William Lee L T

liked and commented on

Dear mooers,

We are coming to the end of a very unusual year full of uncertainty. Whether good or bad, we all witnessed the history.

Before you want to see what you can expect in 2022, let's have a little break and take a guess of the closing price of the S&P 500.

A happy ending or a tragedy? Go big or go home? Place your bet NOW!

Win Reward:

Place your bet on the closing price of the $S&P 500 Index (.SPX.US)$ (i.e.4800.11) on Friday...

We are coming to the end of a very unusual year full of uncertainty. Whether good or bad, we all witnessed the history.

Before you want to see what you can expect in 2022, let's have a little break and take a guess of the closing price of the S&P 500.

A happy ending or a tragedy? Go big or go home? Place your bet NOW!

Win Reward:

Place your bet on the closing price of the $S&P 500 Index (.SPX.US)$ (i.e.4800.11) on Friday...

453

1070

William Lee L T

liked

Hi, mooers.

Welcome to the 2021 Growing Stars of the Year award ceremony. We are thrilled to announce the 9 shining stars of the Moo community for you!

When we look back, we can see our mooers' glittering badges, fruitful transactions, and active interactions in 2021. We truly appreciate their hard work on building wealth and reviewing their investment during the investing journey.![]() Today, our awards go to the 9 outstanding mooers who made sign...

Today, our awards go to the 9 outstanding mooers who made sign...

Welcome to the 2021 Growing Stars of the Year award ceremony. We are thrilled to announce the 9 shining stars of the Moo community for you!

When we look back, we can see our mooers' glittering badges, fruitful transactions, and active interactions in 2021. We truly appreciate their hard work on building wealth and reviewing their investment during the investing journey.

+1

142

62

William Lee L T

liked

Hi, mooers. Welcome to Mooers of the Year 2021, where we present some of the great mooers in the Moo community to you.

As we review 2021, do you still remember the first mooer you followed when you joined the Moo community? Have you ever been impressed by others' insights and clicked the like button instantly?![]()

Here, we'd like to present The Most Followed and The Most Engaged mooers this year to you. Check out the ranking lists now and tell us: Do you recognize any of them? Have you received any inspiring ideas or valuable investing tips from them? If the answers are yes, feel free to extend your appreciation to them in the comment section below!

![]() Congratulations!!

Congratulations!!

@Mcsnacks H Tupack @OldNormanBates @The Stock Scalpers @treydongui @SEA Hedge @heracheong @Mr Truth @Anonymoo @Mars Mooo @Tanya C @DayleyTrades @huatSG @Stock Watch @disassembly line

A big thank you to all mooers! You are the ones who create a harmonious atmosphere and interact friendly in our community. Thank you for giving a hand to the new mooers and contributing ingenious ideas to our community. Shall we walk into 2022 together and continue to write fantastic stories in the Moo community?

![]() Rewards:

Rewards:

1.'Mooers of 2021' medal: Each mooers on the lists are entitled to one medal only, so there will only be one medal for mooers on both lists.

2.2021 points: Unlike the medal, mooers can receive up to 4042 points if their names are on both lists.

*These rewards will be distributed to your account 15–30 working days after the winner announcement. Please stay tuned!

If luck is not on your side this time, here is a tip for you.

Keep sharing great insights and moments to strike chords with mooers. We are looking forward to seeing you again next year!

![]() Thanks again for all your love and supports! We hope to continue to accompany you and offer ever-improving services to you in the future. Let's grow together to the Moo!!

Thanks again for all your love and supports! We hope to continue to accompany you and offer ever-improving services to you in the future. Let's grow together to the Moo!!

As we review 2021, do you still remember the first mooer you followed when you joined the Moo community? Have you ever been impressed by others' insights and clicked the like button instantly?

Here, we'd like to present The Most Followed and The Most Engaged mooers this year to you. Check out the ranking lists now and tell us: Do you recognize any of them? Have you received any inspiring ideas or valuable investing tips from them? If the answers are yes, feel free to extend your appreciation to them in the comment section below!

@Mcsnacks H Tupack @OldNormanBates @The Stock Scalpers @treydongui @SEA Hedge @heracheong @Mr Truth @Anonymoo @Mars Mooo @Tanya C @DayleyTrades @huatSG @Stock Watch @disassembly line

A big thank you to all mooers! You are the ones who create a harmonious atmosphere and interact friendly in our community. Thank you for giving a hand to the new mooers and contributing ingenious ideas to our community. Shall we walk into 2022 together and continue to write fantastic stories in the Moo community?

1.'Mooers of 2021' medal: Each mooers on the lists are entitled to one medal only, so there will only be one medal for mooers on both lists.

2.2021 points: Unlike the medal, mooers can receive up to 4042 points if their names are on both lists.

*These rewards will be distributed to your account 15–30 working days after the winner announcement. Please stay tuned!

