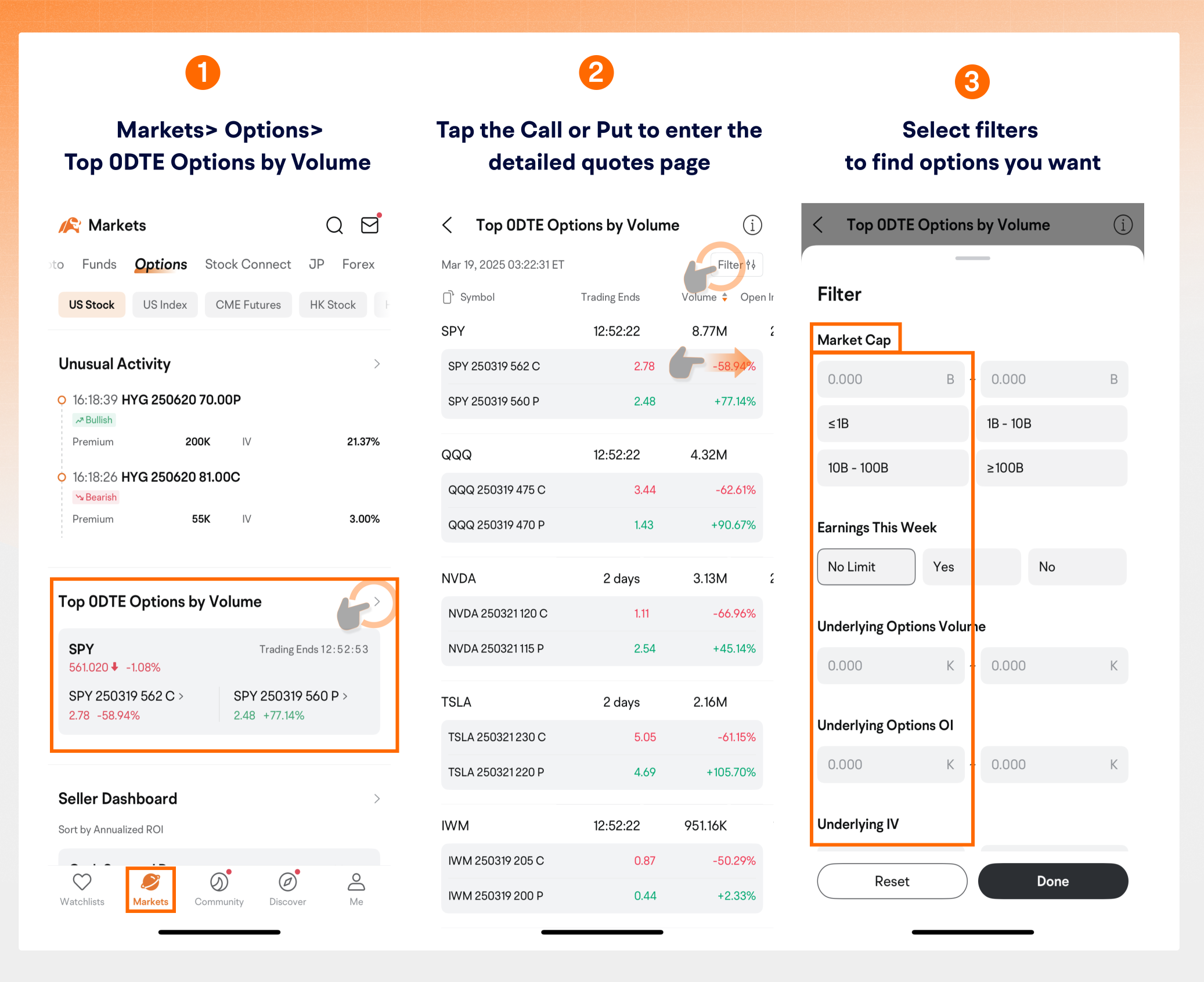

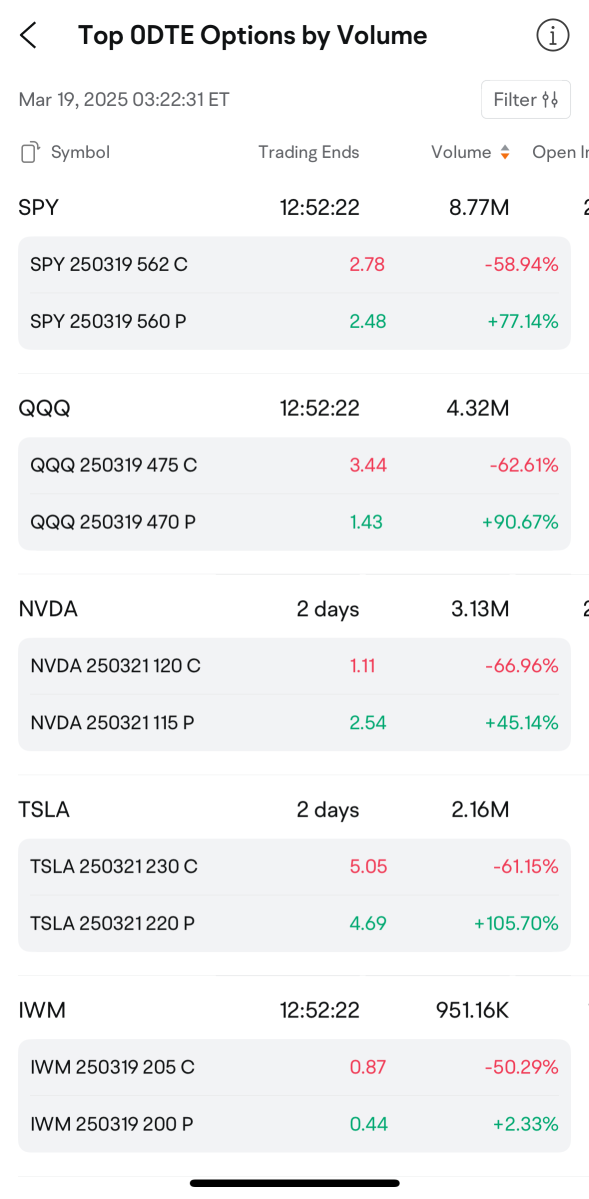

As 2025 first Triple Witching Day is coming soon, we're excited to introduce an insightful tool that can complement how you research and trade options -- Top 0DTE Options by Volume feature. Designed specifically for traders who seek to capture market movements as they unfold, this feature provides access to real-time updates on soon-to-expire options, so you can quickly make informed decisions.

Why We Think You'll L...

+1

69

43

36

WANDD88

liked and voted

Last week, the markets were dominated by escalating trade tensions, with tariffs on steel and aluminum imports sparking fears of a global trade war. The European Union retaliated with counter-tariffs on $28 billion worth of U.S. goods, further spooking investors. Meanwhile, concerns over valuations and earnings continued to weigh on the tech sector, with $Adobe (ADBE.US)$ and $Intel (INTC.US)$ making headlines f...

+13

2072

359

23

WANDD88

voted

Week 2's curtain falls, but the drama's just beginning!

Who's ruling our top 10 paper trading leaderboard this week?

Brace yourself for the big reveal! 📈💰

👏Congratulations to the top 10 trading titans!

@iamshf @103226286 @105405816 @ChangHorng @103178067 @105227245 @105386639 @Kenwoo @ALAN86 @Ckent2213

*The profit/loss (P/L) data is based on trading activity from March 10th to March 15th.

Last week, the standout performances of top traders revealed s...

Who's ruling our top 10 paper trading leaderboard this week?

Brace yourself for the big reveal! 📈💰

👏Congratulations to the top 10 trading titans!

@iamshf @103226286 @105405816 @ChangHorng @103178067 @105227245 @105386639 @Kenwoo @ALAN86 @Ckent2213

*The profit/loss (P/L) data is based on trading activity from March 10th to March 15th.

Last week, the standout performances of top traders revealed s...

