what doyouwant

liked

$Tesla (TSLA.US)$

The Tesla stock price broke through 234.190-234.280 and stabilized, marking a qualitative change in the market.

1. What is a breakout? Why is it so important?

– A breakout refers to the price of a stock breaking through a significant level (upward breakout of a Resistance or downward breakout of a Support). These are key levels that have historically been difficult for stocks to surpass, and once broken, it may indicate the beginning of a strong new trend.

– Successful breakouts often lead to strong price momentum, as traders who have been waiting for the stock to break out may join in, increasing demand and further pushing the price in the direction of the breakout.

2. How to discover potential breakout stocks.

In addition to relying on traditional chart patterns or Indicators, more intuitive methods can be considered to find potentially explosive Stocks.

A. "The Calm Before the Storm" Method

– Look for low volatility: Stocks that have been trading within a narrow Range for a period of time may be ready to break out. This is the origin of the phrase "The Calm Before the Storm." When a stock is consolidating horizontally, it's like the market is building up energy to move in one direction. How to identify: Use Bollinger Bands to check if the stock has low volatility (when the Bollinger Bands are tightly contracted). Alternatively, pay attention to Stocks with small daily price fluctuations over a few weeks.

B. Abnormal volume increase (large "spike")

– Volume is key: When you see Volume suddenly soar and the price moves in a certain direction, it could be a strong indication of a breakthrough...

The Tesla stock price broke through 234.190-234.280 and stabilized, marking a qualitative change in the market.

1. What is a breakout? Why is it so important?

– A breakout refers to the price of a stock breaking through a significant level (upward breakout of a Resistance or downward breakout of a Support). These are key levels that have historically been difficult for stocks to surpass, and once broken, it may indicate the beginning of a strong new trend.

– Successful breakouts often lead to strong price momentum, as traders who have been waiting for the stock to break out may join in, increasing demand and further pushing the price in the direction of the breakout.

2. How to discover potential breakout stocks.

In addition to relying on traditional chart patterns or Indicators, more intuitive methods can be considered to find potentially explosive Stocks.

A. "The Calm Before the Storm" Method

– Look for low volatility: Stocks that have been trading within a narrow Range for a period of time may be ready to break out. This is the origin of the phrase "The Calm Before the Storm." When a stock is consolidating horizontally, it's like the market is building up energy to move in one direction. How to identify: Use Bollinger Bands to check if the stock has low volatility (when the Bollinger Bands are tightly contracted). Alternatively, pay attention to Stocks with small daily price fluctuations over a few weeks.

B. Abnormal volume increase (large "spike")

– Volume is key: When you see Volume suddenly soar and the price moves in a certain direction, it could be a strong indication of a breakthrough...

Translated

6

3

what doyouwant

liked

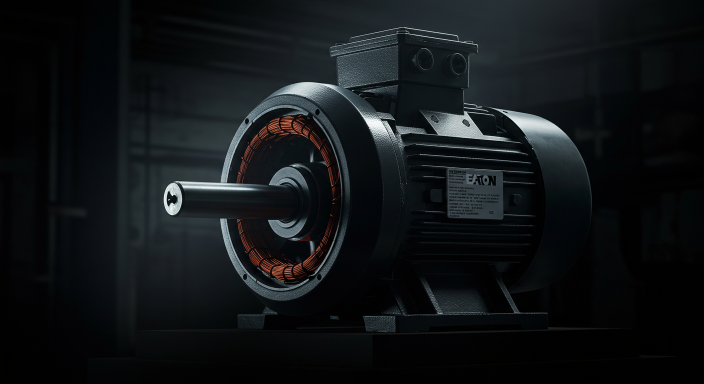

Recently, the power management giant $Eaton (ETN.US)$ (Eaton Corporation, NYSE: ETN) has become the focus of market attention.Morgan Stanley's latest report raised Eaton's Target Price to $385, and is Bullish on the company's growth potential in AI Datacenter Energy demand, electrification development, and sustainable energy transition. Eaton's stock price experienced some fluctuations in 2025, but Analysts generally believe that the companyStrong long-term growth momentum.As the demand for energy consumption in Global Datacenters surges, Eaton's Electrical Utilities solutions business may enter a prosperous development period.

