where is my money

liked

where is my money

liked

WCT Holdings injects three assets, and the Paradigm A-REIT has been approved for listing.

WCT Holdings $WCT (9679.MY)$ announced that it has obtained approval from the Malaysian Securities Commission to list the Paradigm A-REIT on the Malaysian Stock Exchange.

WCT stated in an announcement submitted on Monday that the Paradigm A-REIT will list with an initial fund size of 1.6 billion units, with a portfolio of three Properties, totaling an estimated valuation of 2.44 billion Ringgit.

According to the announcement, the acquisition of the three Assets will be completed through the issuance of 1.6 billion units (at 1 Ringgit each) and a payment of 0.837 billion Ringgit in Cash. The Cash portion will be financed through commercial Real Estate mortgage medium-term notes.

The three Assets mentioned above are, respectively, the Klang Bukit Tinggi Shopping Center, the Petaling Jaya BRT Mall, and the Johor Bahru BRT Mall.

The listing plan of the BRT Trust will involve a public offering of up to 0.25466 billion units.

Currently, the listing plan of the BRT Trust still requires approval from the Malaysian Stock Exchange, WCT Holdings' shareholders, and the relevant state government agencies to complete the asset transfer process.

Additionally, Maybank Investment Banking has been appointed as the main advisor for the establishment and listing of the Palletech Property/A-REIT.

Source: Nanyang Siang Pau

Disclaimer: This content is for reference and Education purposes only and does not constitute any specific investment, investment strategy, or endorsement. Readers should bear any risks and liabilities arising from reliance on this content. Before making any investment decisions, please ensure...

WCT Holdings $WCT (9679.MY)$ announced that it has obtained approval from the Malaysian Securities Commission to list the Paradigm A-REIT on the Malaysian Stock Exchange.

WCT stated in an announcement submitted on Monday that the Paradigm A-REIT will list with an initial fund size of 1.6 billion units, with a portfolio of three Properties, totaling an estimated valuation of 2.44 billion Ringgit.

According to the announcement, the acquisition of the three Assets will be completed through the issuance of 1.6 billion units (at 1 Ringgit each) and a payment of 0.837 billion Ringgit in Cash. The Cash portion will be financed through commercial Real Estate mortgage medium-term notes.

The three Assets mentioned above are, respectively, the Klang Bukit Tinggi Shopping Center, the Petaling Jaya BRT Mall, and the Johor Bahru BRT Mall.

The listing plan of the BRT Trust will involve a public offering of up to 0.25466 billion units.

Currently, the listing plan of the BRT Trust still requires approval from the Malaysian Stock Exchange, WCT Holdings' shareholders, and the relevant state government agencies to complete the asset transfer process.

Additionally, Maybank Investment Banking has been appointed as the main advisor for the establishment and listing of the Palletech Property/A-REIT.

Source: Nanyang Siang Pau

Disclaimer: This content is for reference and Education purposes only and does not constitute any specific investment, investment strategy, or endorsement. Readers should bear any risks and liabilities arising from reliance on this content. Before making any investment decisions, please ensure...

Translated

13

2

where is my money

liked

As you see, the Paper Trading Match is making a grand return!

🏆 Unleash Your Trading Skills

Here, you can get a chance to enhance your trading skills by participating in simulated trades within an environment mimicking real market conditions with real-time quotes. Let's sharpen your skills over six weeks!

🎁 Claim Your Victory

Top participants can win up to US$500 stock cash coupons. In addition, all participants have the chance to ...

65

3

5

where is my money

liked

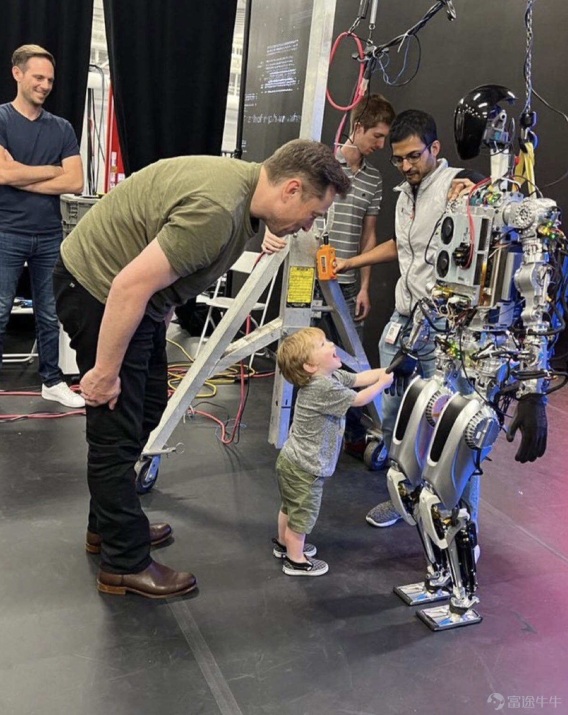

$Tesla (TSLA.US)$

The Tesla Full Self-Driving crowdsourced dataset that Elon Musk has approved has doubled since he shared it last month.