+4

180

109

12

WANDD88

voted

Hi, mooers! 👋

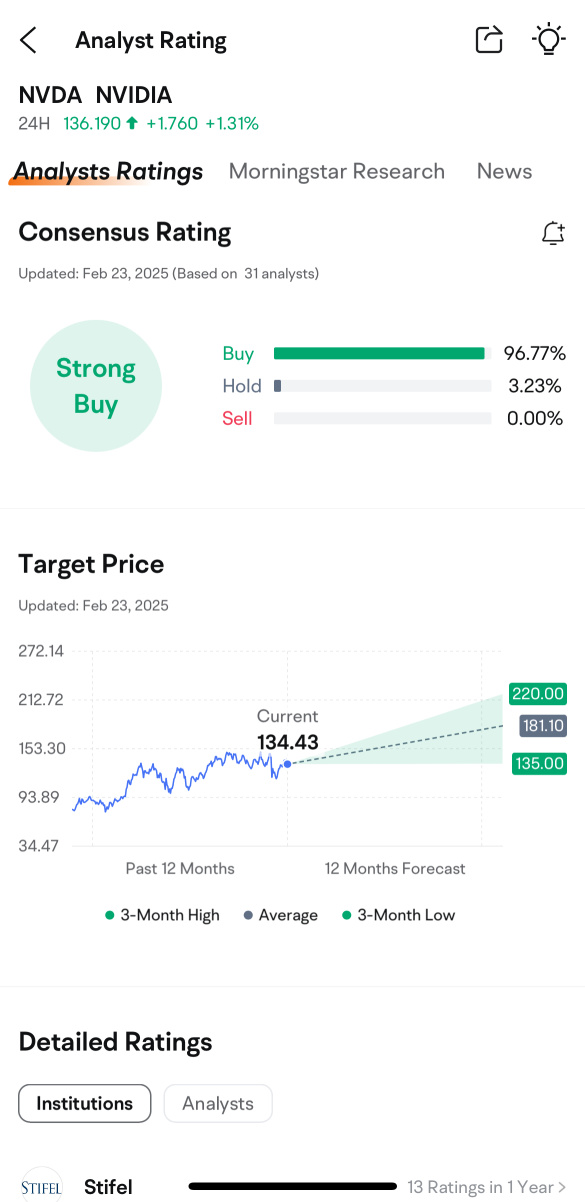

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

645

1022

40

WANDD88

voted

While CNY is days away. Counting down to Trump 2.0 and its effects are already shaking the market. Being optimistic at heart, with the ushering of the new year. Wishing everyone to Huat Big, Win lots and Stay Healthy this 2025. ![]()

![]()

![]()

![]()

Wealth 🀄️comes when I sit back and relax. Not too sure about this as I believe in working hard![]() for life goals while wishing for the best, as man plans but god disposes.

for life goals while wishing for the best, as man plans but god disposes. ![]()

Year of the Snake 🐍, if your superstitious or believe in the cosmos m...

Wealth 🀄️comes when I sit back and relax. Not too sure about this as I believe in working hard

Year of the Snake 🐍, if your superstitious or believe in the cosmos m...

14

WANDD88

Set a live reminder

$Microsoft (MSFT.US)$

Microsoft Q2 FY2025 earnings conference call is scheduled for January 29 at 5:30 PM ET /January 30 at 6:30 AM SGT/January 30 at 9:30 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Microsoft's Q2 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what Microsoft's management has to say!

Disclaimer:

This presentation is...

Microsoft Q2 FY2025 earnings conference call is scheduled for January 29 at 5:30 PM ET /January 30 at 6:30 AM SGT/January 30 at 9:30 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Microsoft's Q2 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what Microsoft's management has to say!

Disclaimer:

This presentation is...

Microsoft Q2 FY2025 earnings conference call

Jan 30 06:30

24

1

1

WANDD88

Set a live reminder

$Meta Platforms (META.US)$

Meta Platforms Q4 2024 earnings conference call is scheduled for January 29 at 5:00 PM ET /January 30 at 6:00 AM SGT/January 30 at 9:00 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Meta Platforms's Q4 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what Meta Platforms's management has to say!

Disclaimer:...

Meta Platforms Q4 2024 earnings conference call is scheduled for January 29 at 5:00 PM ET /January 30 at 6:00 AM SGT/January 30 at 9:00 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Meta Platforms's Q4 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what Meta Platforms's management has to say!

Disclaimer:...

Meta Platforms Q4 2024 earnings conference call

Jan 30 06:00

21

1

WANDD88

liked

$Tesla (TSLA.US)$ $Bitcoin (BTC.CC)$ $SPDR S&P 500 ETF (SPY.US)$ We're in a pullback phase right now. Buy a little as it dips, build your position in batches. No one can time the bottom perfectly. I think before Trump takes office, stock prices might drop to the 60-day EMA, or even break below the 120-day EMA in a more extreme scenario. Let's prepare for the worst. Don't let emotions cloud your judgment when the market's down. Hopefully, things will start looking up...