If luck is not on your side this time, here is a tip for you.

Keep sharing great insights and moments to strike chords with mooers. We are looking forward to seeing you again next year!

190

107

William Lee L T

liked

2021 is an unusual year for the stock market. Despite the worry of inflation and pandemic, the US stock market is on its longest bull-run in history. Kicked off with the mania of WSB, the market keeps heading north and ends at nearly all-time highs.

Event 1: WSB Beat Hedge Funds

Date: Jan 2021

At the beginning of this year, a group of millennials revolved around $GameStop (GME.US)$, a retail company that struggled with selling video games, to fight against hedge funds. After WallStreetBets pumped GameStop's stock price to unprecedented heights, some institutional investors who shorted the company's stocks almost bankrupted. Following the rule of "Go big or go home", WSB turned to other "meme stocks" such as $AMC Entertainment (AMC.US)$ , whose stock price soared by 455% in Q2.

Mooer's takeaways: What makes you profit or lose from the market?

@GT1982 shared two lingos in particular:

1) DYODD

Do your own due diligence as always. To summarise this, it means never copy or act on an investment idea based on hearsay without studying the company first.

2) FOMO.

Fear of missing out. Many investors, new and veteran alike, are guilty of this. Very often this leads to a painful loss. In short, do not chase a stock just because many are doing it. Study the company fundamentals first which essentially is related to lingo No. 1.

View More>>

Event 2: Global Chip Shortages

Date: May 2021

The global shortage of microchips has become a severe problem in 2021. The gap between insufficient supply and surging demand causes dilemmas for companies desperate for chips. Semiconductors are necessary for cars, PCs, smartphones, etc. Manufacturers of these products are facing an unprecedented situation. However, a crisis for one could be an opportunity for another. Since the market crashed in March 2020, the $PHLX Semiconductor Index(.SOX.US)$ has more than doubled.

Mooer's takeaways: What is the "DNA" of technology

@HuatLady said:

In this millennium, our reliance on the use of semiconductor for technological advances is undisputed worldwide. Automobiles, smartphones, home appliances and wireless networks depend heavily on the use of semiconductors. This is what "makes the world goes round", and is the "DNA" of technology.

The key challenges are:

1) The inability to meet the market's demands. Since 2019, there is an acute shortage of chips' supply globally. These high demands for chips may stretch into 2023. This will incur a 27% loss if there is a 3 months' delay in manufacturing.

2) Hence the cost of manufacturing may not meet planned budget. After weighing through both the positive and negative aspects of semiconductor investment, I opt to follow my heart and favours the trading of quality semiconductor shares as a long term investment.

View More>>

Event 3: S&P 500 Doubled amid a Pandemic Dip

Date: Aug2021

In August 2021, the $S&P 500 Index (.SPX.US)$ rallied 100% from the pandemic dip since March 2020, becoming another milestone for the US stock market.

Mooer's takeaways: How to invest at a market high?

@Dadacai said:

There is a possibility of market correction and funds being stuck when investing during market highs so my approaches are as follows:

1) Choose stocks I have confidence in and don't mind holding for the long term.

2) Split the purchases into 3 or more lots at different timings to average out the cost.

3) For intraday trading, choose stocks which have a high volume of trading and set a stop loss.

4) Don't invest what I cannot afford to lose.

View More>>

Event 4: Metaverse, the Next Generation of the Internet

Date: Oct 2021

Metaverse is regarded as the next generation of the Internet by some institutions. It's a can't-miss concept in 2021 that may lead to an investing buzz in the next decade. To attract market attention, tech giants have laid out their versions of the metaverse. On October 28, Facebook $Meta Platforms (FB.US)$ officially changed its corporate name to Meta as part of a major rebrand, shaking off the social media by launching new strategies to go "all in" to the metaverse.

Mooer's takeaways: Are Metaverse and playing games with VR the same?

@NANA123 said:

The reason why people distinguish the virtual world from the real world is because the virtual world generated by the platform-style Internet at this stage cannot carry people's asset rights and social identity. The identity achievements and assets acquired by people in the virtual world are in the hands of platform operators. If the operator chooses to close the platform or close the account forcefully, everything you've gained on the platform goes up in smoke. However, the rapid development of blockchain technology in recent years has derived a decentralized Internet form, which effectively guarantees the transparency and certainty of the virtual world rules generated under this form.

View More>>

Event 5: EV Mania

Date: Nov2021

On October 21, $Tesla (TSLA.US)$ released the 2021 Q3 earnings that beat the market's expectations. Its stock price increased by 22% in a week. When Tesla's stock price hit a record high of 1243.49 dollars, the shareholders started to buckle up. Meanwhile, other EV stocks were also growing fast. Rivian, a rival of Tesla, saw its price soared by 120% five trading days after it got listed. Lucid also yielded good results.

Mooer's takeaways: How much risk are you comfortable with?