What does it say about the state of Tesla's Full Self-Driving program now?

We have been complaining for years about Tesla's lack of data on its Full Self-Driving program. Because Tesla has not provided data, we have to rely on a less-than-ideal but better-than-nothing crowdsourced dataset.

Elon Musk has positively referenced th...

The Tesla Full Self-Driving crowdsourced dataset that Elon Musk has approved has doubled since he shared it last month.

What does it say about the state of Tesla's Full Self-Driving program now?

We have been complaining for years about Tesla's lack of data on its Full Self-Driving program. Because Tesla has not provided data, we have to rely on a less-than-ideal but better-than-nothing crowdsourced dataset.

Elon Musk has positively referenced th...

13

2

where is my money

liked

17

2

where is my money

liked

$Gitlab (GTLB.US)$ will be reporting its fiscal Q4 2025 earning result on 03 Mar 2025 after the market close.

GTLB is anticipating the fourth-quarter fiscal 2025 revenues to be between $205 million and $206 million, indicating 25-26% year-over-year growth.

The Non-GAAP earnings per share are anticipated to be between 22 cents and 23 cents. Analysts are expecting the consensus earnings per share forecast to come in at 23 cents.

GitLab (GTLB) Last Po...

GTLB is anticipating the fourth-quarter fiscal 2025 revenues to be between $205 million and $206 million, indicating 25-26% year-over-year growth.

The Non-GAAP earnings per share are anticipated to be between 22 cents and 23 cents. Analysts are expecting the consensus earnings per share forecast to come in at 23 cents.

GitLab (GTLB) Last Po...

+1

21

where is my money

liked

NVDA options flow data provides key insights into market sentiment, potential institutional positioning, and possible future price action. Let’s break it down and identify how to trade smartly based on this data. ![]()

🚀 Key Observations![]()

1️⃣ Trade Snapshot – Bullish or Bearish Bias?

• PUT/CALL Volume Ratio → 42.84% (Put) vs. 57.16% (Call)

• More call buying than put buying, suggesting a bullish bias.

• Total volume: 7.78M → 182.78% of the 30-day average → HU...

🚀 Key Observations

1️⃣ Trade Snapshot – Bullish or Bearish Bias?

• PUT/CALL Volume Ratio → 42.84% (Put) vs. 57.16% (Call)

• More call buying than put buying, suggesting a bullish bias.

• Total volume: 7.78M → 182.78% of the 30-day average → HU...

18

where is my money

liked

$Tesla (TSLA.US)$

Key points: Respecting the uncertainty principle and spatial orientation barrier principle of financial markets, and acknowledging one's own shortcomings is the beginning of evading risks, gaining wisdom, and achieving victory in financial markets. Only the ignorant believe themselves to be omnipotent, buying low and selling high. In the long run, whether one buys and sells or sells and buys, the money is either counted or lost, and only they know the truth. The dazzling Hall of Fame on Wall Street already has precedents. Even with HMM (Hidden Markov Model), a large group of mathematicians (mainly statisticians), physicists, computational linguists, large high-speed computers, and specialized software of Renaissance Technologies LLC, after the passing of the late world-renowned mathematician, investor, and philanthropist James Harris Simons, the originally high-precision hedge funds renowned for their ultra-high ROI have fallen to the level of herding wolf-level hedge funds, which is truly lamentable. Losing the soul figure has left the group leaderless, scientists with differing personalities refuse to yield, and internal conflicts and inefficiencies continue relentlessly, ...

Tesla is the core of h...

Key points: Respecting the uncertainty principle and spatial orientation barrier principle of financial markets, and acknowledging one's own shortcomings is the beginning of evading risks, gaining wisdom, and achieving victory in financial markets. Only the ignorant believe themselves to be omnipotent, buying low and selling high. In the long run, whether one buys and sells or sells and buys, the money is either counted or lost, and only they know the truth. The dazzling Hall of Fame on Wall Street already has precedents. Even with HMM (Hidden Markov Model), a large group of mathematicians (mainly statisticians), physicists, computational linguists, large high-speed computers, and specialized software of Renaissance Technologies LLC, after the passing of the late world-renowned mathematician, investor, and philanthropist James Harris Simons, the originally high-precision hedge funds renowned for their ultra-high ROI have fallen to the level of herding wolf-level hedge funds, which is truly lamentable. Losing the soul figure has left the group leaderless, scientists with differing personalities refuse to yield, and internal conflicts and inefficiencies continue relentlessly, ...

Tesla is the core of h...

Translated

+6

23

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)