This article will analyze Eaton's growth potential from the following perspectives:Earnings Reports data, Target Price forecasts, industry trends, competitive advantages, and investment risks.Combining this with market analysis of "US stocks 101", this will help investors grasp investment opportunities in this industrial stock.

Morgan Stanley raises the Target Price, where does Eaton's growth momentum lie?

According to Morgan Stanley's latest research report, Eaton's Target Price has been raised from $350 to $385, indicating over 20% upside potential. The main reasons includethe surge in demand for AI servers and Datacenters, the acceleration of Smart Grids construction, the trend of global electrification, and Eaton's leadership in the Electrical Utilities management solutions sector.

Market research Institutions indicate that as artificial intelligence...

This article will analyze Eaton's growth potential from the following perspectives:Earnings Reports data, Target Price forecasts, industry trends, competitive advantages, and investment risks.Combining this with market analysis of "US stocks 101", this will help investors grasp investment opportunities in this industrial stock.

Morgan Stanley raises the Target Price, where does Eaton's growth momentum lie?

According to Morgan Stanley's latest research report, Eaton's Target Price has been raised from $350 to $385, indicating over 20% upside potential. The main reasons includethe surge in demand for AI servers and Datacenters, the acceleration of Smart Grids construction, the trend of global electrification, and Eaton's leadership in the Electrical Utilities management solutions sector.

Market research Institutions indicate that as artificial intelligence...

Translated

9

what doyouwant

liked

what doyouwant

liked

$FTSE Bursa Malaysia KLCI Index (.KLSE.MY)$ resumed its sell down and retraced all the way back towards the 1484 points region with still an overall negative market sentiment here as we still had over 650 counters closing red for the day along with it. Daily trading volume still settled around the 3 billion mark, mainly dominated by sellers still.

Main stocks that showed strong buying momentum would be the likes of SAPNRG, NATGATE, MRDIY, MYEG, and 9...

Main stocks that showed strong buying momentum would be the likes of SAPNRG, NATGATE, MRDIY, MYEG, and 9...

13

1

what doyouwant

liked

In a bearish market, achieving relatively stable returns requires a mix of defensive strategies, diversification, and risk management. Here are some approaches to consider:

1. Defensive Stocks & Sectors

Invest in companies that provide essential goods and services, which tend to be more resilient during downturns. These include:

Consumer Staples (e.g., food, household products, healthcare)

Utilities (e.g., electricity, water, telecommunications)

Healthcare & Pharmaceuticals

2. Di...

1. Defensive Stocks & Sectors

Invest in companies that provide essential goods and services, which tend to be more resilient during downturns. These include:

Consumer Staples (e.g., food, household products, healthcare)

Utilities (e.g., electricity, water, telecommunications)

Healthcare & Pharmaceuticals

2. Di...

13

2

what doyouwant

liked

$Tesla (TSLA.US)$ im new

i simply buy a put at 1068 for strike price of 250

then tesla drop alot half and hour later.

then i faster sell to close the put

i see some gain of usd 500

but i am confused since havent reach breakeven price?

i simply buy a put at 1068 for strike price of 250

then tesla drop alot half and hour later.

then i faster sell to close the put

i see some gain of usd 500

but i am confused since havent reach breakeven price?

5

2

what doyouwant

liked

some months i got lucky as i bought a lot of $ECOWLD (8206.MY)$ $PPB (4065.MY)$ $TM (4863.MY)$

some months super unlucky as I have $UEMS (5148.MY)$ $SIMEPROP (5288.MY)$ $NATGATE (0270.MY)$

2025 I am Still quite down.

some months super unlucky as I have $UEMS (5148.MY)$ $SIMEPROP (5288.MY)$ $NATGATE (0270.MY)$

2025 I am Still quite down.

+3

15

3

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)