Translated

543

208

48

WANDD88

voted

Hi mooers! ![]()

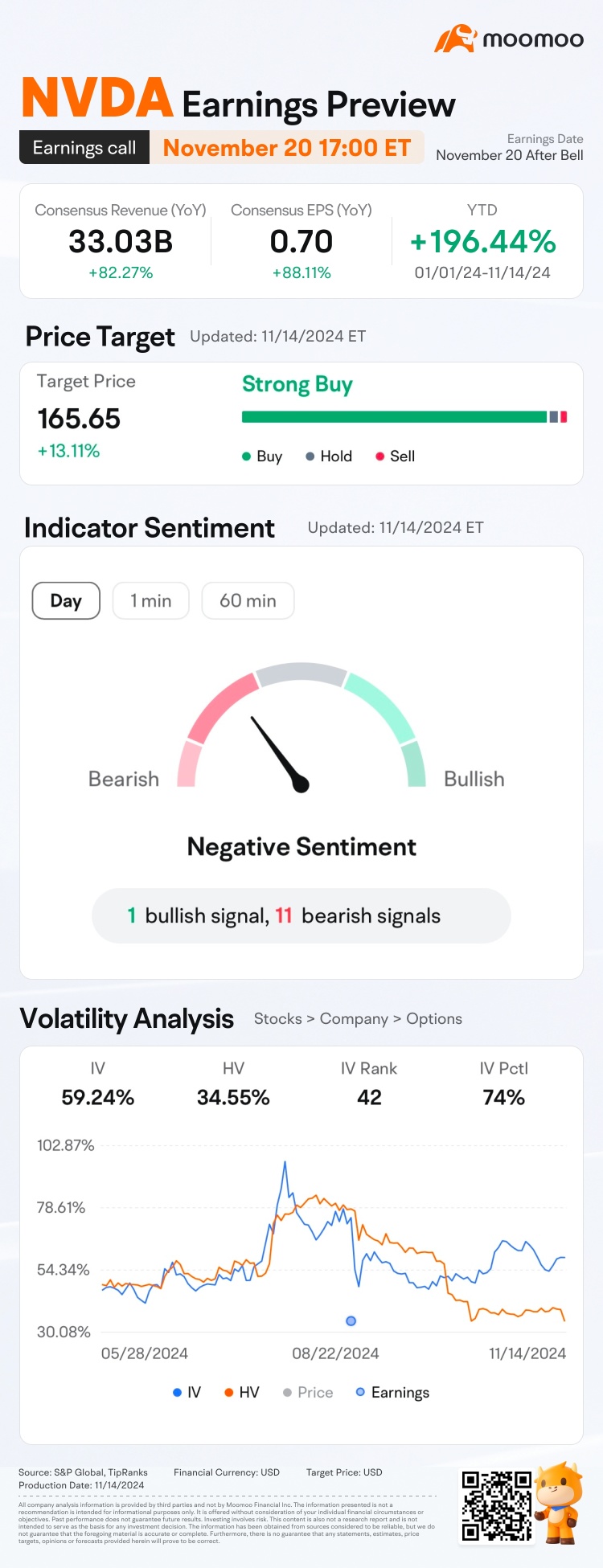

The world's most valuable company, $NVIDIA (NVDA.US)$, is set to release its Q3 FY2025 financial results on November 20 after the bell. Unlock insights with NVDA Earnings Hub>>

As of 14 November, share prices of $NVIDIA (NVDA.US)$ have increased +196.44% in this year.![]() It is now the world's most valuable company with a $3.6 trillion market cap

It is now the world's most valuable company with a $3.6 trillion market cap![]() .

.

As big tech companies like $Amazon (AMZN.US)$, $Alphabet-A (GOOGL.US)$ and $Meta Platforms (META.US)$ all poise...

The world's most valuable company, $NVIDIA (NVDA.US)$, is set to release its Q3 FY2025 financial results on November 20 after the bell. Unlock insights with NVDA Earnings Hub>>

As of 14 November, share prices of $NVIDIA (NVDA.US)$ have increased +196.44% in this year.

As big tech companies like $Amazon (AMZN.US)$, $Alphabet-A (GOOGL.US)$ and $Meta Platforms (META.US)$ all poise...

76

100

12

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)