@HopeAlways said:

The stock market appears to be giving incredibly high valuations to EV stocks, whether the companies have proven themselves effective manufacturers or not. As with the EV stocks, there will be winners and losers, and these investments seem to belong to the more speculative portion of a stock portfolio. Understanding individual risk tolerance level is an important step in determining which EV stock is suitable for investors.

View More>>

Which event do you like the most? Does any of the events above ring the bell?

Feel free to leave your comments below!

Click for More>>

+3

138

25

William Lee L T

liked

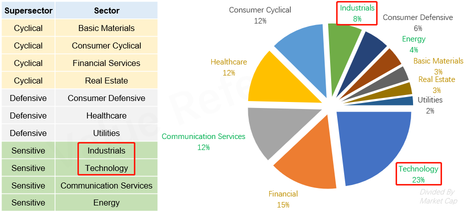

Last two weeks we reviewed the valuation of cyclical stocks and defense stocks. And this week we will look into other two parts —— Technology & Industrials.

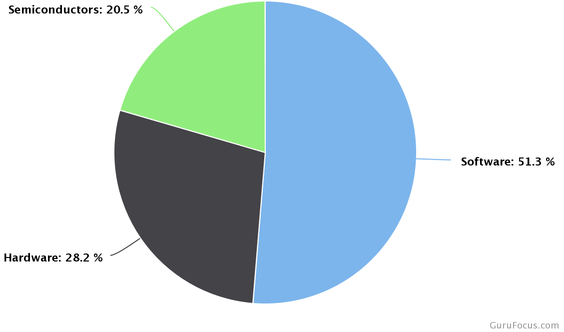

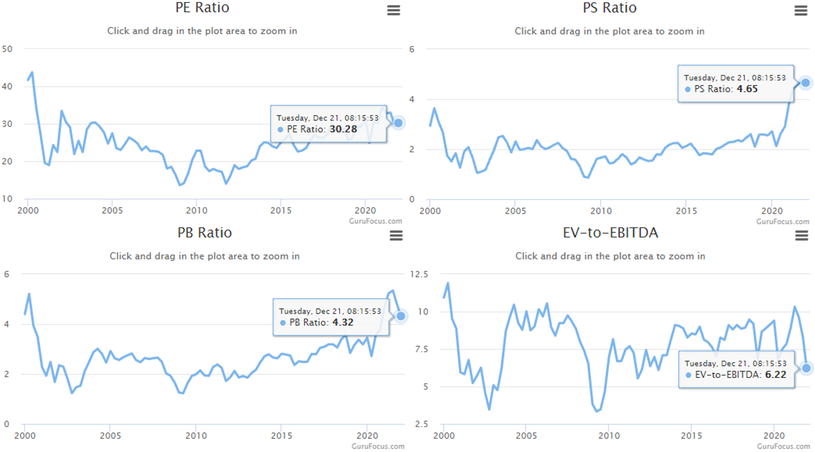

1. Technology

This sector includes design, development, and support of computer operating systems and applications. And also includes companies that make computer equipment, data storage products, networking products, semiconductors, and components.

Companies in this sector include $Apple (AAPL.US)$ , $Microsoft (MSFT.US)$ , and $IBM Corp (IBM.US)$ .

Sector Weighting

Key Ratio Charts

Industry Comparison

2. Industrials

This sector includes manufacture machinery, hand-held tools, and industrial products. And also includes aerospace and defense firms as well as companies engaged in transportation services.

Companies in this sector include $3M (MMM.US)$ , $Boeing (BA.US)$ , and $United Parcel Service (UPS.US)$.

Sector Weighting

Key Ratio Charts

Industry Comparison

- Next time we will talk about Communication Services and Energy.

- Follow me to catch the value!![]()

![]()

Source: gurufocus

1. Technology

This sector includes design, development, and support of computer operating systems and applications. And also includes companies that make computer equipment, data storage products, networking products, semiconductors, and components.

Companies in this sector include $Apple (AAPL.US)$ , $Microsoft (MSFT.US)$ , and $IBM Corp (IBM.US)$ .

Sector Weighting

Key Ratio Charts

Industry Comparison

2. Industrials

This sector includes manufacture machinery, hand-held tools, and industrial products. And also includes aerospace and defense firms as well as companies engaged in transportation services.

Companies in this sector include $3M (MMM.US)$ , $Boeing (BA.US)$ , and $United Parcel Service (UPS.US)$.

Sector Weighting

Key Ratio Charts

Industry Comparison

- Next time we will talk about Communication Services and Energy.

- Follow me to catch the value!

Source: gurufocus

+4

68

5

William Lee L T

liked

$DFIRG USD (D01.SG)$ Can buy and hold or wait? Experts pls advise

9

10

William Lee L T

liked

$NIO Inc (NIO.US)$

364.7k@30

364.7k@30

16

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)